Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCQB) is regarded as presenting an outstanding opportunity for investors here since its stock is still trading at a very low price, but that is unlikely to be the case for long, given that late yesterday, with bureaucratic obstacles resolved, the company announced that it is restarting underground operations at its Wingdam Project.

Other positives for investors to take into consideration are that the costs of mining operations will be borne by its Joint Venture partner, D&L Mining, with Omineca itself being well financed with a major CA$2.4 million private placement for hard rock exploration drilling, having been completed in December and last but not least mining operations will be advancing into an already delineated high-grade Placer gold deposit, and it won't be long before they see real results because, as it says in the news release "D&L has restarted operations with preparatory tasks, including rehabilitating the haulage/access drift, cleanout, and upgrading dewatering sumps, ventilation upgrades, bulkhead installation and evaluation/reinforcement of existing bulkheads as necessary. With all equipment, mining supplies, and manpower aggregated on site and operations well underway, it is expected that gold-bearing gravel recovery will commence in the very near term."

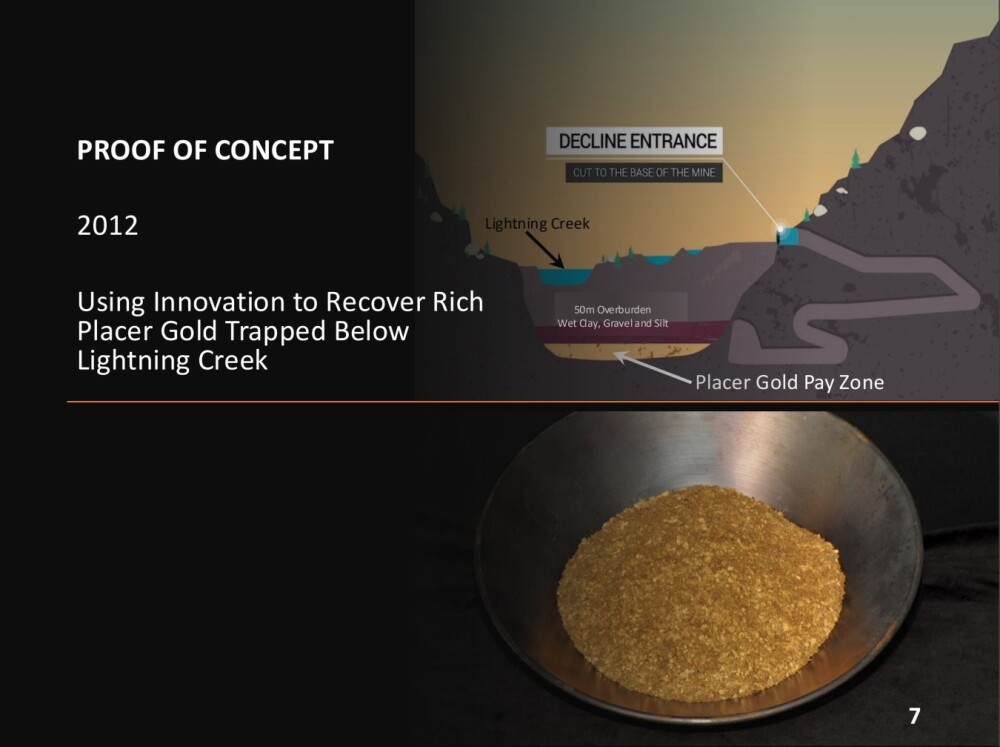

So now, before we review the latest stock charts, we will overview the company and its projects using selected slides from its January 2025 investor deck, but before we do so, it is well worth readers watching the brief under 3-minute video, which describes the extraordinary processes that will be used to get at the rich Placer gold deposit already defined beneath Lightning Creek at the Wingdam Project. Click here to watch the video.

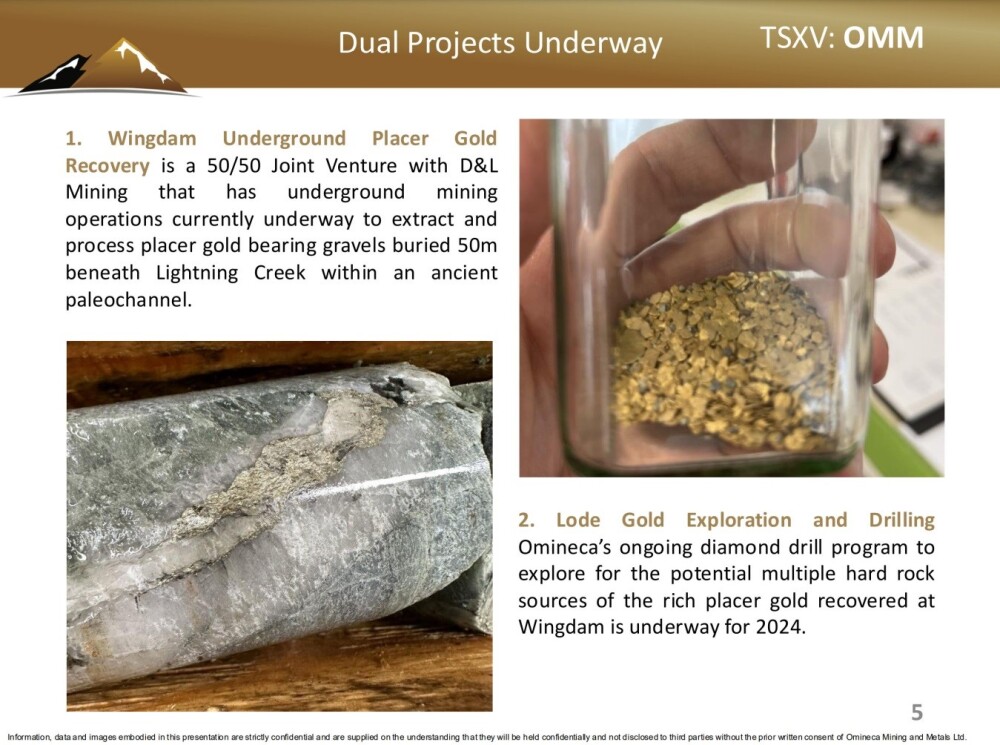

The Wingdam Project is situated in a prolific gold trend in south-central British Columbia, with the company having an impressive 61,329-hectare land position that includes Hardrock and Placer claims.

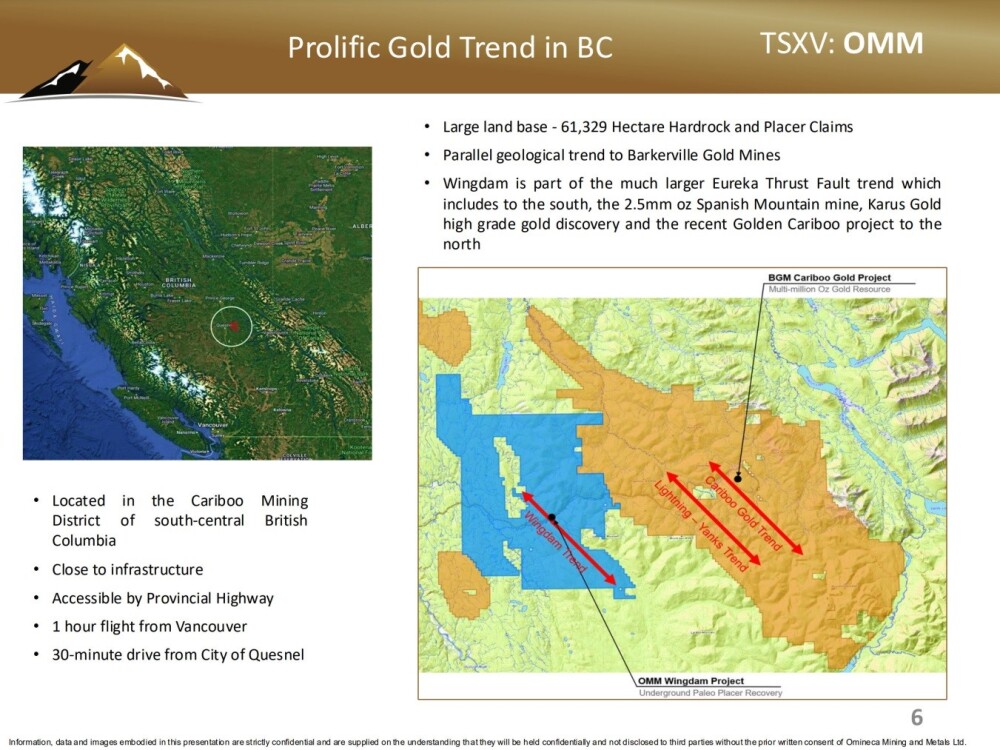

There are dual projects underway — in addition to going ahead and mining out the rich Placer deposit beneath Lightning Creek, the company has an ongoing diamond drill program that is looking for the potential multiple hard rock sources of the rich Placer gold deposit at Wingdam.

As set out in the project video this is how the company is getting at the rich Placer gold deposit located beneath Lightning Creek.

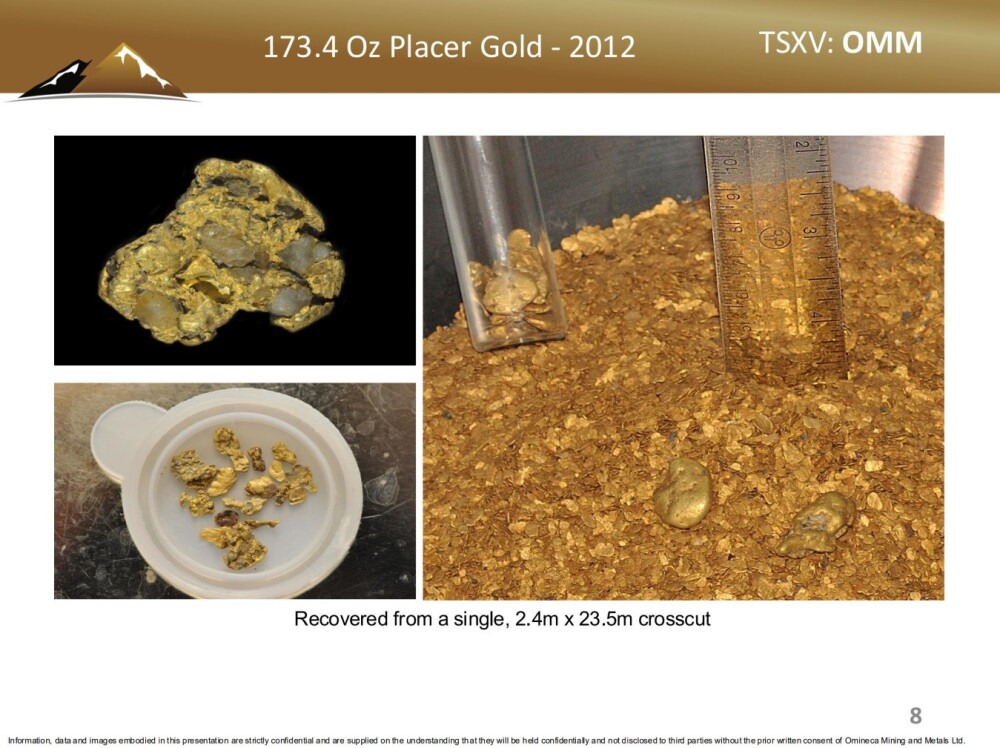

"There's gold under them thar creeks!" — and this is what it looks like when you find it — gold already recovered from an exploratory crosscut under Lightning Creek.

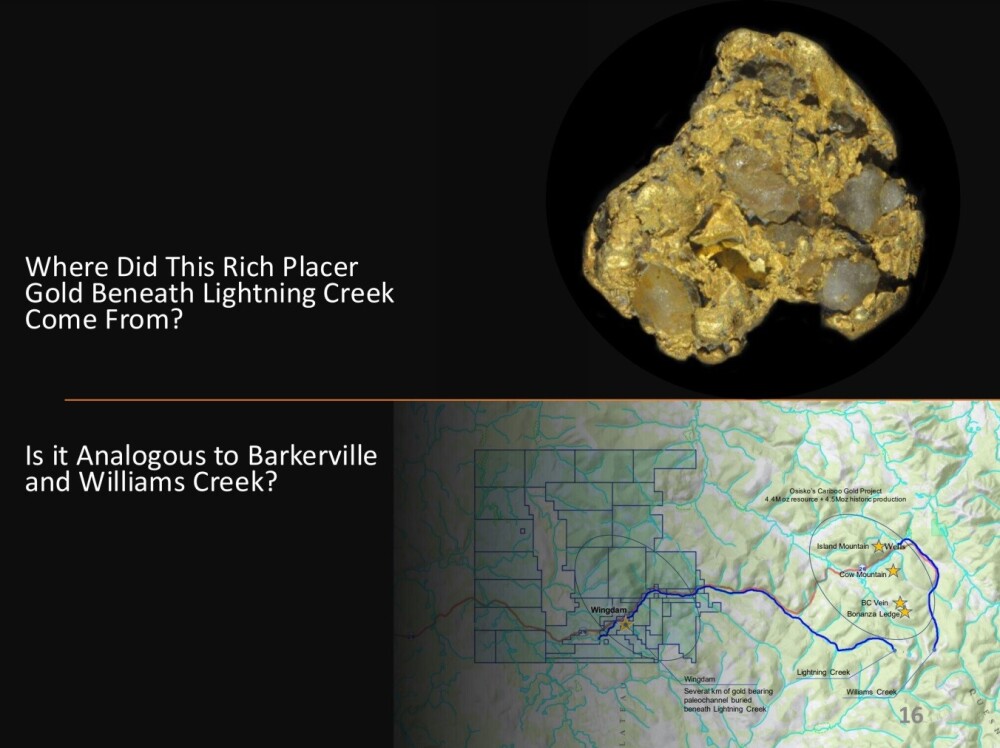

The rich deposit under Lightning Creek naturally raises the question of where it came from, which is especially relevant when you consider that the company holds a large surrounding land area, which it is already exploring.

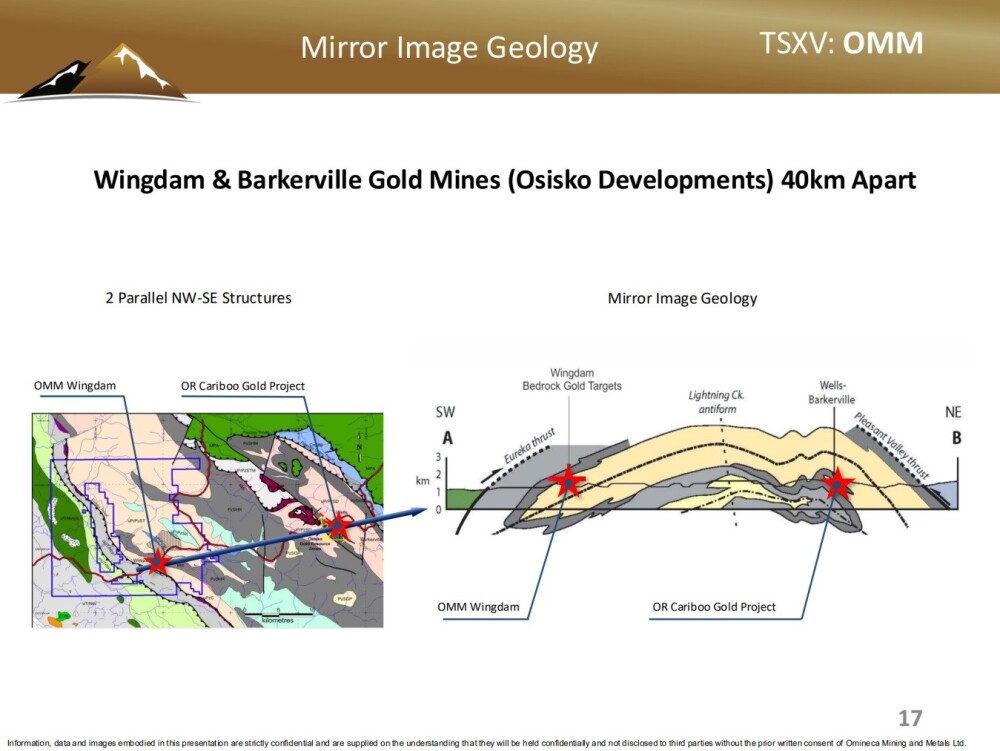

The remarkable similarity of the Wingdam Project to the Barkerville Gold Mines (Osisko) property 40 km away certainly bodes well for important discoveries at Wingdam and its environs.

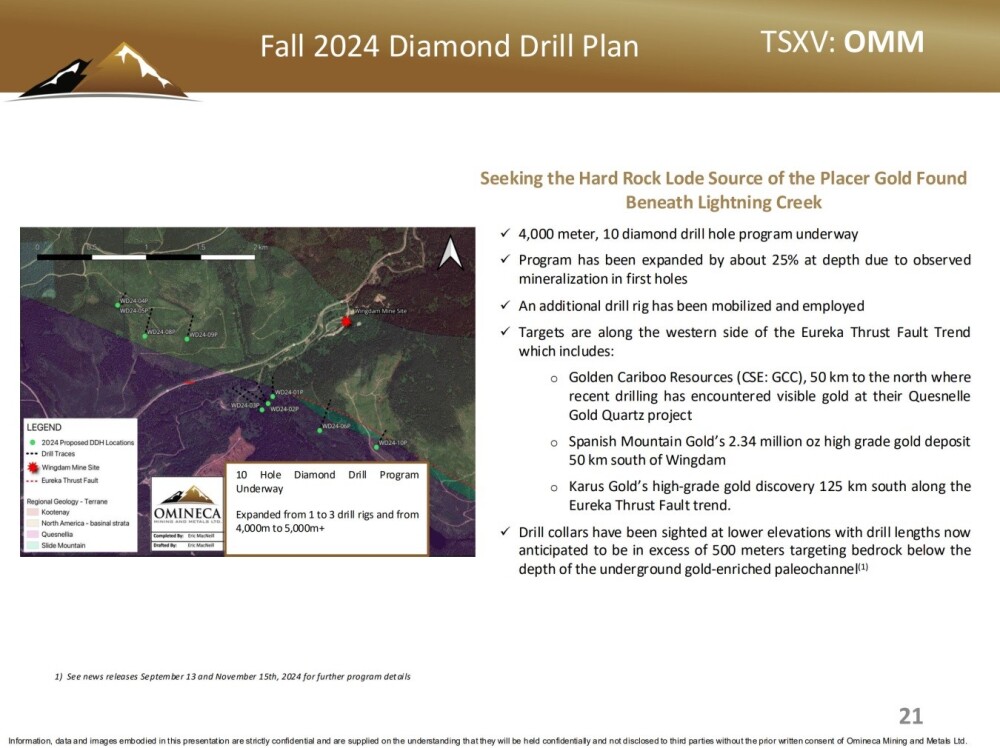

The company is already getting on with locating the Hard Rock Lode Source of the Placer gold found beneath Lightning Creek, and the drill program described here is ongoing through 2025.

So with mining operations getting underway under Lightning Creek after much preparation that should generate substantial revenue and an ongoing drill program in prospective ground in pursuit of the Hard Rock Lode Source there is plenty to look forward to going forward.

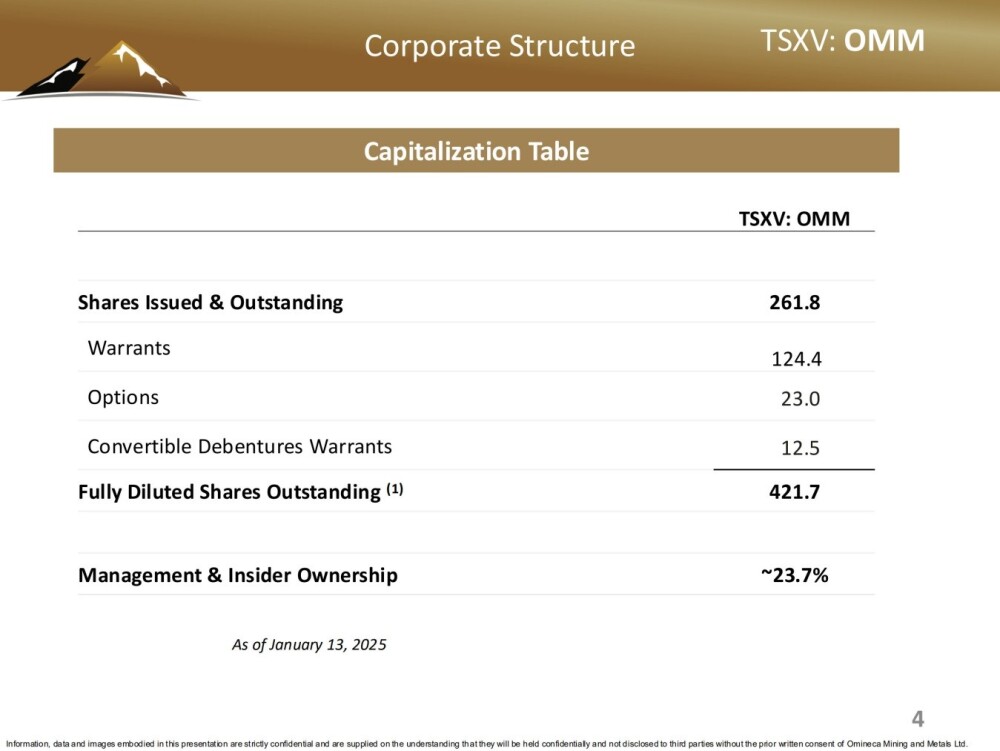

Lastly, we will look at the company's capitalization. It has 261.8 million shares in issue, of which about 23.7% are owned by management and insiders.

Now we will review the latest stock charts of the company.

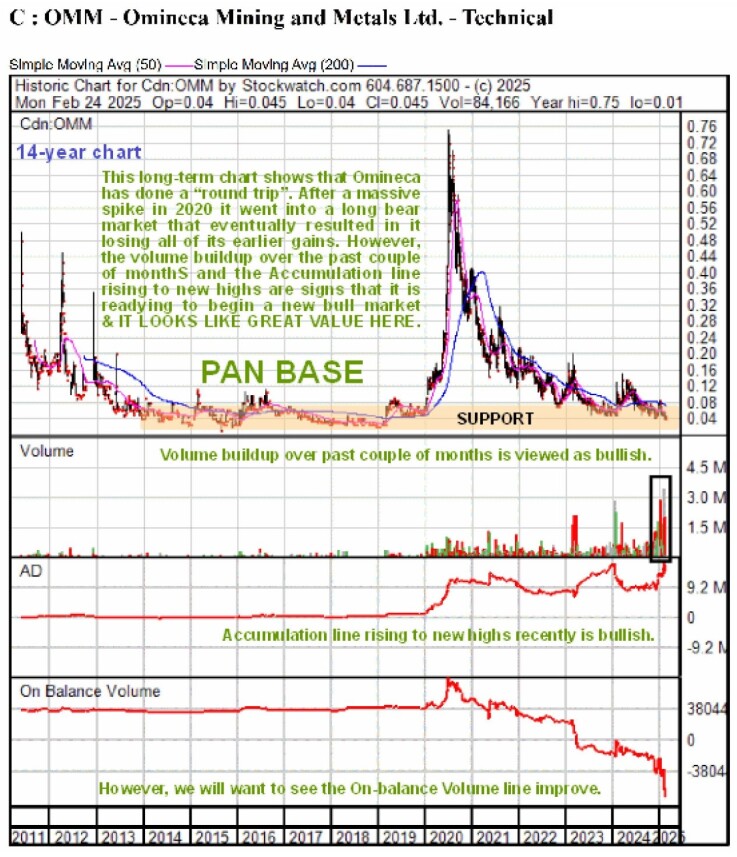

Starting with the long-term 14-year chart, we can see that Omineca Mining & Metals broke out of a gigantic Pan base that had been forming for almost 7 years and launched into a dramatic spike that peaked in the middle of 2020.

It then reversed into a severe bear market that completely erased all of the gains made during the 2020 spike bull market and has continued right up to the present, although the rate of decline has steadily slowed. The stock is now in a zone of strong support associated with the earlier giant Pan base. Before leaving this chart, it is worth observing the big volume buildup of the past several months that has driven the Accumulation line to new highs, which we will now look at more closely on a 6-year chart.

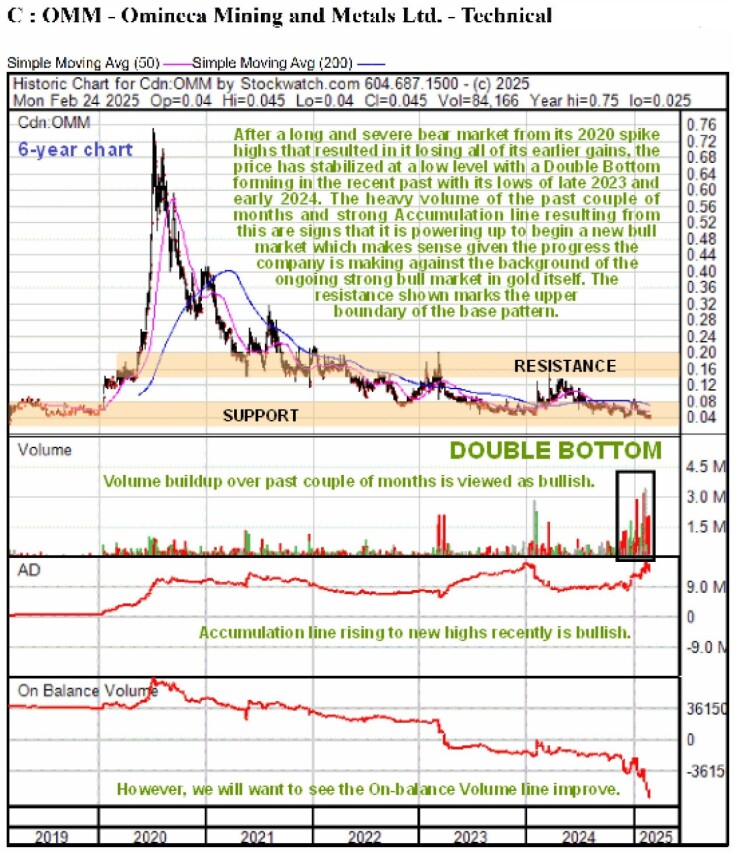

Having observed the origins of the huge 2020 spike on the long-term 14-year chart, we will now look at it and, more especially, the long bear market that followed it on a 6-year chart. On this chart, we can see how the rate of decline has gradually decelerated until it hit bottom late in 2023 and early in 2024 at just 4 cents, and even though it has dipped a shade below these lows early in December and again this month, it looks like the stock is forming a Double Bottom with those earlier lows, an interpretation that is supported by the volume buildup of the past several months that has driven the Accumulation line to new highs.

Rather strangely, the On-balance Volume line has dived to new lows at the same time, and in this situation, the Accumulation line is ascribed greater significance because it is a "tick for tick" intraday indicator, whereas On-balance Volume is calculated on the basis of end-of-day data and is thus considered to be a less accurate barometer of what is going on.

The reason that the persistent high volume of the past several months is viewed as bullish is that most of the sellers are selling for a loss, whereas most of the buyers will not be inclined to sell again until they have turned a profit, and so they are progressively "locking up" more and more stock which creates a supply shortfall that is immediately exacerbated by any influx of demand. Given the promising fundamentals detailed above, the current very low price of the stock, it is viewed as most attractive here.

The 18-month chart shows most of the Double Bottom pattern that has formed over the past 15 months or so, and on it, we can see in more detail the factors that were described in relation to the 6-year chart above. In addition, we can also more clearly see how the price in early December and again this month dipped a shade below the lows of the first low of the Double Bottom, but not enough to negate the validity of the pattern.

Also, the lows of December and this month constitute a lesser order Double Bottom, assuming it doesn't drop further, and if they hold — or even if they don't, as it physically can't drop much further — they are presenting an opportunity to buy Omineca at a very low price indeed.

Omineca Mining & Metals is therefore rated an Immediate Strong Buy for all time horizons. The first target is CA$0.08; the next target is CA$0.18 – CA$0.20, with a much higher target farther out at CA$0.70 – CA$0.75.

Omineca Mining & Metals' website.

Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCQB) closed for trading at CA$0.045 US$0.0284 on February 24, 2025.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Omineca Mining and Minerals Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Omineca Mining and Minerals Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.