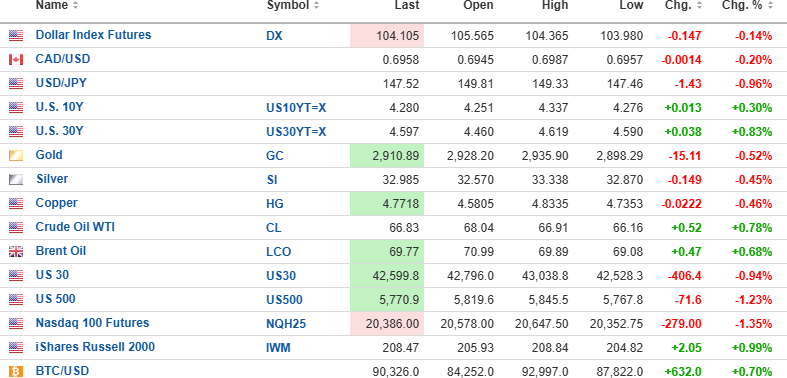

The U.S. dollar Index futures are lower by 0.14% to 104.105, with the 10-year yield up 0.30% to 4.280% and the 10-year yield up 0.83% to 4.597%.

Gold (-1.23%), silver (- .45%), and copper (-0.46%) are down, while oil (+0.78%) is higher.

The DJIA futures (-0.94%) are down 406.4 points; the S&P 500 futures (-1.23%) are up 37.6 points; and the NASDAQ 100 futures (-1.35%) are lower by 279.00 points.

Risk barometer Bitcoin is up 0.70% to $90,326.

Yesterday, I wrote: "My instincts tell me that in order to set up the next rally, there needs to be more pain, and only a crash in the RSI down to 20-25 and a big violation of the 200-dma will inflict that type of pain."

That was why I elected to stand aside from any leveraged trades in either the SPY:US or the VIX:US/UVIX:US. In retrospect, I was so focused on the Fitzroy Minerals' tape action (1,785,420 shares traded) that I should have been paying more attention to volatility. With the 64.48 point bounce in the S&P 500, it certainly brought the volatility trades back into a decent range as the UVIX:US, which was punted at $40.50 on Tuesday morning,g closed yesterday at $35.09 and while it is down 13.36% from my exit point, it is called $39.67 bid pre-opening.

I may have missed that re-entry. For now, no action is to be taken on the UVIX:US.

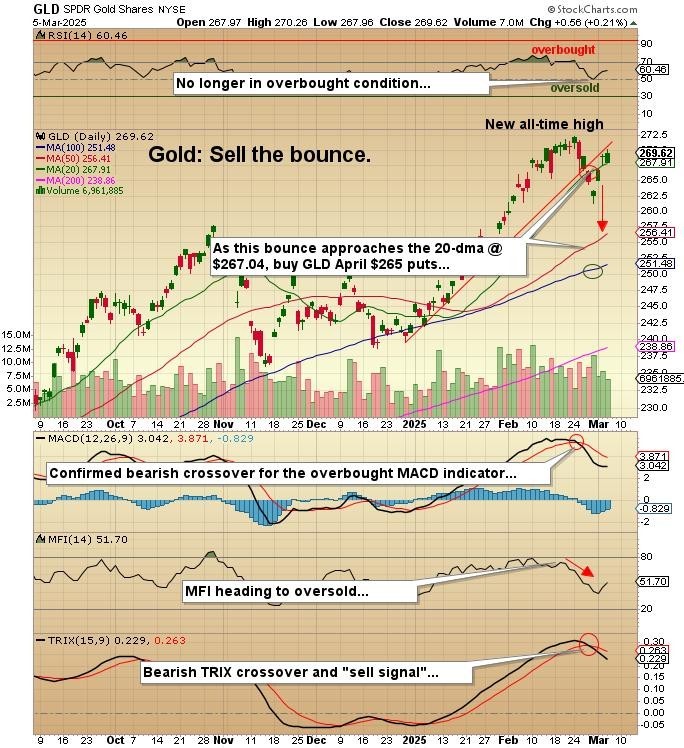

GLD:US

With the chart shown below, I find it hard to be long gold on a near-term basis. All indicators are pointing to a test of the 50-dma at $256.41, which is over $13 below Wednesday's close.

At the same time, the longer-term chart points to new record highs above $3k, but just not now. I remain long 25 contracts GLD April $265 puts looking for an exit by tomorrow's close.

Fitzroy Minerals Inc.

Unbelievable tape action yesterday in the shares of my favorite copper explorer/developer, Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), as it traded 1,785,420 on the TSX Venture and another 160,060 in the U.S. Freddie called me while on his road trip indicating that even the big U.S. desk traders noticed the "pin action" especially on a day when most juniors lapse into the post-PDAC hangover as the booths are all gone and the pitchmen (and ladies) hoarse from two-and-a-half days of selling their stories.

In my 47 years of hearing these "stories," I have yet to come across one as compelling as FTZ/FTZFF. They have already confirmed a discovery at Caballos with the news release from February 10, with the only holdback being the assays (expected shortly) confirming economic grade and width.

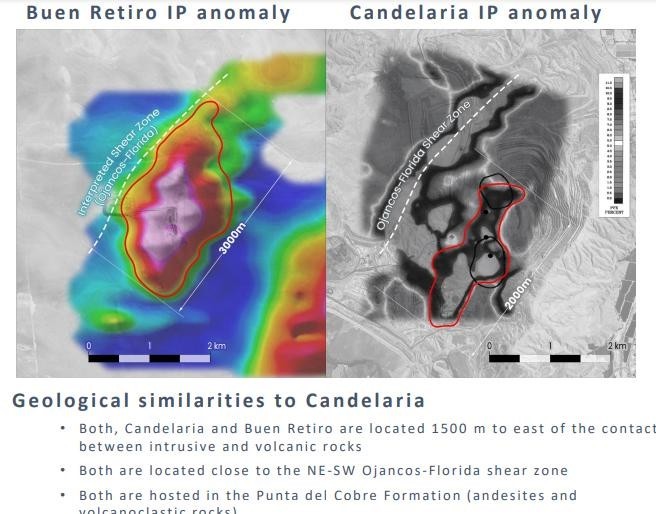

They have already announced their intention to acquire Ptolemy Mining, a U.K.-based holding company with assets that include the Manto Negro copper mine, the Sierra Fritis concessions, and the Buen Retiro IOCG concessions, with the latter expected to be drilled starting this month after regulatory approvals have been obtained.

The approval process for this transaction has been an impediment to the marketing of the Fitzroy "story" largely because the regulators have prohibited any use of Ptolemy data until the transaction has been approved. It is, however, public knowledge that these projects held by Ptolemy Mining can be researched by accessing their website which provides a link to the corporate presentation.

As much as I am excited over the 185-metre interval of sulphide mineralization at Caballos and what it may mean for near-term valuation adjustment, the end-of-the-rainbow prize is Buen Retiro, a prospect that carries all the characteristics of the Candelaria IOCG Mine currently owned and operated by the mighty Lundin Mining Corp.. "BR" contains an oxide cap that is believed to be in the range of 30 million tonnes. The near-term plan once approvals are secured is to execute the following:

- Define the oxides (by way of a 15-hole drill)

- Discover the sulphides (believed to be the IOCG anomaly located beneath the oxides)

- Develop quickly (Low CAPEX, excellent infrastructure, mining-friendly jurisdiction)

- Increase Valuation (Pucobre option sets up 3X's return of capital in return for 30%)

I urge all subscribers to go onto the Ptolemy website and scroll down through the interviews with Matt Gordon, Merlin Marr-Johnson, and Gilberto Schubert. Try to get a feel for the reasons you own (or should own) the stock.

As soon as CIRO (Canadian Investment Regulatory Organization) issues the green light on the Ptolemy acquisition, assay results from Caballos should follow right behind.

It is at this point that the multi-pronged, fully-funded exploration programs kick into gear with active drilling at Caballos, Buen Retiro, and Polimet. With copper now a mere $0.40 per pound from an all-time high, it is a superb time to be a Fitzroy Minerals shareholder.

| Want to be the first to know about interesting Base Metals, Critical Metals, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.