Atlas Lithium Corp. (ATLX:NASDAQ) has highlighted its presence in the critical minerals sector through its current 32.2% stake in Atlas Critical Minerals Corp. This strategic investment provides Atlas Lithium with exposure to rare earth elements, titanium, graphite, and uranium, positioning the company as a key participant in Brazil's evolving resource landscape.

Marc Fogassa, CEO and Chairman of Atlas Lithium, highlighted the significance of this development, stating in the press release, "Global demand for critical minerals has never been more urgent. Recent geopolitical developments have underscored the vital importance of critical minerals for economic and national security. Atlas Lithium is strategically positioned to play a key role in this increasingly important sector."

Atlas Critical Minerals' rare earth holdings span approximately 54,000 hectares across Goiás and Minas Gerais, Brazil. Initial soil sampling results have identified rare earth oxide (TREO) concentrations as high as 15,000 ppm, along with titanium dioxide concentrations of up to 20%. These minerals are essential for manufacturing permanent magnets used in electric vehicle (EV) motors, wind turbines, and defense systems. With China currently dominating rare earth production and refining, new sources are increasingly sought after to ensure supply chain diversification.

In addition to rare earths, Atlas Critical Minerals is assessing graphite assets in Brazil to support the growing demand for lithium-ion battery materials. As the EV sector expands, reliable graphite supply is critical for energy storage solutions.

The company's involvement in uranium exploration comes at a time of renewed global interest in nuclear energy. With nations prioritizing energy security and decarbonization, uranium has gained attention as a reliable low-carbon power source. While Brazil's uranium sector is heavily regulated and requires special permits, Atlas Critical Minerals has identified promising geological formations within the country. Brazil's activation of its third nuclear reactor further signals a growing domestic and international interest in uranium.

Atlas Lithium's diversified approach aligns with its primary lithium operations at the Neves Project in Brazil's Lithium Valley. The company's exposure to multiple high-demand minerals strengthens its strategic position amid a shifting global supply chain landscape.

Lithium Market Faces Tightening Supply, Tech Advancements

Fastmarkets reported on February 6 that lithium market conditions tightened following production cuts in China and Australia, alongside a projected demand increase from electric vehicles and energy storage systems.

Paul Lusty, head of battery raw material analytics at Fastmarkets, noted, "Lithium market conditions — particularly during the latter part of 2024 — led to growing producer restraint, both in China and elsewhere." He added that production adjustments and project suspensions had contributed to a rebalancing of market dynamics, with a possible supply deficit emerging by 2026.

H.C. Wainwright & Co. projected a potential return of 190% based on the US$19.00 target price, compared to a share price at the time of publication.

CarbonCredits.com emphasized on February 13 that advancements in lithium mining technology were reducing environmental impact, helping to reshape perceptions of the industry. Michael McKibben, a geochemist at the University of California, stated, "It's important not to call it mining . . . because compared with conventional lithium mining, this process has minimal environmental impacts."

Atlas Lithium Expands Beyond Lithium With Diversified Critical Minerals Strategy

Atlas Lithium's stake in Atlas Critical Minerals aligns with its long-term strategy of establishing a foothold in essential mineral markets beyond lithium.

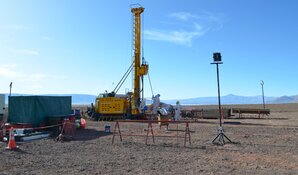

The Neves Project remains Atlas Lithium's primary focus. The modular processing plant for the project is set to arrive in Brazil in March 2025, representing a key milestone. With permits secured, the company aims to transition to lithium production while simultaneously benefiting from its exposure to other minerals.

Atlas Lithium's strategic partnerships with major industry players further reinforce its growth trajectory, according to the company. The company has secured substantial investments and offtake agreements, underscoring the confidence of global partners in its projects. Recent agreements include strategic investments and prepayments for lithium concentrate supply.

Atlas Critical Minerals' exploration initiatives present additional upside potential, the company noted. Ongoing assessments of rare earth and graphite deposits, along with uranium exploration efforts, could expand the company's resource base. If successful, these projects may enhance Atlas Lithium's valuation and long-term prospects in the critical minerals sector.

With geopolitical factors reshaping global supply chains, Atlas Lithium believes that its diversified approach positions it favorably in the evolving critical minerals landscape. The company continues to advance its lithium production plans while leveraging its stake in Atlas Critical Minerals to capture additional opportunities in high-demand resources.

Important Disclosures:

- Atlas Lithium Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Atlas Lithium Corp. and Atlas Critical Minerals Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.