Light AI Inc. (ALGO:CBOE) has three main things going for it. It is an AI company and is not of a size that would make it vulnerable to collateral damage from the DeepSeek debacle. It is a young stock that is currently in an uptrend that looks to continue, and it is about to start a major publicity drive that is likely to generate more interest in the company and its stock it would be unlikely to be doing this if it hadn't arrived at the point where it is able to launch onto the market its products / services. Another positive is that early in January, the company announced the successful conclusion of a major financing.

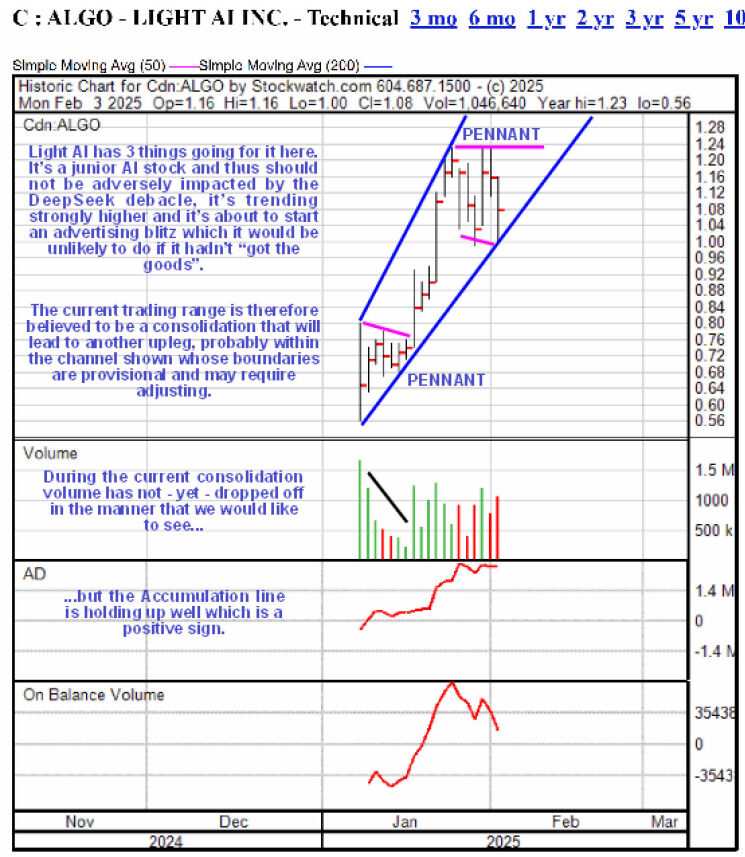

So, the uptrend in the stock looks set to continue and possibly accelerate. There isn't much history, but on a 3-month chart, we can see that since it came to market early last month, it has been trending strongly higher. After it started trading, a bull Pennant formed, which launched it into a strong upleg.

Then it settled into a trading range, which is believed to be another Flag / Pennant that will lead to another upleg. Volume within this pattern is higher than we would like to see up until now, but the Accumulation line has held up well during it, so it looks set to break higher — especially given the upcoming multi-pronged advertising campaign. It has been kept under observation in recent days, angling for a dip, and yesterday, we got one with it dropping 7%, so it is rated an Immediate Buy Here.

Light AI's website

Light AI Inc. (ALGO:CBOE) closed for trading at CA$1.15 on January 7, 2025.

| Want to be the first to know about interesting Medical Devices and Life Sciences Tools & Diagnostics investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Light AI.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.