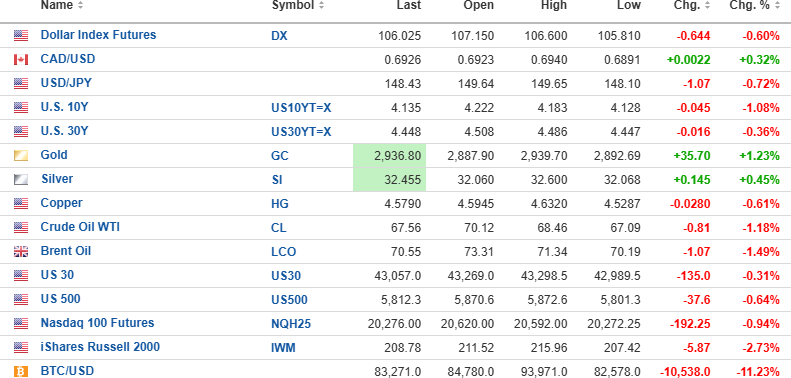

The U.S. dollar Index futures are lower by 0.644% to 106.025, with the 10-year yield down 1.08% to 4.135% and the 10-year yield down 0.36% to 4.448%.

Gold (+1.23%) and silver (+0.45%) are up, but copper (-0.61%) and oil (-1.18%) are lower.

The DJIA futures (-0.31%) are down 135 points; the S&P 500 futures (-0.64%) are up 37.6 points; and the NASDAQ 100 futures (-0.94%) are up 192.25 points.

Risk barometer Bitcoin is down 11.23% to $83,271, which has now once again moved into bear market territory.

Stocks

The 600-point rebound on Friday turned into a 649-point near-crash yesterday as the DJIA was at one point down almost 1,000 points. This morning, the S&P futures are continuing their corrective action, but the big story is volatility with the VIX:US up 1.75 to 24.53, the highest level for that index since mid-December when the S&P lost 128 points after the FOMC engineered a hawkish "pause."

The market is approaching oversold status, and while I think it might take a few more days for the RSI to plunge below 30, I want to take profits on the UVIX:US, which is on the books at $32.65.

In the GGMA 2025 Trading Account:

- Sell 2,000 UVIX:US at $40.00 to yield 22.51% in three and a half months.

Traders have a habit of shorting the VIX:US whenever there are outsized spikes in volatility. Conspiracy theorists would contend that it is the method used by the Working Group on Capital Markets (otherwise known colloquially as "The Plunge Protection Team") to support the equity markets every time they look wobbly.

The theory holds that when the S&P futures pits see the VIX:US suddenly getting hammered back down after a sudden sharp spike, traders leap to the fore and start bidding up the S&P futures. This is why I have to pay myself whenever we get these spikes. Otherwise, there is a good chance of leaving profits on the table. The sub-15 level is the ideal entry point for this trade, and I am sticking to it.

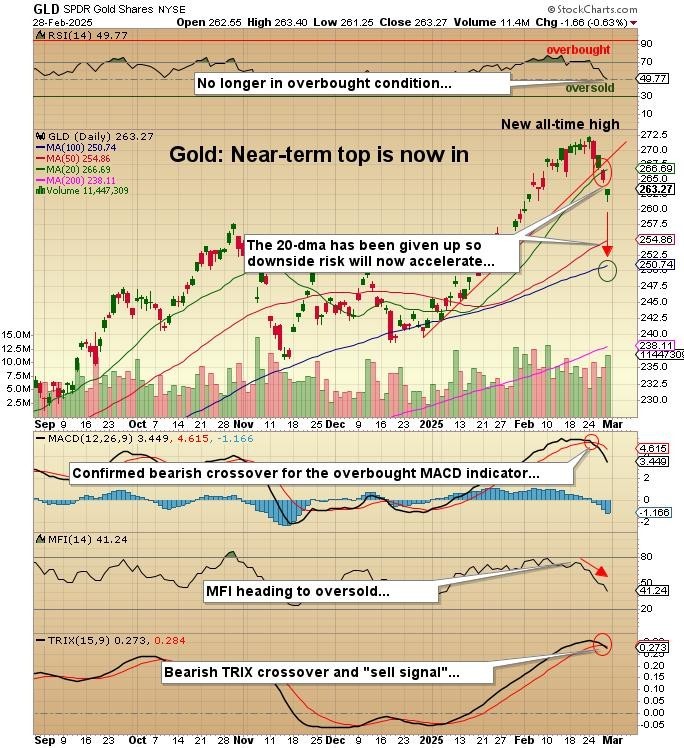

Gold / GLD:US

I am long 10 contracts of the GLD April $265 puts from $4.35 and because it is a 50% position, I look to add to the position but considerably below the $4.55 level at which it closed yesterday.

In the GGMA 2025 Trading Account:

- Buy second tranche 25 contracts GLD April $265 puts at $2.55.

Keep entering this order through Friday, March 7.

I have added 500,000 Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) to the GGMA 2025 Trading Account at a price of US$0.1041 per share (CA$0.15), which is the price of the current unit financing. I also hold a large number of the FTZ warrants, most of which have an exercise price of US$0.1735 (CA$0.25), but I do not include those in the totals until they are converted into shares.

I know I sound like a broken record but if you are underweight FTZ/FTZFF, do not hesitate to add to holdings. Once the Ptolemy ("Buen Retiro") transaction has closed, it is my expectation that assays from Caballos will be made public. It is my belief that these two events will change the fortunes of this company and the lives of its shareholders.

| Want to be the first to know about interesting Base Metals, Gold and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.