For years, the junior mining sector has struggled under the weight of weak investor sentiment, low liquidity, and challenging financing conditions.

However, recent technical and fundamental indicators suggest a significant shift may be on the horizon. The early-stage exploration market — particularly in gold, silver, and base metals, appears poised for a breakout, and savvy investors are beginning to take notice.

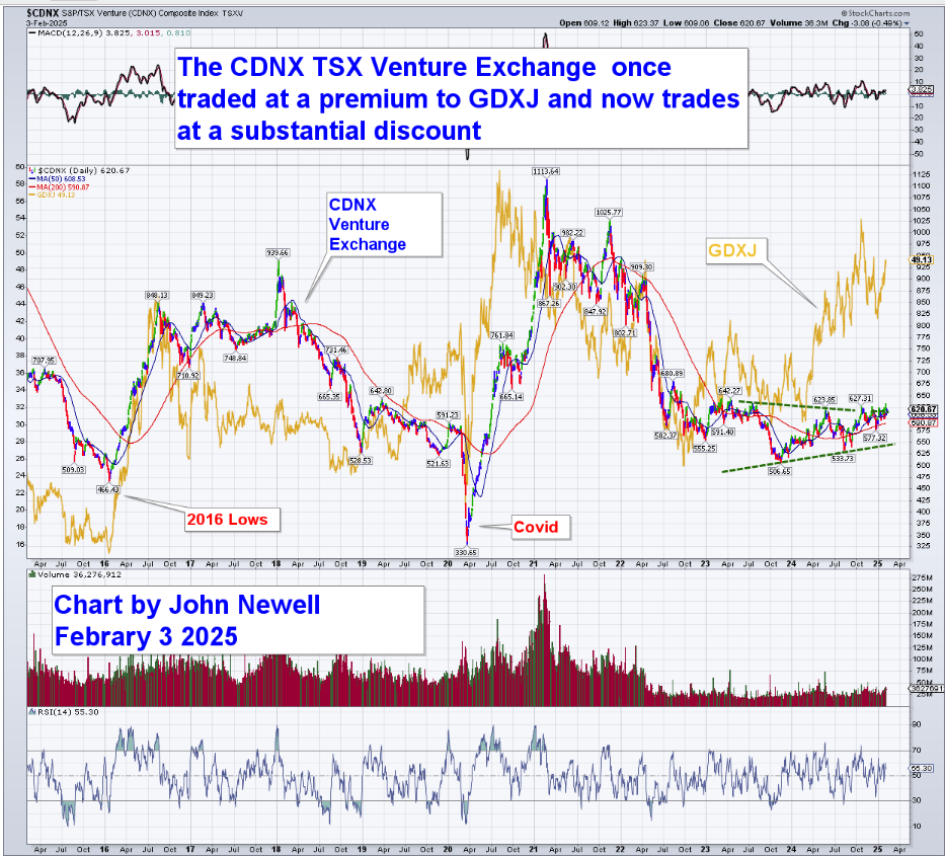

The chart above shows the deep discount the CDNX Index has on the price of gold currently.

A Cyclical Powerhouse for Juniors

The TSX Venture Exchange (TSXV) has long served as the primary marketplace for small-cap mining, energy, and technology companies in Canada.

Unlike senior exchanges, it is highly sensitive to commodity cycles and investor sentiment.

Key Aspects of the TSXV:

- Heavily Weighted Toward Junior Mining — Many of the companies listed on the TSXV are focused on gold, silver, copper, and other critical minerals exploration.

- Highly Cyclical — The exchange has a history of extreme booms and busts, often following gold and base metals price trends.

- Liquidity Challenges — Unlike major exchanges, the TSXV can experience low trading volumes, making capital raises more difficult during downturns.

- Sentiment-Driven — The performance of the exchange often mirrors overall investor risk appetite. When speculation returns, the TSXV tends to move aggressively higher.

Right now, these factors are converging, and technical indicators suggest a breakout that could signal a long-overdue bull run for junior mining stocks.

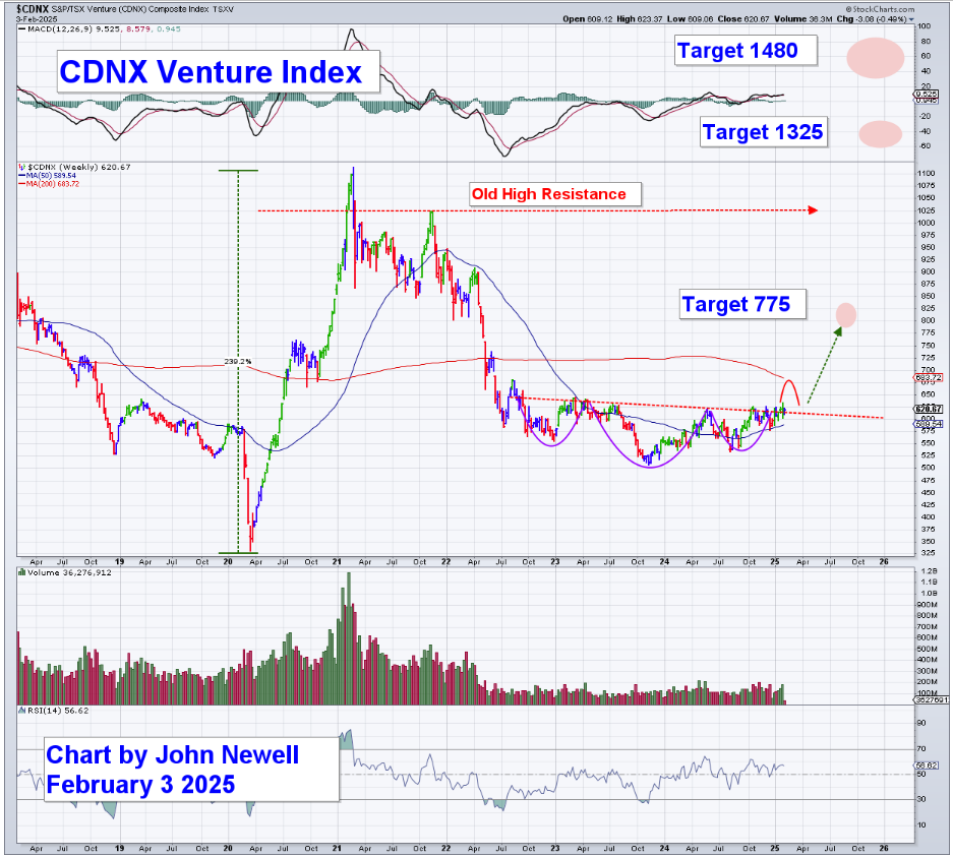

Breaking Out After a Multi-Year Bottom

After nearly two years of consolidation and resistance at key technical levels, the junior mining sector is showing signs of a powerful reversal. A large inverse head-and-shoulders pattern, a classic bullish formation, has formed on the charts, suggesting that a breakout could be imminent.

Key Technical Signals:

- Breakout from Long-Term Resistance (~650 level) – A move above this level indicates that investor sentiment is improving.

- Bullish Chart Patterns (Inverse Head & Shoulders / Cup & Handle) – These classic setups suggest significant upside potential.

- 200-week Moving Average as Resistance. If this critical level is broken, a move toward 775 and beyond becomes likely.

- MACD Turning Bullish — A rising momentum indicator points to increasing buying interest.

- Volume Increasing — A surge in trading volume would confirm institutional interest, making the rally more sustainable.

Potential Upside Targets:

Technical targets suggest . . .

- First target 775 — after an Initial breakout level.

- Second target 1325 — older highs could be some Major historical resistance.

- Third target 1480 — Long-term target from the previous bull cycle.

What This Means for Junior Mining Companies

A bullish move in the junior mining sector has profound implications for companies that have been struggling to raise capital. The last few years have been brutal for exploration-stage firms, with many trading at depressed valuations despite holding world-class assets.

However, history suggests that when sentiment shifts, capital floods back into the space.

Key Takeaways:

- Better Access to Financing: A rising market means junior explorers can raise money at better valuations, reducing dilution.

- Gold Surge as a Catalyst: With gold prices threatening to break $3,000/oz and beyond, the macro backdrop strongly favors exploration companies.

- Increased M&A Activity: When junior companies start re-rating, mid-tier and major miners become aggressive in acquiring high-quality assets.

- A Perfect Environment for New Discoveries: Higher stock prices provide more funding for exploration drilling, leading to potential new discoveries that can further drive share prices.

Positioning for the Next Junior Mining Boom

For companies like West Red Lake Gold Mines Inc. (WRLG:TSX.V; WRLGF:OTCQB), which are already in the heart of major mining districts like Red Lake, Ontario, this environment presents a once-in-a-decade opportunity.

Investors who understand the cyclical nature of the TSXV and commodity markets recognize that the best time to position for a bull market is before the breakout happens.

With the right combination of strong technical indicators, increasing precious metal and base metal prices, and renewed investor interest, 2025 could mark the beginning of an explosive rally for junior mining stocks.

The window for securing strategic financing and attracting institutional investors may be opening right now.

| Want to be the first to know about interesting Silver, Critical Metals, Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Inc.

- John Newell: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.