Recently, I highlighted a fascinating disconnect in the gold mining industry: while mining companies are generating increasingly robust cash flows, investor sentiment remains remarkably pessimistic toward the sector.

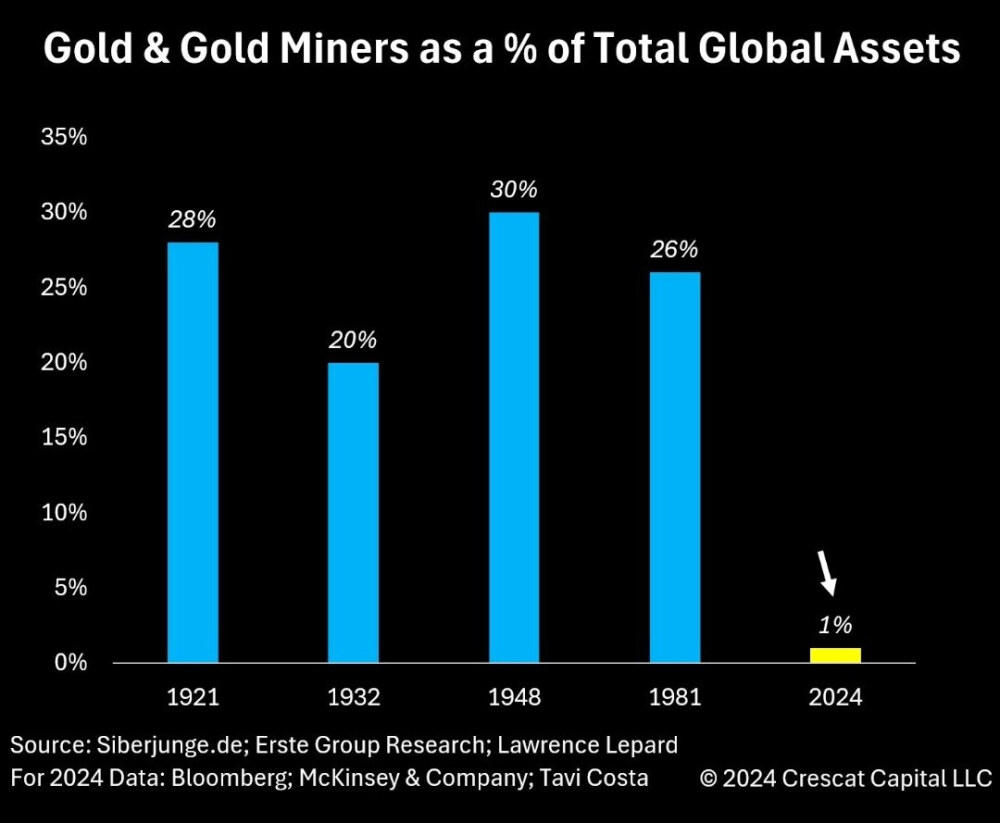

To put this in historical perspective: during the gold market's peak in the early 1980s, gold and gold mining equities made up approximately 25% of global assets. Fast forward to today, and that figure has dropped dramatically to under 1% of the total.

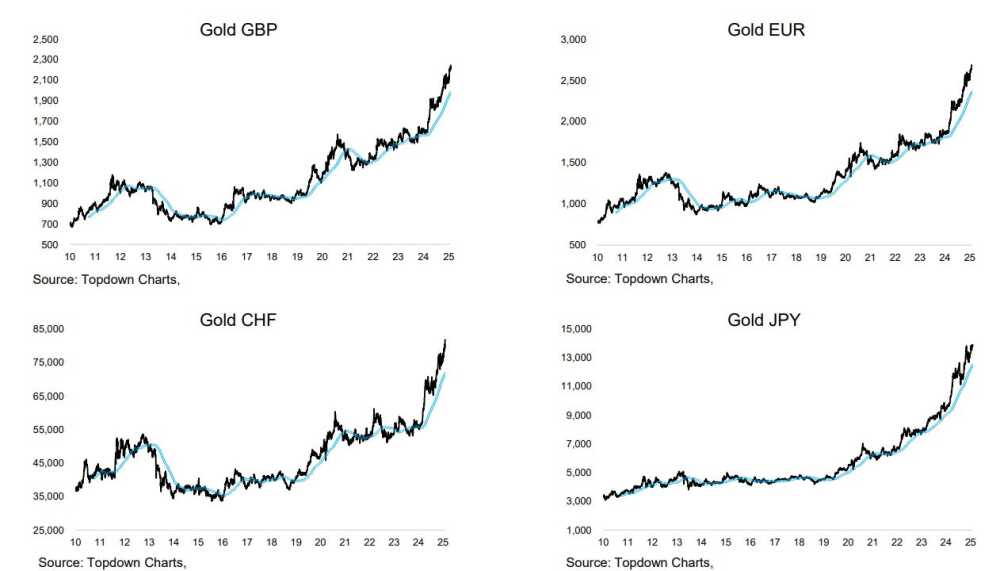

The thing that makes this all more interesting is that when priced next to global currencies, gold is at all-time high levels.

What explains the paradox of record-low investment in gold mining companies while gold prices reach unprecedented heights?

To grasp the present opportunity for investors, we need to examine how we arrived at this situation. Three critical periods have shaped today's environment of underinvestment and market skepticism in the gold mining sector:

First, the Acquisition Spree (2008-2012): As gold surged from its Global Financial Crisis low of $695 to peak at $1923/oz in August 2011, mining executives embarked on an aggressive buying spree. This period saw several catastrophic corporate purchases, notably:

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) spent $7.3 billion acquiring Equinox Minerals in 2011, Newmont Corp. (NEM:NYSE) bought Fronteer Gold for $2.3 billion in 2011, and Kinross Gold Corp. (K:TSX; KGC:NYSE) purchased Red Back Mining for $7.1 billion in 2010.

These transactions devastated shareholder value not only because companies overpaid but also due to the subsequent downturn in gold and copper markets.

Second, the Industry Downturn (2012-2015): The mining sector endured severe pain during the metals bear market following the GFC and Eurozone Crisis. The previous era's expensive acquisitions, built on assumptions of ever-rising metal prices and an obsession with size regardless of cost, proved disastrous. As metal prices declined and profits evaporated, shareholders suffered massive losses, leaving deep scars across the industry.

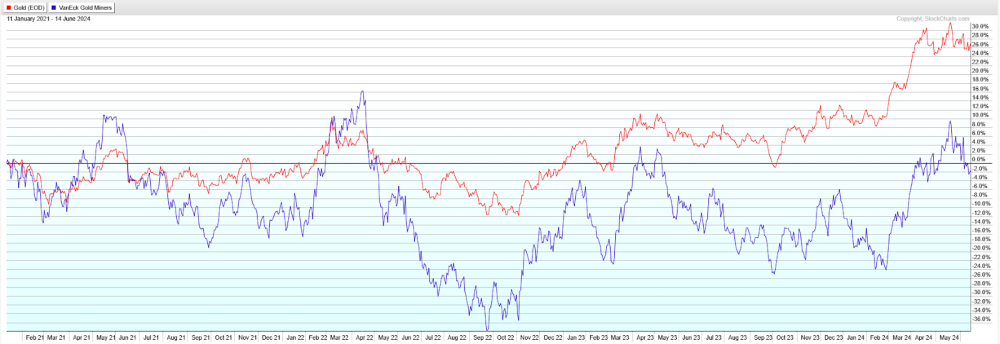

Third, the Cost Explosion (2021-2024): Though gold traded in a range between $1625 and $2000, widespread economic inflation and supply chain disruptions drove mining costs dramatically higher. This period particularly frustrated gold mining investors, as mining stocks significantly underperformed the price of gold itself.

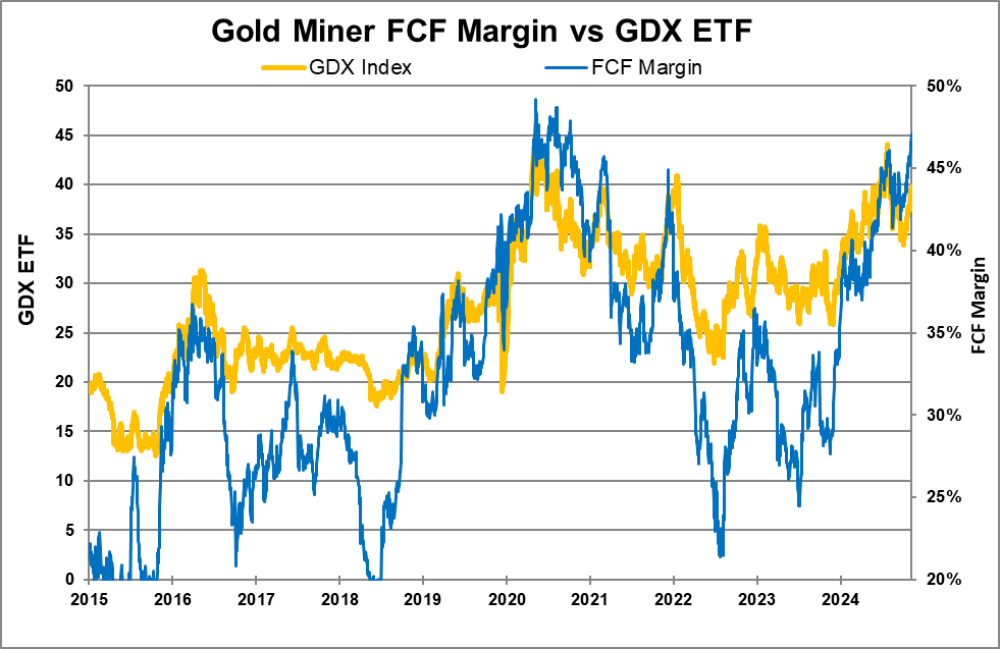

Between January 2021 and June 2024, gold appreciated approximately 27%, while the GDX (gold miners index) fell 1.8% — a stark divergence. This disconnect, combined with surging operational costs during a period of strong metal prices, triggered widespread investor exodus from the sector throughout 2023 and 2024.

The gold mining sector today epitomizes the saying 'it's darkest before the dawn.' Public interest has waned, institutional investors have retreated to historic lows, yet paradoxically, gold prices are setting new records while mining companies report consecutive quarters of unprecedented free cash flow.

The contrast between record gold prices and pessimistic market sentiment toward mining stocks would alone merit serious investigation. But when examining the sector's robust financial metrics — including healthy balance sheets, minimal debt, and increasing profitability — the situation becomes almost surreal, demanding a triple-take to verify if such an extraordinary opportunity could actually exist.

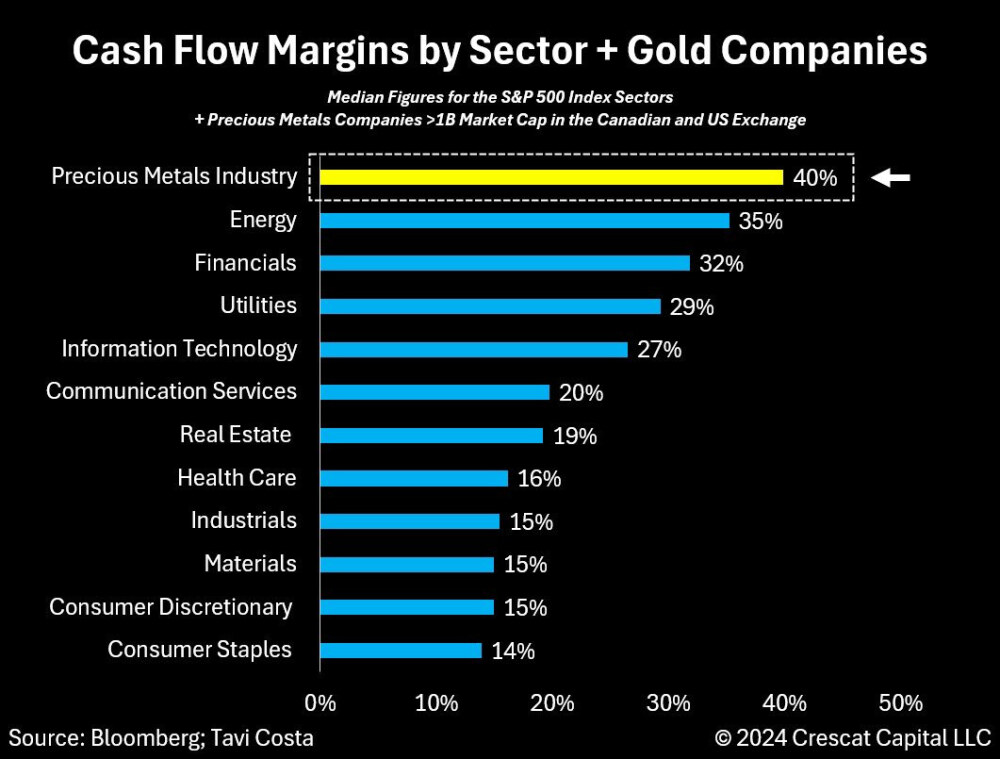

Now, let's examine the profitability metrics of gold miners:

Following a period of operational streamlining and prioritizing profits over production volumes, the gold mining sector has transformed into a profitability powerhouse, now outperforming traditionally strong sectors like energy and financial services.

Let's examine the profit metrics from major producers (those with market capitalizations exceeding $1 billion):

Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) leads with:

- A gross margin of 38%

- An operating margin of 34.4%

Kinross Gold Corp. (K:TSX; KGC:NYSE) shows:

- A gross margin of 27.7%

- An operating margin of 24.5%

IAMGOLD Corp. (IMG:TSX; IAG:NYSE) delivers:

- A gross margin of 30.4%

- An operating margin of 29.5%

With gold averaging approximately $2,650/oz in Q4 and Agnico projecting all-in sustaining costs around $1,250/oz, they're positioned to achieve unprecedented AISC margins exceeding 50%. Their operating margins, including corporate overhead, are expected to surpass 40%.

When evaluating mining companies, operating margins indicate short-term efficiency, while AISC margins better reflect long-term profitability. However, the two most telling metrics are free cash flow generation and all-in-sustaining cost margins. Currently, both metrics are trending strongly upward, with numerous gold producers hitting record levels.

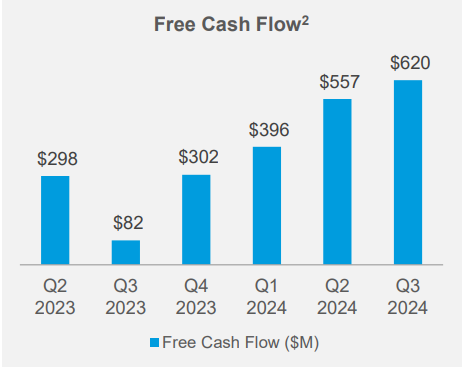

Let's examine a visualization of Agnico Eagle's free cash flow trajectory:

Free-cash flow margins for gold miners are gearing toward their 2020 peak and will possibly reach new all-time highs in 2025:

The industry is seeing unprecedented profitability, with free cash flow margins reaching 50% — a remarkable achievement not just for gold mining, but across any sector.

This combination of peak profitability and robust metal prices has created an unusual challenge: excess cash. The industry faces four main options for deploying this capital:

1. Distribute it to shareholders via dividends and stock repurchases

2. Reduce debt levels (though they're already at historic lows)

3. Fund internal growth through exploration and project development

4. Purchase other assets (including operating mines, development projects, and exploration properties)

While the industry has largely focused on the first two conservative approaches in recent years, and the third represents ongoing but gradual growth, it's the fourth option that presents the most compelling opportunity for dramatic growth and investor returns.

The upcoming wave of gold producer earnings announcements, coupled with two major industry gatherings (BMO Metals & Mining in Florida in late February and PDAC in Toronto in early March), could catalyze a new surge of merger and acquisition activity.

Given the challenges and slim odds of making significant new gold discoveries in stable jurisdictions, it's more practical for cash-rich producers to acquire already-discovered and partially de-risked assets to enhance their project pipeline.

The financing landscape heavily favors larger companies, with junior miners typically facing costs of capital above 15%, while major producers like Barrick or Newmont enjoy rates around 8%.

Scale is crucial in mining. Consolidating quality assets under one umbrella reduces overhead costs and lowers the overall cost of capital across the portfolio.

Additional drivers for increased M&A include:

Operational efficiency: Larger operations benefit from economies of scale, spreading fixed costs across greater production volumes.

Financial strength: Major mining companies enjoy superior access to capital markets, enabling them to tackle projects beyond the reach of smaller firms.

Technical advantage: Larger companies can invest in cutting-edge technology and attract top talent, boosting operational efficiency.

Market leverage: Bigger companies wield greater negotiating power with suppliers and customers, securing better terms.

Two Companies With M&A Possibilities

I'm highlighting two particularly promising companies amid this expected M&A acceleration. First is a producer completing its ramp-up to full production at one of Canada's largest gold mines. Second is an emerging producer preparing to restart a high-grade historical mine. These companies have different market capitalizations and risk-reward profiles.

IAMGOLD Corp. (IMG: TSX; IAG:NYSE) my top gold mining pick for 2024, has delivered impressive returns, rising over 100% and outperforming its peer group significantly.

While deeply out of favor in Q4 2023, IAG has transformed its image through strong operations, successful ramp-up at its flagship Côté Gold Mine, and a remarkable 200%+ share price gain since October 2023.

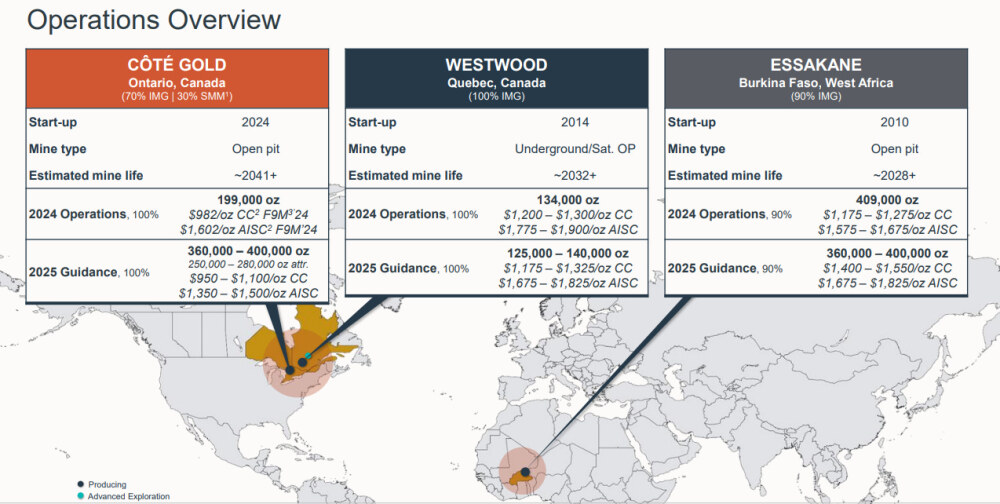

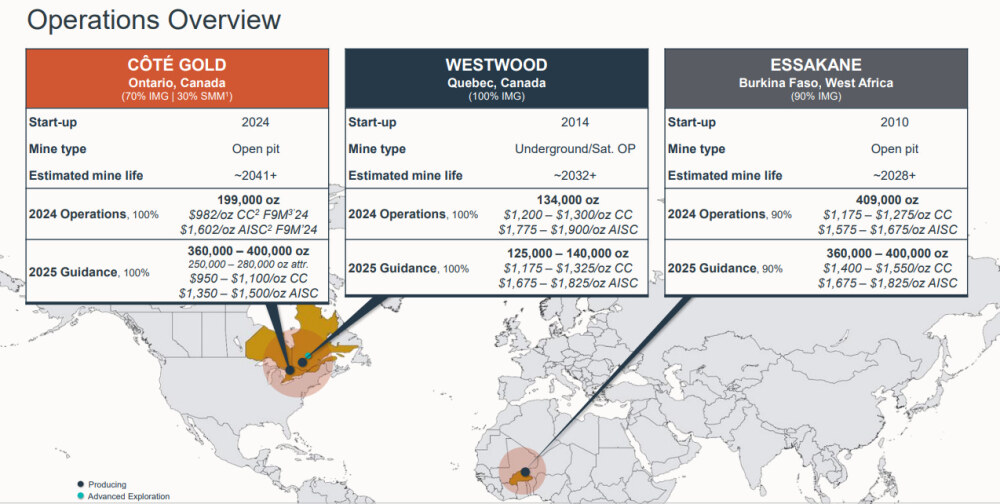

The key to understanding IAG's value proposition lies in its growth trajectory in gold production, anchored by several high-caliber development projects in Quebec, a premier mining jurisdiction:

While Essakane in West Africa has been IAG's primary performer in recent years, leadership will transition to the Côté project in the coming years.

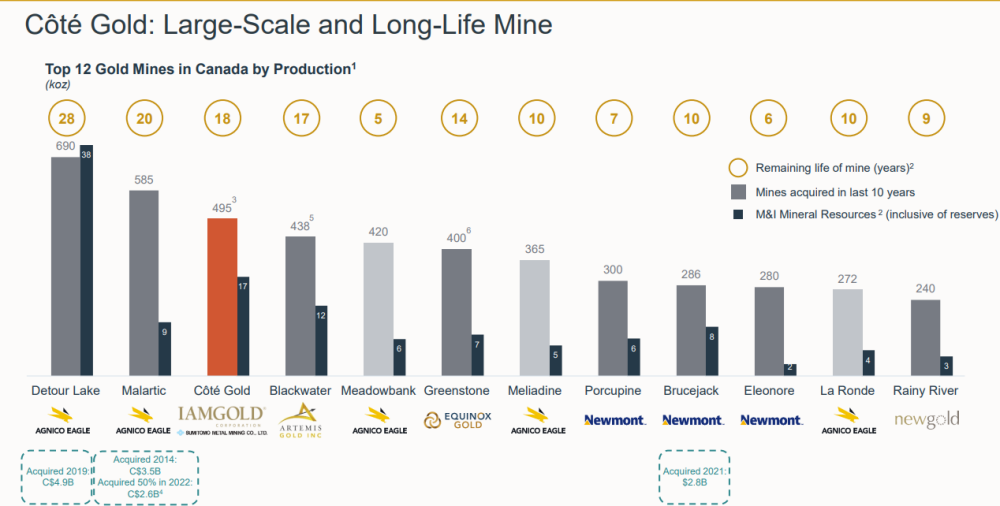

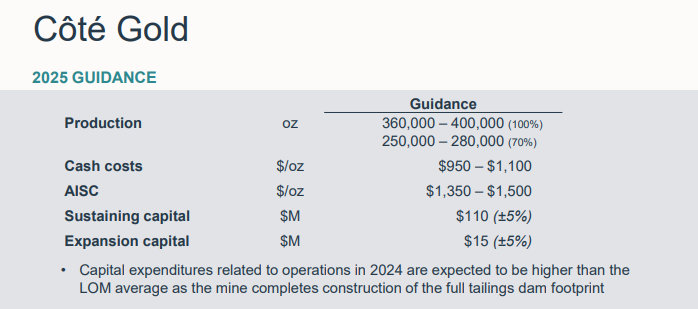

Côté is projected to achieve production of nearly 400,000 ounces by 2025, with an impressive mine life spanning 18 years. Upon reaching full operational capacity, Côté is positioned to rank among Canada's top three long-term gold-producing mines:

While Essakane in West Africa has been IAG's cornerstone operation recently, Côté will soon take the lead position. Côté is forecast to produce approximately 400,000 ounces annually by 2025, supported by an extended 18-year mine life.

Upon reaching full production, it's set to join the ranks of Canada's three largest long-running gold operations:

The financial metrics are compelling, with the operation achieving nearly 50% AISC margins at current gold prices:

The Westwood Complex in Quebec, often overlooked, continues to generate significant cash flow. IAG recently extended its operational timeline to 2032. Furthermore, the company's development portfolio in Chibougamau (Quebec), including Nelligan and Monster Lake, provides an attractive growth pipeline. Nelligan bears notable similarities to Côté, featuring large-scale, near-surface mineralization. Its strategic location within an established mining district with robust infrastructure makes it a priority for future expansion.

National Bank has designated IAMGOLD as their top sector pick, setting a price target of CA$12.50 (US$8.75), noting:

"IAMGOLD remains our Top Pick in the Intermediates due to the incremental de-risking of the Côté gold mine ramp-up and strong operational performance over the last several quarters. In our view, IAMGOLD is a potential acquisition target given its discounted valuation and high-quality asset base that supports a robust FCF generation outlook, with the bulk of its NAV tied to low-risk jurisdictions."

I classify IAG as a moderate-risk gold producer, given its established operations and healthy balance sheet. However, with a US$3.7 billion market cap, doubling in value becomes more challenging at this scale.

Higher risk often accompanies greater potential returns.

My second gold producer recommendation carries more risk than IAMGOLD but could deliver multiple times the return on investment.

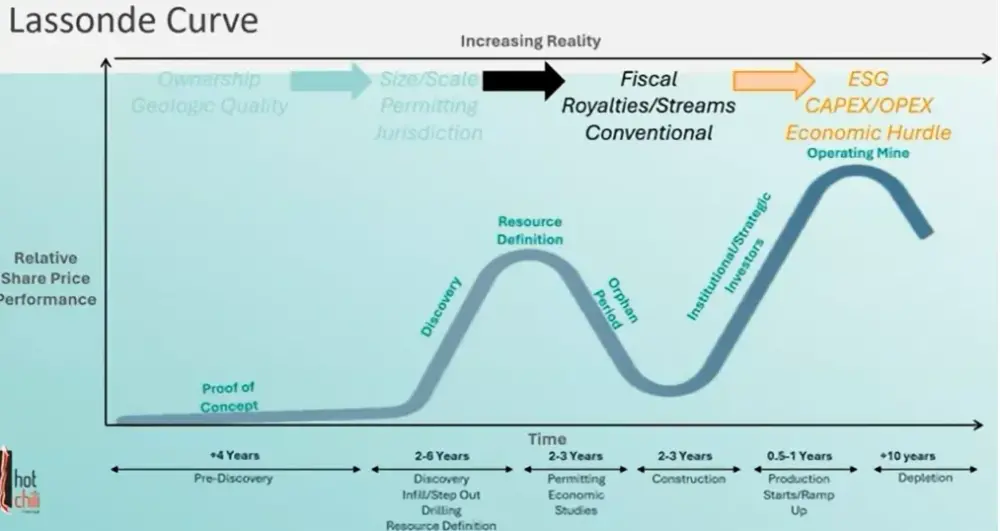

The Lassonde Curve serves as a crucial roadmap for junior mining investors, illustrating a project's position in its lifecycle. While the discovery phase generates the most excitement and speculation, the pre-production phase often proves the most profitable. As production approaches, junior mining companies frequently experience valuation increases as institutional investors anticipate the transition to commercial production and cash flow generation.

Additionally, achieving producer status makes a company eligible for inclusion in numerous ETFs and mutual funds that were previously off-limits. This transition from retail to institutional ownership can significantly impact a junior miner's valuation and reduce its capital costs.

A promising emerging Canadian gold producer is entering this crucial pre-production phase.

West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB) is reviving the Madsen Mine in Red Lake, Ontario. This high-grade underground operation is scheduled to begin ramping up to commercial production by mid-2025.

The company's recent prefeasibility study (PFS) reveals compelling economics for the mine restart.

The PFS is built on a conservative gold reserve estimate of 458,000 ounces at 8.16 g/t gold, supporting a 7.2-year operation processing 800 tonnes daily and yielding an average of 67,600 ounces annually.

The study projects all-in-sustaining costs of US$1,681/oz. This PFS significantly validates the planned mid-2025 restart.

Madsen offers substantial expansion potential beyond these reserves, which could boost annual output and potentially drive AISC below US$1,600/oz. Notably, the previous operator (Pure Gold) invested CA$350 million in mine and mill reconstruction, with West Red Lake adding another CA$100 million since acquiring the asset in 2023.

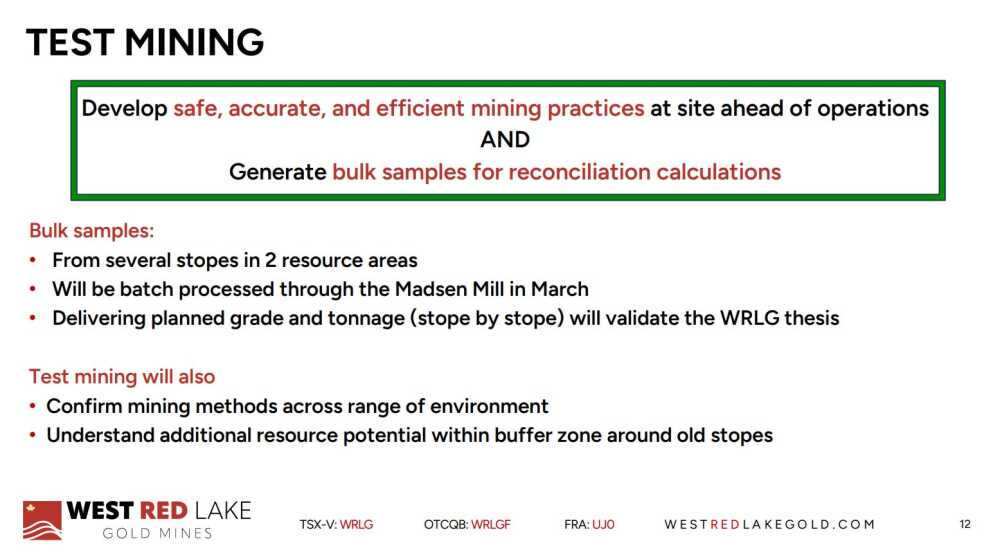

By reducing drill spacing from 20 to 7 meters, West Red Lake has enhanced confidence in ore body continuity and expected grades. Their detailed mine engineering, including a 15-month stope planning horizon, helps ensure consistent mill feed. Stopes - the underground chambers where ore is extracted — must be prepared well ahead to maintain efficient mining operations.

A major upcoming catalyst will be April's bulk sampling results from multiple stopes across two resource areas. Successful bulk sample processing will lead to test mining, followed by full mine ramp-up in June/July.

Successfully restarting Madsen will enable WRLG to begin generating cash flow, supporting further growth initiatives including:

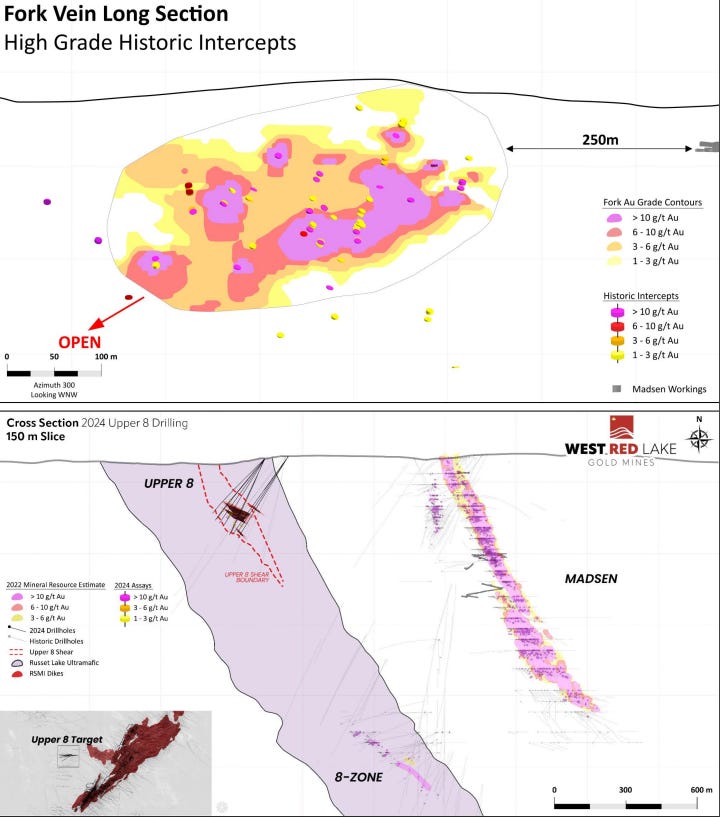

- Fork deposit: newly identified high-grade core spanning 400 x 250 x 200 meters

- Upper 8: recent near-surface discovery within 500 meters of existing infrastructure

- Rowan deposit: 12.8 g/t near-surface inferred resource, potentially mineable by 2027

Cantor Fitzgerald analyst Matthew O'Keefe maintains a BUY rating with a CA$1.50 target, noting:

"With the de-risking PFS we have updated our valuation methodology to reflect an equally weighted 1.0x NAV / 5.5x 2026e CFPS from a 0.8x P/NAV basis previously. As a result, our price target increases to $1.50 per share from $1.40 per share previously. Our Buy rating is unchanged. With the PFS providing a solid basis for the mine restart, we remain confident that the restart of the Madsen mine will be successful. The high-grade nature of the mine with its significant upside potential should ultimately drive a premium valuation. We note that our $1.50/shr price target remains conservative based on a long-term gold price estimate of US$2,200/oz."

I currently hold positions in both IAG and WRLG.V and plan to provide an update following IAG's Q4 2024 earnings announcement in two weeks.

Want to hear more from me? Check out the Goldfinger Substack and YouTube channel.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp., Agnico Eagle Mines Ltd., and West Red Lake Gold Mines Ltd.

- Robert Sinn: I, or members of my immediate household or family, own securities of: IAMGold Corp. and West Red Lake Gold Mines Ltd. My company has a financial relationship with West Red Lake Gold Mines Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Robert Sinn Disclosures

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. West Red Lake Gold Mines Ltd. is a high-risk venture stock and not suitable for most investors. Consult West Red Lake Gold Mines Ltd’s SEDAR profiles for important risk disclosures.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.sedarplus.ca for important risk disclosures. It’s your money and your responsibility.