One of the most famous investors in Canadian history is Eric Sprott, and that is for a very good reason. Hailing from a middle-class background in the west end of Toronto, Eric is the classic example of a hard-working lad with more than a few wheels applying his skills as an accountant in analyzing the merits of a myriad of investments leading to the formation of Sprott Securities in 1981and then Sprott Asset Management in 2001.

There is not a day that goes by when I do not hear about something Eric has said regarding the precious metals word, and that is because any man who accumulates a net worth of $1 billion (plus) without the aid of an inheritance or trust fund completes the real definition of the term "entrepreneur."

So, when I take the time to tip my hat to a successful gentleman like Mr. Sprott, it is with absolute sincerity and, in fact, reverence for his ability to parlay success over an extended period of time. It is not easy to have five and ten baggers consistently over time, but what must be remembered is that Eric has earned the right to take big swings at the plat,e which also means that he will be more inclined than the average investor to "misses" which he readily admits to in many if not all of his podcast/interviews.

Eric is quoted as saying that he thinks silver is going to be $200-250 an ounce and lists a number of reasons, with the first and foremost being a shortage situation that I find baffling. That particular portion of the bullish case for silver is baffling because, in nature, silver is anything but "rare."

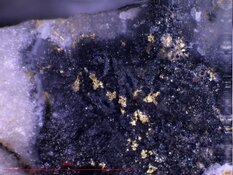

As one can see from the quote shown above, the "principal sources of silver are the ores of copper, copper-nickel, lead, and lead-zinc obtained from Peru, Bolivia, Mexico, Chile, Australia, Poland, and Serbia." While the bullish case for copper lies in the dwindling supply and escalating demand, the grades of the world's biggest copper and zinc mining operations are sinking fast, but until we see $15,000/tonne copper ($6.80/lb.), it is unlikely that any new mines will be put into production and even if a production decision were made tomorrow, that copper or zinc will not hit the market for ten years. That also means that the silver that comes as a byproduct will also not be seen for ten years, so to the extent that there are no new sources of base metal supply about to come onstream, it is reasonable to apply that analysis to silver.

However, above-ground supply as represented by the billions of tonnes of slag containing hundreds of millions of ounces of silver is never included in any of the estimates used by the World Silver Institute. In fact, the numbers one gets from the WSI is heavily skewed to the "de minimis" interpretation of the impact of biproduct slag upon the spot price.

I once pitched a Glencore executive on a 30m-tonne silver deposit in Peru after which he very politely explained to me that he had waste dumps with three times as many ounces as I was trying to peddle, leaving me hiding under the exhibit table while trying to steal back my business card. Talk about embarrassment!

Now, before the army upon army of silver bugs descend upon me like a traitorous Benedict Arnold of the Precious Metals World, let it be known that I do believe that eventually silver will be hauled higher, not by the forces of reduced supply (otherwise known as "shortage"), but rather by the increased impact of accelerating demand. The demand of which I speak will be the direct result of the high and rising price of gold and one that will inevitably attract all forms of speculation. It is a historical fact that there is a direct correlation between gold and silver.

The effect of "substitution" in economics states that when prices rise too far to remain manageable by passing those increases on to the ultimate consumer, the producer will find a substitute for the product. In the case of the gold-silver relationship, the gold-to-silver-ratio ("GSR") is supposed to move lower as the precious metals bull market unfolds, but since 2020, the best it could do was touch 63.71 in February of 2022 during the ill-fated "SilverSqueeze" campaign that resulted in body bags at the side of the "Road to Riches" by every fledgling silver bug new to the space.

I contend that there is no shortage of silver but that there is a pent-up torrent of demand that will be unleashed upon silver before the bull run in gold is finished, but that demand will be unleashed by those that would deem gold "too expensive" at prices exceeding $3K. The silver trade (if there is one) will be ignited by an overpowering move by gold to a number safely above $3k and a solid three-day close for silver above $35/ounce. The Rule of Substitution will drive prices infinitely higher, which will be a clarion call for the generalists to finally come "over the wall" and into the precious metals in earnest.

At that time, I will be the first one to hike up my britches and proudly declare membership in the "$50 Silver Club," but please do not try to tell me that manipulation by the bullion banks and Comex shenanigans are the sole explanations for the lagging silver price.

That silver is getting to market somehow or else the banks would steer clear of the short side. Watch gold — period.

Stocks

The oncoming light at the end of the stock market tunnel is a bear market express train barrelling down upon an unsuspecting public with merciless ferocity after a winter of hibernation. I find it hilarious how the mainstream media are suddenly realizing that "American exceptionalism" is not going to be a rationalization for owning overpriced stocks but rather a necessity in putting up with the "detoxification" predicted by Treasury Secretary Scott Bessent this week.

That "detoxification" referred to the length of time that is needed to wean the American economy off its insatiable reliance upon fiscal largesse, which is another way of saying that a recession is coming right at us, and it is no accident. The Trump Administration is targeting the deficit and the 10-year yield, which they know must be reduced in order to get their finances in order.

If that means a 7% unemployment rate and negative growth, then so be it. And if the average American, affectionately known as "Main Street" by the financial media, has to suffer as a result of this targeted recession, then so be it because if there is one sector that can never suffer one step backward in the bull market in money creation and currency control, it is the American banks, forever protected and promoted by the Fed, the Treasury, and the insufferable American media.

At the top of every bull market and at the end of every bubble, the financial media run down a list of reasons that "it's different this time" until, one by one, each and every reason gets blown apart by the advancing storm of bear market signals. In the late 1990s, the takeover of Time Warner by America Online marked the first stage of speculative excess gone wild as arguably the worst take-over in U.S. history signaled the top. In 2008, the demise of Bear Stearns and Lehman Bros. signaled a similar ritual of demonic sacrifice as Jim Cramer begged his CNBC audience to buy both companies in their final death throes before the markets went into a vertical descent upon the realization that the American banking system had been blown to pieces by greed, mismanagement, and government complicity.

Here in 2025, the financial media is rapidly running out of reasons to stay supportive of the current administration which enjoyed their uncompromised support in the immediate post-election euphoria as the "tariffs on, tariffs off" staccato-like executive orders emanating from the White House have markets gyrating like a bobble-head doll in the rear window of a dirt buggy.

"How can I manage my company without the certainty of trade policies?" complained the CEO of a major U.S. company this week as the auto sector sent its message to President Trump that tariffs on Canada and Mexican auto parts would vault domestic U.S. prices higher by 25% in a New York minute. CNBC anchors were likewise doing 180° turnabouts on this schizophrenic trade policy, but only because it was disturbing their perpetual bullish narrative that attracts sponsors and pays salaries.

In a note to subscribers, I pointed to Nvidia Corp. (NVDA:NASDAQ), the poster child and lead sled dog in the last two-and-a-half-year bull run in stocks led by the "AI" mania where over 530 ETFs created by Wall Street contained unusually large weightings in the stock. CNBC has been cheering on the "healthy rotation" out of the Mag Seven into the "small caps" as one of the reasons to stay positive in the market despite the obvious technical breakdown in the leader. NVDA has plummeted down through every one of the 20, 50, 100, and 200-dma lines with absolute certainty and clarity of both purpose and direction. It has taken with it all of the Mag Seven names, where the only one up on a year-to-date basis remains META:US, and that is barely hanging on to its feeble 7.24% annual gain.

I look at the S&P 500, which this week went into negative year-to-date status and is now down 2.43%, which is almost as brutal as the ETF tracking the small-cap Russell 2000 index (IWM:US) down 7.10% year-to-date and sending most of the "healthy rotation" CNBC proponents into fits of abject depression. I would draw to everyone's attention the fact that while NVDA is well below its 200-dma, the ETF tracking the S&P 500 (SPY:US) is still hovering above its 200-dma, which resides at $569.54 versus its close at $575.92. Before we get any type of tradable rally, I think markets will need a full reset where RSI for the S&P (now 37.02) plunges into deeply oversold territory below 30 while taking out the 200-dma by several dollars.

That means that the CBOE Volatility Index (VIX:US) will need to move to a supra-30 reading versus its rally peak today of 24.94 before the short-covering reversal took it down in a fit of monkey-hammering, hedge fund savagery.

The final stages of all declines are fun in that it is at the point where "gradual" rates of decline morph into "vertical" rates of decline that you get the most exciting of the "pin action" in both

shorts and the volatility trades. While I think we are a lot closer today to the end of the decline on the X-axis (time), we may have a lot more to go on the y-axis (price) portion of this correction.

From a sentiment standpoint, there has not been enough pain yet. I need to see CNBC host Scott Wapner begging for a "Fed Emergency Rate Cut" while being near tears as CNBC flashes the caption "Markets in Turmoil" every five minutes at the bottom of the screen.

What will really confirm for me that the bear market has arrived is if neither the Fed nor the White House comments on a 1,000-point Dow decline. I went short via the SPY April $550 puts today, and while it is a relatively small position, this trade will have a short leash but a long fuse in the event that today's 65-point rally continues.

Junior Resource Issues

Wednesday at noon, I celebrated the fact that I successfully avoided the world's largest snake oil sales conference covering the world of mineral exploration and development — the Prospectors and Developers Annual Convention held every year in early March, where dozens upon dozens of junior resource companies arrive in Toronto with the expressed intent of relieving someone — anyone — of their hard-earned savings.

Back in the 1970s and 1980s, when I first attended this conglomeration of prospectors and actual producing companies, I would meet a myriad of the most interesting, hard-working people ever to grace the halls of the Royal York Hotel ballroom. The worse a man could tie his tie or shine his boots (not shoes), the more interesting and worthwhile the meeting was. I cannot tell you how many times I ran into a grizzled old mining guy from Timmins or Kirkland Lake or Rouyn, Quebec, staring straight up at the towering buildings while trying to avoid the crush of crowds infinitely larger than anything he had ever seen before.

They were always the personalities that I sought out because if the tie was on straight, the shoes were shined brightly, and the smile was of Hollywood charm and grace, I often learned the hard way to run for the hills. Those were the savvy charmers who were experts in mining the market instead of the ground.

Those suits have now moved on to far greener and far more lucrative pastures like "AI" conventions in Vegas or Silicon Valley or L.A. because they did such a wondrous job of strip-mining the resource sector in recent years that nothing was left to mine in the halls of the PDAC companies. In fact, this year was a far more well-attended affair than the past ten years, thanks largely to a near $3k gold price and a robust copper price above $4.50/lb. Equally more important was the proportionally large component of industry professionals, otherwise known as "scouts," plumbing the aisles of the Metro Convention Centre for projects.

This year, just as was the case in January at the Vancouver Resource Investment Conference, there were roughly eight industry bird dogs for every blue-haired retail tire-kicker toting shopping bags full of resource company trinkets complete with key-chains, calendars, and one-page tout sheets. These scouts were in Toronto to find projects of merit, which was a departure from years past and the first sign of life stirring in an otherwise moribund sector.

It comes as no surprise to me that the sector is finally entering a turnaround phase. The funding apparatus that was once the envy of the venture capital space — the Canadian mining sector — was plundered for years by the most ruthless of vermin ever to lace on their Versace room- working boots but in recent weeks seems to have captured the attention of the high-net-worth crowd which is always a precursor to the institutional crowd. That is historically the signal for the ultimate hyenas of the food chain — the investment bankers — to descend upon the junior resource space like a pack in search of a carcass and begin the greed-fueled feeding frenzy that always moves from scarcity to abundance at record speed once the worm turns.

As unflattering as that may seem, it is like watching the wolf pack descend upon the deer herds, plucking only the weakest of the group in a masterful exercise in culling. The bankers are a vital cog in the junior resource wheel.

What I am noticing during this past few weeks of corrective action in the Mag Seven sector and the absolute drubbing of the 2X and 3X ETFs that track Bitcoin or its Ponzi-scheme cousin — MicroStrategy Inc. (MSTR:NASDAQ) — is that the companies that populate the TSX Venture Exchange are holding up rather well.

In fact, two of my top holdings — Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) and Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) — went out at the highs for the week and up 69.28% and 29.41% YTD with the TSX Venture Exchange Index up a mere 1.24% YTD. While I would love to take the proverbial bow for being a stock-picking wizard, the reality is that real money is starting to gravitate to real deals where people and projects pass the mustard test and where the money raised goes into the ground and not all into the pockets of the promoters.

Speaking of promoters, I have absolutely no problem whatsoever with the use of the term "promoter" because, without them, there would be no new mines and very few (if any) new discoveries. Ask anyone who ever followed the fortunes of Robert Friedlan,d whom I met long before his graduation to fame and fortune after he nearly bankrupted Inco Ltd. with his masterful sale of the Voisey's Bay nickel-copper-cobalt discovery to them for $4.3 billion in1996.

The first time I met him in the old Pacific Marine building in Vancouver in the early 1990s, I had to check the inside of my suit jacket to be sure my wallet was still there a mere ten minutes listening to one of his "pitches." As masterful communicator, his new company, Ivanhoe Mines Ltd. (IVN:TSX; IVPAF:OTCQX) is focused primarily on copper and is a part-owner of the Kamoa- Kakula copper project in — of all places — the Democratic Republic of the Congo the Democratic Republic of the Congo one of the most dangerous places to work in the world.

And they are making a fortune. Without people like Friedland, there would be no new discoveries and no new mines, and locales deemed to be "uninvestible" would never be able to employ and train thousands of their citizens while improving lifestyles and educational milestones. One other important consideration: investing with Bob Friedland has, over time, proven to be a very wise decision — he has made his shareholders a mountain of money.

Let us all hope that the era of the deified mining promoter returns with the attendant return of symbiotic enrichment they historically bring to the table. Such would be a wonderment for the junior mining sector and the future of its investors.

| Want to be the first to know about interesting Gold, Critical Metals, Silver and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: SPY, Getchell Gold Corp., and Fitzroy Minerals Inc. My company has a financial relationship with: SPY, Getchell Gold Corp., and Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.