Even though the price of Silver North Resources Ltd.'s (SNAG:TSX; TARSF: OTCQB) stock is about the same as when we last looked at it late in October and the silver price is slightly lower than it was back then, technically the outlook for both is considerably improved with both silver and Silver North being poised to advance for reasons that will become clear when we review the latest charts.

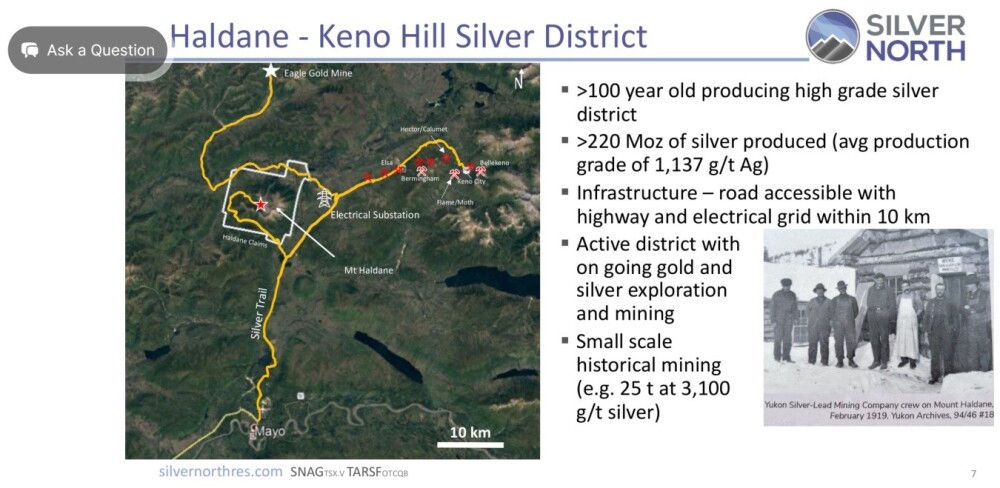

Fundamentally, 2024 was a good year for Silver North, as set out in the January 30 news release. In a year where the price of silver saw a 21.5% increase ($23.65 to $28.90 per ounce) and looks to trend higher, Silver North has positioned itself as a leading primary silver explorer in Canada. 2024 saw a new zone discovered at the company's flagship Haldane silver project in the Keno District, Yukon Territory, with impressive drill results being announced in the middle of November, which include 1.83 meters of 1088 grams / tonne silver, while at the Tim silver project (optioned to Coeur Mining), geological evidence observed in drill core has confirmed the presence of a Carbonate Replacement Deposit ("CRD") style system in the emerging Silvertip CRD district of northern BC and southern Yukon. Analytical results are pending for all six holes from the 2024 program at Tim and are expected to be released before the end of February, i.e., within the next few weeks.

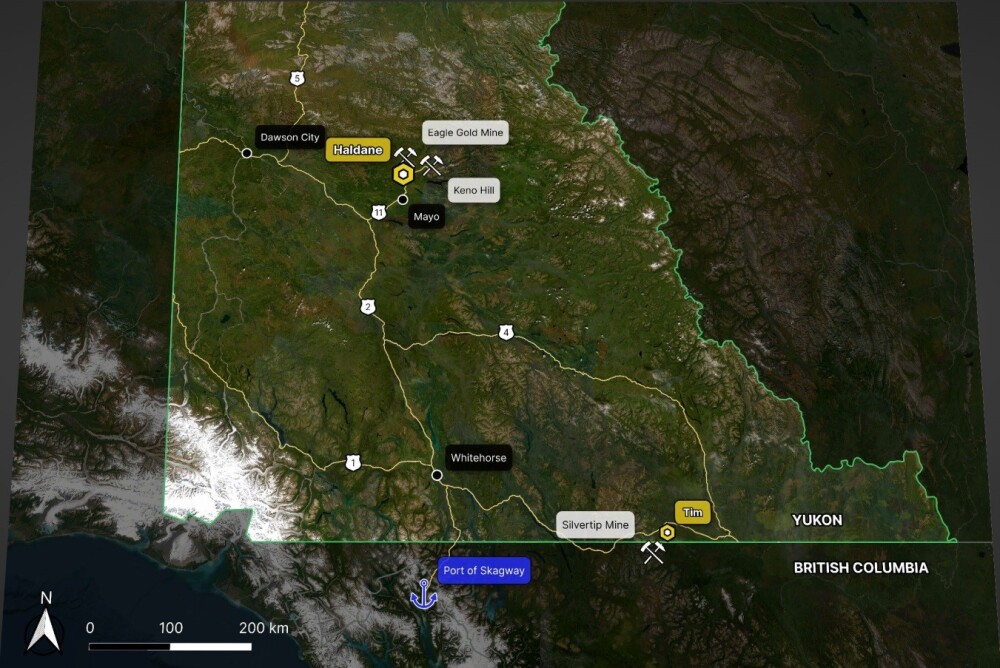

The company's two primary properties, Haldane and Tim in the Yukon, are located a considerable distance from each other with Tim being very close to the border with British Columbia.

Below, you will see the Mt. Haldane – Keno Hill Silver District.

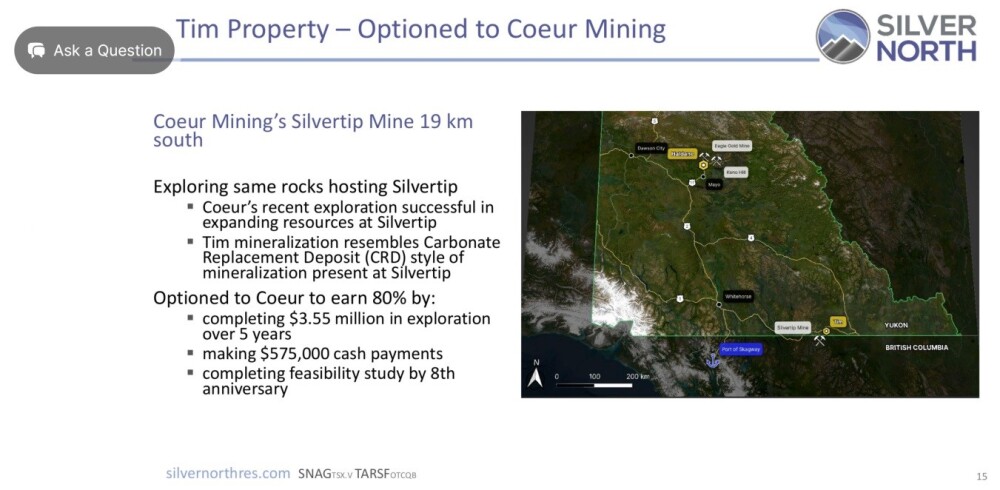

Here is an overview of the Tim Property:

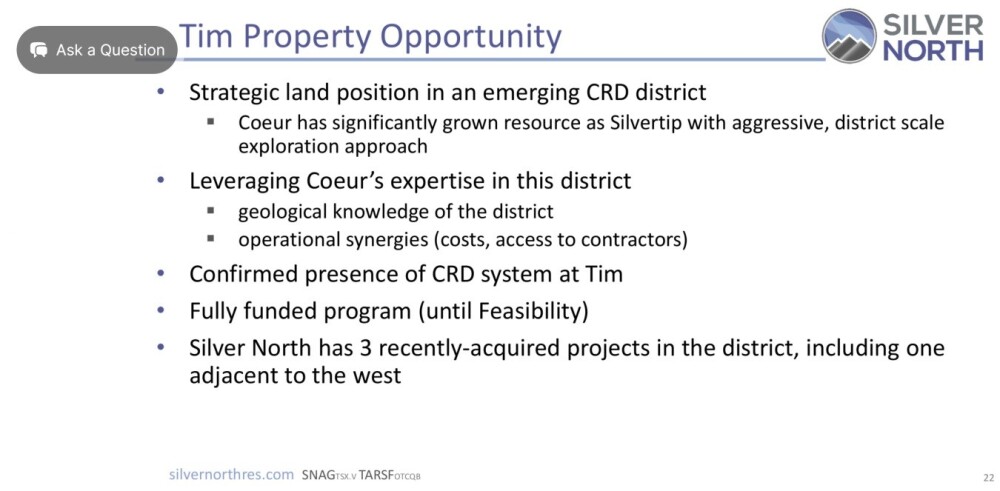

The positive attributes of the Tim Property are set out below.

With respect to the three recently acquired projects in the district mentioned at the bottom of the above illustration, during 2024, management added three claim groups in the Silvertip District, with the addition of the GDR Property. While at a very early stage of exploration, all three claim groups exhibit characteristics consistent with the presence of CRD-style mineralization. Importantly, the Veronica claims adjacent to the Tim Property are host to an untested 450 x 450-metre silver-lead-zinc soil geochemical anomaly with silver values as high as 31 ppm from soil samples. Carbonate rocks have been mapped in the vicinity, making this an intriguing target for further CRD exploration.

Coeur Mining's confidence in the potential of the company's Tim Project is made clear by the fact that it has been and is funding exploration at the property, and not surprisingly, it has an option to earn a 51% interest in the Project. Also giving grounds for confidence and affording logistical advantages are the fact that the Tim property is located 19 km northeast of Coeur Mining's Silvertip Project. Coeur will plan out follow-up drilling this year on the basis of final analytical results from the 6 holes drilled there that are expected to be received this month and in conjunction with data from the two airborne geophysical surveys (magnetics, radiometric, and mobile MT) undertaken last year.

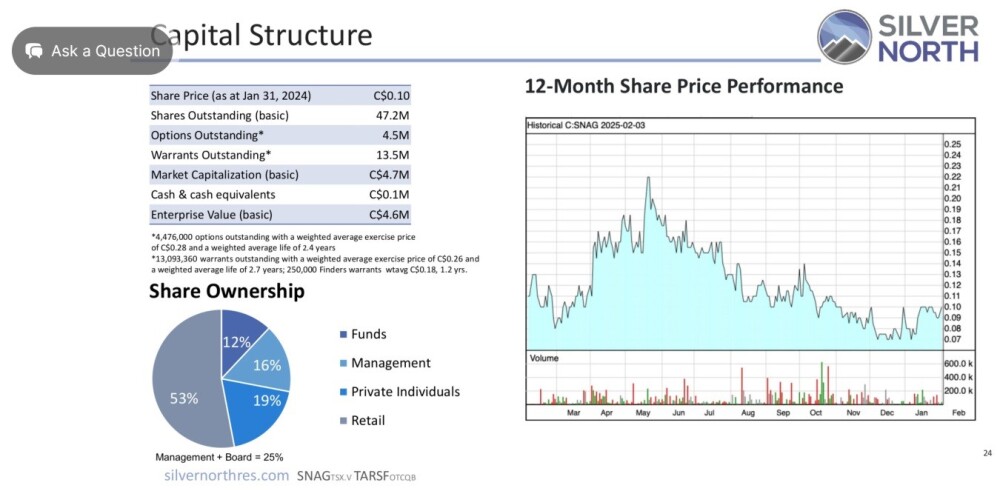

The capital structure of the company is as follows — as we can see, there are a reasonable 47.2 million shares in issue, and as approaching half of these are owned by funds, management, and large private investors, that leaves a relatively modest 25 million or so shares in the float.

The company has indicated that it will undertake funding exercises in due course to finance further exploration work at Haldane, but given the positive indications to date and the decidedly positive outlook for the silver price this year, these fundings are expected to be well taken up and probably oversubscribed.

Now, we will review the latest stock charts for Silver North Resources to see why it is more of a Buy than ever.

Although the price of Silver North Resources' stock is little changed from when we last looked at it, the technical condition of the stock has improved significantly putting it in an even better position to advance as we will now proceed to see.

Starting with the shorter-term 6-month chart, we see that, although the price dipped further into a low in mid to late-December in sympathy with continued sector weakness up to that point, it has since recovered well, and it is now clear that it is close to completing a Head-and-Shoulders bottom beneath the resistance level shown. Note the improving upside volume on the rise to complete the Head of the Head-and-Shoulders bottom and again on the rise to complete the Right Shoulder, which has driven the Accumulation line quite steeply higher.

This is bullish volume action, which indicates that the H&S bottom pattern is genuine and that a breakout from it into a new bull market is likely to occur soon and the now positive momentum trend (MACD) also makes this a likely outcome. A breakout into the first upleg of a new bull market will soon lead to a cross of the main moving averages, which will provide "official" confirmation that a new bull market has begun.

On the 2-year chart, we see that although Silver North made a new low towards the end of the year, the price had pushed into the apex of a bullish Falling Wedge pattern, which means that the higher volume rally to form the right side of the Head of the Head-and-Shoulders bottom that we looked at on the 6-month chart also constituted a breakout from the Falling Wedge.

In recent weeks, it has consolidated this breakout ahead of the expected uptrend that the Wedge pattern portends gaining traction, which should happen soon. Also worth observing on this chart is the persistent high volume from the Spring of last year, which means that a significant quantity of stock has rotated from weaker to stronger hands since the sellers are mostly selling at a loss and the new buyers are looking for gains and are less likely to sell until they get them. Even if Silver North only advances to the band of resistance shown at the top of this chart, we are looking at it more than doubling from the current price.

Zooming out again, the 9-year chart "opens out" the giant base pattern that has formed from 2015, and on it, we can see that, within this base pattern, and from the start 2021 highs, there has been a severe bear market that brought the price down to a very low level where a trading range has developed over the past two years that looks like a base pattern which the price is now near to the bottom of, and hence this is considered to be a very good point to buy. (The reason for using a 9-year chart instead of a 10-year one is that going back 10 years includes much higher prices that flatten out subsequent action, making it more difficult to see what has been going on).

Finally, we will look at the very long-term chart going back 20 years. This chart shows us that Silver North traded at vastly higher prices at the peak of the great 2000s PM sector bull market, which was in 2011. The main value of this chart is that it shows us what juniors like Silver North are capable of when a major PM sector bull market grips the investing public's imagination, as happened in the late 2000s with gold plodding ever higher and looking set to accelerate and silver destined to follow suit looks on course to happen again.

Finally, we will look briefly at a 6-year chart for silver itself, which quickly makes clear that there could scarcely be a better time to buy quality silver stocks than now.

The conclusion is that Silver North is now poised to break out into a major bull market, and it is rated as a Strong Buy for all time horizons.

Silver North Resources' website.

Silver North Resources, SNAG.V, C$0.11, TARSF on OTC, $0.085, closing prices on 10th February 25.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |