There was no pre-opening alert this morning as I was a prior engagement that is going to keep me busy through Wednesday of next week as the Prospectors and Developers Association Convention begins on Sunday.

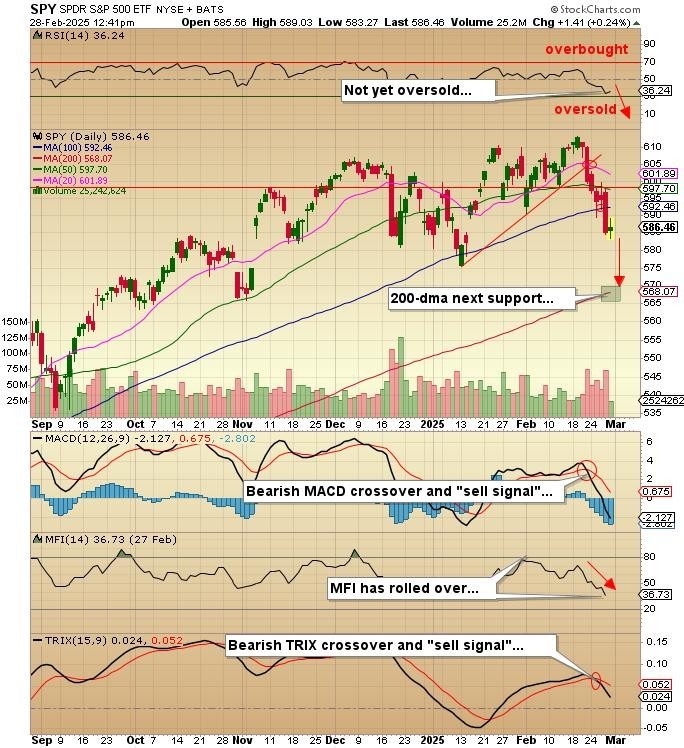

Stocks snapped open this morning with the SPY:US opening at $585.56; trading up to $589.03 then falling back to $583.27 as traders are struggling with the horrific action in the "MAG Seven" group and especially the dreadful action in NVidia Corp. (NVDA:US) and Bitcoin both of which are losing more ground today.

I warned of the possibility of a short, sharp crash on Monday if the markets are unable to mount even the slightest of bounces today. So far, the DJIA has lost over 255 points of the morning high, with NVDA:US giving up over $4 of earlier gains.

For speculators in the GGMA 2025 Trading Account:

- Buy 10 contracts SPY April $570 puts at $5.25 limit

If the SPY:US is down over $1.00 by 3:30 pm, add another 10 contracts. If it is up $1.00 by then, cut bait and get flat into the weekend.

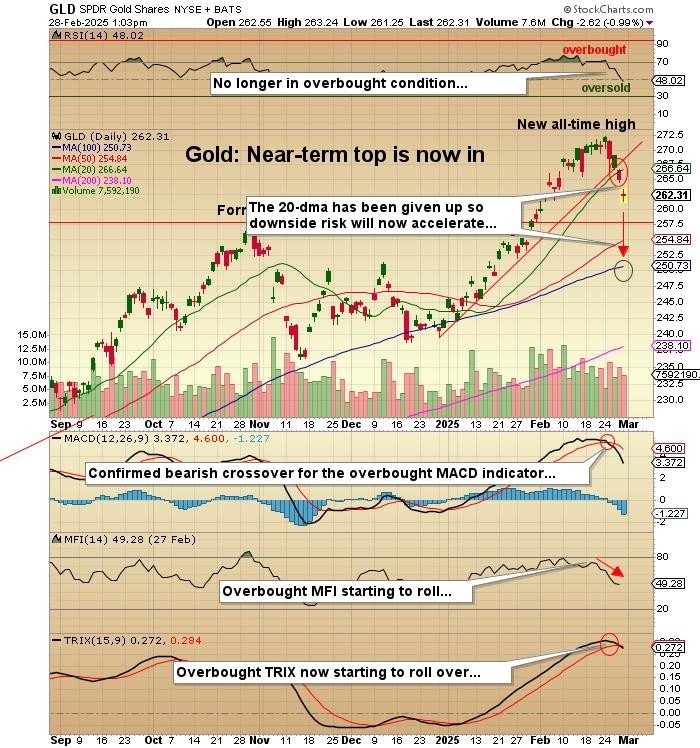

Gold

GLD:US broke the 20-dma at $266.24 and is now headed to the 50-dma at $254.84, which is $8.00 lower than the current price. Gold bugs around the Twitterverse are ready to commit hara-kiri, but the reality is that gold desperately needed this pullback to lay the foundation for a much sounder assault on the $3k level, which I believe is coming before a more serious top is put in.

Gold producers are making literal fortunes with gold at $2,854 and considering the fact that it was trading at $2,661 on the day after New Year's, gold added over $300 per ounce in 60 short days, moving from a gradual rise to a vertical rise in record time.

I want to see the GLD:US back at $254 within the next few weeks, then stabilize, trade sideways while it works off the overbought condition, and head straight north for a move to my 2025 target of $3,650 or $325 for the GLD:US.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of SPDR S&P 500 and SPDR Gold Shares. My company has a financial relationship with SPDR S&P 500 and SPDR Gold Shares. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.