Granite Creek Copper Ltd. (GCX:TSX.V; GCXXF:OTCQB) has announced its participation in a technology development initiative focused on ultramafic rock formations, targeting enhanced metal extraction alongside permanent carbon sequestration. The project, titled Development of Extraction and Carbonation Technology for Ultramafic Rocks, is being led by Kemetco Research Inc. and will concentrate on laboratory and pilot-scale research aimed at optimizing metal recovery while capturing atmospheric carbon dioxide through mineral carbonation.

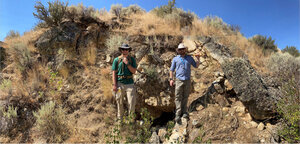

The company has committed to supplying material from its 100%-owned Star Ni-Cu-PGE project in central British Columbia, an area identified as geologically suitable for this process. The Star project covers 2,500 hectares and hosts ultramafic rocks that are prospective for nickel, copper, cobalt, platinum group metals (PGMs), and gold. In addition to mineral resources, the property has shown potential for carbon sequestration and geological hydrogen production.

Granite Creek Copper President and CEO Tim Johnson highlighted the significance of ultramafic formations in emerging technologies, stating in the news release, "The breadth of utility of ultramafic rocks continues to impress as exciting new technological advances and focus are brought to bear. Already prospective for nickel, copper, cobalt and platinum group metals, the Star project can add carbon sequestration and geologic hydrogen production to the potential uses for the rocks found on site."

The project site is located approximately 190 kilometers northeast of Smithers, British Columbia, and lies within five kilometers of the Omineca Resource Road and powerline that serviced the former Kemess Mine. The proximity to existing infrastructure may provide logistical advantages for future development.

Copper Market Faces Strong Demand

According to Market Research Future, on January 16, the high-purity copper market was projected to reach US$28 billion by 2032, with a CAGR of 4.15%. Increased adoption of electric vehicles (EVs), renewable energy technologies, and advanced electronics was driving demand, as high-purity copper's superior electrical conductivity and corrosion resistance made it essential for power generation and transmission applications. The shift toward solar panels, wind energy, and semiconductor manufacturing reinforced copper's role in supporting sustainable infrastructure.

Trade policy uncertainties added further complexity to the market. As reported by Reuters on January 20, Goldman Sachs assessed a 50% probability of a 10% U.S. tariff on copper by the end of the first quarter, contributing to concerns about global supply chains. The report noted that market participants were pricing in the possibility of trade restrictions, which could influence supply dynamics and production costs.

The broader copper market was expected to expand significantly over the coming years. According to Technavio, on January 21, the sector was forecast to grow by US$70 billion between 2024 and 2028, with a CAGR of 6.78%. The Asia-Pacific (APAC) region accounted for 73% of this projected growth, with rising demand across electronics, telecommunications, and infrastructure sectors. The transition to 5G networks and the Internet of Things (IoT) further contributed to copper consumption, as the metal's electrical conductivity made it indispensable for wiring and circuit board applications. However, Technavio also noted that price fluctuations posed a challenge, with supply-demand imbalances and macroeconomic factors influencing pricing trends.

Copper prices remained volatile throughout 2024, with significant fluctuations. SMM on January 23 reported that copper futures across major exchanges hit record highs in May, driven by expectations of tight copper ore supply, production cuts in copper cathode, and increasing copper consumption in AI applications. The price of SHFE copper fluctuated between 88,940 yuan per metric ton at its highest and 67,380 yuan per metric ton at its lowest, highlighting substantial volatility. While prices trended upward by the end of the year, SMM noted that sharp price swings presented challenges for downstream copper consumption.

Supply-side constraints remained a key market factor. The SMM report further cited concerns over tight copper concentrate supply persisted throughout 2024, leading to treatment charges (TC) turning negative at points during the year. Meanwhile, China's copper cathode production increased by 620,500 metric tons year-over-year, reflecting a 5.42% growth rate. Despite this increase, supply shortages remained a concern, with SMM stating that limited new large-scale copper mine projects were unlikely to ease the supply constraints in the short term.

Copper's role in industrial applications continued to expand, particularly in agriculture. According to AgriBusiness, on January 29, demand for copper fungicides was expected to grow at a 6.5% CAGR through 2032, driven by increasing agricultural use to combat fungal diseases. The report highlighted that governments were investing in sustainable farming practices, further bolstering demand for copper-based fungicides.

Granite Creek Copper Advances Sustainable Resource Development with Innovative Technology

As detailed in its corporate presentation, Granite Creek Copper's involvement in the ultramafic technology development project aligns with the growing industry focus on integrating resource extraction with environmental sustainability. The potential for carbon sequestration through mineral carbonation presents a dual opportunity for the company, enhancing both the economic and environmental prospects of the Star project.

The technology being developed by Kemetco Research Inc. aims to improve metal extraction efficiency while mitigating the environmental impact of mining operations. If successful, this approach could provide Granite Creek with a competitive advantage in a market that increasingly values responsible resource development.

Additionally, the Star project's diversified resource potential, which includes nickel, copper, cobalt, PGMs, and gold, positions the company to benefit from multiple commodity cycles. The potential for geological hydrogen production, an emerging area of interest in the clean energy transition, adds another dimension to the project's long-term value proposition.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Granite Creek Copper Ltd. (GCX:TSX.V; GCXXF:OTCQB)

With access to infrastructure and ongoing participation in innovative research, Granite Creek Copper continues to position itself within the broader shift toward sustainable mining practices. Future milestones, including pilot-scale testing and further validation of the carbonation technology, will provide key indicators of the project's progress and commercial viability.

Ownership and Share Structure

According to Refinitiv, insiders own 6.29% of Granite Creek Copper, including the CEO Johnson with 2.56%. The next top two, both directors, are Robert Sennott with 2.01% and Michael Rowley with 1.37%.

The company does not have any institutional investors. Retail investors own the remaining 93.71%.

Granite Creek has 198.27 million shares outstanding and 185.79 million free-float traded shares. The company's market cap is CA$3.97 million, and it trades in a 52-week range of CA$0.02 to CA$0.06 per share.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Granite Creek Copper Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.