In an era where the global energy transition and artificial intelligence revolution are driving unprecedented demand for critical metals, copper has emerged as a linchpin of economic growth. One company strategically positioned to capitalize on this trend is Libero Copper and Gold Corp. (LBC:TSX.V; LBCMF:OTCQB; DE:29H).

With its flagship Mocoa Copper-Molybdenum Project in Putumayo, Colombia, the company is focused on unlocking the value of one of the largest undeveloped copper deposits in the region.

Led by an experienced management team and supported by a strong shareholder base, Libero Copper is advancing Mocoa toward becoming a key supplier of copper for the green energy future.

Copper Market Fundamentals

Copper demand is surging as the world transitions toward electrification, digitalization, and clean energy. Industry experts forecast a sustained copper supply deficit, with major players like Goldman Sachs dubbing it "the new oil."

Expanding demand drivers include electric vehicles (EVs), artificial intelligence (AI), data centers, grid augmentation, and industrial electrification. Meanwhile, supply constraints, including aging mines, lack of new discoveries, and permitting hurdles, are restricting output. Analysts predict copper prices could exceed $5.00/lb, bolstered by global economic trends and constrained production.

The Mocoa Property

The Mocoa Copper-Molybdenum Project is in the Putumayo Department of southern Colombia, approximately 10 kilometers north of the town of Mocoa. The deposit is part of the Jurassic porphyry belt that extends through Ecuador and Colombia, which also hosts other significant deposits like Mirador and Warintza.

Geology & Resource Estimate: Mocoa is a classic porphyry copper-molybdenum system with disseminated chalcopyrite, molybdenite, and minor bornite mineralization. The deposit contains an inferred mineral resource of 636 million tonnes grading 0.45% copper equivalent (0.33% Cu and 0.036% Mo), representing 4.6 billion pounds of contained copper and 511 million pounds of molybdenum. The mineralization remains open along strike and at depth, offering significant exploration upside.

Infrastructure & Accessibility: The project benefits from excellent infrastructure, including paved national highways, nearby regional airports, and access to the national power grid. Freshwater resources are also abundant, further supporting potential future development.

Exploration & Development Strategy: The company has identified multiple high-priority drill targets, including additional porphyry systems adjacent to the main Mocoa deposit. The next phase of work will include permitting, community engagement, and an expanded drill campaign aimed at expanding the resource base and further de-risking the project.

Historical Work: Mocoa was first discovered in 1973 through a United Nations-led regional geochemical survey. Over the years, companies including B2Gold and AngloGold Ashanti have conducted exploration work, leading to extensive drilling campaigns that have outlined the current resource base. Recent drilling by Libero Copper has confirmed the presence of high-grade copper and molybdenum mineralization over significant intercepts, including a standout result of 1,229m grading 0.58% CuEq.

Management Team

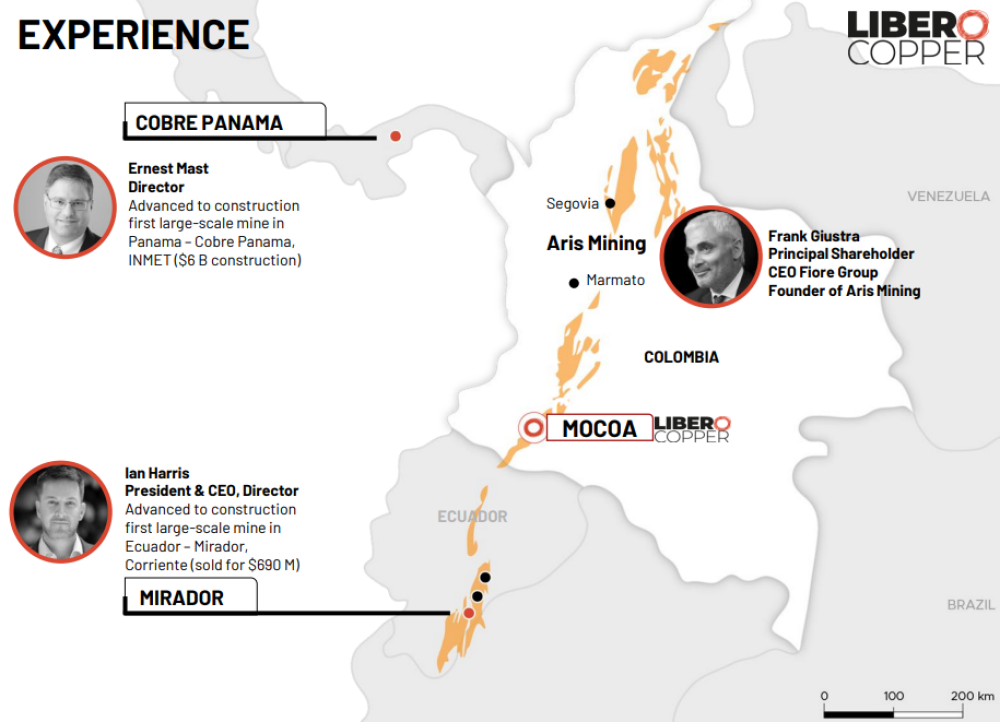

Libero Copper is helmed by a seasoned leadership team with a track record of advancing world-class mining projects.

Ian Harris, President & CEO and Director, is a mining engineer with over 20 years of experience leading projects worldwide, including over 10 years working and living in South America. Notably, he played a pivotal role in advancing the Mirador mine in Ecuador, which led to the sale of Corriente Resources for $690 million.

Ernest Mast, Director, brings over 30 years of technical and executive expertise, having previously served as President and CEO of Primero Mining, CEO of Inmet's Cobre Panama, and Vice President of Operations at New Gold.

Robert Van Egmond, Director, is a professional geologist with 35 years of international exploration experience across North and South America and Africa.

Jay Sujir, Director, is a securities and natural resources lawyer with 25 years of experience, currently a senior partner at Farris, Vaughan, Wills & Murphy LLP.

Share Ownership and Structure

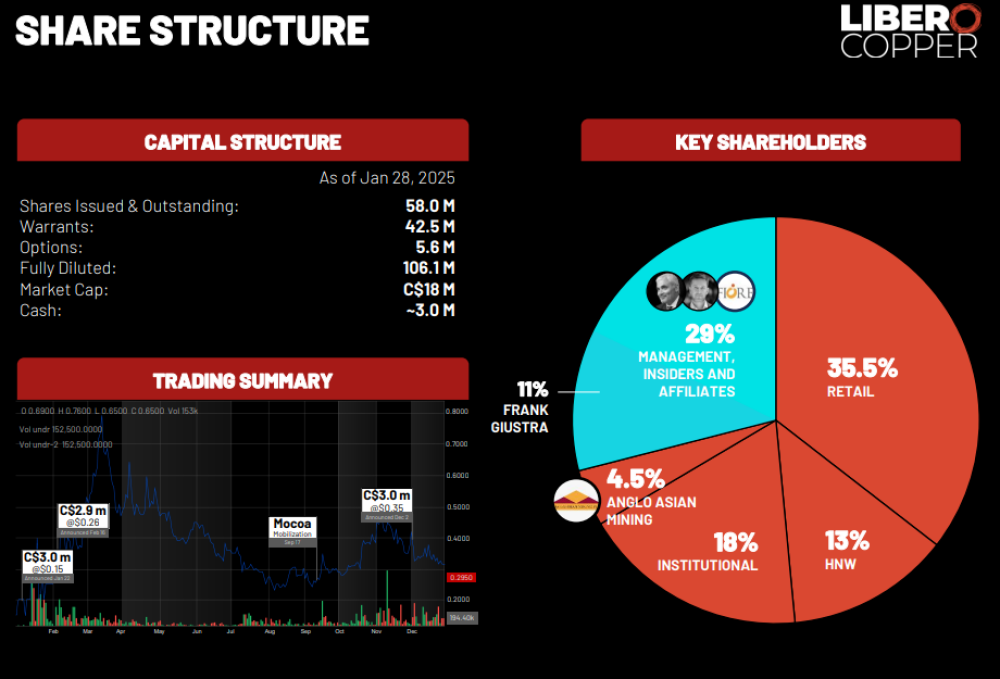

Libero Copper maintains a well-structured share ownership model, fostering both institutional and retail participation. The company has 58.0 million shares outstanding, with an additional 42.5 million warrants and 5.6 million options, bringing the fully diluted share count to 106.1 million. The company's market cap stands at approximately C$18 million.

Key shareholders include Frank Giustra, who holds 11%, Anglo Asian Mining with 4.5%, management, insiders, and affiliates with 29%, institutional investors with 18%, high-net-worth individuals with 13%, and retail investors with 35.5%.

Technical Analysis of LBC.V

Recent stock chart analysis suggests a potential breakout for Libero Copper. (see chart below) Shares appear to have established a base at CA$0.25, with targets of CA$0.50, CA$0.65, and CA$1.20. Technical indicators, such as the MACD, signal a potential uptrend while increasing volume indicates growing investor interest.

Support Level:

- Shares appear to have established a base at CA$0.25.

Breakout Targets:

- 1st target: CA$0.50

- 2nd target: CA$0.65

- 3rd target: CA$1.20

Conclusion

Libero Copper is poised to capitalize on the structural bull market in copper, underpinned by its world-class Mocoa deposit and a leadership team with a proven ability to advance projects.

With a tight share structure, increasing investor awareness, and robust market fundamentals, Libero Copper offers an attractive investment opportunity at current prices for those seeking exposure to the next wave of copper expansion at the low end of the share price range.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Libero Copper and Gold Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.