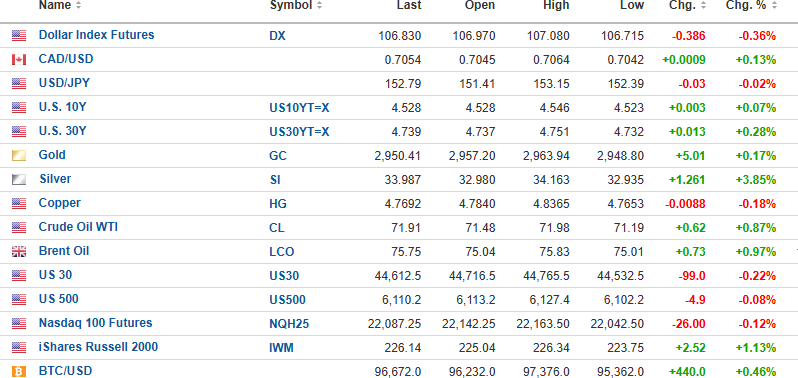

USD index futures are down 0.80% to 106.960, with the 10-year yield up 0.07% to 4.528% and the 30-year up 0.28% to 4.739%.

Gold (+0.17%), silver (+0.3.85%), and oil (+0.87%) are higher, but copper (-0.18%) is lower.

Stock futures are lower, with the DJIA (-0.22%) down 99 points, the S&P 500 (-0.08%) down 4.9 points, and the NASDAQ (-0.12%) down 26 points. Risk barometer Bitcoin is up 0.46% to $96,672.

Fitzroy Minerals Inc.

It was my understanding that Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) had the green light from the regulators to move the financing to $3.5 million from $3.0 million as long as the price stayed below CA$0.20 through Wednesday. However, at the very last hour and without any advanced notice, these rocket scientists at CIRO decided to demand "consent letters" from every existing FTZ/FTZFF shareholder before allowing the increase.

What they were missing is that most of the investors in this placement are already shareholders of the company, so asking for consent is not only a waste of time and money but also makes absolutely no sense. However, if there is one certainty that never disappears, it is that these kiddies who are trying to move up the corporate ladder can never be seen to be wrong so rather than trying to fight them, you just nod your head and say, "Yes, sir" (or "Yes ma'am") and go off on your merry way. What it meant for me was that I had to cut back on my participation by half as well as reduce allotments across the board.

In the end, getting the minimum $2.5 million into the bank account allows FTZ/FTZFF to secure final approval on the Buen Retiro asset, which I stopped writing and talking about at the end of November after all of the diatribe involving the regulators and ownership disclosures. Once it is "over the wall," you can expect a 15-hole program to commence in mid-March that will create a ton of excitement to complement the pleasant surprise we have coming at Caballos. I have a very good feeling about Caballos, and from that last press release, management does too.

"Drilling 186 m of sulphides, including a 73 m interval with stronger mineralization, is a great start at Caballos." – Merlin Marr-Johnson

Getchell Gold

I must have had three dozen emails and WhatsApp messages commending Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) Chairman Bob Bass for stepping up and writing a check for the exercise of one million options at $0.10.

To have the largest shareholder with the most "skin in the game" pony up to fortify the working capital position creates superb optics for any and all monitoring the insider activity.

Our fortunes as shareholders took an important turn last year when Bob assumed the role as Chairman, and now, with the economically robust PEA and strong metallurgy, valuation can only increase as more eyes and ears discover the Fondaway Canyon story.

Stocks

Stock are called lower as the retail sales number at 8:30 am was surprisingly weak.

Volatility remains elevated.

| Want to be the first to know about interesting Gold, Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Getchell Gold Corp. and Fitzroy Minerals Inc. My company has a financial relationship with Getchell Gold Corp. and Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.