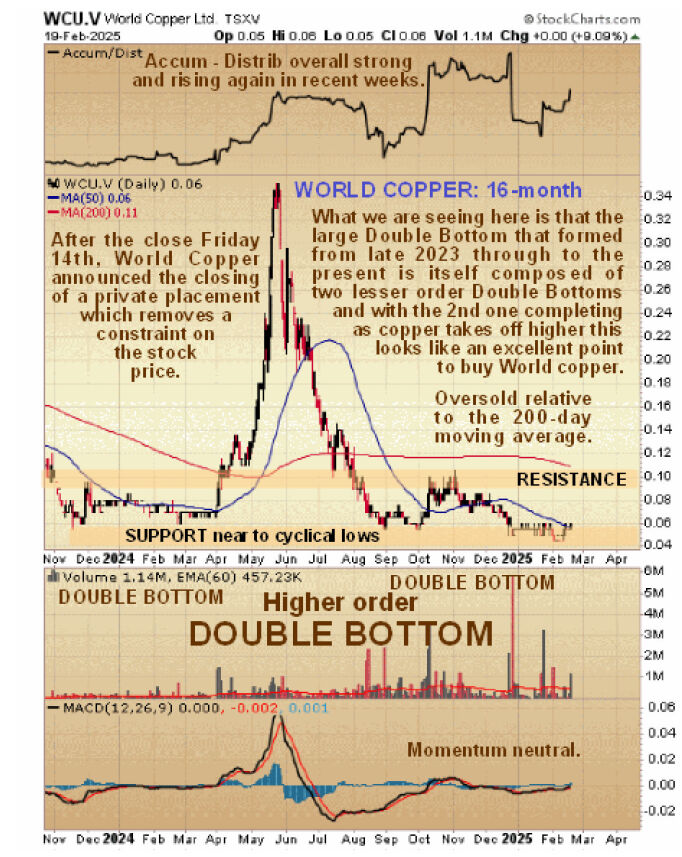

World Copper Ltd. (WCU:TSX.V; WCUFF:OTCQX; 7LY0:FRA) appears to be completing a Double Bottom with its lows of last September – October, as we can see on its latest 16-month chart below, and this Double Bottom constitutes the second low of a higher order Double Bottom whose first low, which formed in late 2023 and early 2024, is visible to the left of the chart but perhaps better seen on the 5-year chart lower down the page.

Three bullish factors have come into play in the last few weeks that should see World Copper ascend away from these low levels soon, or immediately. One is that, in the face of a supply crunch, copper has broken out of a large Triangle to embark on a major new uptrend. Another is that, after the close of trading on Friday the 14, World Copper announced the closing of a private placement.

However, by far, the most important news, out (on February 19) is that the company had entered into a binding letter agreement to sell its Zonia Project to an undisclosed third party for $26 million. The proposed transaction will be effected by way of a share purchase and sale transaction, pursuant to which the purchaser would acquire all of the issued and outstanding shares of the company's Arizona subsidiary, Cardero Copper (USA) Ltd. (Subco). This development is thought likely to lead to an uptrend in the stock before much longer.

The 5-year chart puts the larger order Double Bottom that formed following the severe bear market from the early 2022 highs, in better perspective.

On this chart, we can see several additional bullish factors, including the volume buildup over the past year, which shows a lot of stock rotation that is interpreted as bullish because the new owners of stock will be less inclined to sell until they have turned a profit, the overall rising trend of the Accumulation line, which has started higher again in the recent past and the gradual improvement in momentum (MACD) which looks set to enter positive territory.

Having broken out of a large Triangle just this month, copper is now trending strongly higher, which provides a positive background factor for World Copper, especially with the funding now behind it.

This is, therefore, considered to be a very favorable point to buy or add to positions in World Copper.

World Copper's website

World Copper Ltd. (WCU:TSX.V; WCUFF:OTCQX; 7LY0:FRA) closed for trading at CA$0.05, US$0.037 on February 21, 2025.

| Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- World Copper Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of World Copper Ltd.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.