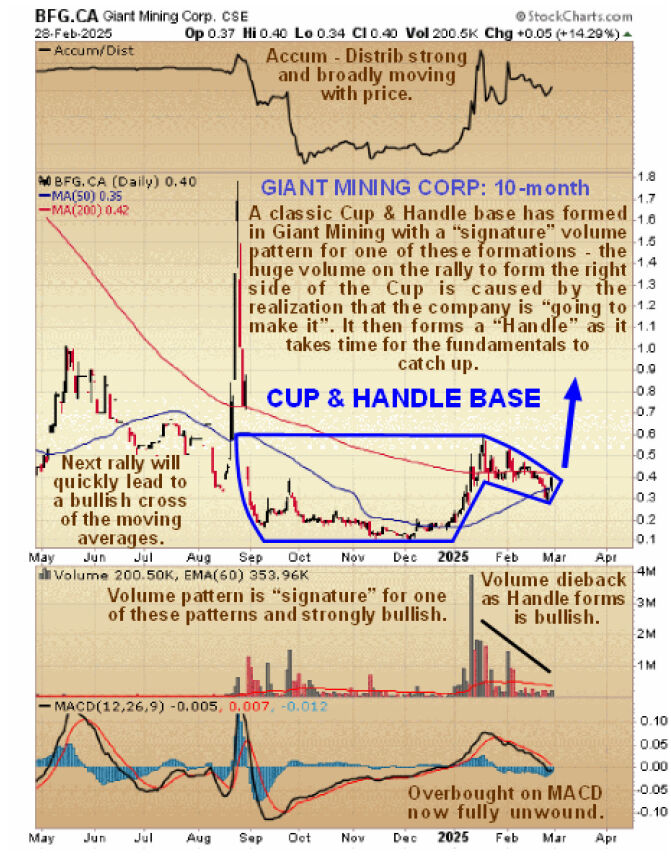

We are looking at Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) again here because it is right now completing a big Cup & Handle base pattern and on Friday it started moving up sharply on the growing realization of the positive implications of the tariff barriers for domestic U.S. copper companies like Giant Mining.

On its latest 10-month chart, we can see how the Cup & Handle base pattern is now complete, and what is especially significant is the highly bullish volume pattern, with the strong volume on the rally to complete the right side of the Cup being a characteristic of a genuine example of one of these patterns and there is a fundamental explanation for it. It is caused by the sudden realization amongst a body of investors that the company is "turning the corner" and going to make it.

But of course it takes time for the fundamentals to catch up with the rosier expectations, which is why the price then consolidates in a Handle trading range or reaction. Provided that the volume pattern remains positive as the Handle forms, which in this case it does, it means that it will go onto to break out of its upside into a new bull market and, late last week, a catalyst in the form of the growing awareness that the tariff barriers will make domestic producers of copper like Giant Mining, as it will be, more important.

The duration of the Cup & Handle base pattern has allowed time for the 200-day moving average to drop down close to the price and flatten out, putting the stock in a better position to advance and the current bunching of price and moving averages is most auspicious, and we can readily observe that another upleg from here will quickly result in a bullish cross of the moving averages that will "officially" mark the start of an important new bull market.

The longer-term 2-year chart makes it clear just what a bargain Giant Mining is here, for this base pattern has formed at a very low level following a severe bear market — as recently as early 2023 it was trading at over CA$4.00 and if you go back further you will find that it was trading as high as CA$140 early in 2021 (adjusted for a couple of big rollbacks).

This is, therefore, considered to be an excellent time to buy Giant Mining or add to positions in it.

Giant Mining Corp.'s website.

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) closed for trading at CA$0.41, US$0.29 on March 4, 2025.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.