In a career spanning 48 years, I have run into some pretty sticky situations involving decisions that had to be made against a) the rules of trading, b) what the experts were all saying, and c) my better judgment. In most cases, the application of brain-numbing stimulants like JW Black or fine Argentinian Shiraz could ease the pain and suffering associated with those decisions. As I think back upon the particularly memorable decisions, they were divided down the middle between taking a well-earned (and sometimes very large) profit on a trade and taking an agonizing (and sometimes very large) loss on a trade. Never did I ever lament over the outcome of any decision that involved blue-chip stocks or a bond position caught offside after a series of central bank tightening moves. I rarely lost sleep over a copper trade or a margin call on a carload of pork belly futures that were seriously denting my net worth statement, forcing me to hide from the bank manager's phone calls and asking for more collateral.

However, if I was to count the number of sheep leaping over imaginary fences at three in the morning with cold perspiration sogging my pajamas, the one point of commonality in the decision was that it involved GOLD.

I recall the summer of 1989 after I had barely weathered the Crash of '87, where the trading pits offered jokes like "How do you get your broker out of a tree?" Answer: "Cut the rope." I had watched a $500,000 portfolio made up of predominantly mining stocks shrink mercilessly to $18,000 in a matter of days and multiple margin calls. Never will I forget the calls from my Vancouver friends, also employed by the securities industry, laughing uproariously at the 508-point crash in the Dow Jones Industrial Index that fateful day while the old Vancouver Stock Exchange Index was down nigh on a penny or two.

That laughter reverberating from west of the Rocky Mountains turned to screams of anguish over the next four days as investors absolutely destroyed everything and anything in its path, taking the junior mining issues down 90-95% by week's end and nearly forcing a shutdown of that western exchange normally reserved for gunslingers and riverboat gamblers.

Within a few weeks, I was staring forlornly at my account statement, wondering beyond all imagination how I could explain to my rolling-pin-wielding wife why I could no longer pay off the mortgage she had been demanding for most of the summer and fall of 1987. As the telephone jangled annoyingly on the edge of my cluttered desk, I assumed it would be a shell-shocked client going over the month-end statement and demanding that I send them the "real one" because "this one cannot be mine."

Filled with dread only a man with a conscience can experience, I mustered up the intestinal fortitude to pick up the receiver, kicking into a full Academy Award performance of unbridled confidence and optimism. However, what to my wondering eyes should appear but the name "M. Pezim" on the identifier, and then into my ear crackled the gravelly voice of none other than Murray Pezim, the King of the Mining Promoters who gave up his Toronto butcher shop to become a serial entrepreneur financing junior exploration companies listed on the VSE.

"Murray, before you open your mouth and bag me on one your deals," I started, "you should know that I have one client left, and that's me, and I am looking for a new broker." to which I heard that unmistakeable cackle of laughter from "the Pez." "Furthermore, I got no money, and I got no appetite for junior mining deals anymore." More laughter from the Pez.

"Quit whinin' you sorry-assed schmuck. I am calling to change your life. I gotta deal that will solve all yer problems and get yer wife back into the sack with ya."

Murray then went into his "pitch" and proceeded to tell me about this drilling program in some godforsaken part of the B.C. Interior called "The Golden Triangle," where his company (called Calpine Resource) was in partnership with a company run by legendary minefinder Ron Netolitzky called Cons. Stikine Resources (later named simply "Stikine Resources). I looked at the share capital of Calpine (30 million out) versus Stikine (6 million out) and decided to place the remnants of my crash-shattered net worth into a 20,000-share purchase at $0.90 per share. Within a few weeks, I got the call that something BIG was happening with the drill program located next to a little waterway draining out of the mountains called Eskay Creek, and before I could mutter the word "redemption," Stikine was at $4.00 per share and the talk of the town and the bars and boardrooms of Vancouver and Toronto. As the drilling news flowed in and the share price gathered steam, I found myself sleeping less and less, tossing and turning more and more, and the closer my little net worth statement approached the pre-crash levels of spring 1987. I also could not go for more than a day without hearing the excited chirping from the man who started the entire Eskay Creek ball rolling – the Pez. As Stikine shot like a rocket, leaving Florida airspace in a hurray to $8, then $10 and $15 per share, Murray's Calpine could barely exceed $4.00 because of all the financings he was doing with every broker that had a pulse.

After a closing price at $25 in less than eighteen months from that fateful phone call, I agonized all night long with my first-born son suffering from the sleep-depriving malady known as colic while thinking of selling the position in between rounds of lullaby lilts, which at the time were the only thing that could put the child to sleep. The next morning, I arrived bleary-eyed at my desk and made a call to an ally who toiled for Yorkton Calgary and who knew the play far better than I did.

"Don't sell your stock. . ." he told me with unaccustomed emphasis . . . "Ron's gonna sell this thing any day now," to which I responded, "My account is now where it was before the Crash, and my home life needs some peace." I sold 20,000 shares at $25 and had the $500k back where it existed some eighteen months earlier.

As tough a decision as that was to make, it was even tougher forcing my psyche to forget what happened in the next three weeks as Stikine was sold for $67/share to International Corona (An old Pezim company from the Hemlo days) as I stared at the headlines in horror and disbelief.

Scarred by the stark memory of lost profits by that premature sale, it has since governed all of my portfolio decisions for the past thirty-five years but only, pertaining to gold or gold exploration companies. It is as if the neural synapses have been encrypted with a program disallowing me from selling gold or anything with a snowball's chance of finding gold. As strange as that sounds, it even affects me here in the twilight of my existence in the world of gold and gold miners — which brings me to this most unfortunate dilemma.

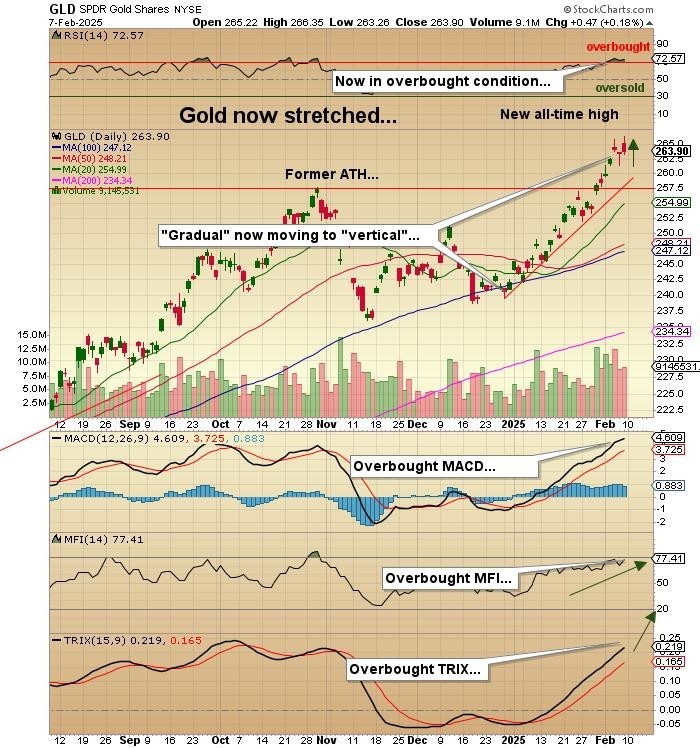

The gold price since 2020 had been in a slow ascent until October 2022, when the U.S. Fed decided to end its tightening campaign. However, since last November, when the Fed elected to slash the Fed Funds rate by a full half-point, instead of the USD weakening, it shot northward as if cannon driven, and with it, instead of crashing against the strong USD, gold has also been on a tear moving from a gradual to a vertical incline as seen in the past five months.

Since one of my intractable trading rules is "whenever a market moves from "gradual" to "vertical," it is approaching the terminus of the move," I am facing a most unfortunate dilemma.

If this were any market other than gold, I would be a devout seller. Using the ETF for physical gold (GLD:US) as my proxy, RSI is at 72.57 (overbought), and MACD, MFI, and TRIX are all registering overbought readings. If this were copper or silver or the QQQ:US, I would declare that it has entered the terminal phase of the advance.

However, with the 2025 White House pulling back Band-Aids left, right, and center, I have no idea what sort of market-impacting revelation will come bubbling and boiling to the surface. The likelihood of a "black swan-like event" is great and growing, with the culprit being a USD crash or correction after such a dynamic advance.

Furthermore, since portfolio managers use GLD:US as portfolio insurance, if the Trump witch-hunt throws a wrench into investor sentiment and starts to cause an equity rout, those PMs will dump their insurance policies to offset other losses, and that could take gold down sharply. Mind you, there has been a great deal of unwinding from the election outcome until the end of January, so positioning is nowhere near as "gold-heavy" as it was in late October.

My inclination is to remain long with the junior gold developers with decent deposits demonstrating high sensitivity to rising gold prices. No better place to hunt for one than in the form of a longstanding favorite of mine — Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) — whose recently released Preliminary Economic assessment ("PEA") has brought abo ut a sharp rally as their Fondaway Canyon project is fast becoming an attractive, high-IRR asset for the aggressive M&A specialists.

Sporting a 10-year Life of Mine and a 46.7% IRR at US$2,250 Au, the after-tax net present value ("NPV") of the Fondaway Canyon deposit is US$474 million for a company sporting a fully-diluted market cap of only US$38.5 million. That leaves a lot of room for "lift" as the appetite for the junior gold space improves.

There are a large number of junior developers out there who deserve to be granted a great deal more respect for either their deposits or the quality of their management teams. I would normally post a list of my favourites but this brutal bear market in the micro-cap juniors has created far too large a list to publish here.

In sum, my dilemma, while most unfortunate, finds at its core the recognition that while the Trump-Musk team of relentless corruption-finders are in full regalia, one is fairly safe remaining fully exposed to gold and gold mining stocks but that will not stop me from fitful nights and restless days. My 2025 target price for gold remains at US$3,650 per ounce.

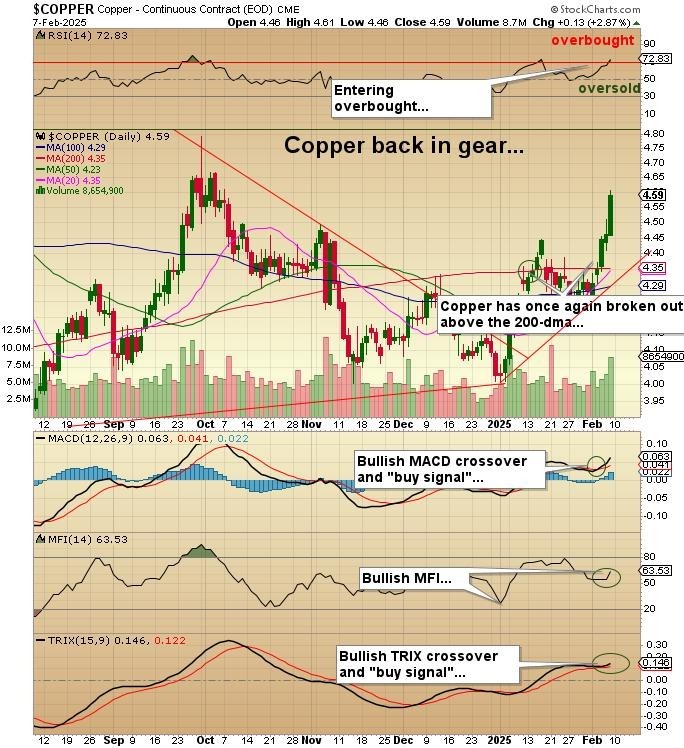

Dr. Copper

When the U.S. election results were made abundantly clear on the evening of November 5, 2024. I took one look at the campaign promises made by the ten-President-elect and decided that if he adhered to his promises of budget reform and tariffs, the global economy could not generate enough demand to maintain the upward price trend for copper. Followers of my work will attest to my assumption that gold would be a temporary victim of Trump's rhetoric, but copper's demise could be somewhat more serious and take longer.

Until this last week, the script I laid out was pretty much on the money with gold bottoming in December but copper getting carpet-bombed from $4.50/lb. to $4.00/lb. within literally days of the Trump victory. It was so unnerving that I came within a hair's breadth of stepping aside my bullish stance on Dr. Copper and sticking instead to gold, but luckily for us, I persevered until mid-January when I published a note with "Copper Back in Gear" as a headline.

Despite moving to levels higher than where it was before last November's election, my darling little Freeport-McMoRan Inc. (FCX:NYSE) had failed to comply with the instructions left at the check-in desk. Topping at $55.23 last May, the stock hit a low a week ago at $34.89 despite the rebound in copper. I would propose that FCX:US is a huge buying opportunity in here, keeping in mind that a good portion of annual after-tax cash flow comes from their ownership of Grasberg and gold.

My top junior developer-explorer in the copper space is Chilean operator Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), whose drill programs at both Caballos and Polimet shall soon yield results.

The juniors all trading on the TSX Venture Exchange should command a strong tailwind if we see a 2-day close above 650. If I get gold right and a USD $3,650 print by year-end, the TSXV will see a move above 1,000 as we saw in early 2021 with gold under $2,000.

GGMA 2025 Trading Account

With the big move in Getchell, the combination of it and Fitzroy are now net profitable, whereas, for most of the past two years, Getchell has dragged everything lower.

If I were to add the warrants that I received off the 2024 debenture issue, which, thanks to many of my subscribers, rescued the Fondaway Canyon asset, I would have an ACB at around US$0.135, which would push the net profit into positive territory. However, until I exercise them, I can only count the shares I own. As I wrote earlier, with a gold price of $2,250, the after-tax NPV is $474 million.

At $2,750 gold (it closed at US$2,887 Friday night), the after-tax IRR is 66.9%, with the NPV at $760 million. Compare the figures to the GTCH/GGLDF market cap (assuming full dilution to 205.9 million shares) of CA$55.6 million. I own some pretty cheap shares, but with numbers like these, I simply cannot entertain a sale price under 50% of NPV or $1.85 per share.

| Want to be the first to know about interesting Critical Metals, Base Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Getchell Gold Corp. and Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.