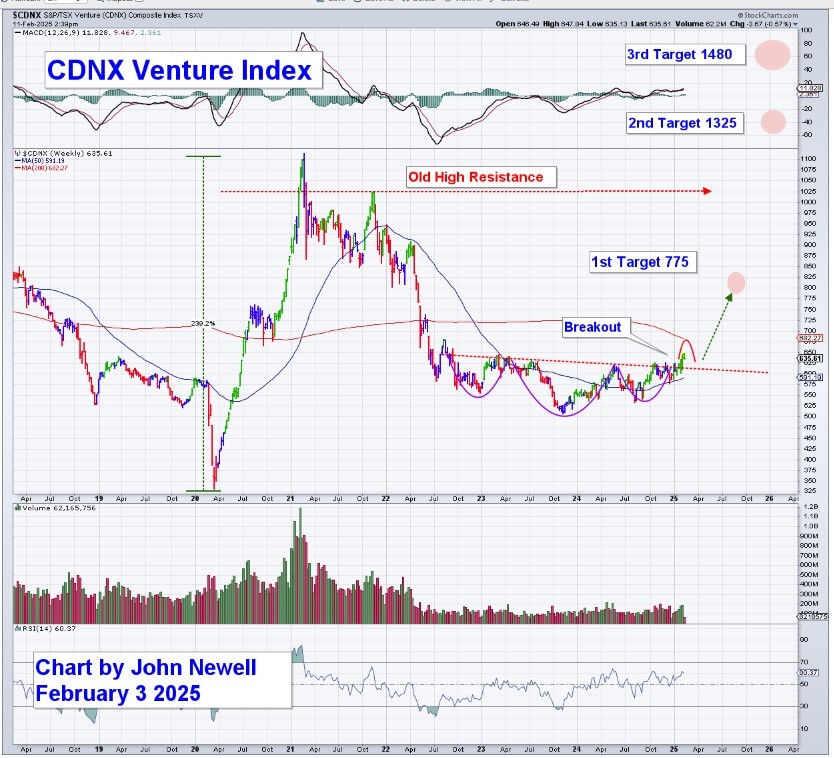

Investor sentiment toward junior mining stocks is shifting as the TSX Venture Index (CDNX) has officially broken out after a prolonged consolidation. This upward move signals renewed interest in small-cap exploration stocks, particularly those with high-growth potential in gold and lithium.

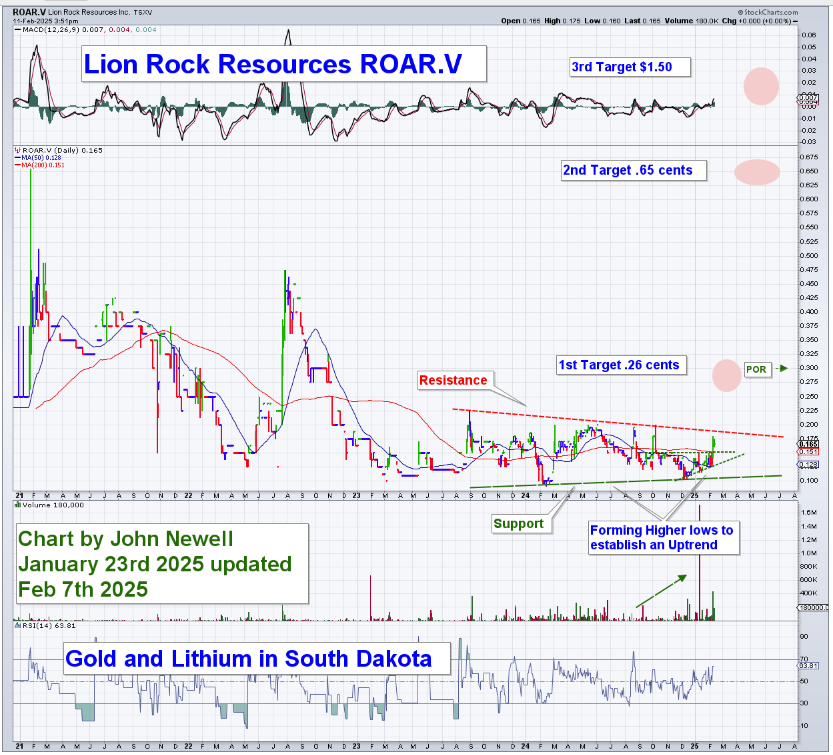

One company that stands out in this changing landscape is Lion Rock Resources (ROAR:TSX), a junior gold-lithium explorer advancing a high-grade project in South Dakota. Notably, Lion Rock's stock chart closely mirrors the CDNX breakout pattern, suggesting it may be on the verge of a significantly higher move.

With technical and fundamental factors aligning, Lion Rock is positioned to be a beneficiary of the rising junior mining market.

Technical Indicators Flashing a Breakout Setup

The CDNX Venture Index, which tracks small-cap mining stocks, has confirmed a breakout after years of sideways to down movement. This is a critical development, as CDNX strength has historically preceded bull runs in junior explorers. (See previous Streetwise CDNX article for reference here: Is Junior Mining Bull Market About to Reignite?

CDNX Key Levels to Watch:

- First Target: 775 – Confirmed breakout above 650, with pullbacks to test support being common.

- Second Target: 1,325 – Next major resistance level.

- Third Target: 1,480 – Full sector recovery target.

This matters because when CDNX breaks out, junior mining stocks tend to follow. Stocks still in the early breakout phase, like Lion Rock, could be among the next to move. The last major CDNX breakout saw multiple junior explorers surge between 200%–500%.

A quick look at Lion Rock's technical chart shows a similar breakout setup but slightly behind CDNX, indicating that a potential breakout could be imminent.

Lion Rock's Three-Target Breakout Model

- First Target: $0.26 – A breakout above $0.18–$0.20 could confirm the start of a strong uptrend.

- Second Target: $0.65 – A major resistance level from mid-2022, where volume and momentum could accelerate.

- Third Target: $1.50 – A long-term price objective aligning with historical highs and the company's growth trajectory.

If momentum continues building, with increasing volume and CDNX already moving higher, ROAR.V could follow suit in the coming weeks, just on TSX Venture momentum alone.

Fundamentals Align with Technical Strength

Beyond the technical picture, Lion Rock's fundamentals are strengthening, increasing confidence in the potential for a sustained move higher.

Recent $2.16M Financing Provides Capital for Drilling

On February 6, 2025, Lion Rock closed a $2.16M private placement at $0.10 per unit, with each unit including a warrant at $0.20 (expiring 2027).

This financing ensures Lion Rock has the capital to execute a major drill program at the Volney Gold-Lithium Project.

2025 Drill Program: Catalysts Ahead

Lion Rock is preparing to launch a 5,000m drill program in Q1–Q2 2025, focusing on:

- Expanding high-grade gold at the Rusty Shaft.

- Testing lithium-rich pegmatites at Giant Volney.

- Following up on newly identified targets.

A successful drill season, with potentially strong results expected in Q2 2025, could significantly re-rate the stock.

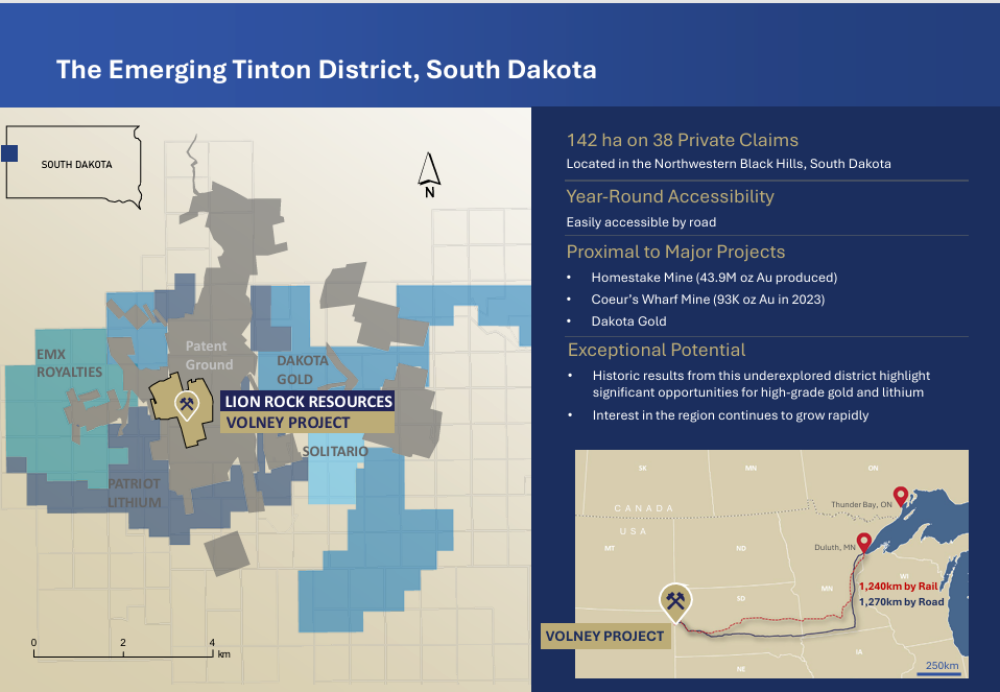

South Dakota: A World-Class Gold & Lithium District

Lion Rock's flagship Volney Project is in the Black Hills of South Dakota, an area with over 60 million ounces of historical gold production.

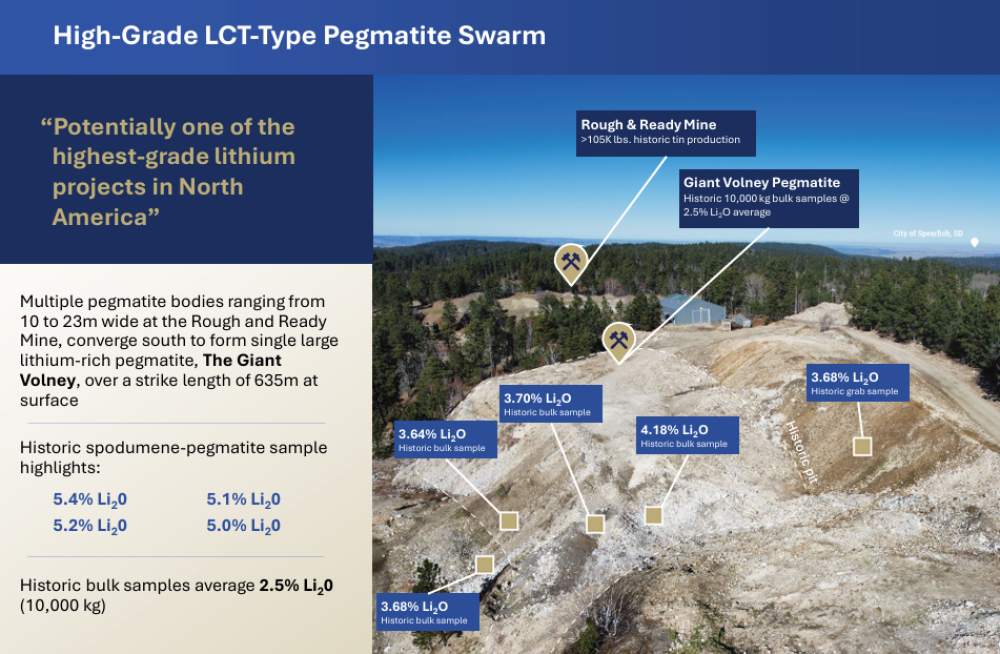

The project has historically delivered:

- High-Grade Gold – Historic channel sampling returned 18.2 g/t Au over 18.3m.

- High-Grade Lithium – Bulk sampling from Giant Volney Pegmatite yielded grades up to 5.4% Li₂O.

- Shear-Hosted Gold Potential – The Rusty Shear Zone is believed to be the source of over 420,000 ounces of historic placer gold production.

The dual exposure to gold and lithium provides a diversified upside at a time when both metals are in high demand.

Why the CDNX Breakout Strengthens the Lion Rock Opportunity

The CDNX breakout is a major confirmation signal that the junior mining sector is entering a bullish phase.

- Lion Rock's stock pattern closely follows CDNX, but is slightly behind, suggesting upside potential.

- If CDNX continues higher, juniors like Lion Rock could be among the biggest winners.

CDNX Levels to Watch vs. Lion Rock

- CDNX has already broken out past 650, while Lion Rock is testing its breakout zone ($0.18–$0.20).

- CDNX's next target is 775, and if momentum holds, juniors could re-rate higher in the coming months.

- Lion Rock's historical highs of over $1.00 align with the potential for a sector-wide rally.

Final Thoughts: A Perfect Storm for Junior Miners

With sector momentum rising, gold, silver, copper, and critical minerals like lithium, with prices increasing and key technical patterns confirming strength, junior miners appear positioned for significant upside in 2025 and beyond.

Lion Rock Resources is entering a high-growth phase, and the stock appears to be on the verge of a technical breakout, mirroring the CDNX Venture Index, which has already broken out in the past week — so these are early days.

With technical, fundamental, and macroeconomic factors aligning, Lion Rock's potential breakout could be well-timed for investors looking to position in a rising junior mining market.

As the junior resource market heats up, this could be the perfect time to pay attention to Lion Rock Resources.

| Want to be the first to know about interesting Gold and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure: This article is for informational purposes only and does not constitute financial advice. I own shares in Lion Rock Resources.

Fundamentals Align with Technical Strength

Fundamentals Supporting the Rally

Beyond the technical picture, Lion Rock's fundamentals are strengthening, which is increasing confidence for the potential of sustained move higher. Helping with this was the recent $2.16M financing Provides Capital for Drilling.

On February 6, 2025, Lion Rock closed a $2.16M private placement at $0.10 per unit, with each unit including a warrant at $0.20 (expiring 2027). This gives the company the funds to advance its high-impact exploration program at the Volney Gold-Lithium Project.

This financing ensures Lion Rock has the capital to execute a major drill program at the Volney Gold-Lithium Project with the 5,000m Drill Program as a catalyst ahead.

Lion Rock is preparing to launch a 5,000m drill program in Q1–Q2 2025, focusing on, expanding high-grade gold at the Rusty Shaft, testing lithium-rich pegmatites at Giant Volney, and following up on newly identified targets. A successful drill season with potentially good results, expected in Q2 2025, could significantly re-rate the stock.

Lion Rock's flagship Volney Project is located in the Black Hills of South Dakota A World-Class Gold & Lithium District an area with over 60 million ounces of historical gold production.

The project has historically delivered High-Grade Gold: Historic channel sampling returned 18.2 g/t Au over 18.3m., High-Grade Lithium Bulk sampling from Giant Volney Pegmatite yielded grades up to 5.4% Li2O. and the Rusty Shear Zone is believed to be the source of over 420,000 ounces of historic placer gold production.

The dual exposure to gold and lithium provides a diversified upside at a time when both metals are in high demand.

| Want to be the first to know about interesting Gold and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Lion Rock Resources.

- John Newell: I, or members of my immediate household or family, own securities of: Lion Rock Resources. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.