Banyan Gold Corp. (BYN:TSX.V) has released a summary of its 2024 diamond drill program results at the AurMac Project in Yukon, Canada. The program, which consisted of 21,000 meters of drilling across 118 diamond drill holes at the Airstrip and Powerline deposits, identified multiple high-grade gold intersections near the surface and at depth.

The drilling at Airstrip Deposit expanded known mineralization beyond previous resource estimates, including high-grade near-surface intervals. Notable results include drill hole AX-24-590, which intersected 15.9 meters of 9.32 grams per tonne (g/t) gold from 65.7 meters, marking the first interval exceeding 100 gram-meters at this deposit. Additional high-grade intersections include AX-24-593, which returned 13.8 meters at 3.81 g/t gold from 67.6 meters, and AX-24-604, which intersected 46.4 meters at 1.31 g/t gold from 55.8 meters. The deposit remains open in all directions.

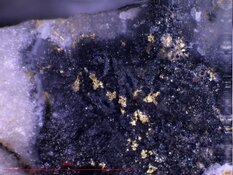

Drilling at Powerline Deposit also produced significant results, with drillhole AX-24-540 intersecting 23.1 meters of 5.68 g/t gold from 159.3 meters, including 0.2 meters of 539.3 g/t gold. Sixteen drill holes recorded intervals exceeding 50 gram-meters, reinforcing the deposit's high-grade potential. Gold mineralization at both deposits is associated with an intrusion-related gold system, characteristic of the Tombstone Gold Belt and Selwyn Basin deposits.

Banyan expects to release an updated mineral resource estimate (MRE) in the second quarter of 2025. The most recent MRE, published in February 2024, estimated an inferred resource of 7.0 million ounces of gold across the AurMac Project, with 6.16 million ounces attributed to the Powerline deposit and 845,000 ounces at Airstrip.

Tara Christie, President and CEO, emphasized the impact of these results, stating in the news release, "The discovery of high-grade zones and understanding the geological context puts us on track to reshape perceptions of the AurMac Gold Deposits." She added that 2024 drilling confirmed the project's potential for both grade and ounce growth.

Gold Holds Strength as Trade Uncertainty and Inflation Drive Demand

Gold prices maintained strong momentum in early 2025, driven by trade tensions, economic uncertainty, and central bank demand. According to U.S. Global Investors, on February 24, gold surged to an all-time high of US$2,940 per ounce, pushing its market cap above US$20 trillion for the first time.

The report highlighted ongoing discussions about revaluing U.S. gold reserves, which have remained officially priced at US$42 per ounce since 1973. Frank Holmes noted that adjusting reserves to market value could significantly enhance the U.S. balance sheet while reinforcing gold's role as a financial asset. Additionally, he pointed to sustained central bank demand, with over 1,000 tons purchased globally for the third consecutive year in 2024, led by the National Bank of Poland and the People's Bank of China.

On March 6, Paydirt Prospector highlighted Banyan Gold's 2024 drill program results, emphasizing the company's ability to confirm long widths of mineable-grade gold and identify high-grade zones within its broader mineralization.

On February 25, 321Gold reported that trade policies under the Trump administration had created stagflationary conditions, which were broadly supportive of gold prices.

The report suggested that while gold was due for a short-term pause, its long-term trajectory remained positive due to rising inflation and global demand. The analysis also pointed to the continued strength of gold as a hedge against economic uncertainty, particularly as investors sought alternatives to fiat currency.

Kitco published a piece on February 26 that mentioned how gold futures stabilized following a sharp US$40 drop, with the most active April contract closing at US$2,933.80 per ounce. The report attributed gold's resilience to expectations that U.S. tariffs on Canada and Mexico, set to take effect in March, would fuel economic uncertainty and inflation. Kitco cited concerns that such policies could lead to a broader trade war, prompting investors to allocate more capital to safe-haven assets.

On March 5, Reuters reported that gold remained above US$2,900 per ounce, even as investors awaited U.S. payroll data. Spot gold was recorded at US$2,913.99 per ounce, while U.S. gold futures settled at US$2,926. Market strategist Peter Grant of Zaner Metals stated that "buying interest remained strong," despite short-term fluctuations. The report noted that tariffs had played a significant role in gold's 11 record highs since the beginning of the year, reinforcing its appeal as a hedge against economic volatility.

Upcoming Milestones Position Banyan Gold for Growth at AurMac

Banyan Gold's investor presentation outlines multiple near-term catalysts aimed at advancing the AurMac Project. The company plans to conduct at least 10,000 additional meters of drilling in 2025, targeting the expansion of high-grade zones identified in 2024. This drilling will focus on extensions of known mineralization and geophysical targets within Banyan's 100%-owned property.

An updated MRE, expected in the second quarter of 2025, will incorporate the latest drill results and provide a revised estimate of the project's resource potential. In the fourth quarter, Banyan intends to release a preliminary economic assessment (PEA) that will evaluate the project's potential economic viability, including metallurgy, processing costs, and overall development considerations.

Banyan also benefits from established infrastructure, including road access, proximity to a power station, and regional hydroelectric power. The company continues to engage with local communities and regulatory bodies, leveraging over 15 years of baseline environmental data to facilitate the permitting process.

With a strong treasury and recent financings securing its exploration activities through 2025, Banyan Gold believes that it remains positioned to advance AurMac toward potential development. Further drill results and resource updates in the coming months will provide additional insight into the project's growth potential.

Strong Exploration Results and Growth Potential Support Banyan Gold's Valuation

According to Paradigm Capital on February 4, Banyan Gold's ongoing drill program at its AurMac project produced encouraging results, particularly in defining higher-grade "starter pits" at the Powerline and Airstrip deposits. The firm noted that an updated resource estimate was expected in the second quarter of 2025, followed by a preliminary economic assessment by year-end. Analysts viewed the discovery of mineralization between the two deposits as a sign of further resource expansion potential, stating that "this is showing the potential to expand resources and perhaps join the Powerline and Airstrip deposits into what could be one very large open pit."

On March 6, Paydirt Prospector highlighted Banyan Gold's 2024 drill program results, emphasizing the company's ability to confirm long widths of mineable-grade gold and identify high-grade zones within its broader mineralization. The report described Banyan's AurMac project as "undervalued based on the in-situ value it has already established," maintaining a buy recommendation for those not yet holding shares. The firm also underscored the project's market positioning, noting that Banyan Gold's location near infrastructure and roads placed it at the center of a potential regional consolidation.

Both sources indicated that Banyan Gold's exploration success and strategic location provided a strong foundation for future resource growth. Analysts highlighted that continued drilling and upcoming economic studies could further enhance the company's valuation.

Ownership and Share Structure

According to Refinitiv, 16.90% of Banyan Gold is owned by institutions. Of them, Franklin Advisors has the most with 9.74%. Fidelity management has 7.12%.

7.44% of the company is held by management and insiders including Tara M. Christie with 4.25% and David Reid at 1.72%. Strategic Entity, Victoria Gold Corp, holds 10.39%. The remainder is retail.

Banyan Gold Corp has 271.07 million free float shares, a market capitalization of CA$53.07 million, and a 52 week range of CA$0.0990 to $0.2797.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

1) James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

2) This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.