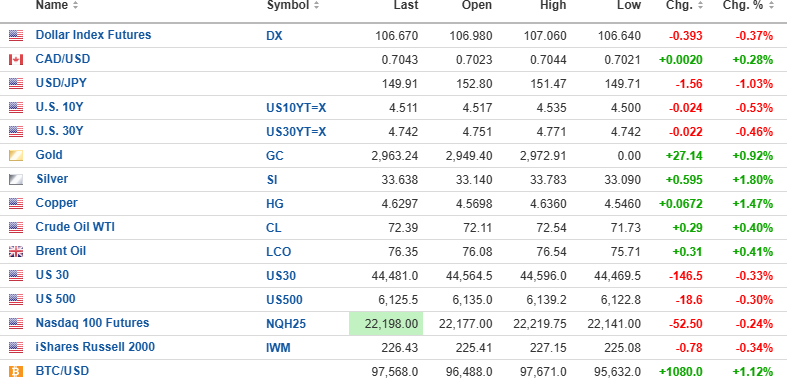

USD index futures are down 0.37% to 106.670, with the 10-year yield down 0.53% to 4.511% and the 30-year down 0.46% to 4.742%.

Gold (+0.92%), silver (+1.80%), oil (+0.40%), and copper (+ 1.47%) are higher.

Stock futures are lower, with the DJIA (-0.33%) down 146.5 points, the S&P 500 (-0.30%) down 18.6 points, and the NASDAQ (-0.24%) down 52.50. points. R

isk barometer Bitcoin is up 1.12% to $97,568.

Stocks

Triggered by poor forward guidance and an earning miss by Walmart, the nation's largest retailer is confirming everything the economic data has been signaling — the consumer is running out of spending power. Since the U.S. economy (and the markets) have been driven by consumer spending, this is a trend that threatens to derail the rally and ignite a bid under the bond market. However, more of this constant barrage of tweets and pronouncements, and edicts from the Trump-Musk White House now includes the suggestion of a US$5,000 cheque to households as a method of passing along the savings being wrought by the DOGE attack team to the average tax-paying household.

As was seen in 2020-2021, cheques to households will also ignite inflation, so this morning, the 10-year yield is down only marginally in reaction to the Walmart news. Also pressing on the interest rate structure is the minutes of the last FOMC meeting, where several members expressed concern over inflation and started to float the idea of raising the Fed Funds rate, which would make them all (and especially Jay Powell), look fairly foolish in light of the 1% cut seen in Q4/2024. Stocks are backing off from record highs, but it should be noted that while the S&P 500 hit a record high yesterday, the unweighted S&P 500 (SPXEW:US) has not registered a record high since November 29, while the Dow Jones Industrial Average last traded at a record on December 4.

Since the NASDAQ 100 contains many of the same overweighted components as the S&P 500 (as in the MAG Seven) group, it is no surprise that it registered a record high on Valentine's Day.

So with the record highs by the S&P 500 and NDX 100 now unconfirmed by the DJIA, the DJTA, the Equal Weight S&P 500, significant divergences are beginning to emerge and these are the cracks that always appear first at or near market tops.

I am going out on a limb this morning and am taking a small, short position.

In the GGMA 2025 Trading Account:

- Buy 10 contracts SPY March $600 puts at $4.35

I am anticipating that the retail crowd will try to BTFD ("add on weakness") this morning taking these options back to unchanged. Target for the SPY:US is $565 by March 20th expiry date.

Gold

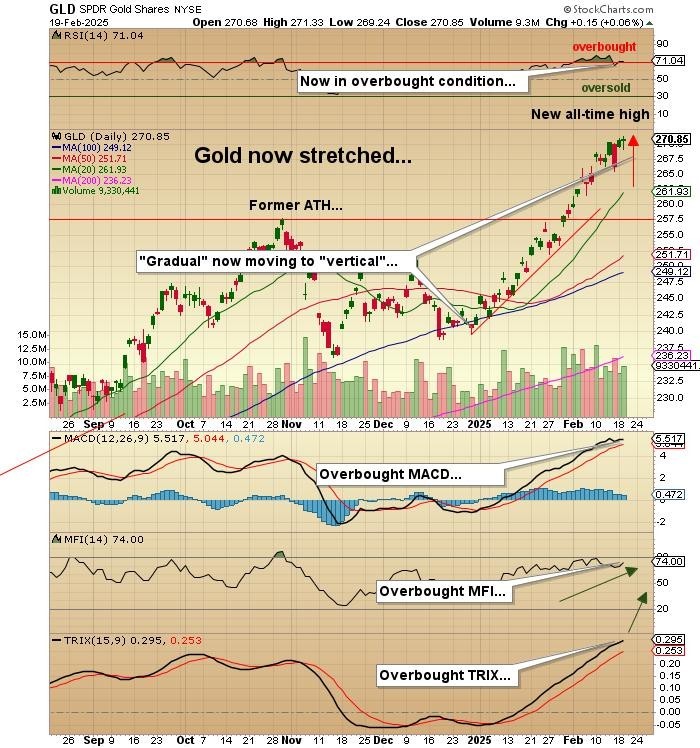

My last comment on gold was last week when I opined that we were probably seeing the start of a correction to the low $ 2,800 based upon the overbought conditions and the COT structure, where Commercials running an aggregate short book over 300,000 contracts was synonymous with historical market tops for gold.

Well, that idea was soundly rejected this week with GLD:US hitting a record high on Tuesday at $271.00. However, that has not changed my opinion on gold in the short term as it desperately needs to correct rather than continuing with this vertical "rope" that seems to have every trader and their siblings all cheerily on board.

The bullion banks yanked the April Gold futures down this morning from a record high of $2,972.91 to the current $2,941.69 and appear to be attempting to put a bridle on the golden stallion. Hence, I am going to bet with the bullion banks and the overbought conditions.

- Buy 10 contracts GLD March $270 put options at $4.50.

I will tempt fate and give this trade until Friday's close before deciding to hold or sell.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.