Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) is looking more attractive than ever here because it has dropped to the lower boundary of a giant trading range from which it is expected to reverse to the upside, resulting in good percentage gains from the current price. The company is advancing steadily towards its goals with the combination of improving cost efficiencies, increasing production, and the prospect of a powerful bull market for its principal product, silver, promising a bright future — and a much higher stock price.

Just over the past few days, the company has announced a significant increase in the mineral resource estimate for the Nueva Recuperada Project, including additional high-grade resources at the Plata Mining Unit.

Within the news announcement, Silver X CEO Jose M. Garcia commented, "Our Nueva Recuperada Property continues to position itself as one of the most relevant silver projects in South America. We are developing an outstanding asset, a district-scale property that will see mining activities for several decades," and "The Plata Mining Unit stands out as a high-grade project where we have managed to identify 6.35 MT of resources on 19 veins out of the 171 veins that are mapped in the area. As a producing company, we envision an opportunity to combine fast-track production with a growing resource in a good silver market. Nueva Recuperada will accomplish fast organic growth over the next few years."

Because of this resource upgrade and because of the approaching major silver bull market, the company just announced a CA$3 million private placement is expected to be well-received and completed in a timely manner, notwithstanding the normal "knee-jerk" reaction to this news by the market today, and it is worth pointing out that since the stock price has just dropped below the price of the offering at CA$0.17 Friday, as shown on our charts, it has no further to fall and should now rise, especially once it becomes apparent that the offering is being well taken up.

Before we look at the specifics of the company it's worth reminding ourselves why silver is such an attractive investment here.

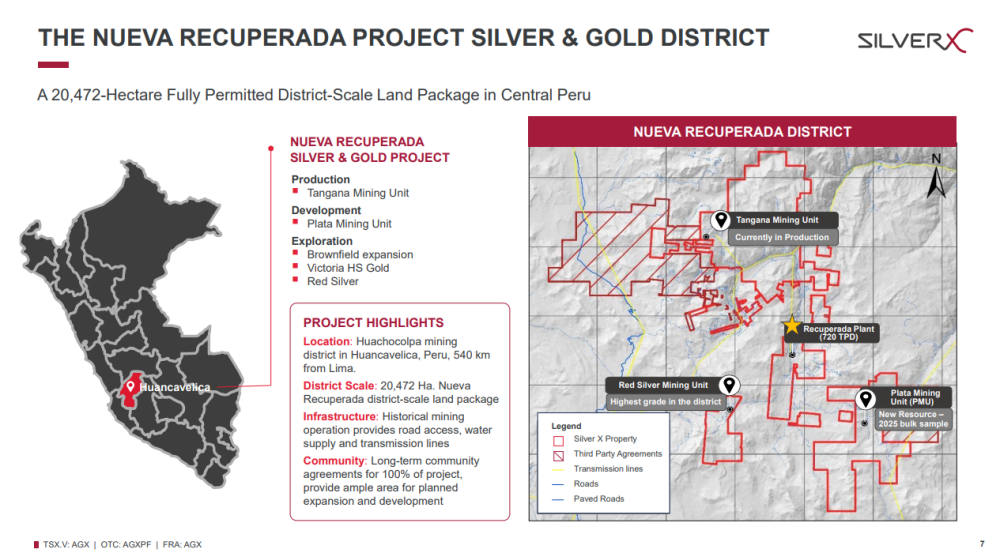

The company's operations are located in Peru, which is one of the most important base and precious metals producers.

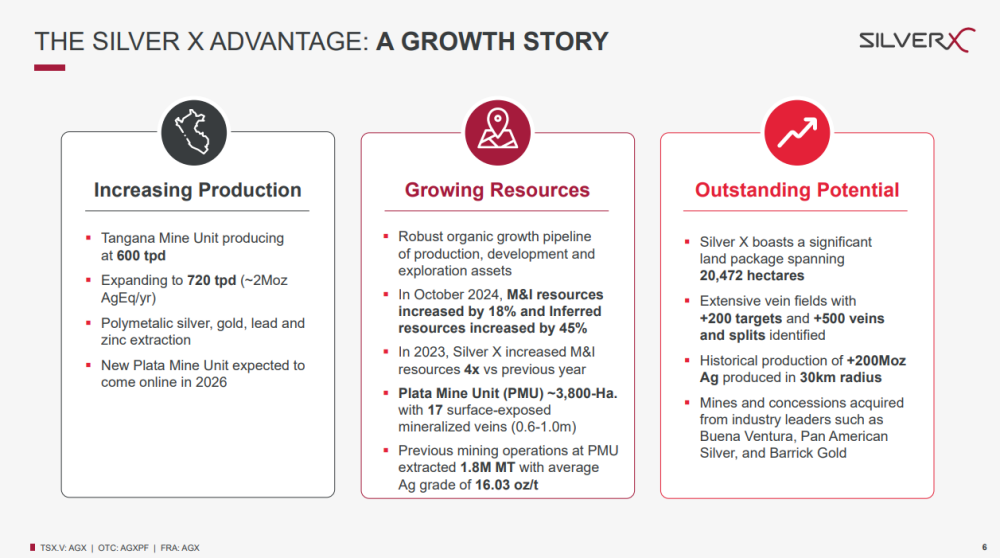

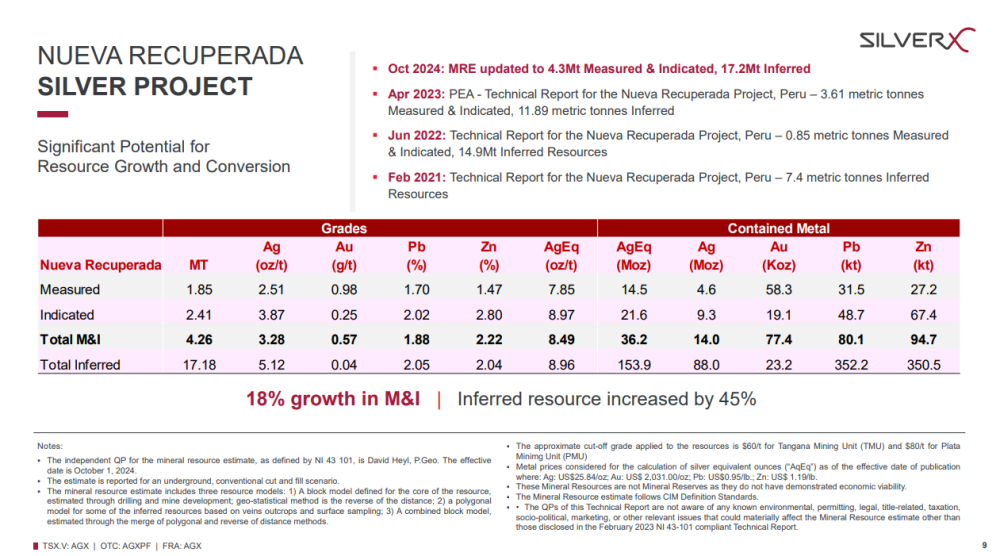

The case for Silver X Mining as an investment may be summarized on just one page, and a very important point is that the company increased measured and inferred resources by 18% in just one year (2023).

Before reviewing the latest stock charts for Silver X, we will look at the fundamentals of the company using the latest investor deck, which is new (out this month).

Silver X Mining is already a producer that, in addition to its primary product, silver, also mines gold, lead, and zinc at its district-scale project in Peru, which has a lot of scope for both increasing production and brownfield expansion. So, strong growth is a prospect, especially as metal prices are expected to advance.

The company's flagship property is the Nueva Recuperada silver project, which is already producing with production set to continue to increase. The next slide shows the location of Nueva Recuperada in Peru and a map showing the main targets within the property.

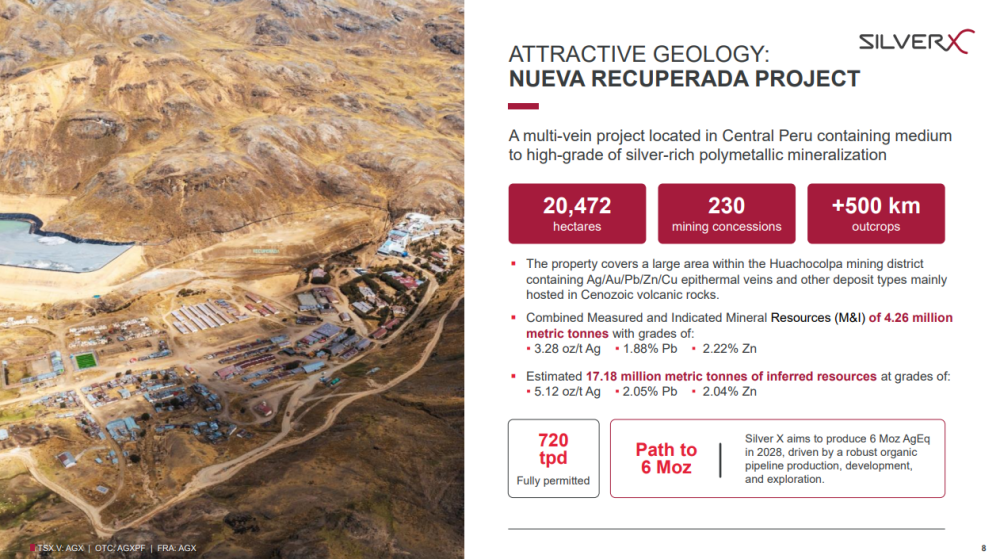

Nueva Recuperada is a massive 20,000-hectare District Scale property with tremendous potential.

This next slide provides an overview of it:

This resource chart for Nueva Recuperada shows, as said above, that there was an 18% increase in measured and indicated resources within one year.

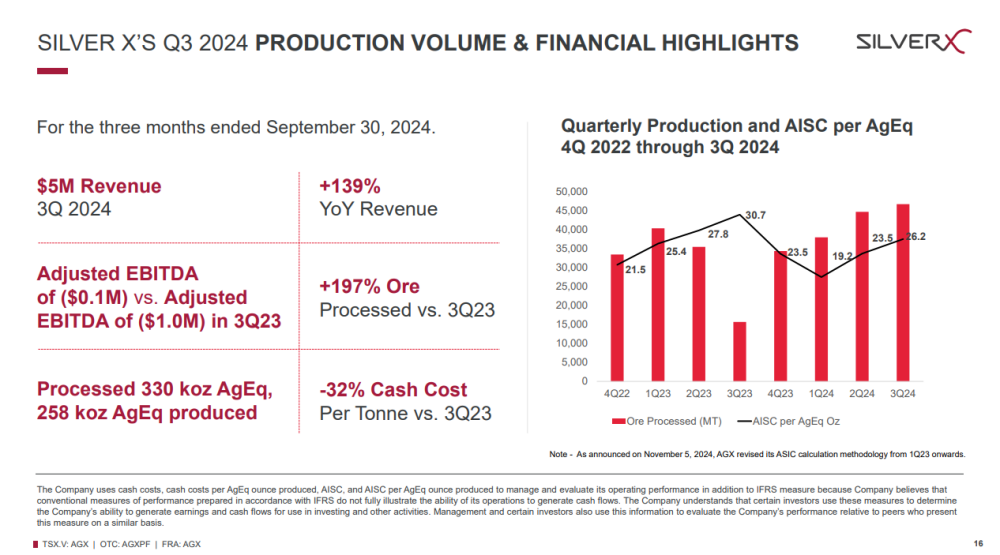

Production volume and financial highlights are below.

The company plans to triple current production at the Tangana Mining Unit through 2026 – 2028.

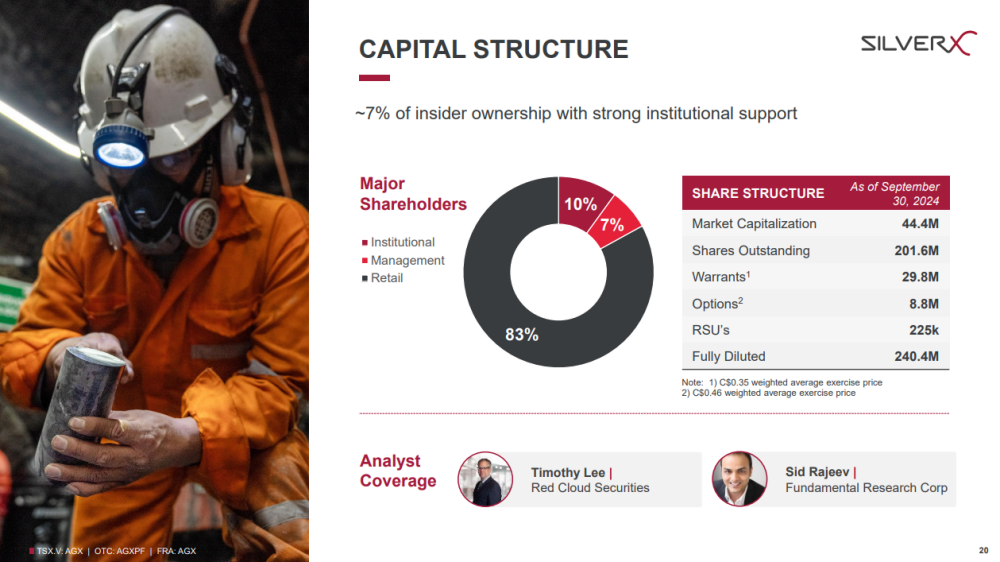

The final slide shows the capital structure of the company.

Turning now to the stock charts for Silver X Mining, we see on the 15-month chart that it has today (February 28) broken to new all-time intraday lows, albeit marginally, on last night's news about a sizable financing, but as this financing is at CA$0.17 which is a little above the current price and as the financing is expected to be well taken up and completed in a timely manner especially as the outlook for the silver price is better than ever, we are probably seeing an important low right now from which the price will start to ascend.

On the 5-year chart, we can see that, following a bear market from its late 2020 – start 2021 highs, or from where it started trading again in July 2021, Silver X has been fluctuating in a wide trading range bounded between about CA$0.15 on the downside and CA$0.47 on the upside that is viewed as a major base pattern that is best described as a Double Bottom.

It has found support repeatedly at about the CA$0.15 level from which it has staged significant rallies and it is expected to do so again shortly, especially as silver itself, the most undervalued commodity of all, is powering up for a major advance.

The conclusion is that, with very little downside from the current price and a lot of upside, Silver X Mining is rated an Immediate Buy for all time horizons.

The first target for an advance is CA$0.22 – CA$0.23. The second target is CA$0.36 – CA$0.38. The third target is CA$0.45 – CA$0.50, and it should ascend to higher levels.

Silver X Mining's website.

Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) closed for trading at CA$0.155, US$0.10445 on March 3, 2025.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver X Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver X Mining Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.