West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB) reported new high-grade drilling results from its 100%-owned Madsen Mine project in the Red Lake Gold District of northwestern Ontario as the company continues to build resources and restart the mine sometime this year.

The new results from the South Austin Zone focus on expanding its inventory of high-confidence ounces as it moves from being a developer to a producer.

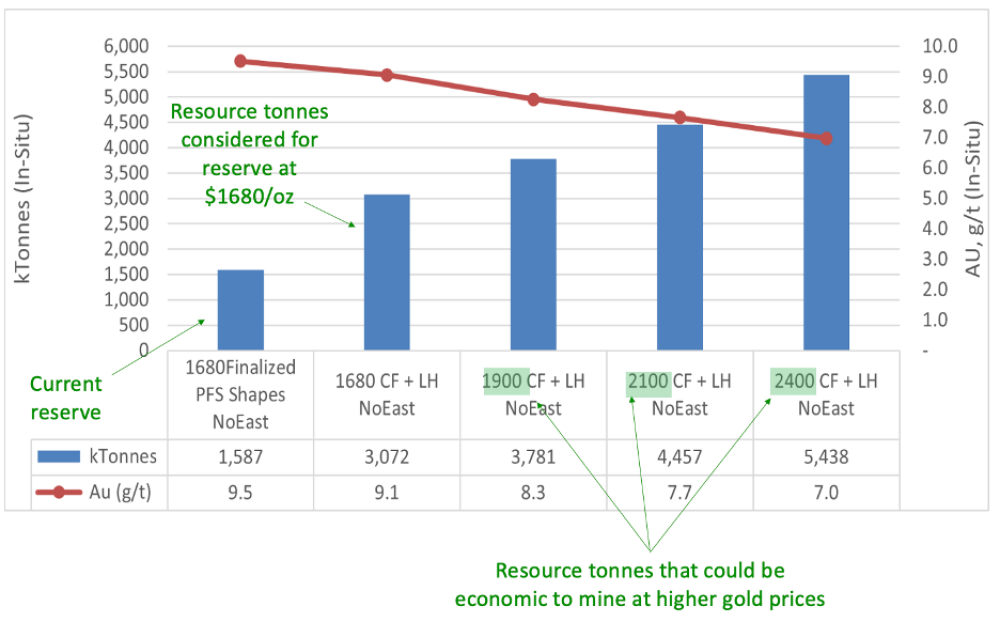

In creating a pre-feasibility study (PFS) for the Madsen Mine in 2024, a "very conservative" gold price of US$1,680 per ounce was used as the test for which parts of the 1.7 million indicated ounces in rock averaging 7.4 grams per tonne gold (g/t Au) might be economic to mine. That test led to a reserve of 478,000 ounces in 1.82 million probable tonnes grading 8.2 g/t Au.

But the price of gold has since soared, making a 40%-plus run over the last year, with many experts believing it will hit the US$3,000 per ounce mark this year.

At higher prices that are still conservative compared to the current market, the PFS technical report shows that raising the gold price used in that first test of economic viability could increase the tonnes of the resource that are economic to mine by as much as 80% (see chart).

In planning the mine, the conservative cutoff price is "not what's driving our mine planning at the site," Vice President of Communications Gwen Preston told Streetwise Reports. "We're using a much higher gold price as we design our stopes because that's the practical application of what the situation is today and what makes sense to mine."

In an updated research note on February 13, Velocity Trade Capital Analyst Paul O'Brien said West Red Lake "has advanced the (Madsen) mine in a rapid and methodical manner since acquisition" in 2023. "We estimate production commencement in Q3/25, ramping up to 800 tonnes per day throughput."

Velocity maintained its Outperform rating on the stock with a CA$1.25 per share price target, a 56% potential return for investors the time the note was written.

Reaching commercial production at Madsen would potentially result in a rerating for the company, O'Brien noted.

Details of South Austin Results

The new drill results released are focused on the high-grade South Austin Zone, which currently contains an Indicated mineral resource of 474,600 ounces grading 8.7 grams per tonne gold (g/t Au) with an additional Inferred resource of 31,800 ounces grading 8.7 g/t Au, the company said.

"The purpose of this drilling was definition and expansion within priority areas of South Austin to continue building an inventory of high-confidence ounces to support the restart of production at the Madsen mine," the company said in its release.

Some highlights of the results include:

- Hole MM24D-08-4447-069 intersected 10.6 meters at 114.26 g/t Au from 122 meters to 132.6 meters, Including 0.7 meters at 1,609.26 g/t Au, from 130.5 meters to 131.2 meters, within a broader high-grade interval of 4.25 meters at 282 g/t Au from 127.8 meters to 132.05 meters. "This high-grade intercept was complimented by visible gold hosted within a 0.85-meter wide diopside vein," West Red Lake said.

- Hole MM24D-08-4447-064 intersected 3 meters at 77.9 g/t Au from 120 meters to 123 meters, Including 1 meter at 233.2 g/t Au from 121 meters to 122 meters.

- Hole MM24D-08-4447-073 Intersected 8.5 meters at 24.48 g/t Au, from 126 meters to 134.5 meters, Including 1.15 meters at 30.19 g/t Au from 129.85 meters to 131 meters, also including 2.9 meters at 53.76 g/t Au from 131.6 meters to 134.5 meters.

- Hole MM24D-08-4447-072 intersected 7 meters at 29.22 g/t Au from 108 meters to 115 meters, Including 4 meters at 48.87 g/t Au from 111 meters to 115 meters.

- Hole MM24D-08-4447-067 intersected 10.15 meters at 18.76 g/t Au from 127.85 meters to 138 meters, Including 1.75 meters at 92.52 g/t Au from 128.85 meters to 130.6 meters.

- Hole MM24D-08-4447-054 intersected 5 meters at 21.12 g/t Au from 115.5 meters to 120.5 meters, Including 1 meter at 103.39 g/t Au from 115.5 meters to 116.6 meters. This high-grade intercept was complimented by visible gold hosted within blue-grey quartz veinlets, the company said.

- Hole MM24D-08-4447-063 intersected 1 meter at 99.80 g/t Au from 79 meters to 80 meters. This high-grade intercept was complimented by visible gold hosted within a strongly altered foliated zone.

- Hole MM24D-08-4447-076 intersected 2 meters at 33.18 g/t Au from 125 meters to 127 meters, Including 1 meter at 66.05 g/t Au from 125 meters to 126 meters.

- Hole MM24D-08-4447-071 intersected 3.65 meters at 13.33 g/t Au from 121.55 meters to 125.2 meters, Including 0.5 meters at 74.57 g/t Au from 124.1 meters to 124.6 meters.

- Hole MM24D-08-4447-068 intersected 5.4 meters at 7.87 g/t Au from 136.6 meters to 142 meters, Including 1 meter at 34.47 g/t Au from 137.6 meters to 138.6 meters. This high-grade intercept was complimented by visible gold hosted within a 0.53-meter wide diopside vein.

"As we continue to define and expand this deeper portion of South Austin … it's very encouraging to see consistent increases in grade and thickness of the mineralized zone as the drilling program advances," West Red Lake President and Chief Executive Officer Shane Williams said. "This success speaks to our geology team’s understanding of the orebody and systematic approach to how data is received, processed, and interpreted to ensure the next round of drilling is directed exactly where it needs to be. We see tremendous potential at depth in the Madsen orebody and results like the ones highlighted in this update illustrate the exceptional high-grade potential that exists within Red Lake gold systems."

Expert: Mine Offers 'Substantial Expansion Potential'

Robert Sinn, a 22-year veteran trader and portfolio manager focused on precious metals, mining, and biotech, recently wrote for Streetwise Reports that, like the company, he believes Madsen "offers substantial expansion potential beyond" its reserves.

"By reducing drill spacing from 20 to 7 meters, West Red Lake has enhanced confidence in ore body continuity and expected grades," Sinn wrote. "Their detailed mine engineering, including a 15-month stope planning horizon, helps ensure consistent mill feed. Stopes — the underground chambers where ore is extracted — must be prepared well ahead to maintain efficient mining operations."

Sinn said a major upcoming catalyst for West Red Lake will be April's bulk sampling results from multiple stopes across three resource areas. Success delivering expected tonnes and grade from these stopes to the mill would validate WRLG's entire approach to understanding and mining the high-grade deposit at Madsen. Once the mill is restarted to process the bulk sample, West Red Lake Gold will roll into full mine ramp-up, he noted.

"Successfully restarting Madsen will enable WRLG to begin generating cash flow, supporting further growth initiatives," Sinn said.

Gold was first discovered at the Red Lake Camp in 1897. Since large-scale mining began there in 1938, more than 26 million ounces (Moz) Au have been produced from underground mines. "The area is known for exceptionally high-grade Au, with one famous sample, the Campbell Mine Whopper, containing 431 ounces in a football-sized rock," Ian Burron wrote for Geology for Investors.

Nearly a century later, "the last few years have seen the tide once again turn in Red Lake's favor."

The Catalyst: Gold's Downside Still Limited

Gold has repeatedly hit new highs in recent weeks, rising at least 13% on the year so far, Lyle Niedens reported for Investopedia.

Niedens wrote that the threshold of US$3,000 appears in reach, as gold is considered a safe-haven asset for investors during times of uncertainty.

"Several Wall Street firms have raised their gold price forecasts to US$3,000 or higher," Niedens wrote. "Goldman Sachs, for instance, cited 'structurally higher central bank demand' for gold in addition to investors' appetite for parking assets in safe havens when it early this week raised its gold-price forecast to US$3,100 by the end of 2025, up from US$2,890 previously."

On Monday, gold prices gained following a three-week low in the previous session, according to Rahul Paswan reporting for Reuters.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB)

Gold prices gained on Monday following a more than three-week low in the previous session as they drew support from a weaker dollar and safe-haven buying triggered by concern over U.S. President Donald Trump's tariff policies, reported Rahul Paswan for Reuters.

The dollar index dropped by 0.6% from a more than two-week high in the previous session, reflecting weakness that makes dollar-priced gold less expensive for buyers holding other currencies.

"Gold's downside remains limited, given the apparent demand for safe havens amid rising geopolitical and economic growth uncertainties," said Han Tan, Exinity Group's chief market analyst, according to Paswan.

Ownership and Share Structure

Strategic investor Sprott Resource Lending Corp. holds about 16%. institutions hold about 30%, management, insiders, and advisors hold about 10%, and the remaining shares are held by retail investors.

The company's market cap is CA$200.28 million. The 52-week range for the stock is CA$0.52 to CA$1.04.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- West Red Lake Gold Mines Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.