Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN; 3TZ:FSE), a gold junior exploration company, is looking like a Strong Speculative Buy here. The stock is still at a low level, not far above strong support, and the company just came out with good news this morning, announcing a significant extension to the Halo zone on its Quesnelle Gold Quartz Mine Property.

Whilst the grades found are good, the big news here is the extent of it.

Golden Cariboo's President and CEO, Frank Callaghan, stated, "Drill hole QGQ24-20 capped off a remarkable year, stepping out 100m and delivering another exceptional intercept that affirms the Halo zone as a major discovery in the Cariboo Gold District. Greenstone contacts host many of the world's premier gold camps, and we have now identified one only 4 kilometers from a major highway and community in central British Columbia. The next chapter of another bedrock source of the long and storied Cariboo Gold Fields is now being written in Hixon."

Now, we will swiftly review the stock charts for Golden Cariboo to see why it looks like such a Strong Buy here.

Starting with the 1-year chart, we see that, early this month, the price broke out of the downtrend, leading into the second low of a Double Bottom made with its lows of last July – August.

On the 3-year chart, we can see that this Double Bottom constitutes either the low of the Handle of a Cup & Handle base or the Right Shoulder of a Head-and-Shoulders bottom because this larger pattern can be classed as a hybrid between the two.

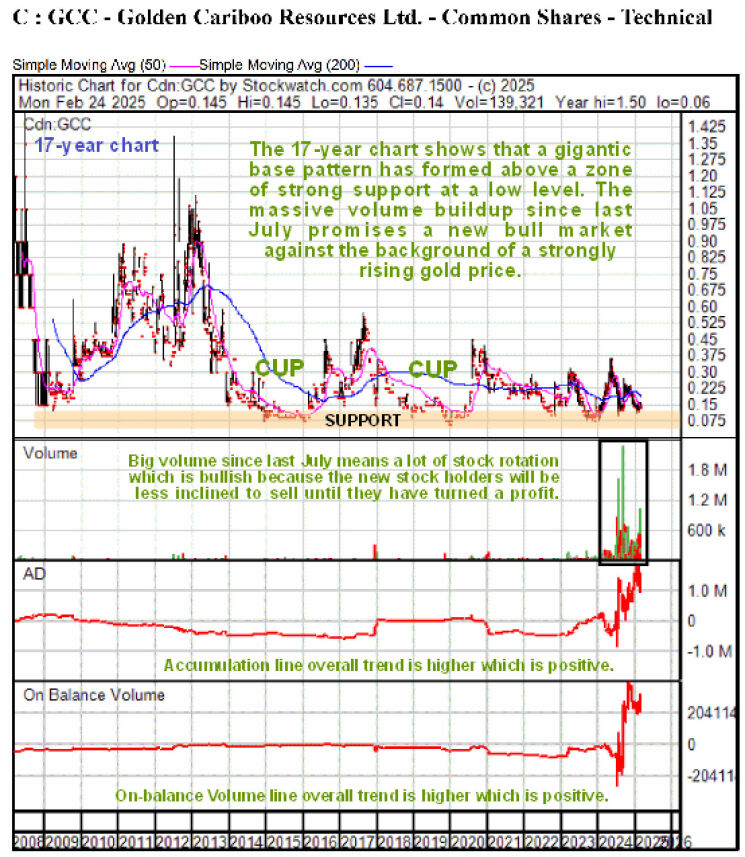

Zooming out again via the 7-year chart, we see that whatever the pattern is that we saw on the 3-year chart, it forms the latter part of a much larger odd-shaped Cup & Handle base with the big volume since the middle of last year that has driven up volume indicators being viewed as bullish because it indicates heavy rotation of stock from weaker to stronger hands, since the sellers are mostly selling at a loss and the buyers will not be inclined to sell until they have turned a profit.

Zooming out still further by means of a 17-year chart, we see that a gigantic base pattern has formed above a zone of strong support at a low level, with the recent high volume and stronger volume indicators promising a new bull market, especially given the ongoing upward march of gold itself.

Golden Cariboo Resources' website

Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN; 3TZ:FSE) closed for trading at CA$0.135, US$0.0943 on February 27, 2025.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Golden Cariboo Resources Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Cariboo Resources Ltd.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.