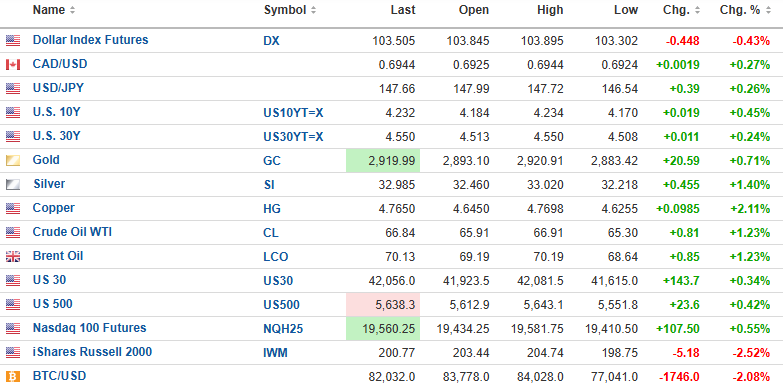

The U.S. dollar Index futures are lower by 0.43% to 103.505, with the 10-year yield up 0.45% to 4.232% and the 30-year yield up 0.24% to 4.550%.

Gold (+0.71), silver (+1.40%), copper (+2.11%), and oil (+1.23%) are all up.

The DJIA futures (+0.34%) are up 143.7 points; the S&P 500 futures (+0.42%) are up 23.6 points; and the NASDAQ 100 futures (+0.55%) are higher by 107.50 points.

Risk barometer Bitcoin is down 2.08% to $82,032 and is continuing its corrective action.

Stocks

After the past couple of weeks of "volatility" (otherwise known as a "sell-off"), I find it absolutely hilarious that the guest commentators are all referring to this minuscule drawdown in the S&P 500 as a "crash."

I have been through three distinct crashes in my forty-seven years and trust me, this move down from 6,147 to 5,770 is anything but a "crash". A 6.13% drop is a minor downtick, but because the Gen-Exers and the Millennials have never actually endured a bear market, let alone a crash, they think anything more than a day or two of declines is the beginning of the Next Great Depression.

As you can see from the chart posted above, the RSI is now a hair above the 30 level, which means it has almost entered into oversold territory. The larger question with which I am currently grappling is whether this drawdown in the MACD, MFI, and TRIX needs to be officially accompanied by the RSI into oversold status before I can declare a "buy signal."

The other problem I have is that whenever the trend of a decline (or advance) moves from "gradual" to "vertical" (like yesterday in the NASDAQ), history dictates that you are in the final stages of the move. However, the "final stages" on the above chart is the X-axis (time), so while it might be nearing the end of the decline in terms of its length, the far more important measuring stick is the Y-axis (price), and that is where it gets very tricky.

This decline might be over by Friday, but if I cover shorts and take down my volatility trades too early and start allocating to the long side, by the time Friday arrives, this market could lose another 10-15% if the sell-off becomes a liquidity event. That part of my dilemma is where Lady Luck needs to be watching over you because nobody on this planet knows the point where the margin clerks have completed the unwind.

However, for this morning, I will be watching the opening 30 minutes very closely to see if the 15-point rebound in the S&P 500 futures can hold. If it cannot, I will replace my SPY puts that I sold too early yesterday with RSI threatening to break 30. When the bottoms arrived in March 2009 and March 2020, RSI was under 20 after price declines went deeply vertical. We are not there yet, so I am more inclined to sell the rally than to try to perform a professional knife-catching exercise.

- For now, HOLD all VIX April $25 calls

- Be ready to BUY 25 SPY April $550 puts

Copper

There is nary an hour that goes by on "X" (Twitter) that I fail to see yet another armchair "guru" talking up the price of silver, but that is normally what happens after they have changed their icon with the "laser eyes" to a hard rock miner carrying a pick. "Silver to $100!" is all over the airwaves and streaming across the Twitterverse, but I find that curious because the last time I looked, gold futures were up 0.71%; silver futures were up 1.40%; but copper futures are ahead 2.11%. Unexciting, boring, who-gives-a-damn copper is a mere $0.40 from its all-time high of $5.199/lb. last seen in May of 2024.

The action in the copper arena has got a number of the people I follow (usually "old-timers" like me) plumbing the depths of their sources in London and New York to try to learn if this strength is tariff-related or whether it is centered around the surprising turnabout in the EU with their newfound commitment to defense spending. If the Europeans are serious, a great deal of copper will be consumed in developing the advanced weaponry required to combat that evil Russian bear that is bearing down on Paris, Brussels, and, of course, London because Vlad the Impaler does not know history and refuses to believe that Hitler tried and failed to take over Europe. (Forgive the sarcasm.)

One way or another, the copper market is acting strangely well, especially in light of the stock market drawdown this past few weeks. Normally, sagging stock prices are a precursor for weaker economic numbers, and a weaker economy is usually reflected by Dr. Copper going into full retreat. However, something else is driving copper, and I, for one, think it might be the grim realization by the big Asian consumers like China, Korea, and Japan that copper supplies are dwindling a lot more rapidly than the experts think to the extent that any minor tweak in demand is going to send price spiraling northward.

Subscribers already own large positions in my favorite junior copper explorer/developer — Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) — and they own positions in my favorite blue-chip stock — Freeport-McMoRan Inc. (FCX:NYSE) — but perhaps a few shares in the junior copper ETF run by Sprott Inc. — COPJ:US — might be an opportune way to beef up our holdings in the red metal.

In the GGMA 2025 Trading Account:

- Buy 1,000 COPJ:US at $18.75

- Stop loss: $14.95 Target: $25.00

| Want to be the first to know about interesting Gold, Base Metals, Silver and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.