U.S. dollar index futures are higher by 0.22% to 106.570, while the 10-year yield is lower by 0.07% to 4.295, but the 30-year yield is lower by 0.13% to 4.55%.

Gold (-0.13%) is lower; silver (+0.41%) and copper (+1.87%) are higher, but oil (-0.06%) is down.

The DJIA futures (+0.21%) are higher by 92.7 points; the S&P 500 futures (+0.44%) are up 26.2 points; and the NASDAQ 100 (+0.67%) are up 142 points.

Risk barometer Bitcoin is showing a clear topping action and is down again, off 1.67% to $88,138.

Stocks

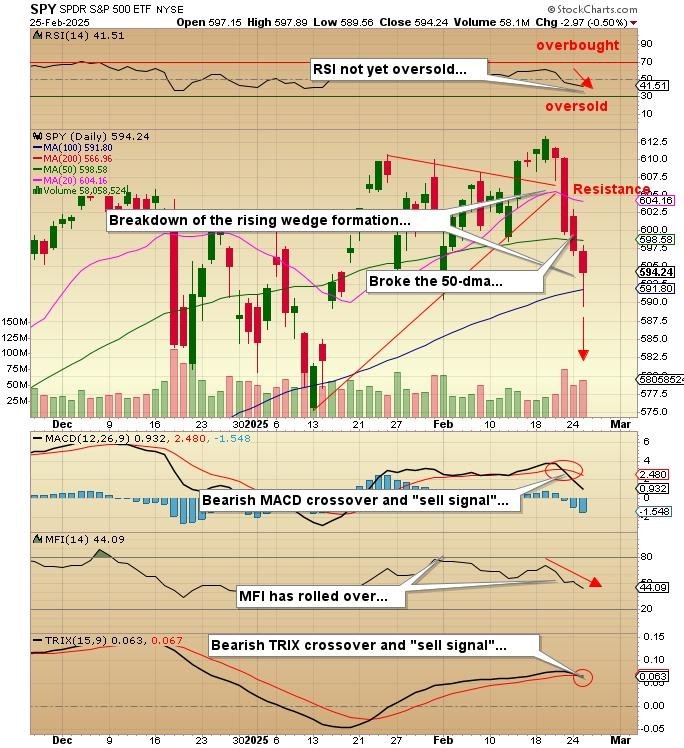

Yesterday, the S&P 500 opened higher, but once the 100-dma at $591.80 gave way to the selling pressure, a boatload of sell-stops were triggered, taking it right down to $589.56 before the late afternoon rally took it right back above the 100-dma.

Futures are pointing to an opening just below the 50-dma at $598.58, which is where I will be an aggressive seller.

VIX

I covered all March call options yesterday and am now awaiting a pullback in volatility to that sub-15 range, which has been an ideal accumulation range for the VIX:US trade. It has been the pattern for traders to sell/short all moves above 20 and then cover quickly under 15. On rare occasions like the August 5, 2024, Japan "carry trade" rout that took the VIX:US to over 40 so we get these outsized moves, but when they occur, the gains are monumental.

With the Trump 2.0 presidency moving "hell-bent for leather" upon tariffs and government waste removal, he runs the risk of derailing the global economy, starting with the U.S. and spreading abroad. This is why I maintain a bias toward the volatility trade. One of these mornings, one of these gargantuan passive funds is going to decide to sell, and when they do, they will flush every shred of leverage out of the system, leaving body bags everywhere in sight.

There is a reason that Warren Buffett is sitting on over $300 billion in cash and continues to sell.

Freeport McMoRan Inc.

It has been a while since I updated the Freeport-McMoRan Inc. (FCX:NYSE) trade, and since it registered a 52-week low on February 3 at $34.89, it has been acting as if it has zero benefit from its 30% share of revenue from gold production at the Grasberg Mine. The world's top producer of copper, FCX, is my numero uno blue-chip company and one that has treated me very well over the past five years, but that has not been the case since last August.

I have an average cost on 3,000 shares at $37.73, which is 31.69% off the 52-week high at $55.23, last seen on May 20 of last year.

It appears as though the institutional community are choosing to ignore the stellar results displayed by the company in virtually all facets of their business because the chart pattern looks as if the copper price was under $2.00/lb. and gold under $2,000/oz.

This morning, copper exploded higher, trading as high as $4.749/lb. as President Trump ordered an investigation into copper and is considering tariffs designed to boost domestic production. FCX is called $1.50 higher.

I own the FCX March $40 calls, and they are seriously underwater as the 100-contract position is due to expire on March 21. I am looking to add to the position, but since March has a relatively short fuse, I am looking at the FCX June $40 calls.

This morning in the GGMA 2025 Trading Account:

- Buy 50 contracts FCX June $40 calls 2 $2.00 limit

This is a 50% position with a target of $10 by June expiry. I will add into weakness next week.

Want to be the first to know about interesting Gold, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.