Volt Lithium Corp. (VLT:TSV; VLTLF:US; I2D:FSE) has announced the successful lithium extraction results from its Generation 5 field unit operating in the Permian Basin, Texas. The company reported achieving up to 99% lithium recovery through internal nuclear magnetic resonance (NMR) testing, which aligns with previous third-party validations of its direct lithium extraction (DLE) technology.

"The first 90 system tests have been critical in understanding the full capabilities of our Generation 5 field unit," said Alex Wylie, Volt's president and CEO, in the announcement. "We're especially pleased that scaling up to a 10,000-barrel-per-day system continues to deliver 99% extraction results. These insights will guide our next steps toward automating the unit for greater throughput and cost optimization."

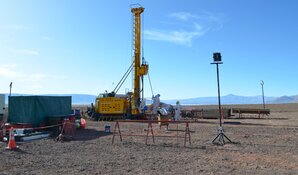

The Generation 5 system represents Volt's largest DLE deployment to date. The company has been conducting extensive testing on reagent usage, cycle times, and processing parameters as it works toward automating the system. Once fully automated, the unit is expected to enhance production efficiency and reduce operating costs.

In anticipation of commercial demand, Volt has also begun stockpiling lithium concentrate, a move that positions the company for future customer engagements. The company plans to continue refining its operating parameters in the coming weeks as it prepares for the next phase of scaling up its operations.

Lithium Sector Sees Strengthening Fundamentals Amid Market Rebalancing

The lithium sector continued to gain momentum in early 2025, with analysts highlighting improving market conditions and growing demand. According to a January 14 report from USA News Group, lithium's role in the energy transition was expected to regain strength as supply dynamics shifted.

The article noted that after a period of oversupply, the market was projected to see a reduced surplus of lithium carbonate equivalent (LCE), from nearly 150,000 tonnes in 2024 to approximately 80,000 tonnes in 2025. A potential supply shortage was also forecasted in the coming years, with Benchmark analysts estimating that the industry would require US$116 billion in investments by 2030 to meet the increasing demand for electric vehicles (EVs).

In a March 5 research note, Technical Analyst Clive Maund provided an update on Volt Lithium and highlighted the company's strong technical setup.

Precedence Research projected that the global lithium market would reach US$28.45 billion by 2033, driven by a compound annual growth rate (CAGR) of 12.5%. Bank of America further supported this outlook, predicting that the lithium market could shift into a supply deficit by 2027, with 2025 marking the peak of the current oversupply.

On February 6, Fastmarkets noted that after years of oversupply, lithium market conditions had begun tightening in 2025, with supply expected to shift into balance. The publication stated that Australian production cuts and improving demand for battery materials were helping stabilize the market. Fastmarkets projected that after an estimated 154,000-tonne surplus in 2024, the market would see only a 10,000-tonne surplus in 2025 before shifting into a 1,500-tonne deficit in 2026.

A February 24 report from S&P Global Commodity Insights highlighted a surge in lithium global bidding activity following a period of sluggish demand in late 2024 and early 2025. The article noted that multiple battery-grade lithium carbonate tenders closed between February 18 and February 21, marking a shift in market sentiment. While some industry participants viewed the rise in tenders as a sign of renewed activity, others expressed caution about potential price volatility. A source from Tianqi Lithium stated, "It sends a positive signal to the market, but we must be cautious that some may use this opportunity to drive prices higher." The report also noted that long-term contract prices remained a primary sales strategy for many producers, though some, like Ganfeng Lithium, were considering scaling up their participation in future tenders. Despite mixed reactions, the increase in bidding events reflected heightened interest in lithium procurement, reinforcing its role as a critical resource in the energy transition.

Volt Lithium Expands Its Footprint as a Pioneer in Oilfield Brine Extraction

As outlined in its February Investor Presentation, Volt Lithium has positioned itself as a potential leader in lithium extraction from oilfield brines, aiming to become North America's first commercial producer in this category. According to its latest investor presentation, the company's DLE technology is designed to operate at large-scale production levels, with the ability to process over 10,000 barrels per day.

With its Permian Basin operations underway, Volt is focused on optimizing costs and increasing lithium recovery efficiencies. The company reports that its all-in extraction and operating costs are below US$2,900 per tonne of lithium carbonate equivalent, which could support robust margins in various lithium pricing environments.

Beyond Texas, Volt is also working on expanding its footprint. The company has secured funding for a field study in North Dakota's Bakken Formation, with plans to deploy a field unit in the region by the second quarter of 2025. As the lithium market continues to develop, Volt's proprietary DLE technology and strategic partnerships may support its long-term commercial goals.

Volt Lithium Earns Buy Rating for Advancements in Low-Cost Lithium Extraction

On January 23, Michael Ballanger of GGM Advisory Inc. upgraded Volt Lithium's rating to a Buy, citing the company's advancements in lithium extraction from oilfield brine as a distinguishing factor in the sector. He highlighted Volt's ability to maintain low operational costs while producing battery-grade lithium, positioning it competitively within the evolving market. Ballanger also noted that recent developments had enhanced Volt's investment appeal, particularly as lithium market conditions showed signs of improvement.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Volt Lithium Corp. (VLT:TSV;VLTLF:US;I2D:FSE)

In a March 5 research note, Technical Analyst Clive Maund provided an update on Volt Lithium and highlighted the company's strong technical setup, suggesting it was nearing a breakout from a large intermediate base pattern that had been forming since November. The report pointed to Volt's latest milestone in lithium extraction, with its Generation 5 Field Unit in the Permian Basin achieving 99% lithium recovery, as a potential catalyst for this move. Maund noted that Volt Lithium had already delivered significant gains for early investors, with shares doubling from their 2024 lows.

Ownership and Share Structure

Refinitiv provided a breakdown of the company's ownership and share structure, where management and insiders own approximately 14% of the company.

According to Refinitiv, James Alexander Wylie owns 7.97% of the company, Martin Scase owns 4.53%, Warner Uhl owns 0.81%, Morgan Tiernan owns 0.35%, and Kyle Robert Hookey owns 0.10%.

Refinitiv reports that institutions own less than 1% of the company, as Eagle Claw Investments Pty. Ltd. owns 0.98%.

According to Reuters, the company has 165.97 million shares outstanding and a market cap of CA$54.77 million. It trades in a 52-week range of CA$0.16 and CA$0.49.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Volt Lithium Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.