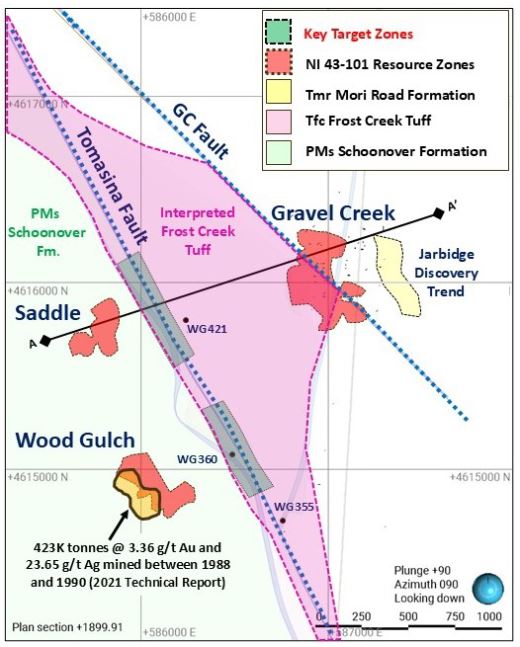

Western Exploration Inc. (WEX:TSX.V; WEXPF:OTCQX) delineated an undrilled prospective zone near the Wood Gulch and Gravel Creek deposits at its Aura gold-silver project in Nevada, according to a news release.

This new area is 1 kilometer (1 km) west of Gravel Creek and intersects the volcanic rocks that host the underground, high-grade Gravel Creek sulphide deposit. The zone's strike length is more than five times the known strike length of the current Gravel Creek mineralization.

This exploration target is significant for Western, as is the Jarbidge one (100 meters [100m] east of Gravel Creek and drill tested last year), President and Chief Executive Officer Darcy Marud said in the release, because they "offer significant new resource expansion potential to the current Gravel Creek resource." The resource stands at 245,000 ounces (245 Koz) of 5.81 grams per ton gold equivalent (5.81 g/t Au eq) in the Indicated category and 443 Koz of 5.02 g/t Au eq in the Inferred category, according to the company's website.

The recently defined area, with three outcropping zones of mineralization, extends more than 3 km along the Tomasina Fault system. Tomasina intersects the highly prospective Frost Creek tuff that hosts the mineralization at Gravel Creek. Some of Frost Creek's wide intercepts within the current Gravel Creek resource are 18.29m of 9.67 g/t Au eq (hole WG391) and 20.43m of 11.97 g/t Au eq (hole WG443). As such, the potential exists for wide, 10−25m, zones of high-grade gold-silver mineralization in the new target.

Given its location at depth and to the east of the Saddle and Wood Gulch resource zones, the untested area of potential was tapped for production historically via the Wood Gulch mine, the release explained. In fact, the Wood Gulch open pit reportedly contained some of the highest-grade drill intercepts recorded on the Aura property, such as 13.72m of 29.59 g/t Au eq (WG-125) and 9.14m of 30.38 g/t Au eq (WG-145).

The Wood Gulch plan of operations and permitted drill sites encompass the Tomasina target that, at 75-400m from the surface, bodes well for reduced drill costs and future development.

"Drill testing the Tomasina Fault zone will be a key part of Western Exploration's exploration program on the Aura project in 2025," noted Marud in the release.

Priority will be given to where the Tomasina Fault zones crosscut the Frost Creek tuff downdip from known surface mineralization in the Wood Gulch and Saddle resources, as shown on the map.

Promising Project in Premier Place

Headquartered in Reno, Nev., Western Exploration owns a high-potential asset (a 6,000-hectare land package) containing a promising project in a premier mining jurisdiction, described Fundamental Research Corp. (FRC) Analyst Sid Rajeev in a November 2024 report.

The project is Aura, consisting of three sediment-hosted, Carlin-type gold deposits, each with its own NI 43-101-compliant resource: Gravel Creek, Wood Gulch, and Doby George. Together, the trio hosts 1,320,000 ounces (1.32 Moz) of Au eq, Indicated and Inferred.

Aura is about 120 km north of the city of Elko in mining-friendly Nevada, the top gold-producing and second-highest silver-producing state in the U.S. in 2024, according to Investing News Network. Adequate infrastructure, including road access, water, and power, are nearby.

Western's strategy, outlined on its website, is to make grassroots discoveries and evolve them into world-class gold mining operations. This is what the management team is working toward at Aura, now specifically with its back-to-back exploration programs.

Collectively, the professionals leading the charge at Western are well-experienced, the company said. President and CEO Marud himself, for example, most recently worked for 10 years as an executive at Yamana Gold and previously held positions at Homestake Mining Co., FMC Gold Co., and Meridian Gold (MNG:TSX.V). He has been involved in the discovery and development of notable precious metal deposits, including El Penon in Chile, Mercedes in Mexico, and Pilar and Corpo Sul (Chapada) in Brazil.

US$8,000/Oz Gold 'Increasingly Probable'

The gold price hit a new all-time high of US$2,955 per ounce (US$2,955/oz) on Feb. 20. This was the start of a year, that is expected to be another strong one for the metal, still in a long-term bull market, according to a World Gold Council (WGC) article.

"In 2025, we expect central banks to remain in the driving seat and gold exchange-traded fund investors to join the fray, especially if we see lower, albeit volatile, interest rates," wrote Louise Street, WGC's senior markets analyst. "On the other hand, jewelry weakness will likely continue as high gold prices and soft economic growth squeeze consumer spending power. Geopolitical and macroeconomic uncertainty should be prevalent themes this year, supporting demand for gold as a store of wealth and hedge against risk."

Recently, Goldman Sachs boosted its gold price forecast for year-end 2025 to US$3,100/oz from US$2,890 due to an anticipated surge in central bank demand, reported Goldfix on Feb. 19.

InvestingHaven predicts US$3,260 gold in 2025 and, for the rest of the decade, near US$3,775 in 2026 and US$5,120 by 2030, driven mainly by heightened inflation and increasing central bank demand.

John Newell of John Newell and Associates believes gold eventually could exceed even that. "An explosive move toward US$8,000/oz is not just possible; it's increasingly probable," he wrote in a recent article. "For those looking to hedge against inflation, preserve wealth and capitalize on a potential historic price surge," he added, "gold remains one of the most compelling investment opportunities of our time."

One way to capitalize on the yellow metal's bull market is to invest in the stocks of juniors, or explorers, as they "are at historically low valuations even as gold is at record levels and climbing higher," advised Brien Lundin, editor/publisher of Gold Newsletter, on Feb. 16.

The Catalysts: More Progress at Aura

Investors can expect heavy news flow from Western this year, Marud told The Gold Advisor's Jeff Clark last month. The precious metals explorer is still finalizing its drill plan for this year, but it will include testing the newly defined Tomasina exploration target.

"In combination with the continued evaluation of the high-grade vein zone outlined in the Jarbidge rhyolite in 2024, we believe we have a significant opportunity to continue to grow the Gravel Creek resource base," Marud said in the company's latest release.

Also, work is underway on a preliminary economic assessment of Doby George, a near-surface, high-grade oxide deposit.

"It's got over 800 drill holes in it, good metallurgy, 70% recovery, heap leach, so very straightforward," Marud told Clark. "But I think it's going to shock the market when they see this junior company has this resource that we haven't heard much about."

Experts Say Stock is a Buy

Western Exploration has the attention of several experts. Brien Lundin, editor/publisher of Gold Newsletter, is positive on the company and its prospects, he wrote on Jan. 30, and rates it Buy. He pointed out that the company's resources are in "prime territory in Nevada." In a December 2025 newsletter edition, he commented: "I think Western Exploration makes for a compelling bet on rising gold prices and exploration success in 2025."

Also last month, Technical Analyst Maund wrote that Western Exploration's stock charts suggested that an "upside breakout from the base pattern is pending." Bullish factors included the formation of a head-and-shoulders bottom, the volume buildup since mid-2024 and the large portion of the buildup being upside. As such, he deemed the stock an immediate Strong Buy for all timeframes.

The Gold Advisor's Clark told Streetwise Reports he liked Western Exploration, in large part, because its global resource at Aura could be expanded to 2 Moz, based on recent drill results. Other company highlights he wrote included Geologist Mark Hawksworth managing and overseeing exploration at Aura, given his experience and success in making discoveries. Also of note, Clark wrote, is Western's strategic investors: Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and Golkonda LLC.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC)

Western Exploration holds a spot as one of FRC's Top Picks among the precious metals companies in its coverage universe, according to its analyst, Rajeev. He purported recently that WEX is becoming a strong acquisition target. On the stock, the analyst has a Buy rating and a fair value estimate implying a 207% potential return.

What's more, WEX made the 2025 OTCQX Best 50, a ranking of top-performing companies on the OTCQX Best Market based on 2024 total return and average daily dollar volume growth.

Ownership and Share Structure

According to Refinitiv, strategic entities own about 61% of Western Exploration. These include the Top 2 shareholders overall, Golkonda with 44% and Agnico Eagle with 14%. Insiders and management hold about 3%.

Institutional investors, Euro Pacific Asset Management LLC, Auramet Capital Partners, TXAU Ventures and U.S. Global Investors Inc., own about 12%. The rest is in retail.

The precious metals explorer has 45.43 million (45.43M) outstanding shares and 17.85M free-float traded shares. Its market cap is CA$42.25 million. Its 52-week range is CA$0.70−1.50 per share.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Western Exploration Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Exploration Inc.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.