Q2 Metals Corp. (QTWOTSX-V; OTCQB:QUEXF) has received US$7,684,999.80 from the exercise of 12,808,333 share purchase warrants ahead of their expiration. The warrants, which carried a strike price of US$0.60 per share, were originally issued as part of a private placement financing that closed on February 23, 2023.

The company stated that these proceeds further strengthen its balance sheet, with its fiscal year-end on February 28 expected to reflect a cash position of approximately US$12.3 million. According to Alicia Milne, president and chief executive officer of Q2 Metals, in the announcement, "We are extremely pleased to add the cash proceeds from the exercise of these expiring warrants to Q2's strong balance sheet. Our fully funded 2025 winter drill campaign at Cisco is underway, and we look forward to displaying our core and speaking with investors at a very busy PDAC next week."

Q2 Metals is actively engaged in the Cisco lithium project, located in the Eeyou Istchee James Bay region of Quebec, a jurisdiction recognized for its mining-friendly policies and significant lithium resources. The company has been conducting exploration and drilling programs to define and expand lithium mineralization at the Cisco project.

Lithium Sector Sees Market Shift as Demand and Investment Outlook Strengthen

The lithium sector continued its upward trajectory in early 2025, with analysts pointing to improving market fundamentals and rising demand. A January 14 report from USA News Group indicated that lithium's role in the energy transition was regaining strength as supply dynamics evolved. The report highlighted a shift from an oversupplied market to a more balanced outlook, with lithium carbonate equivalent (LCE) surplus expected to decline from nearly 150,000 tonnes in 2024 to approximately 80,000 tonnes in 2025. Looking further ahead, Benchmark analysts projected a potential supply shortage, estimating that US$116 billion in investment would be needed by 2030 to meet growing electric vehicle (EV) demand.

Canaccord Genuity gave Q2 Metals a Speculative Buy rating and a CA$2.00 price target.

Precedence Research supported this outlook, forecasting that the global lithium market would reach US$28.45 billion by 2033, driven by a compound annual growth rate (CAGR) of 12.5%. Bank of America also weighed in on the market's trajectory, predicting that lithium supply could shift into a deficit by 2027, with 2025 marking the peak of the current oversupply cycle.

On February 6, Fastmarkets reported that after a prolonged period of oversupply, lithium market conditions had begun tightening in 2025. The publication attributed this shift to Australian production cuts and strengthening demand for battery materials. Fastmarkets projected that the estimated 154,000-tonne surplus in 2024 would narrow significantly to just 10,000 tonnes in 2025 before flipping into a 1,500-tonne deficit in 2026.

Argonaut Securities described the Cisco lithium project as a discovery of global significance.

Further signs of renewed market activity emerged in a February 24 report from S&P Global Commodity Insights, which noted a surge in global bidding for lithium following a period of subdued demand in late 2024 and early 2025.

Between February 18 and February 21, multiple tenders for battery-grade lithium carbonate closed, signaling a shift in sentiment. While some industry participants viewed the increase in tenders as a sign of stronger demand, others remained cautious about potential price fluctuations.

A representative from Tianqi Lithium commented, "It sends a positive signal to the market, but we must be cautious that some may use this opportunity to drive prices higher."

The report also noted that long-term contracts remained the preferred sales strategy for many producers, though companies such as Ganfeng Lithium were evaluating greater participation in future tenders. Despite varied perspectives, the heightened bidding activity underscored lithium's growing importance as a key resource in the global energy transition.

Third-Party Expert Analysis of Q2

On February 26, Canaccord Genuity gave Q2 Metals a Speculative Buy rating and a CA$2.00 price target. According to analyst Katie Lachapelle, the Cisco lithium project in Quebec's James Bay region has "significant scale potential," with drilling results positioning it among globally recognized deposits.

The research note pointed to the company's standout drill intercepts, including 347.1 meters at 1.35% Li₂O, ranking among the highest reported grade intervals worldwide. Based on available drilling data, Canaccord estimated a resource of 207 million tonnes at 1.3% Li₂O, noting that Q2 had achieved comparable results to other major lithium discoveries despite conducting significantly fewer meters of drilling. The report also emphasized Cisco's favorable infrastructure, with access to major highways and rail networks that could provide logistical advantages over other lithium projects in the region. Canaccord's valuation applied a risked enterprise value to resource multiple of US$2.00 per tonne, factoring in exploration upside and the company's net cash position.

In a February 27 research note, Argonaut Securities described the Cisco lithium project as a discovery of global significance. Analyst George Ross noted that independent 3D modeling of the deposit indicated a complex pegmatite system with 4-6 major parallel lodes, suggesting strong potential for resource expansion. Based on drilling to date, Argonaut estimated an inventory of 164 million tonnes grading 1.13% Li₂O (above a 0.6% cut-off), with the deposit remaining open along multiple directions.

The report highlighted key drill results, including 347.1 meters at 1.35% Li₂O, 215.6 meters at 1.69% Li₂O, and 188.6 meters at 1.56% Li₂O, as evidence of the project's scale. Infrastructure advantages were also emphasized, with Cisco's proximity to the Billy Diamond Highway and access to regional power and rail facilities seen as key benefits for potential development. Argonaut stated that Q2's 2025 winter drill program, which includes 6,000-8,000 meters of step-out drilling, would likely extend the known mineralization boundaries, further strengthening the deposit's long-term potential. The report concluded that Cisco's pegmatite thickness and continuity suggest it could support a large, low-strip-ratio open-pit operation extending beyond 500 meters in depth.

These independent analyses reinforce Q2 Metals' position within the lithium sector, with analysts recognizing Cisco as a high-grade project with strong infrastructure advantages. The company's ongoing exploration efforts and upcoming drill programs continue to build on its potential as a significant lithium discovery.

Advancing Lithium Exploration: Q2 Metals Expands Drilling at Cisco Project

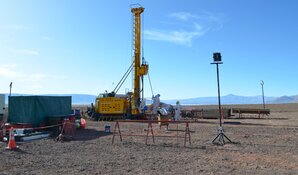

Q2 Metals' ongoing exploration and development activities at the Cisco lithium project remain a key focus for investors, as per the company's investor presentation. The 2025 winter drill program, which commenced on February 1, is designed to expand the results of previous drill holes, including CS-24-018, CS-24-021, and CS-24-023. This phase involves two diamond drill rigs executing step-out drilling between 200 and 400 meters apart to further define mineralization.

The company is also planning a spring/summer drill campaign, which will target additional outcropping pegmatite zones and conduct infill drilling to refine the existing resource model. Results from the winter drill campaign are expected to be released in the coming months, with assay reporting anticipated through the second quarter of 2025.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Q2 Metals Corp. (QTWOTSX-V; OTCQB:QUEXF)

Beyond exploration, the company believes its recognition as a top 50 company on the TSX Venture Exchange in 2025 highlights its position in the sector. Furthermore, the supportive mining environment in Quebec, along with the presence of emerging spodumene refineries and battery supply chain initiatives in the province, underscores the strategic significance of Q2 Metals' lithium assets.

The company's financial position has been bolstered by the warrant exercise, providing funding to support its continued development efforts. With drilling programs in progress and a presence at key industry events, Q2 Metals believes it is positioned to advance its lithium exploration strategy in the months ahead.

Ownership and Share Structure

According to Refinitiv, management and insiders hold 3.58% of Q2, with Simon Cohn holding the most at 1.80%. The rest is retail.

Q2 Metals has a market cap of CA$83.75 million with 136.68 million free float shares. The company's 52 week range is CA$0.21 to $1.48.

Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

1) James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

2) This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.