Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) released an updated NI 43-101-compliant mineral resource estimate for its Nueva Recuperada project in Peru, and it reflects a significant increase in all categories and metals, according to a news release.

"We are sitting on an outstanding asset, a district-scale project," President and Chief Executive Officer (CEO) Jose M. Garcia said in the release. "We continue to build value for investors."

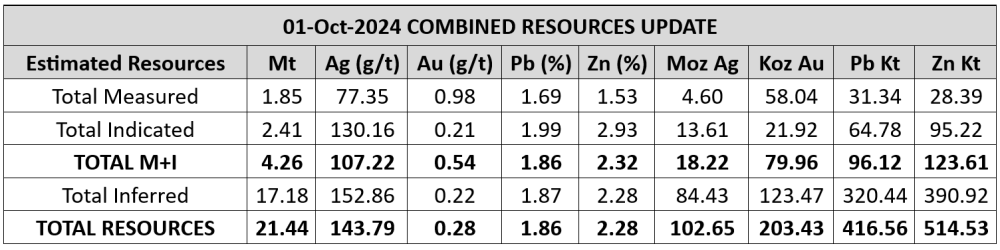

The new global resource for Nueva Recuperada is 21,440,000 tons (21.44 Mt), representing a 38.4% increase from 15.49 Mt in the prior estimate in the October 2022 preliminary economic assessment (PEA). In terms of silver equivalent (Ag eq), the new resource amounts to XX,000,000 ounces (XX Moz).

Globally, the quantities of the three of the four metals present, silver, zinc and lead, grew notably since the PEA resource. Specifically, zinc rose the most, 97.8%, to 514,530 tons (514.53 Kt) from 260.17 Kt. Lead went up 59.3% to 416.56 Kt from 261.56 Kt. Silver increased 54.6% to 102.65 Moz from 66.36 Moz.

The update reflects a boost in the Plata (formerly Esperanza) Mining Unit resource such that it now accounts for about one-third of the overall Nueva Recuperada resource. Plata is a high-quality target encompassing eight royalty-free mining concessions over 4,228.5 hectares. Historically, about 1.8 Mt of 16.03 ounce per ton Au eq were produced there.

"The updated estimate underscores the strategic importance of the Plata project within the Nueva Recuperada portfolio and its role in driving future value for the company," wrote Garcia in the release.

Plata's total current estimated resource is 6.35 Mt of 153.15 grams per ton (153.15 g/t) Ag, 3.37% zinc and 2.03% lead and contains 31.24 Moz of silver.

Between the 2022 PEA and now, Plata's Indicated resource grew 100% to 0.95 Mt at an average grade of 175.03 g/t Ag. The Inferred resource, also expanded, now is 5.39 Mt at an average grade of 149.3 g/t Ag. These category increases signify that material progress has been made at Plata.

Increasing Its Production

Silver X is a British Columbia-based silver producer-developer working to deliver exceptional value to all of its stakeholders, according to its 2025 Corporate Presentation. The company aims to achieve this by consolidating and developing undervalued assets, by adding resources and by increasing production (its target is 6 Moz), in an environment friendly and sustainable way.

Nueva Recuperada, Silver X's 100%-owned cornerstone asset, now consists of four projects and 230 mining concessions, on 20,472 fully permitted hectares in Central Peru's Huachocolpa mining district. Along with the in-development Plata project, the portfolio includes the producing Tangana Mining Unit, and the exploration-stage Red Silver and Victoria projects.

"Our Nueva Recuperada project continues to position as one of the most relevant, underdeveloped silver projects in South America," noted Garcia in the release.

As one way to boost production, Silver X intends to bring the Plata Mining Unit online this year. The related 1,000-hectare easement agreement, valid to 2039, ensures long-term stability of the operation. The project benefits too from the Nueva Recuperada plant, only 15 kilometers (15 km) away, in terms of access to power and other infrastructure.

"We envision an opportunity to combine fast-track production with a growing resource, especially in the face of a good silver market," added Garcia.

Significant exploration upside exists at Plata, where exploration has been confined to the Esperanza 2001 vein, and it remains open at depth. Limited exploration has been done below Level 520, where reportedly there is higher-grade mineralization. Multiple veins have been identified, between 0.6 and 1 meter in width, and grouped into three sectors: Esperanza, Rico Antimonio and Germana. More than 120 km of mineralized veins have been mapped. Extensive sampling also has been done.

"Future work will prioritize expanding the lateral and depth extents of the resource," according to Garcia.

At Tangana, Silver X is expanding production with its in-progress ramp-up to nameplate capacity of 720 tons per day (720 tpd) from 600 tpd. The company has been producing silver, gold, lead and zinc at this project since 2022.

Implied Return of 483%

Red Cloud Securities' net asset value on Nueva Recuperada and its target price on Silver X rose, the latter by 50%, when the firm updated its price forecasts for both precious metals last month, reported Analyst Timothy Lee. Red Cloud's new, current target price on Silver X implies a potential return for investors of 483%.

"We anticipate that favorable gold and silver markets will continue into 2025 given expectations of interest rate cuts, geopolitical impacts and growing central bank demand," read the Commodity Price Update.

Given the strong silver and gold price environment, Silver X could benefit greatly from further production ramp-up, Lee highlighted in an October 2024 research report. The metals' prices are even higher now than they were then.

"We are looking for further production ramp-up from the company's ongoing development work in the Tangana Mining Unit as well as potential development at Plata, which could provide a second ore source," wrote Lee.

Red Cloud rates Silver X Buy.

The Catalyst: Strong Silver Prices

Good news for Silver X investors is that the silver price is expected to move higher this year after its steady climb since Jan. 1, according to Metal Miner. In its Feb. 20 article the price forecaster attributed this to investors turning to silver as a safe haven asset because of ongoing geopolitical conflicts and economic uncertainties.

"Silver is looking to break out again," Chen Lin wrote in the Feb. 20 edition of What is Chen Buying? What is Chen Selling?

According to FXEmpire's Christopher Lewis, the silver price is poised to move higher. Further, were a rally to occur and the price to surpass US$33.33 per ounce (US$33.33/oz) then US$35 silver would be a real possibility, he purported in a Feb. 24 article. (Silver's high this year was US$32.80/oz in mid-February.)

"I do think when you look at the longer-term trajectory, it's in an uptrend," Lewis wrote. "There's really no doubting that. So I am a buyer of dips."

InvestingHaven predicted the silver price will reach US$48/oz this year, consolidate around US$50 next year, move closer to US$77 in 2027 and peak at US$82 in 2030, according to a Feb. 18 article.

"All leading indicators, chart patterns and market dynamics are in favor of silver," the investment research service wrote. "We conclude that the price of silver will continue to mildly rise, combined with one or a few wildly bullish periods."

As for silver's fundamentals this year, the world's supply is forecasted to increase 3% this year to an 11-year high of 1,050,000,000 ounces (1.05 Boz), The Silver Institute wrote on Jan. 29. Silver mine production is expected to grow 2% to 844 Moz, for a seven-year high. Similarly, silver as a byproduct from gold mines is forecasted to rise, too, as is silver recycling, by 5%.

"This year, industrial scrap will be the key growth driver, particularly changeouts in ethylene oxide catalysts," according to the report. "Jewelry and silverware recycling will also rise, reflecting India's price-led gains."

Global silver demand is projected to remain stable this year at 1.2 Boz. Though demand for industrial applications and retail investment will be stronger, a weaker demand for jewelry and silverware will offset the difference.

Thus, despite expectation for increased supply and static demand, another significant silver market deficit is expected this year, the fifth in a row, for the global silver market, of 149 Moz. This figure is 19% lower than last year's but still high historically, the Institute wrote.

Ownership and Share Structure

According to Refinitiv, six strategic investors own 21.63% of Silver X. The top shareholder is Baker Steel Resources Trust Ltd. with 9.66%. Next is CEO Garcia with 7.07%, followed by Sebastian Wahl with 4.83%.

The rest of the company's shares are in retail. There are no institutional investors at this time.

As for share structure, Silver X has 201.89 million (201.89M) outstanding shares and 158.21M free float traded shares.

Its market cap is CA$27.08 million. Its 52-week high and low are CA$0.38 and CA$0.16 per share.

| Want to be the first to know about interesting Base Metals, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |