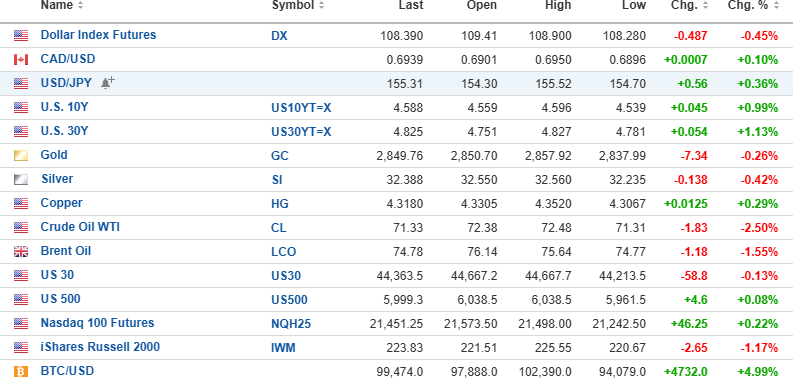

USD index futures are down 0.45% to 108.390, with the 10-year yield up 0.99% to 4.588% and the 30-year up 1.13% to 4.825%.

Gold (-0.26%), silver (-0.42%), and oil (-2.50%) are all dow,n while copper (+0.29%) is up.

Stock futures are mixed, with the DJIA (-0.13%) down 58.8 points, the S&P 500 (+0.08%) up 4.6 points, and the NASDAQ (+0.22%) up 46.25 points. Risk barometer Bitcoin is up 4.99% to $99,474.

Tariffs, Wars, and Volatility

Yesterday morning, I included a paragraph warning holders of volatility positions that if a last-minute deal was pulled off to postpone or cancel the tariffs, stocks could and would scream higher, taking the VIX:US and the UXIX:US sharply lower.

Sure enough, a couple of hours after the opening, with stocks careening lower, Mexico announced that they would be placing 10,000 troops on the border, ensuring tighter border controls and tougher crackdowns on the shipments of fentanyl.

That prompted President Trump to delay the Mexican tariff by one month, after which the markets all turned on a dime and recovered most of their losses.

For those of us holding the VIX March $15 calls, they opened at $4.25, traded up to $4.55, but then faded (as they always do) back to $3.10 as hedgers lifted their portfolio insurance by selling volatility to offset portfolio losses. Similarly, the UVIX:US opened at $34.41, traded up to $35.78, then collapsed to $29.31 as volatility was dumped.

Further near-term risk for holders of the volatility trade was that the discussions between the U.S. and Canada would also turn out successfully and that lasting concessions on border security, immigration, and fentanyl would eliminate the need for tariffs. That did happen, reducing concerns that the bond markets would allow yields to rise, causing additional pressure on stocks.

Also weighing on the volatility trade near-term was that by mid-February, the corporate buyback window will be fully engaged, and that will keep stocks fairly well bid despite the month of February being one of the weakest seasonally for the calendar year.

Needless to say, I was forced to scrap the email alert twice as the absurdity of the news flow made it impossible to trade. As it stands, I remain long the 40 calls VIX March $15 from $3.35 that are trading at $3.60 in the pre-opening.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.