Robert Frost famously wrote, "Two roads diverged in a wood, and I took the one less traveled by, and that has made all the difference." Today, investors in gold and gold equities face a similar crossroads. While gold itself has surged, precious metal equities, as represented by the XAU Index, GDX, and GDXJ, have significantly lagged.

Historically, gold mining stocks have outperformed physical gold by two to three times due to their leverage on earnings and dividends. However, as our attached charts illustrate, this traditional relationship has broken down, creating what may be one of the most compelling contrarian opportunities in the market today.

The Gold Stock Underperformance: An Anomaly in Market History

The XAU Index, which tracks a basket of gold and silver mining companies, has risen only 67% since its inception in 1980, while gold itself has climbed 244% from its 1980 highs of ~ $850 to its current price of ~$2,925.

This represents a significant underperformance, considering that historically, mining shares should outpace gold's price appreciation due to earnings leverage, dividends, and production growth.

Similarly, GDX and GDXJ, the ETFs representing major and junior gold mining companies, respectively, continue to trade at a discount despite the strength in gold prices.

The charts illustrate how gold shares used to trade at a premium to the metal but now lag significantly behind. If the historical ratio reverts, gold stocks should be two to three times higher in percentage terms than gold itself, suggesting a dramatic upside potential.

Understanding the Leverage Effect on Earnings and Share Growth

One of the key reasons gold mining stocks historically outperform physical gold is the earnings leverage effect. When gold prices rise, the revenue per ounce produced increases, but the cost of mining does not rise at the same pace, leading to exponential growth in earnings. For example:

If a mining company has an all-in sustaining cost (AISC) of $1,200 per ounce, and gold trades at $1,800 per ounce, its margin per ounce is $600.

If gold prices rise to $2,400 per ounce, the margin expands to $1,200, a 100% increase in earnings, while gold itself has only risen 33%.

This earnings expansion directly impacts share price growth as profitability increases, dividends are raised, and investors recognize the improved cash flows.

Additionally, many mining companies hedge production or invest in capital-intensive exploration projects that do not immediately reflect in earnings. As gold prices sustain higher levels, these investments begin yielding production growth, further accelerating share price appreciation.

What Accounts for the Discount?

The reasons for this lag are multifaceted, but they are rapidly changing:

- Rising Costs & Inflation: The cost of materials, labor, permitting, and claim fees have increased, cutting into mining companies' profit margins. However, as gold prices continue to rise, miners can absorb these costs more effectively, boosting earnings and valuations.

- Capital & Sentiment Flows: Over the past decade, investor capital has overwhelmingly favored technology stocks, particularly the Magnificent Seven (Apple, Microsoft, Nvidia, etc.), while shunning gold equities. However, with gold quietly outperforming QQQ and broader tech indices, this trend may be reversing.

- Delayed Institutional Participation: While gold ETFs have seen renewed inflows, institutional interest in miners remains muted. As gold enters a sustained bull market, institutional capital is likely to return, driving share prices higher.

- Central Bank Gold Accumulation: Central banks remain net buyers of gold, though at a slower pace. A shift in Western investor sentiment, marked by the accumulation of 150 tonnes of gold ETFs since mid-2024, suggests renewed interest in the sector, a trend that could spill over into equities.

- Gold Price Lagging Impact on Miners: Historically, gold stocks lag physical gold at the beginning of a bull market but then surge ahead as margins expand. We may be witnessing the early stages of this dynamic playing out.

The GDM Chart: Higher Targets Ahead?

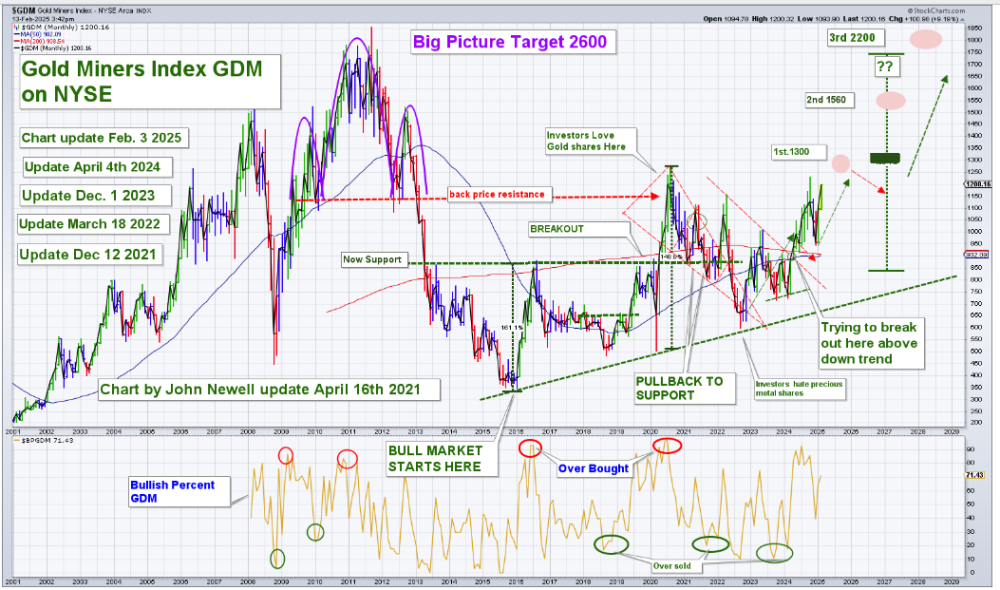

The Gold Miners Index (GDM) chart highlights three higher target levels for gold equities, suggesting a structural breakout is in progress.

The first target of 1300, followed by 1560 and 2200, aligns with previous gold bull markets where miners saw exponential gains. This supports the argument that we are in the early innings of a multi-year rally in gold equities.

Highlighted Stock Ideas: Contrarian Gold Equities Poised for Growth We Have Previously Written Up

Headquartered in Vancouver, Canada, K92 Mining Inc. (KNT:TSX.V) owns the high-grade Kainantu Gold Mine in Papua New Guinea. Since restarting operations in October 2016, the company has delivered six consecutive years of gold production growth, achieving 118,000 ounces of gold equivalent in 2023.

A significant milestone was the May 2017 discovery of Kora North, which combined multiple deposits into the high-grade Kora deposit. Since declaring commercial production in early 2018, the mine has operated at a head grade of approximately 11 g/t AuEq, placing it among the highest-grade operations globally.

Technically, K92 Mining has demonstrated strong technical performance, successfully hitting its previous targets and now setting up for a new leg higher.

After breaking through old resistance levels, K92 is holding higher lows, signaling that selling pressure has diminished. The next technical targets suggest continued upside potential, aligning with broader gold market strength.

Calibre Mining Corp. (CXB:TSX; CXBMF:OTCQX) is a Canadian-listed, Americas-focused, growing mid-tier gold producer with a strong pipeline of development and exploration opportunities across Newfoundland & Labrador in Canada, Nevada, and Washington in the U.S.A., and Nicaragua.

The company is focused on delivering sustainable value for shareholders, local communities, and all stakeholders through responsible operations and a disciplined approach to growth. With a strong balance sheet, a proven management team, strong operating cash flow, accretive development projects, and district-scale exploration opportunities, Calibre aims to unlock significant value.

Technically, Calibre Mining has emerged from a multi-year consolidation, breaking through previous resistance and establishing a new high.

The pattern of higher lows indicates a sustained bullish trend, with strong momentum behind its recent breakout. Key technical targets suggest further appreciation, making CXB.TO an attractive option for investors looking to capitalize on the unfolding gold bull market.

Equinox Gold Corp. (EQX:TSX; EQX:NYSE.A) is a growth-focused Canadian mining company with seven operating gold mines across the Americas, including Canada, the United States, Mexico, and Brazil.

The company is on a path to achieve more than one million ounces of annual gold production by advancing a pipeline of expansion projects.

Technically, Equinox Gold has rebounded technically from its 2022–2024 lows and has already met its first initial technical target.

The stock's strong recovery comes on the heels of its strategic acquisition of Premier Gold, giving it access to the highly prospective Hardrock Property in Ontario. With multiple technical targets in sight, EQX.TO appears poised for continued upside as investor sentiment improves.

A Classic Contrarian Opportunity

Gold equities remain one of the most undervalued and overlooked sectors in the market today. Despite gold's ~80% % surge from its 2022 lows, GDX has seen a ~100% movement, still lagging its historical ratio, continuing to signal ongoing investor skepticism that this move is real.

This divergence mirrors conditions last seen in 1999-2000, right before gold stocks experienced a historic run.

Conclusion: Taking the Road Less Traveled

For investors willing to take the contrarian path, the risk-reward setup in gold equities is compelling. The fundamental backdrop, rising gold prices, improving margins, and shifting sentiment, suggests that gold stocks could dramatically outperform in the coming years.

As the market slowly recognizes the deep undervaluation in mining shares, the old relationship between gold and gold stocks may reassert itself. When it does, those who took the "road less traveled" may find themselves at the forefront of one of the decade's most profitable investment opportunities.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- John Newell: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.