In this year's GGMA 2025 Forecast Issue, I made the decision to stay overweight the junior gold developers, with my top pick and largest holding being a Nevada-based grower with a 2.317m-ounce resource that recently delivered a strikingly robust preliminary economic assessment. That report filed on SEDAR by Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) outlined a 10-year life of mine that at $2,250 gold delivers a 46.7% internal rate of return and a discounted net present value of US$474 million over its life.

Catalysts to further valuation upside include (obviously) rising gold prices and additional exploration and given that the Fondaway Canyon resource is wide open along strike and to depth, the upcoming spring drill program should provide investors with some well-deserved excitement. With Getchell now up 96.3% for the year, its $24.37m market cap has it valued at around 5% of DNPV which is absurd.

Also springing to life was another junior explorer, Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) whose Chairman Campbell Smyth hails from Perth, Australia, whose President/CEO Merlin Marr-Johnson hails form the U.K., and whose country manager hails from Chile, this global management team are exploring for copper in the Valparaiso District of the lower Andes surrounded by major mining companies like Freeport-McMoRan Inc. (FCX:NYSE), Cadelco, Newmont Corp. (NEM:NYSE), and Los Andes Copper. (LA:TSX.V;LSANF:OTCMKTS).

Last week, they reported a 185.7-meter intercept of sulphide mineralization within which there was a "stronger zone" consisting of 73 meters of elevated sulphides. The zone was comprised of chalcopyrite and molybdenite in a region that yields considerable amounts of copper-moly production so while the address is right, all that remains for this to be considered a "major discovery" is the reporting of grade. It is considered "economically viable" if the copper-equivalent grade comes in north of 0.5% but from what I am hearing and reading through the rumor mill, that might be a very conservative estimate.

These are two juniors that are well-funded, and with management owning a large chunk of the issued capital of the respective firms by way of actual "skin" in the game instead of the usual lifestyle-supporting method of accessing free options, the financial exit strategy for management is perfectly aligned with that of the minority shareholders. In fact, in Getchell's case, Chairman Robert Bass reported the early exercise of three-year options, writing a $100,000 cheque to be applied against the working capital position.

Management teams that demonstrate a financial commitment to their companies and are willing to absorb the same investment risk as their shareholders are companies in which I prefer to invest. Both Getchell and Fitzroy are in that category.

Up until ten days ago, I was thinking that GTCH/GGLDF was going to run away with the race as it responded beautifully to that impressive PEA on January 23. However, the news release from February 10 saw FTZ/FTZFF leap forward from $.145 to $.235 as investors studied the 185.7-meter intercept on the first drill hole, which was extraordinary.

I am thoroughly delighted to see investor interest being rekindled in these "penny dreadfuls" because the past four years have been a struggle for many of is in the junior resource space. In past bull markets, moves like the ones we have witnessed in gold and copper would have triggered a rush into the juniors, dwarfing everything in its way. I am hopeful that the current

overbought condition in gold does not dull the appetites of the kiddies who appear to have finally come "over the wall" in the past few weeks into the wonderful world of junior resource investing. There is nothing more exciting than a two-horse race where big purses are on the line, and that is exactly what we have with gold in Nevada and copper in Chile

Swamp-Draining 101

In addition to the DOGE gang unearthing all kinds of hellfire and corruption within the Halls of Washington, D.C., making the rounds in the inboxes of everyone that ever typed "G-O-L-D" on their computer screen is the rumor that Treasury Secretary Scott Bessent intends to "to monetise the assets side of the U.S. balance sheet for the American people" which means he intends to do something with the 8,311 metric tonnes of gold allegedly held in trust for the U.S. government.

As I have been writing about for over 15 years, the only collateral available to the Treasury to be used in fortifying the credit rating of the U.S. Treasury bond market is gold. There is nothing new in that discussion. However, if they move to monetize that Fort Knox gold by re-pricing it, or by issuing new bonds convertible into some of that gold, then the entire reason for owning Bitcoin and the other worthless crypto assets goes completely out the window. Nevertheless, gold got smoked on Friday down $51.70 on the April contract to settle under that magical $2,900 level by $6.30.

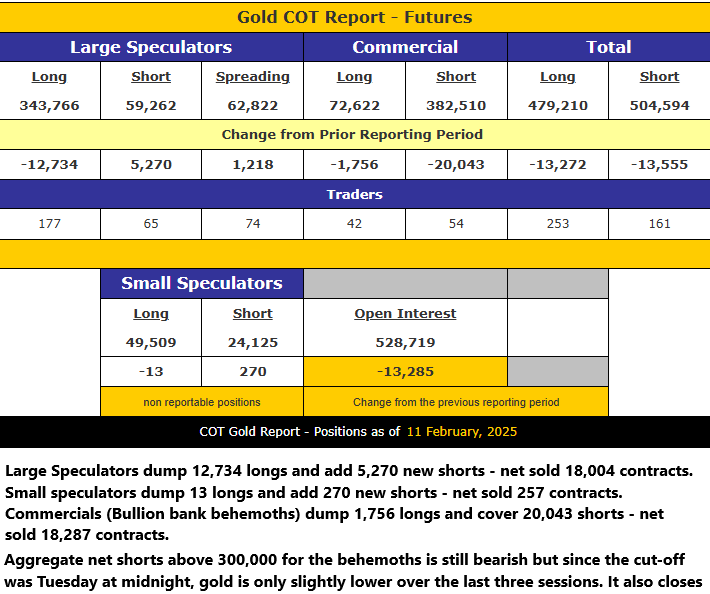

Everyone I know is now convinced that $3,000 gold is a fait accompli and that the gold miners can be bought blind because of valuation discrepancies versus the S&P. What I told subscribers last week was that when those dastardly bullion bank behemoths decide to execute "Rug-Pull 101," they do it with masterful skill and flawless execution and with the COT report last week revealing a net short position of over 330,000 contracts, the market was ripe for the plucking.

And plucking they did in what has become an all too familiar "Freaky Friday" raid where from 10:00 am to 10:30 am gold fell from $2,965 to $2,910 and then in the minutes before the Crimex pit session clanged shut, they trashed it down to $2,889.90. I alluded to the RSI reading elevated to over 80 last Monday along with MACD, MFI, and TRIX indicators all in deeply overbought territory.

With Friday's trashing, RSI is now in < NEUTRAL > so I look to the 50-dma and 100-dma levels as a decent entry point.

The good news is that the RSI backed off to 62 and change on Friday and that the Friday COT revealed an 18,287 contract reduction in the Commercial net short position. At 309,888 net shorts, that number is still too high to provide us with an optimal entry level.

On Tuesday, I wrote the following to my subscribers: "The 50-dma at $2,742 and the 100-dma at $2,733 are decent support and a probe to those levels probably allows a better underpinning for a run to $3,000. Remember the Ballanger Rule on trends: "Whenever a market trend moves from gradual to vertical, it has entered the terminus of the move."

Gold certainly did go "vertical" on Monday and Tuesday which was my first clue that the master manipulators would spring into action. Sure enough, it took until Friday for them to pounce but when they did, they took everyone out behind the woodshed and thoroughly thrashed them, which is good from where I sit, as it will set up a stronger technical base for that all-important race to $3,000.

The silver market did its best to create life-altering margin calls on Friday, trading up to $34.24 as every blogger and fintwit poster was taking victory laps telling the world where they entered and how much they were "UP". That was before the hammer came down while lopping off a full $1.655 per ounce amidst the screaming and wailing of the Silver Squeeze cheerleaders. Silver is almost an impossible market to trade with any kind of conviction with that kind of one-sided volatility. I have yet to take a trading position and I have yet to decide which junior silver deal I will own, proving once again that not only is patience a virtue in the silver market, it is also a necessity.

| Want to be the first to know about interesting Base Metals, Critical Metals, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc. and Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc., Freeport-McMoRan Inc., and Getchell Gold Corp.. My company has a financial relationship with Fitzroy Minerals Inc. and Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.