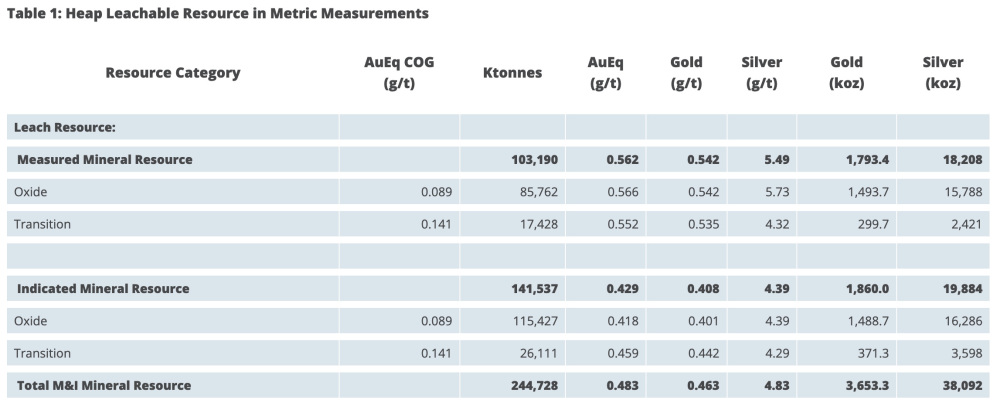

Dakota Gold Corp. (DC:NYSE American) announced a "transformational" resource focused on heap leachable gold at its Richmond Hill Project in South Dakota's historic Homestake District totaling 3.65 million ounces (Moz) of Measured and Indicated mineral resources that the company said will "provide a pathway to near-term production" and will inform an Initial Assessment with Cash Flow (IACF) for the project planned for release mid-2025. The company said work on the IACF has already begun.

The S-K 1300 Initial Assessment mineral resource estimate also identified a heap leachable Inferred resource of 2.61 Moz.

In a release, Dakota said Richmond Hill is expected to have "economics similar to the adjacent Wharf Mine of Coeur Mining, which is expected to generate over US$100 million in free cash flow in 2024 from approximately 90,000 ounces of gold." The Wharf Mine is located just 5 kilometers south of Richmond Hill.

"The heap leachable resource we have identified at Richmond Hill is transformational for Dakota Gold and forms the platform from which we can grow and expand our mining and exploration activities in the Homestake District," said Co-Chair, President, and Chief Executive Officer Robert Quartermain. "In less than three years since commencing drilling, we have outlined a significant near-surface heap leachable resource that we expect to advance through economic studies to Feasibility, and into commercial production as soon as 2029, based on our current work and project understanding."

Quartermain said the fact that the project is on private land with existing infrastructure and close to the company's headquarters in Lead, South Dakota, to be help in reducing production timelines.

In an updated research note on February 7, Agentis Capital's Michael Gray wrote that the update exceeded the firm's expectations and "is too big to ignore."

"We also expect that the project has potential to generate significant free cash flow once in production, which benefits all stakeholders, including our shareholders, local communities, and the State of South Dakota," Quartermain said.

In a webcast discussing the report on Friday, Quartermain said the results will be "transformational" for the company. The news sent Dakota's stock up at least 17% overnight.

In an updated research note on February 7, Agentis Capital's Michael Gray wrote that the update exceeded the firm's expectations and "is too big to ignore." Agentis said it planned to switch its coverage of the company from being a "Gray's Prospect" to full coverage in the first half of 2025.

"We have benchmarked Richmond Hill vs the USA oxide gold developer peers on heap-leachable resources and potential production profiles," Gray wrote. "We believe Richmond Hill is a solid development asset complemented by Maitland as a torquey high-grade, Homestake-style discovery."

'Significantly Upgraded'

Dakota said the report has also identified significant milled resources and outlines a combined heap leach and milled Measured and Indicated resource of 4.64 Moz and a combined heap leach and milled Inferred resource of 5.06 Moz, which "provides long-term optionality for the project."

The newly announced resource "has been significantly upgraded from the maiden Initial Assessment resource ("maiden resource") reported previously in April 2024," the company noted. "In the maiden resource at Richmond Hill, the oxide resource was 60% inferred and had no measured resources. In today's resource update, the leach resource is almost 60% measured and indicated, split roughly equally, and this higher confidence level represents a positive step towards feasibility study stage, and de-risking the project."

The data used for the resource contain 56,734 gold assays from 902 drill holes totaling 90,447 meters of drilling, and an additional 30,743 gold assays from 146 drill holes totaling 45,540 meters of drilling by Dakota Gold since 2022 to expand the resource.

"The results of the new resource for Richmond Hill have exceeded our expectations and showcase the extent and quality of the project mineralization," Vice President Exploration James Berry said. "The step-out drilling incorporated in this update was very successful, as evidenced by the expanded resource. Drilling encountered gold mineralized material in nearly every hole and also encountered higher silver grades than those in the other areas of the resource."

Dakota said the heap leachable resource remains open to the north and in the southeast area of Richmond Hill, which are currently in the process of being permitted for 2025 drilling in the anticipation of expanding the resource further.

"The non-binding financial proposal for up to US$300 million for a development opportunity with Orion Mine Finance, our major shareholder, which was announced on October 12, 2023, could provide Dakota Gold with the financial pathway to a commercial gold operation," the company continued.

The company also said Barrick Gold has agreed to extend the option period for the Richmond Hill option and the Homestake option agreements until December 31, 2028, in return for additional annual payments of US$170,000 and US$340,000 ,respectively. The first of these payments are due March 1, 2026.

Project Sits on 'Prime Real Estate for Exploration'

The historic Homestake Mine produced 41 Moz gold and 9 Moz silver over 126 years. The company has 48,000 acres of holdings surrounding the original mine, which was first discovered in 1876 and consolidated by George Hearst.

In a July article, John Newell of John Newell & Associates wrote, "The area surrounding super giant deposits like Homestake is believed to contain significant additional gold resources, making it prime real estate for exploration."

"The Dakota Gold project is located near the Homestake Mine, which historically produced more than 40 Moz of gold," he wrote. This proximity suggests a high potential for similar deposits. Being in the shadow of many old mines increases the probability of finding significant mineral resources."

The Catalyst: Gold Market Setting Records

The sector has seen a great start to the year, as gold has set new records this week on the back of escalating trade tensions between the U.S. and China, Anmol Choubey and Swati Verma reported for Reuters on Thursday.

"Gold prices slid 1% on Thursday as the U.S. dollar firmed ahead of a key jobs report and investors booked profits, after bullion recorded consecutive record peaks in the previous five sessions," they reported.

"In addition to the volatility in general, we still have inflation in the background that's starting to creep up, so gold is responding as a safe haven," said Alex Ebkarian, chief operating officer at Allegiance Gold, according to the Reuters report.

"Gold is on its way for US$2,900, and you have very strong sentiment despite the fact that in the short-term dollar gained strength," he said.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dakota Gold Corp. (DC:NYSE American)

The market experienced could be on track for an even bigger year, Neils Christensen reported for Kitco. Eric Strand, founder of the boutique precious metals firm AuAg Funds, said he expects gold prices to surpass US$3,000 an ounce this year, Christensen wrote.

"We predict that gold will break the US$3,000 level during the year and potentially finish even higher, with a realistic target of US$3,300," Strand said.

Ownership and Share Structure

About 25% of the company's shares are with management and insiders, including Co-chairman, Director, President and Chief Executive Officer Robert Quartermain, who holds the most shares at 8%, while COO Jerry Aberle holds 4.6%, the company said.

About 26% of its shares are with institutional investors. Top institutional holders include Fourth Sail Capital with 3.9%, Van Eck Associates with 3.7%, Blackrock Institutional Trust Co. with 3.9%, The Vanguard Group Inc. with about 3.6%, Fidelity Management and Research Co. LLC with 2.8%, and CI Global Asset Management with 2.4%.

About 16.5% is with strategic investors, including Orion Mine Finance, which owns about 9.6%, and Barrick Gold Corp., which owns about 2.3%. The rest is retail.

Dakota Gold has a market cap of US$237.02 million, with 94.43 million shares outstanding. It trades in a 52-week range of US$3.25 and US$1.84.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dakota Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dakota Gold Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.