As the worst week since the first week of January drew to a close, I was agonizing over whether to entitle this week's missive "All In" in direct reference to a series of charts from both Goldman Sacks and J.P. Morgan that show that literally everyone is "all in" stocks, gold, and Bitcoin. Whether domestic or foreign, retail or institutional, or small cap versus large cap, portfolios are stuffed full of U.S. common stocks with NYSE margin debt at or approaching record high levels.

The mainstream financial media led by the CNBC bubbleheads are all in full and deafening chorus claiming that those "animal spirits" being unleashed by the Trump presidency are bringing about a "new morning in America," and while the S&P 500 hit another record high on Wednesday, the NYSE advance-decline line was nowhere close. In a note to subscribers last Tuesday before the opening, I made reference to the growing number of divergences cropping up, including a classic Dow Theory sell signal.

"First, the most glaring Dow Theory non-confirmation is the lagging Dow Transports that are 1,239.29 off their record high registered on November 25 of last year, while the Dow Industrials are 527.55 from their record high registered on December 4 of last year. While the time between the Trannies hitting 52-week highs and the Industrials hitting 52-week highs was relatively short, if we see a run to the highs this week in the DJIA, that stubborn DJTA will surely fall short."

The DJIA failed to register a new high this week, bucking the trend set by the S&P 500. If you back out the Mag Seven weightings and instead use the "equal weight" S&P 500 (SPXEW:US), you can see that it fell miserably short of its record high last registered on November 29.

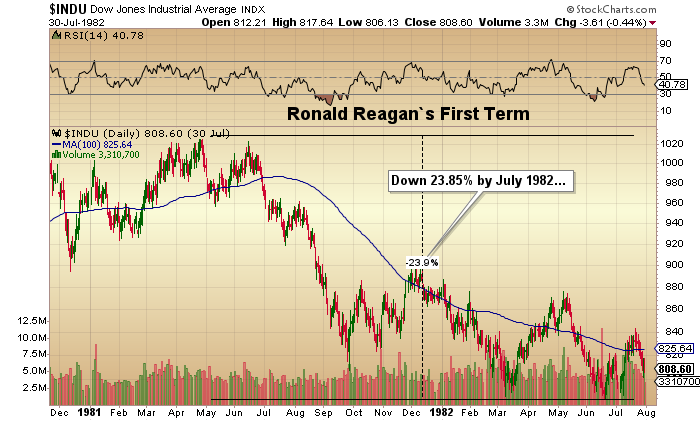

I have been espousing the idea of the Trump 2.0 term in office, which resembles the first term of former President Ronald Reagan, where the similarities to this Trump presidency are striking. Reagan took office in January of 1981 after Americans had been forced to endure four years of the ultra-left (liberal) Democrats under Jimmy Carter and inflation rates approaching double digits.

Of course, that was at a time when inflation rates were not "massaged" by seasonal adjustments and intentional omissions such as the "ex-food-and-energy" number that presumes no one in America eats, heats their homes, or drives a vehicle.

When first elected, markets rejoiced at the arrival of the man who coined the phrase deemed "the most frightening words in the English language": "Hello. I am from your government, and I am here to HELP."

Stocks initially rallied in Q1/1981 as investors thought that the Reagan Administration had their backs, but what they missed was that Reagan vowed to break inflation by breaking the Arab Oil Cartel, and the only effective way to break the upward spiral in oil prices was to dampen demand and he did that through choking off the credit supply to the banking system which drastically reduced supply forcing the cost of credit higher. With that came the 1981-1982 recession, and the rest is, as they say, history.

Here in 2025, Americans have been dealing with accelerated inflation and housing unaffordability while food prices are once again on the rise thanks largely to the rapid ascent in the price of eggs sent rocketing after avian flu forced the euthanization of chickens as a preventative measure.

After four years of policies dominated by "woke" ideologies and practices, the American voting public was more than ready for a change, and change they most certainly have gotten as the Department of Government Efficiency continues to barge into every agency (and even the NGO's) in a desperate and determined effort to eliminate government waste and corruption. As admirable an objective as this may be, it is also undoing all of the job growth and GDP support that came with Biden's fiscal largesse designed to deliver his party back into the White House.

Economic data last week revealed a definite weakening in the U.S. with a big drop in the services sector, the main driver of growth in the U.S. for decades since the Wall Street paper-hangers gutted American manufacturing by packaging it up and shipping it (along with a boatload of technology) abroad. If services roll over, it takes with it 80% of the U.S. economy and a market valued at over 30 times forward earnings will certainly feel the effects of such a slowdown.

As I confessed in the GGMA 2025 Forecast Issue, it is difficult to be an optimist on stocks — especially U.S. non-resource stocks — when the driver of earnings is under siege by way of tariffs or fiscal retrenchment. In fact, the more desperation I hear in the voices of the Wall Street book pumpers as they ratchet price targets higher and higher, repeating ad nauseum the well-rehearsed narrative of this never-ending Trump Trade that will grow to the skies, damning any and all notions of corrections looming on the horizon.

However, before I stand upon a soap box megaphone in hand, spewing bearish invectives in a "Chicken Little" impression of impending financial Armageddon, it must be noted that this market has absolutely annihilated every remaining bear on the planet into extinction. There is literally no one left — not Jim Chanos nor David Einhorn nor Sven Hendrick — who has the intestinal fortitude to go public with their bearish ideas — which in itself confirms the "all in" status of the U.S. equity markets and, at the same time one of the strongest contrarian indicators since 2020.

Gold (and Silver)

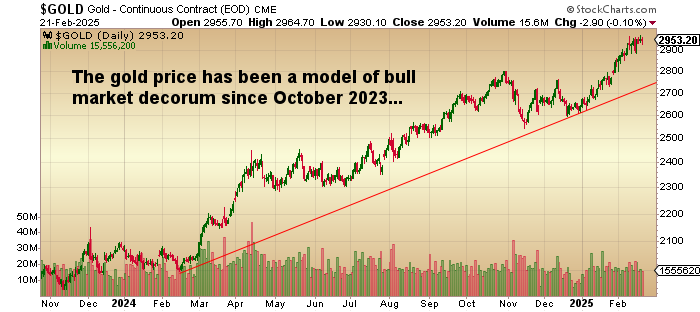

I swore on a stack of Gideon Bibles that no matter what my indicators were telling me, I would never again try to hedge my row upon row of junior gold miners and explorers by shorting gold bullion. No more GLD:US put options would ever again adorn the pages of my brokerage statements due largely to the incredible performance of gold since the lows of October 2023.

Well, my gold charts are reminiscent of the Sirens of ancient Greek mythology that would call out to the sailors trying in vain to navigate through rocky waters in the midst of raging winds and rain. I open the chart book and all I hear and see are the haunting images of those bare-breasted ladies and their beguiling songs. That is exactly how the gold market looks to me as it flirts magically with the US$3k level.

You cannot ask for a better-looking chart than gold since October 2023. Every dip has been bought while the trendline has remained intact acting as an ascending railroad track upon which gold depends. "Don't fight the trend!" is a phrase to repeat where gold is concerned.

However, whenever the price of anything moves from a gradual rise (or fall) to a vertical rise (or fall), the terminus of the move is nigh upon us.

As soon as the Trump 2.0 victory lap had finished spooking the election hedgers out of their golden insurance policies by mid-December, the market moved from a gradual ascent to a near-vertical ascent. The MACD indicator is approaching a bearish crossover, while the Money Flow indicator has started to roll over. While the TRIX is still bullish, it is approaching overbought status. The price action since last December has been thoroughly remarkable to the extent that the GLD:US shown above is still a full $7.15 above the now-vertical 20-dma which sits at $263.59. The 200-dma is now $33.93 below Friday's closing price, and that is several standard deviations from the norm, setting up a high probability for a correction.

Also, while many of the pundits would cackle hysterically at this, the Ides of PDAC are rapidly approaching, and while certainly not a perfect indicator by any means, the arrival of the Prospector and Developers Association Conference in early March in Toronto has tended to mark the end of the seasonally strong period for the precious metals and the junior and senior companies that explore for, develop, and produce them.

So there you have it. I am sticking to my vows and will not attempt to put on any of the hedges I have attempted in the past because, after all, this IS a bull market, and in a bull market, you are either lightly long, long, or heavily long. Flat is too nerve-wracking, and to short gold, even as a hedge against ridiculously overweight junior gold positions, is fraught with inordinate risk. That said, I would refrain from being lured by those Sirens into new PM positions and onto those jagged and very menacing rocks.

Juniors and PDAC

In the old days, when men were men and gold bugs were revered, the big PDAC mining conference in Toronto was an annual "must-attend" for anyone and everyone who followed the mining business. Toronto has always been seen as the mining capital of the world, but when combined with Vancouver, they are the home to over 800 companies involved in the metals.

In the 1990s, many of the workshops and speeches were "Standing Room Only" affairs where members of the audience would bolt from their seats at the mention of a "hot stock" making B-lines for the bank of payphones that preceded cell phones back in the day. After the GFC in 2009 and the gold bugs woke up to their mutual horror that the inevitable meltdown in the financial system causing widespread bank failures had been avoided, the fiscal and monetary steps taken to save the banks allowed a temporary two-year hiatus for gold and silver but by 2011, the bull market was over, and the era of bailouts and bull market rescues had begun. PDAC gradually devolved into a kind of carnival-barker sideshow where senior citizens roamed the aisles loaded down with shopping bags full of company reports, business cards, key chains, and raffle tickets offered as enticements by the starving junior mining entrepreneurs for their support (and buying). After the banks were bailed out in 2009, there was little obvious need for the kind of portfolio insurance provided by gold and gold mining stocks.

However, the promoters kept coming back in the illusive search for a return of the junior mining speculator to the marketplace, and until this year, I had seen very little reason to attend. However, this year, it feels different. It started in January at the Vancouver Resource Investment Conference, where it was reported to me that unlike most years where the ratio of retail customers to industry "bird dogs" was 80:20 (80 retail to 20 industry), the 2025 VRIC saw a complete reversal in the numbers. It was estimated that there were 80 mining industry members sniffing out new projects in which to invest by way of either capital investment or joint venture to every 20 retailers toting shopping bags.

One company that will surely be the focus of excessive tire-kicking will be my favorite junior — Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), whose recent PEA confirmed what I have been saying for nigh-on seven years – that big deposits in Nevada valued at under US$10/ounce would eventually catch a bid AND the attention of the majors.

While I have no knowledge of the latter, the former is clearly evident in the chart (shown above), where the stock has advanced over 125% since it hit its tax loss, selling low on December 13 at CA$0.11. closing at CA$0.25, the high since then was CA$0.295 before the overbought status prompted profit-taking.

Now that the overbought condition has been rectified (with RSI back to 55.25), the shares are once again ready to move higher. And why shouldn't they? At US$2,250 gold, its Fondaway Canyon project has an IRR of 46.7% over a 10.3-year LOM and a discounted after-tax net present value of US$474 million. With a market cap of US$37.7 million, that implies a great deal of lift for both the retail and corporate investor. Furthermore, if one plugs in my 2025 forecasted number for gold at US$3,650, you get tremendous upside leverage, making this little junior developer an ideal proxy for rising gold prices into the balance of the decade.

With PDAC 2025 expected to have a plethora of corporate "scouts" looking for projects, it would come as no surprise to me if Getchell snags a sponsor.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.