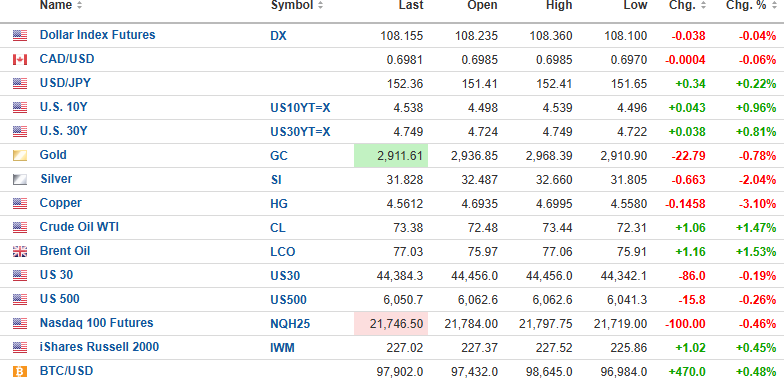

USD index futures are down 0.04% to 108.155, with the 10-year yield up 0.96% to 4.538% and the 30-year up 0.81% to 4.749%.

Gold (-0.78%), silver (-2.04%), and copper (-3.10%) are lower, while oil (+1.47%) is higher.

Stock futures are lower, with the DJIA (-0.19%) down 86.0 points, the S&P 500 (-0.26%) down 15.8 points, and the NASDAQ (-0.46%) down 100.0 points.

Risk barometer Bitcoin is up 48% to $97,902.

Gold

Yesterday, the gold market put on a wonderful move that followed through until around 9:13 pm EST when it looked as though one of the shorts caught offside scrambled for cover, taking the market to $2,968.30 before the sellers came charging in.

This morning, April gold futures are down $22 to $2,912.40 as the RSI has now backed off under 70, last shown at 68.14. The 50- dma at $2,742 and the 100-dma at $2,733 are decent support and probably allows a better underpinning for a run to $3,000.

Remember the Ballanger Rule on trends: "Whenever a market trend moves from gradual to vertical, it has entered the terminus of the move."

April gold moved to near-vertical over the past weekend, starting on Sunday evening in the electronic access market and then last night. If you ever wanted to hand those bullion bank traders a free meal ticket, it was last night's action.

From yesterday: "The two markets to watch are the gold miners and March silver futures. If either or both of those markets start to diverge from gold, the top will not be very far away."

The action in silver remains dreadful, with the GSR above 90. I hate to sound like a broken record, but no bull market in gold can survive without the GSR declining at least to below 70 and preferably to under 50. The lowest in recent years was the 2011 peak in silver, when the GSR moved down to the low $30s.

That is a long way from 90 and keeps me largely on the sidelines when it comes to new silver positions.

Fitzroy Minerals: Caballos News

Fitzroy Minerals Inc.'s (FTZ:TSX.V; FTZFF:OTCQB) news release on Caballos that went out yesterday was met with a great many favorable responses in the form of emails, calls, and direct messages on "X." To hit 185.7 meters of copper-moly sulphide mineralization on the very first drill hole is quite extraordinary.

Assays are expected to be released in early March, but watch the market closely for clues or hints that they might be "spectacular." In Chile, any copper-equivalent grade north of 0.50% will be met with optimism, so with molybdenum commanding five times the ore value per tonne as copper, I believe this could get very exciting in the next few weeks.

With the closing of this CA$0.15 financing, the last precondition for the approval of the Buen Retiro acquisition will have been met, so with all the unexpected excitement at Caballos and the current drill program, including seven holes at Polimet, Fitzroy Minerals Inc. is quickly developing into a major new force in the Chilean mining scene.

At these prices (< US$0.25 per share), forgive me for sounding like a broken record, but the stock is a gift.

| Want to be the first to know about interesting Silver, Gold, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.