On Monday, February 24, 2025, a wealthy mining magnate gave an interview at the BMO Metals & Mining Conference where he stated:

“You know it's a very weird gold market right now, Paul; as we talked about last time we were together, you have this absolutely bizarre disconnect between the gold price, which is at a record high $2900 an ounce, and has just been on wheels for the last year, and the gold equities which are still trading as if gold was $1,800 an ounce. There just has not been money pouring into that equity space because the buyers of gold are a different group of entities than buyers of equities.”

The dominant buyers of gold worldwide remain central banks. Central banks don't purchase mining stocks. This offers the most straightforward rationale for why the gold mining sector has delivered disappointing results despite gold's climb from approximately $2,000/oz in January 2024 to nearly $3,000/oz today.

Nevertheless, the reality is that the value of the commodity the gold mining industry extracts has increased remarkably in the past year. Yet, the valuation of many major gold producer shares (particularly Barrick and Newmont) hasn't matched gold's performance.

What explains this phenomenon?

I've been posed this identical question countless times recently. In fact, just the other evening, I received this question again, responding to an X tweet about Ross Beaty's interview remark:

Corporations as massive as Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and Newmont Corp. (NEM:NYSE) are managing tremendous operational complexities. Their operations span across continents, and each individual mine contains extraordinary levels of multi-dimensional complexity.

The logistical disruptions and cost inflation surge of 2021-2023 severely challenged the large producers, resulting in some underwhelming financial outcomes along the way. It was during this timeframe that numerous investors experienced their ultimate disenchantment with the mining industry.

Thus far, the gold price performance hasn't been sufficient to motivate these investors to return:

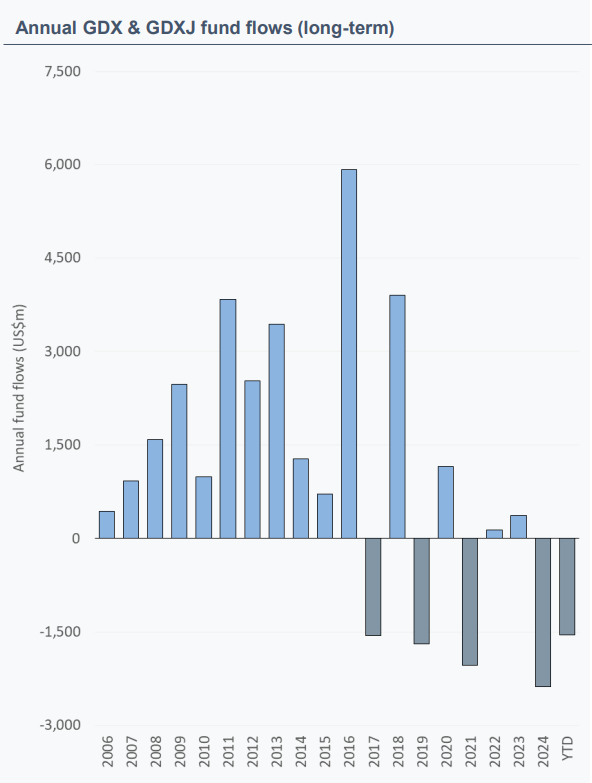

The substantial and highly tradable GDX and GDXJ exchange-traded funds have witnessed withdrawals amounting to several billion dollars during a market period in which gold has continually established new record highs, ascending to levels some considered unattainable.

Again, we must recognize that most purchasers of 400-ounce gold bars aren't potential candidates for investing in gold mining equities. Furthermore, gold mining is a challenging enterprise. Despite generating unprecedented levels of free cash flow in Q4 2024, the most recent quarterly earnings announcements from the leading producers included 2025 projections indicating reduced production, elevated costs, and increased capital expenditures compared to market expectations and their respective 2024 results.

This presents a significant issue.

The gold price surge is excellent, and it provides fuel for much more robust financial performance from the sector. However, the truth is that elevated costs and diminished production won't cause Wall Street hedge fund managers to rush to acquire the GDX.

The gold mining sector requires additional consolidation and more world-class discoveries. The latter is extremely difficult to achieve, while the former is feasible and highly probable to unfold over the coming year.

There's no justification why we can't have a $100 billion market capitalization gold producer. Likewise, there's no reason to maintain numerous single-asset producers. The expense of capital is excessively high for these smaller producers, and the risk is immense.

The encouraging news is that the financial positions of the large producers have never been stronger and the profitability of the sector has likewise never been better. Despite investor sentiment, the gold mining industry has seldom experienced the position of strength it finds itself in today.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp.

- Robert Sinn: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Robert Sinn Disclosures

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. West Red Lake Gold Mines Ltd. is a high-risk venture stock and not suitable for most investors. Consult West Red Lake Gold Mines Ltd’s SEDAR profiles for important risk disclosures.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.sedarplus.ca for important risk disclosures. It’s your money and your responsibility.