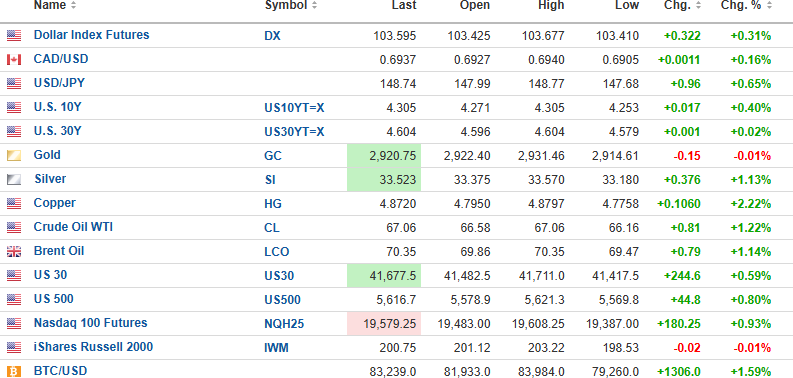

U.S. Dollar Index futures are up 0.31% to 103.595, while the 10-year bond yield is up 0.40% to 4.305%, and the 30-year bond yield is up 0.02$ to 4.604%.

Gold (-0.01%) is down, while silver (+1.13%), oil (+1.22%), and copper (+2.22%) are all higher.

The DJIA futures (+0.59%) are rallying by 244.6 points, while the S&P 500 futures (+0.80%) are ahead 44.8 points, and the NASDAQ 100 futures (+0.93%) are up 180.25.

Risk barometer Bitcoin is bouncing off its low of $79,260, and it is up 1.59% to $83,239 but still in bear market territory.

Stocks

Last night I told all subscribers that now is not the time to be adding new shorts or volatility positions after an 8.67% pullback off the February 19 highs at 6,147.43.

While I believe that there is another 11.33 % to go on the downside for the S&P 500, at a minimum, sentiment has turned "black bearish," with headlines like "Selloff Doesn't Concern Me" and "Recession and Bear Market Ahead" dominating the narrative.

I find it interesting that the last two major bottoms occurred in the month of March with the first in 2009 and the second in 2020 with the one glaring difference being that in both those occasions, markets were buttressed by very friendly fiscal and monetary policies versus the current environment which is decidedly hostile from the fiscal perspective and neutral at best from the monetary side.

This morning at 8:30, the markets will see how consumer prices behaved in February when the CPI is released, with an expectation of 0.3% for both core and non-core inflation. I expect it will have little impact on the 45-point bump in the S&P 500 futures because the new narrative for stock prices is now the White House (Trump) versus the Eccles Building (Powell).

Up until Trump decided to steal the headlines from Jerome Powell, it was the Fed chairman and his army of market-cheering governors and presidents that sent stocks moving in one direction or another, but that is a relic of the past. The new narrative is tariffs and DOGE, and until the markets are convinced that this runaway freight train of executive orders and retaliatory actions has been brought under control, it is the Trump Tweets that are going to be large and in charge of the capital markets and that is just the way Trump wants it. CPI came in a tad "cool" at 0.2%, which has added another 20 points to the 45-point pre-opening bid for the S&P, which is going to give us all a chance to look at portfolios and reduce risk by rebalancing in anticipation of the next down-leg of this newborn baby bear.

Copper

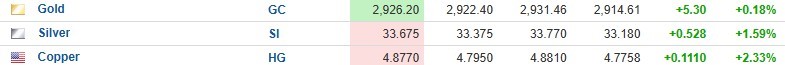

The Twitterverse is rife with more silver chatter this morning as gold has turned higher since the CPI came out, with bloggers and posters all collectively joining the chorus of "$200 silver!!!".

What this pompom-waving crowd is missing is the breathtaking move in copper up over $0.11.lb, which is a 2.33% move to silver's 1.59% move and gold's paltry 0.18% jump.

In fact, with all the cymbal-clashing and pompom-waving about silver, it is interesting to note that the copper market is outperforming both gold and silver by a meaningful degree on a year-to-date basis, up 18.37% to silver's 13.35% and gold's 10.6% returns. Of course, all three of these metals are outperforming the S&P 500 which is down 5.26% YTD (and looking lower).

This prompts me to once again revisit the shares of my favorite blue-chip company, Freeport-McMoRan Inc. (FCX:NYSE), which is now 33% lower than its May 2024 peak at $55.235. The world's primary producer of copper along with an ample amount of gold, the stock has been buffeted by the liquidity squeeze that has affected most of the cyclical names as this global trade war has forced many portfolio managers to adopt a recessionary allocation mix, which simply cannot include cyclicals like FCX.

If copper stays in this uptrend at the current pace, it will see new highs above $5.199/lb. by month-end, and I cannot imagine FCX staying under $40 in that scenario. Despite my bearish views on the U.S. equity markets, I am going to go way out on a limb and do the following:

In the GGMA 2025 Trading Account:

- Add 2,000 FCX at $37.00

- Target: $45

For option players:

- Buy 50 contracts FCX June $40 calls at $2.50

- Target: $5.00

As for the juniors, this move in copper is going to be most timely for Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) whose assays from the Caballos drill hole reported on February 10 (185.7m of mineralization containing chalcopyrite and molybdenite) will be reported shortly. I expect that the final approval of the Ptolemy Mining (Buen Retiro) acquisition will be reported first, after which the assays will be released.

Until I see the release, I will have no certainty, but I expect that Caballos will be a company builder and one that will be hugely beneficial for all shareholders.

I reiterate my "AGGRESSIVE BUY" on FTZ/FTZFF and remind everyone that the company will be fully-funded until well into next year on all three drill campaigns — Caballos, Buen Retiro, and Polimet. How many juniors can make that claim?

| Want to be the first to know about interesting Critical Metals, Silver, Base Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitsroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.