News Update: This morning, February 13, 2025, Treatment.com AI Inc. announced it had entered into a M&A credit facility to fund transaction expenses and closing costs associated with acquisitions. The credit facility is up to $1.5 million at an annual interest rate of 12% and for a term of 18 months. The credit facility is unsecured and is repayable in cash only and no securities of the company are issuable in connection with the facility.

CEO Dr. Essam Hamza commented on the release, "We are pleased to have a non-dilutive credit facility to assist the company in financing our growth through accretive, revenue-building acquisitions."

Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS; 939:FRA) agreed to acquire Rocket Doctor Inc., a Canadian artificial intelligence (AI)-driven digital health platform that allows physicians to build and seamlessly integrate virtual care into their practices in the U.S. and Canada, according to a news release.

Since its founding about five years ago, Rocket Doctor has helped more than 300 physicians deliver medical care. The company has additional provinces and states in its pipeline and prospective business-to-business deals and growth.

In 2024, Rocket Doctor grew its annual recurring revenue to CA$1.9 million (CA$1.9M), reflecting an 88% year-over-year boost. It also increased its total billable value of services to CA$7.1M from CA$4.3M. Overall, last year, the company posted a net loss of about CA$1.3M.

According to the terms of the signed definitive agreement, Treatment shall cover amounts owed under Rocket Doctor's existing simple agreement for future equity (SAFE) and acquire 100% of all Rocket's shares. Total consideration is about CA$11M in Treatment.com shares, with contingent consideration of up to about CA$9.5M based on significant performance milestones.

As part of this acquisition, Treatment will explore the utilization of AI Nurse, based on its Global Library of Medicine (GLM) and conversational voice application, the latter through newly acquired Alea Health Holdings Ltd., to further enhance patient triage and onboarding ahead of Rocket Doctor appointments.

"This will not only help create efficiency and aid the practitioners on the platform but also provide a proof of concept for future commercial sales of Treatment's software," Treatment.com CEO Dr. Essam Hamza said in the release.

Using AI To Transform Healthcare

The mission of Treatment.com AI, headquartered in Vancouver, British Columbia, is to transform and improve healthcare globally through solutions that combine artificial intelligence (AI), machine learning, and best clinical practices to deliver precise medical insights, assist healthcare professionals and students, and eradicate inefficiencies.

The GLM digital platform is the foundation of all the healthcare tech company's software offerings. The library was developed using in-house algorithms and the input of hundreds of healthcare professionals around the world. Consistently updating and improving, the GLM contains more than 10,000 symptoms and risk factors, information about 1,000 diseases and more.

The goal of the GLM is to improv patient outcomes, afford providers more time to spend with patients, lower administration time and costs for healthcare professionals and systems, and helps mitigate fraud within healthcare systems, according to the company's February 2025 Investor Presentation.

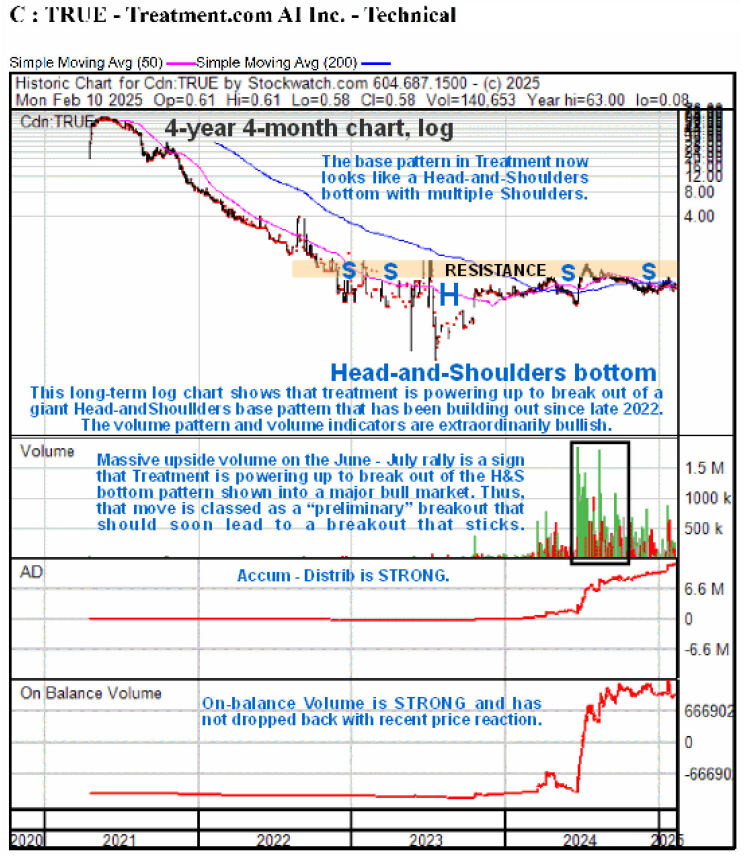

"Treatment.com AI is viewed as a Buy anywhere within the base pattern and especially now following its reaction back from its peak last July, at CA$1.10, to a very favorable entry point," wrote Technical Analyst Clive Maund.

Treatment's products include AI Doctor in a Pocket. For residents and early qualified professionals, it is a clinical decision support tool that provides case-specific clinical assessments, information, and recommendations, the company said. The GLM has indicated a diagnosis accuracy of>92% plus, suggests physical and lab tests and x-rays when appropriate, and even provides billing codes.

With the increased prediction for pharmacists to provide patient triage, a further application of the GLM is envisaged to support pharmacists, automatically documenting all patient interactions, helping to minimize the risk of errors and increase clinical efficiency.

Another product is the Medical Education Suite (MES) for medical and nursing school educators and for students. Treatment's latest release of MES was in November 2024, with a further release planned at the end of Q1 2025

The MES' AI-powered features include about 100 automated medical cases, scripts for simulated patients, and instant scoring with personalized feedback. One of the new tools is AI Patient, which allows students to practice for tests like the Objective Structured Clinical Examination (OSCE). AI Patient provides nonguided and guided exam-simulated modes to help students hone their clinical reasoning.

Treatment is also looking to add an AI-powered voice agent and mental health platform to its assets when its acquisition of Alea Health closes.

Sector To Keep Growing

AI is revolutionizing health care around the world. For instance, deep learning algorithms can detect diseases such as cancer, cardiovascular conditions, and diabetic retinopathy with 90%-plus accuracy and often do so faster and more precisely than human specialists, according to Precedence Research on Feb. 11.

"Medical AI software solutions are designed to enhance clinical decision-making and improve patient care by offering advanced tools for medical diagnosis, drug discovery, and customer service chatbots," wrote Next Move Strategy Consulting (NMSC).

Yet, adoption of AI in medicine has been slower than in other industries, according to a Jan. 22 World Economic Forum (WEF) article.

"AI transformation goes beyond adopting new tools," noted the WEF in its recent white paper, "The Future of AI-Enabled Health: Leading the Way." "It involves rethinking the fundamentals of how health is delivered and accessed."

Also, the specter of federal regulation is "taking away the highest value use of AI functionality in the medical system," former U.S. Food and Drug Administration (FDA) Commissioner Dr. Scott Gottlieb told CNBC's "Squawk Box" on Feb. 7. This pertains to AI tools embedded in the electronic medical record (EMR) that cull data from within, say from clinical notes, lab data, imagine results and more, and provide information that helps a physician with decision making. Under current FDA policy, if it is thought that such a tool provides information in real-time or is so comprehensive that a physician is unlikely to form his own opinion, then it falls under the category of a medical device and is subject to agency regulation.

Because people fear this, Gottlieb added, "they're purposefully limiting the capabilities of these tools in clinical practice right now, and that's unfortunate."

This year, however, healthcare organizations are expected to have more risk tolerance for AI initiatives, which will lead to increased adoption, purported a Jan. 5 article in HealthTech magazine. Yet, groups will be selective about solutions that meet business needs and increase efficiency and cost savings.

Despite this, the global healthcare AI software market is predicted to expand between 2024 and 2030 at a 43.1% compound annual growth rate, NMSC reported. This would take its value to US$217 billion (US$217B) from US$417B.

During this period, North America is the geographical location that is projected to keep dominating the market, noted NMSC. This is due to rising healthcare costs in the States, driving medical providers to keep seeking more time and cost-effective solutions.

Stock Now a Buy

Technical Analyst Clive Maund told Streetwise on February 10 that Treatment's technical charts suggest an upside breakout from its current base pattern will come when the company's share price (now CA$0.80) surpasses its 2023 highs of CA$1.20.

This is indicated by persistent heavy volume in the base pattern and an irregular head and shoulders bottom forming during the past two years.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS;939:FRA)

The heavy volume is bullish, Maund explained, because recent purchasers of the stock likely are hanging onto it until they have turned a profit. This is locking up the stock in the meantime and forcing new buyers to bid up the price.

"Treatment.com AI is viewed as a Buy anywhere within the base pattern and especially now following its reaction back from its peak last July, at CA$1.10, to a very favorable entry point," wrote Maund.

Ownership and Share Structure

According to Sedi.ca, insiders own approximately 8% of Treatment.com AI. Retail investors own the remaining 92%.

The company has 51.2 million outstanding common shares and 44.9 million free-float traded shares.

As for December 2024, according to its investor presentation, Treatment.com AI has a market cap of CA$26 M. Its 52-week trading range is CA$0.355–1.11 per share.

| Want to be the first to know about interesting Healthcare Services investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Treatment.com AI Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Treatment.com AI Inc.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.