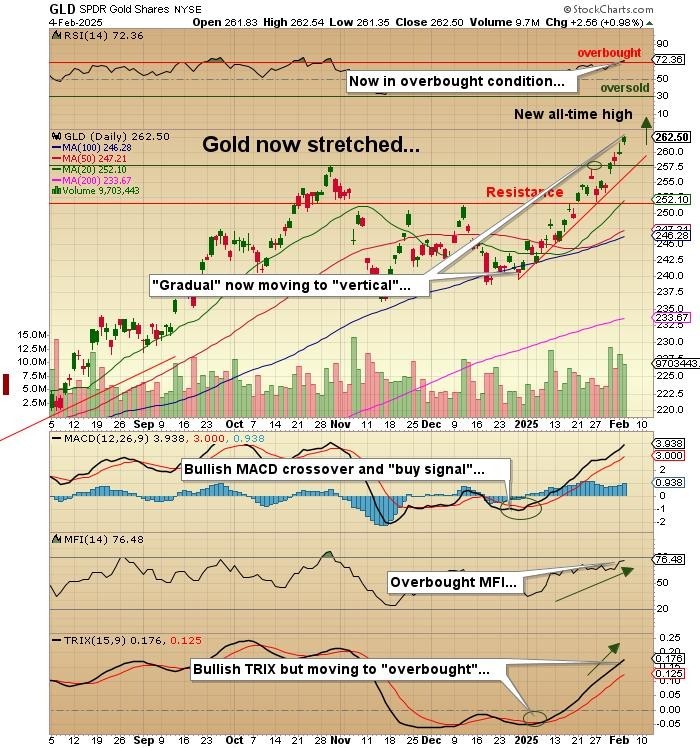

USD index futures are down 0.49% to 107.295, with the 10-year yield down 1.26% to 4.456% and the 30-year down 1.01% to 4.700%.

Gold (+0.65%) and copper (+0.34%) are up, while silver (-0.11%) and oil (-1.05%) are down.

Stock futures are lower, with the DJIA (-0.14%) down 60.5 points, the S&P 500 (-0.39%) down 23.3 points, and the NASDAQ (-0.73%) down 159.00 points.

Risk barometer Bitcoin is down 1.16% to $98,248.

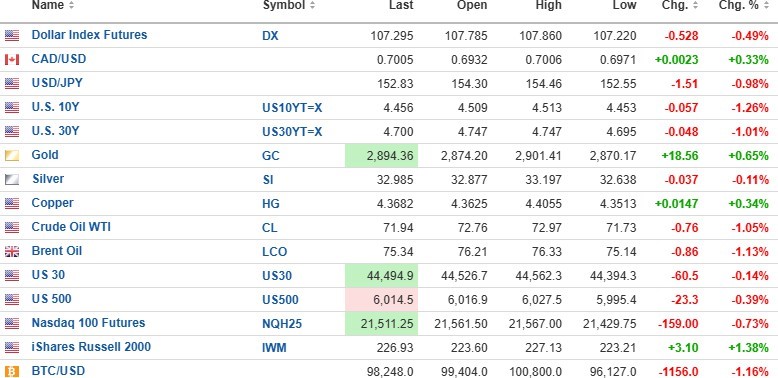

SPY:US and MACD

The markets have been ridiculously volatile since Sunday evening, and the threat of inflation-generating tariffs threatened to derail the Trump 2.0 Rally. Last-minute heroics by the President of Mexico, followed by a last-minute follow-on by Canada's Justin Trudeau, bought those two North American neighbors of the United States a one-month grace period while the American president drums up another list of demands.

Given how quickly Mexico and Canada rolled over, Trump will undoubtedly demand more until his adversaries cry "Uncle!" or retaliate with a series of market-roiling tariffs of their own.

Stocks are lower going into the opening, with the SPY:US yesterday barely evading a bearish MACD crossover and "sell signal." If it closes lower today, it will not be able to evade the crossover, which almost always accompanies a correction of sorts. In addition, it will take out the 20 and 50-dma lines and head down to test the 100-dma at $586.01, then the 200-dma at $559.66.

If by the final hour of trading, the SPY:US is below $596.94,

- Buy 20 puts SPY March $590 at $7.50

- Add 40 more calls VIX March $15 at $3.25

Total position will be 80 calls at average $3.30 – target $10 by expiry.

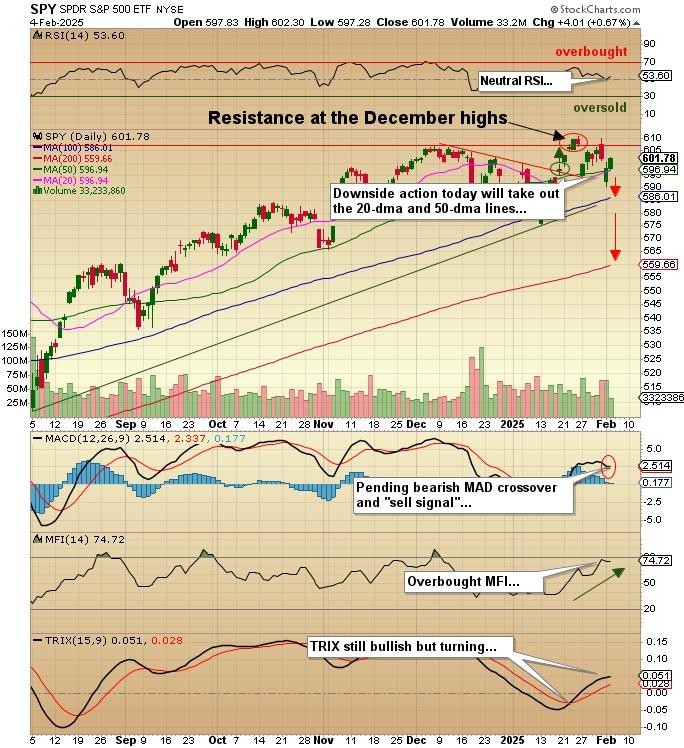

Another Record High for Gold

Gold has been on a tear since New Year's Day and is now trading merrily away just under $2,900 and well on its way to my 2025 target of $3,650 per ounce.

Given the sensibility to earnings for the major gold miners, I look for record cash flow and profits for all members of the HUI, paying particular attention to the higher cost laggards like Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and Newmont Corp. (NEM:NYSE).

It is interesting to see GOLD:US trading at $16.68 versus the August 2020 peak above $28 when gold was trading just under $2,100/ounce. It and NEM might be contrarian "buys" in here.

Getchell Gold Corp.

With an RSI at 74.82, Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) is certainly well into "overbought" territory, but the problem I have with that is found in the PEA released on January 23 where at $2,250 gold, the annual cash flow exceeds $100 million per year over the 10.3-year Life of Mine ("LOM").

Back in the day when I was an analyst, gold producers were valued at 3-5 times cash flow. If we follow that for GTCH/GGLDF, it should be valued at 3-5 times US$100 million or US$300-500 million in market capitalization.

With 205.9 million shares issued and a price of US$0.1708/share, GGLDF carries a market cap of just USD $35.16 million. At $300 million of valuation, it is US$1.45 per GGLDF share and at $500 million of valuation, it values GGLDF at US$2.42 per GGLDF share.

I have floated numbers like this around before, and while my reasoning is sound, until now, the markets failed to agree with me. I am currently of the belief that markets are starting to sniff out the return of the junior gold speculators, and once that happens, there won't be a better story on the board than GTCH/GGLDF.

Sure, it is overbought in the short term but drastically undervalued relative to the resource. I will add/hold looking for one of the big corporates to come a-hunting. . .

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp. and Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: SPDR S&P 500 ETF and Getchell Gold Corp. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.