StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) announced the start of its infill and expansion drilling program at its Hercules gold project in Nevada's Walker Lane, which is meant to build on its recently published exploration target at the project in a technical report earlier this month.

The drill-defined, bulk-tonnage exploration target, as described in the NI 43-101 compliant report, hosts between 819,000 ounces and 1,018,000 ounces (1.018 Moz) of gold (Au) within 40.3 million to 65.6 million tonnes of mineralized material with estimated grades between 0.48 and 0.63 grams per tonne (g/t) Au.

Since the company acquired Hercules late last year for CA$250,000, Hercules has "rapidly evolved into a cornerstone asset in StrikePoint's portfolio, underscoring the company's strategy of creating significant shareholder value through strategic acquisitions and focused exploration," StrikePoint said in a release.

"As the gold price strengthens, it's an exciting time in Nevada's gold mining industry," President and Chief Executive Officer Michael G. Allen said. "Recent mergers and acquisition activities have highlighted the attractiveness of projects in the State of Nevada. Acquiring the Hercules Gold Project for just CA$250,000 and quickly demonstrating an immediate potential for 1 Moz gold underlines our strategy of identifying and advancing undervalued assets in proven jurisdictions."

Allen continued, saying Walker Lane offers a "unique environment for swift resource development, and our upcoming drilling will help us unlock the full scope of this oxide gold system."

StrikePoint said its plans seven to eight holes on multiple targets on the northern portion of Hercules and about 1,500 meters of drilling. The program is expected be completed in late March or early April 2025, with results to follow shortly. The drilling is being carried out under a Plan of Operations permit, the company said.

Dozens of Untested Targets

To quantify the target released March 3, StrikePoint used data, including historical and current drill results, from the Sirens, Hercules, Cliffs, Loaves, Lucky Rusty, Rattlesnakes and NorthEast showings at Hercules. Data were available for 306 historical drill holes, 31,776 meters in all, and 121 surface trenches. The numbers of available sample intervals were 18,409 from drilling and 475 from trenching. A total of 5,620 sample intervals was used.

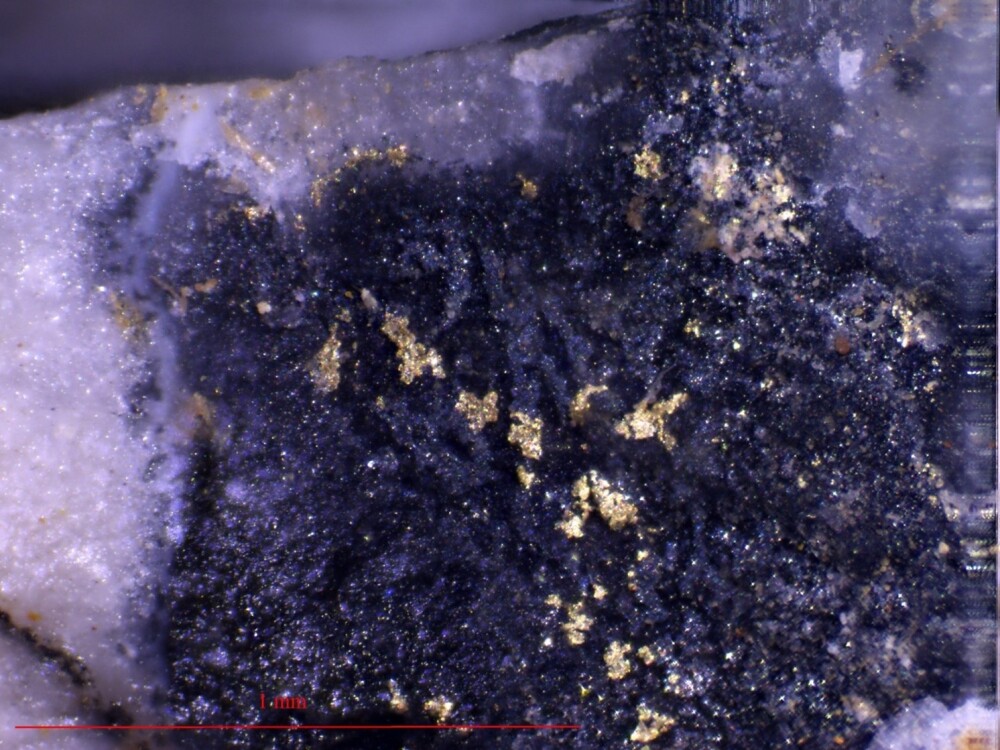

Hercules contains more than 45 untested geophysical and geochemical targets, some of which include visible gold at surface, the company has noted. Also, areas of mineralization remain open for expansion and possibly resource conversion.

"Previous drilling has only scratched the surface of this project's potential," Allen said. "We believe that the Hercules gold project has the potential to be Nevada's next multimillion-ounce gold resource."

StrikePoint has amassed a land package of 145 square kilometers and owns two projects, Hercules and Cuprite in the Walker Lane gold trend. Walker Lane hosts some of the largest volcanic-hosted deposits in the West but has not seen much modern production, according to a Convergent Mining article. The deposits, which often contain silver and base metals too, are of a type that allows for relatively easy gold extraction.

"The Walker Lane has so much more to give," the article's author wrote. "With a massive land area, known significant deposits and the emergence of new exploration models, the Walker Lane may very well take the top spot in gold production from the Carlin Trend sometime in the not-so-distant future."

The Tier 1 gold projects in the Walker Lane include Kinross Gold Corp.'s (K:TSX; KGC:NYSE) Round Mountain, about 130 kilometers north of StrikePoint's Cuprite, which produced 15 Moz of gold, noted the Convergent article, and AngloGold Ashanti Ltd.'s (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) Silicon Gold and Merlin discoveries, about 75 kilometers southeast of Cuprite.

Spanning 100 square kilometers, Hercules features a low-sulfidation epithermal gold system, shown through historical drilling directed by Allen, shares geological similarities with the nearby Comstock Lode, and boasts multiple drill-ready targets.

'Relatively Unlimited' Upside, Analyst Says

StrikePoint's other asset in the Walker Lane is Cuprite, which covers 44 square kilometers and encompasses 574 unpatented claims.

*"Cuprite was off limits for exploitation up until relatively recently, and so by Walker Lane standards, it is relatively 'virgin' territory with big discovery potential," Technical Analyst Clive Maund wrote in a recent contributor opinion.

Last year, StrikePoint completed a five-hole maiden drill program at Cuprite, which showed mineralization in four of the holes.

Shortly after the target report was released, Jeff Clark of The Gold Advisor noted that he was looking forward to exploration plans from the company like those announced on Monday.

"Based on the prospectivity of Hercules, especially given this new exploration target report, I expect this project to receive the lion's share of StrikePoint's attention in 2025," wrote on March 6. "That said, I’m still waiting for an actual exploration program at Hercules before I move the company off our hold list."

Maund described StrikePoint as a stock with big upside and very little downside. He predicted that the company could make "huge percentage gains" from where it was trading at the time of this article, at about CA$0.16 per share.

According to the charts, SKP is about to come out of its long bear market since 2021 when it peaked at 20 times the current share price, noted Maund. As such, the upside it offers is "relatively unlimited."

"Strikepoint Gold is very good value here and is likely to start higher soon," Maund wrote.

The Catalyst: Gold Goes Higher and Higher

Gold slipped below the US$2,900 mark during the first half of the European session on Monday, moving back closer to the lower end of a nearly one-week-old trading range, FX Street's Haresh Menghani reported on Monday.

As investors look past Friday's weaker U.S. jobs report, the U.S. dollar staged a modest bounce from its lowest level since November and turned out to be a key factor undermining the precious metal, Menghani wrote.

"However, bets that the Federal Reserve (Fed) will cut interest rates multiple times this year and a steep intraday decline in the U.S. Treasury bond yields might hold back the USD bulls from placing fresh bets," Menghani said. "Furthermore, worries about the economic fallout from U.S. President Donald Trump's trade tariffs and global trade war fears could offer some support to the safe-haven gold price and help limit losses."

Gold has seen multiple records so far this year, and some experts are saying US$3,000 gold appears in reach, Lyle Niedens reported for Investopedia.

"Several Wall Street firms have raised their gold price forecasts to US$3,000 or higher," Niedens wrote on February 20. "Goldman Sachs, for instance, cited 'structurally higher central bank demand' for gold in addition to investors' appetite for parking assets in safe havens when it early this week raised its gold-price forecast to US$3,100 by the end of 2025, up from US$2,890 previously."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB)

Others said it could rise even further. "An explosive move toward US$8,000/ounce is not just possible; it's increasingly probable," John Newell of John Newell and Associates wrote in a recent article.

"For those looking to hedge against inflation, preserve wealth, and capitalize on a potential historic price surge," added Newell, "gold remains one of the most compelling investment opportunities of our time."

Ownership and Share Structure

According to Refinitiv, Executive Chairman Shawn Khunkhun owns 0.28% of the company, President and CEO Michael G. Allen owns 1%, Director Ian Richard Harris owns 0.07%, and Director Adrian Wallace Fleming owns 0.02%.

Refinitiv reported that institutional and strategic investors own approximately 12.64% of the company, including 2176423 Ontario Ltd. with 7.17%, Pathfinder Asset Management Ltd. with 4.81%, and U.S. Global Investors Inc. with 0.66%.

According to Refinitiv, the company has 41.59 million shares outstanding and a market cap of CA$6.69 million. It trades in a 52-week range of CA$0.12 and CA$0.90.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- StrikePoint Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Strikepoint Gold Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on December 13, 2024

- For the quoted article (published on December 13, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.