It is no exaggeration to say that Terra Clean Energy Corp. (TCEC:CSE; TCEFF:OTC; T1KC:FSE) is an exceptional investment at this time for a number of important and readily demonstrable fundamental and technical reasons. With respect to the former, the company is an established explorer looking for uranium in the prolific Athabasca Basin in Saskatchewan, Canada, at its Fraser Lakes B Uranium Deposit, where it has already made discoveries and while the grades encountered — so far — have been lower grade by the standards of the Basin, they are at shallow depth making open pit extraction possible and also close to infrastructure which further reduces costs, and there is plenty of scope for increasing both the grade and the magnitude of the resource going forward on the company's sizable property, especially as an extensive drilling program is currently underway.

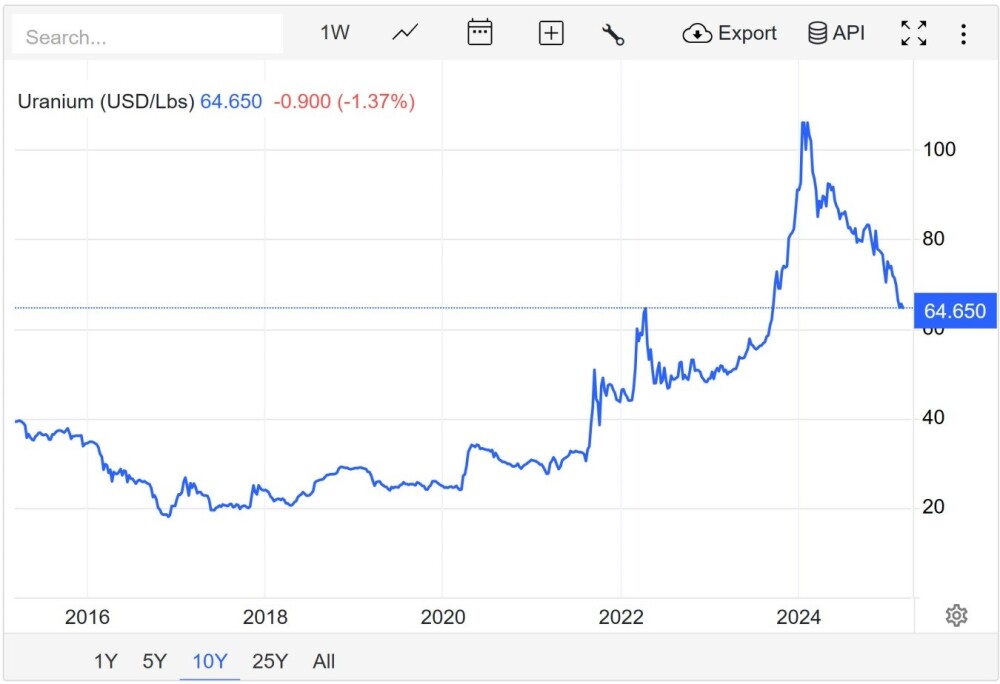

In addition, the continuing drive for clean energy generation is likely to result in the uranium price reversing to the upside after its bear market of the past year, especially as this drop has brought the price back to an important support level in the $60 area — see 10-year uranium price chart below. On top of all this, there have been significant management changes with the appointment of a new CEO, Greg Cameron and a new vice-president of exploration, C. Trevor Perkins, effective at the start of this year, which the market evidently approves of, given the strong buying of the stock that has occurred since.

Mr Cameron commented, "I'm excited to lead Terra and begin an aggressive development plan of the South Falcon uranium deposit. We believe strongly that our upcoming exploration program will allow us to increase both the size and grade of the current deposit. With renewed optimism in the uranium sector and fresh capital to deploy, we believe the timing is right to create a lot of value."

With respect to the technical aspects, the stock has been advancing on quite heavy upside volume this year that has brought it to the point of breaking out into a major new bull market, as we will see when we review the latest stock charts and the ability of the stock price to respond to increased demand is of course enhanced by the 1 for 4 stock consolidation that took place early in December which reduced the number of shares to a relatively modest 36.3 million.

We will now overview the fundamentals of the company and its assets using pages from the latest investor deck.

This first page provides an overview of the company — a key advantage is the ability to develop a shallow near-surface deposit, which will have a major cost advantage, and, as mentioned above, there is always the possibility of discovering significantly higher grades.

The Athabasca Basin is renowned as the best place in the world to explore for uranium.

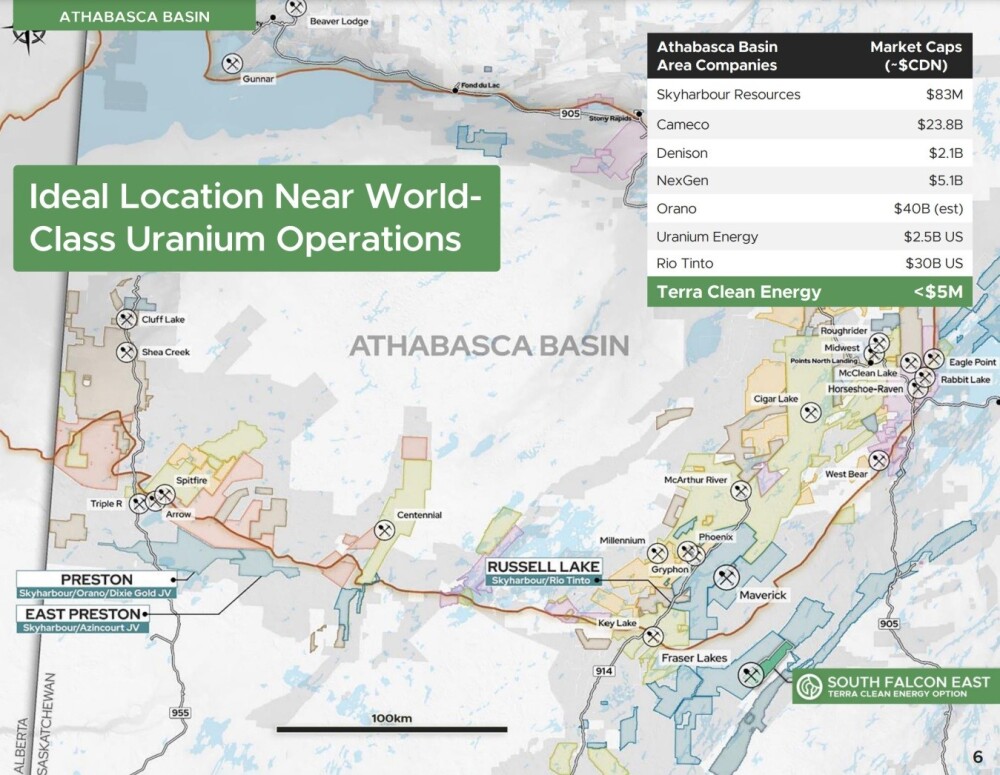

The next page shows the location of the company's South Falcon East property to the SE of the Athabasca Basin and its situation relative to other world-class uranium operations in the area, including those operated by big companies such as Cameco Corp. (CCO:TSX; CCJ:NYSE) and Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT).

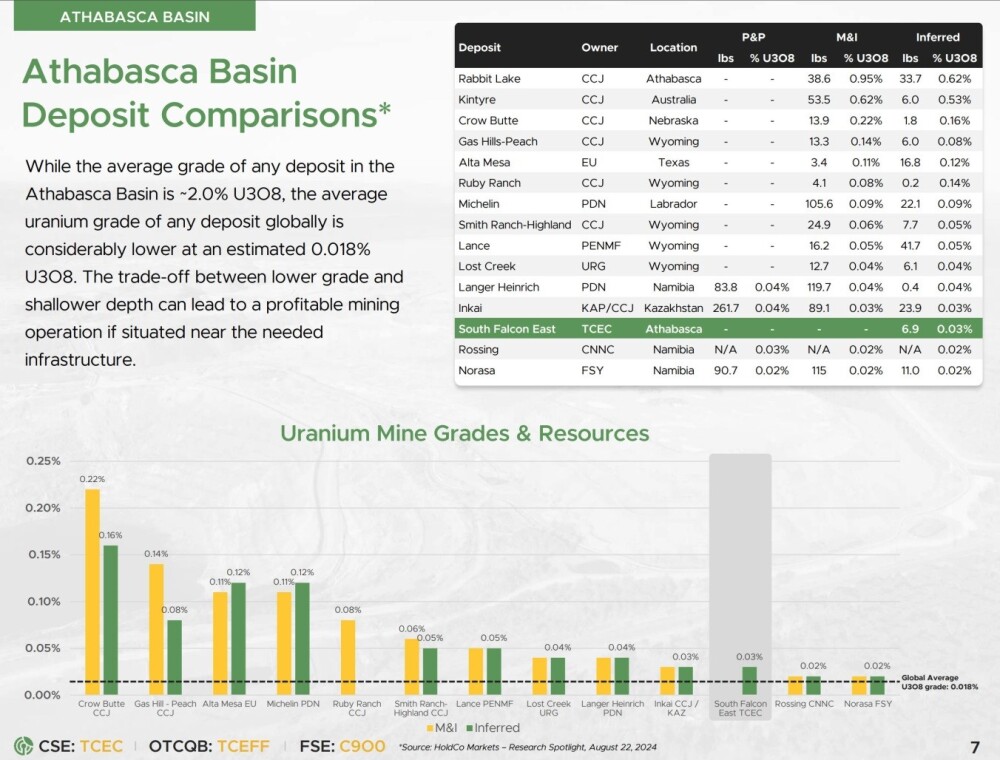

Although the grades encountered to date may not look very impressive by the standards of the basin, they are considerably higher than the global average, with the shallow depth of deposits found thus far being a major advantage.

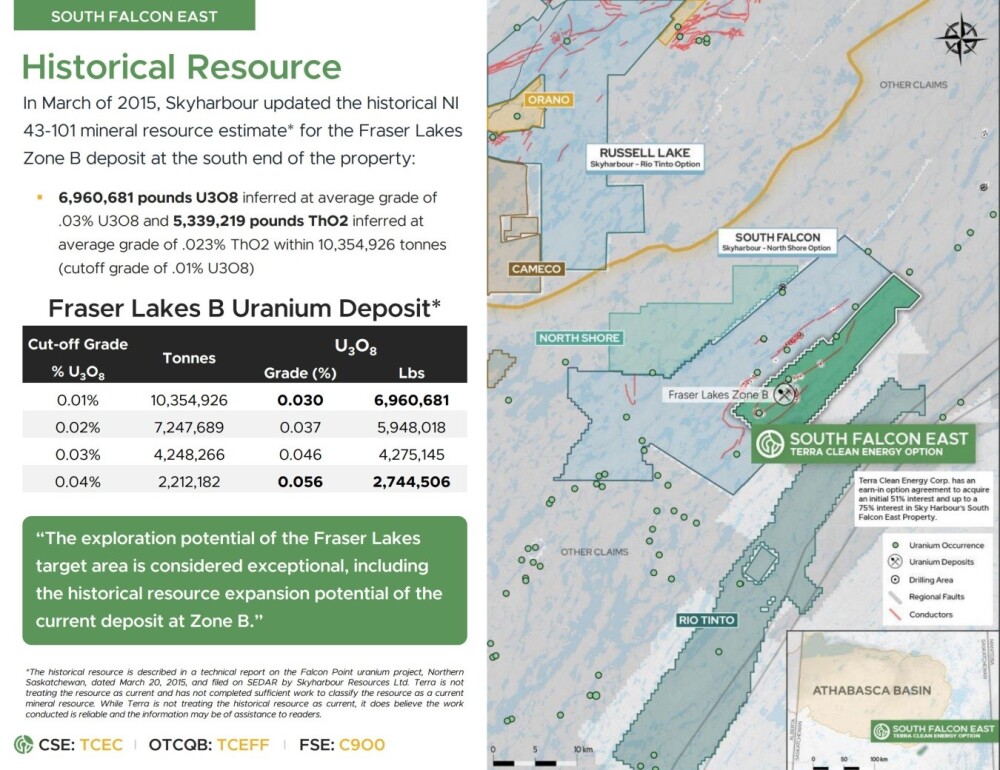

The next page includes a map of the property plus a table showing the already defined resource at Fraser Lakes B by an NI-43 – 101 MRE undertaken by Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) in 2015.

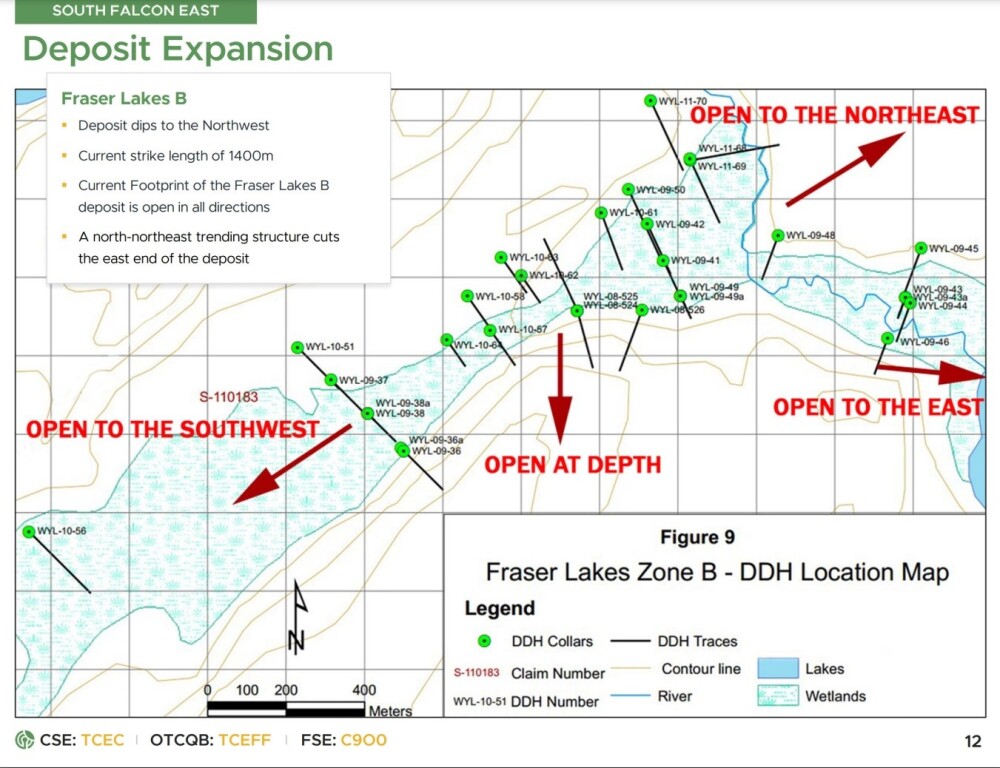

The deposit is open to expansion in all directions.

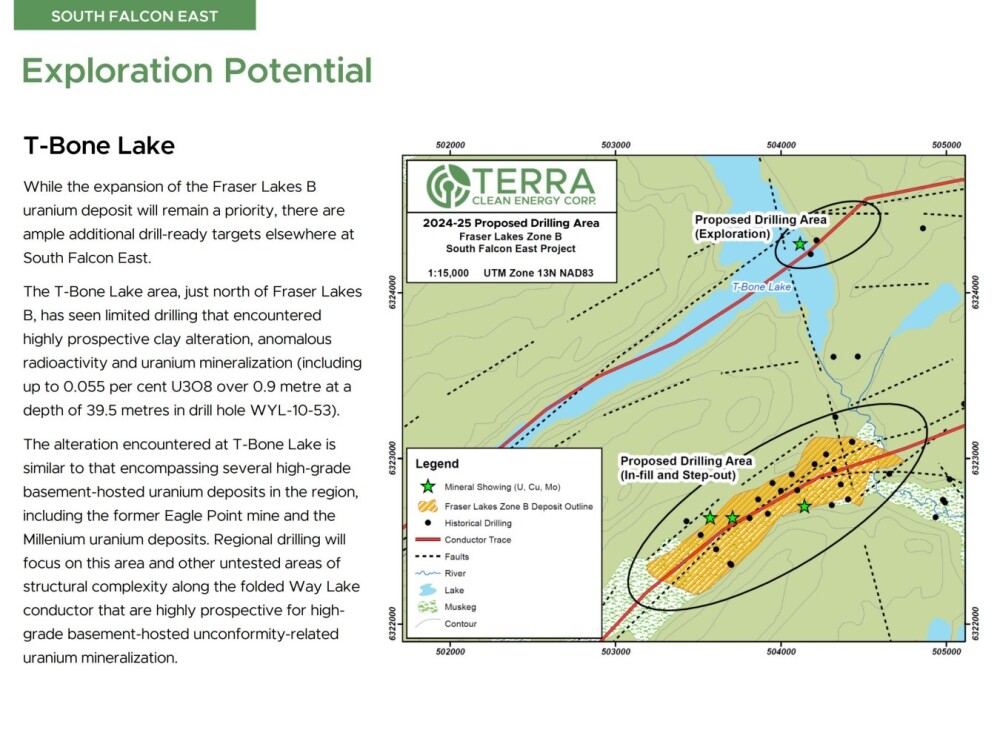

There are other parts of the property with considerable discovery potential, such as T-bone Lake.

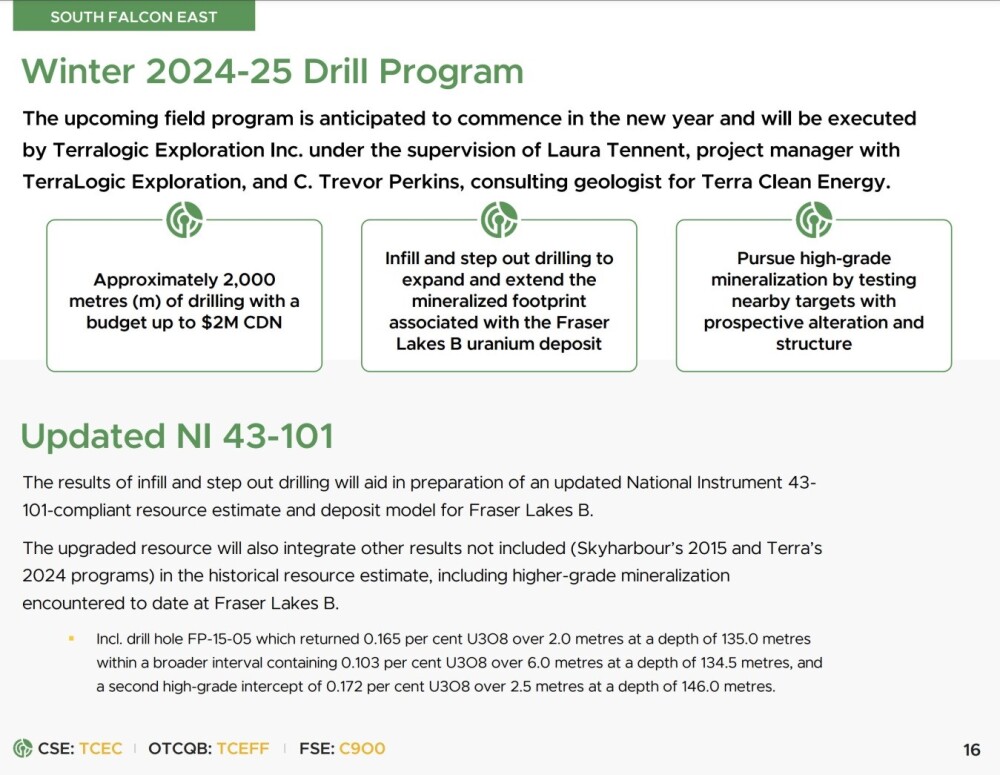

The big Winter drill program that is now well advanced will contribute to an updated NI-43-101 MRE.

The following table presents details of the company's capitalization and shows that a modest 36.3 million shares are in issue following the previously mentioned 1 for 4 consolidation on December 4.

Now, I will review the latest charts for Terra Clean Energy.

The charts present an exceptionally strong setup. Starting with the 3-year chart, we see that Terra went through a severe bear market from its early 2023 high at about CA$2.90, which erased most of the stock's value by the time it had run its course late last year. This bear market took the form of a classic 3-wave A-B-C decline, with the first down leg being steep and followed by a shallow B-wave relief rally before a more leisurely but still destructive C-wave decline set in.

The fact that the Accumulation line was trending higher all last year even as the price declined was an indication that, even though the price was dropping, the stock was being furtively accumulated by believers in the future of the company.

This year to date, however, we have seen much more dramatic and overt evidence that a major bull market is close at hand with increasingly aggressive "Smart Money" buying of stock that has driven the On-balance Volume line steeply higher and all that has stopped the stock from really taking off higher already is the remaining weak holders being flushed out, symbolized by the 200-day moving average still falling — but it won't be for much longer.

On the 1-year chart, we can see how the decelerating downtrend finally came to a halt in November – December when a bullish Cup & Handle base started to form that we correctly identified in the January update, as it has since broken out of this pattern although it has yet to break fully clear of the downtrend which it is now in the process of doing.

On this chart there are a number of bullish points to observe. The just-mentioned breakout from the Cup & Handle base has taken the price above its 50-day moving average, which is now rising and converging on the 200-day, a positive setup that will soon lead to a bullish cross of the 50-day above the 200-day in the event that another upleg occurs soon.

This is expected and with good reason, for we have seen strong upside volume since mid-January that has driven the On-balance Volume line, in particular, steeply higher.

The 5-month chart presents an entirely positive picture. On it, we can see that, having broken out of the Cup & Handle base on good volume in January as predicted, the price is currently consolidating this breakout in a classic bull Flag that is forming above the support at the upper boundary of the base pattern and above the rising 50-day moving average, with the marked volume dieback during this pattern a sign that it is destined to break higher into another upleg soon.

The conclusion is that Terra Clean Energy is on the cusp of a clear breakout into a major bull market. Holders should, therefore, stay long, and it is rated a Strong Buy here for all time horizons, and this is a good point to add to positions. The first target for an advance is the CA$0.85 – CA$0.90 zone. The second target is a zone of resistance in the CA$1.25 – CA$1.40 area, with a third target in the vicinity of the early 2023 high in the CA$2.90 area, and higher targets are possible.

Terra Clean Energy's website.

Terra Clean Energy Corp. (TCEC:CSE; TCEFF:OTC; T1KC:FSE) closed for trading at CA$0.26, US$0.18244 on March 6, 2025.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Terra Clean Energy Corp. and Skyharbour Resources are a billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Terra Clean Energy Corp. and Cameco Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.