This evening, after I had shopped around for a birthday present for my six-year-old grandson, I returned home, poured myself a glass of finely aged Shiraz, and scanned the usual internet sites to see how many exclamation marks were following the headlines of gold bullion trading at record highs. Surprisingly, the headlines were somewhat muted, and despite a truly solid weekly performance for the precious metals and the miners, the providers of headlines and breathless superlatives have been held journalistically moribund by the performance of the junior miners.

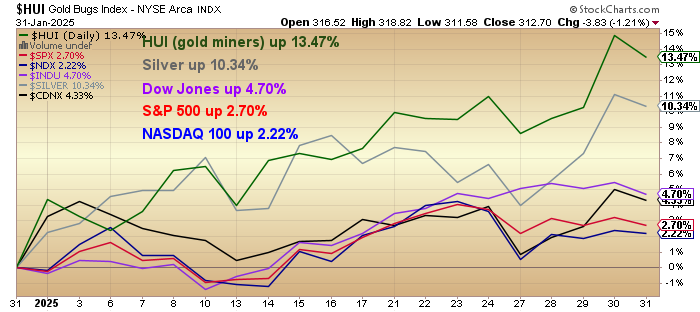

While the HUI took off, posting a 13.47% advance for the month, the poor TSX Venture Exchange could barely beat the bedraggled S&P500 and NASDAQ, which got smoked thanks to the arrival of the "DeepSeek," which had millions of Millennial and Gen-X speculators all checking their monthly supply of Depends alongside ample dosages of phenobarbital and discount liquor.

The reaction on Monday to the sudden discovery of a bona fide competitor to Nvidia, Microsoft, Apple, and "all things Elon" was vintage as the CNBC anchors trotted out shill after shill and cheerleader after cheerleader, all avowing their undying conviction that "the Chinese are lying!" and that the software does not hold a candle to that wonderful hardware-driven technology that is five hundred times more expensive and one-fifth as efficient as the Chinese AI prototype.

As I have been proclaiming for months (years, decades, lifetimes. . .), there is never a bad time to own gold as long as you have a fridge full of food, the mortgage covered, and the wife's credit cards all with zero balances and in her purse. Throw in a burgeoning liquor cabinet and a well-stocked wine cellar, and life rarely gets any better, especially when gold spits in the face of a rising U.S. dollar and legions of anti-gold HOLDers all looking for the next MicroStrategy Ponzi scheme in which to sink life savings and reputational capital.

Gold mining stocks outperformed the NASDAQ 100 by a factor of six last month, led by the staggering performance of the best-run gold miner in the world, the mighty Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), which hit a record high of $95.38 before reversing downward as was the case with the gold price which ran into a wall of selling above $2,860 as the month of January ground to a close.

After a particularly robust opening few hours in the Crimex pit session, the bullion banks traders decided to follow the tariff news that hit the wires at roughly 1:15 pm and sold gold hand over fist to close the market down $13.70 to $2,831.50, reversing the move to new highs and sending every gold bug on the planet home in a blue funk after a typical "Freaky Friday" event all too common in the world of precious metals investing.

At 3:30, the COT report showed a 330,000-plus contract net short position on the books of those dastardly commercial traders (bullion bank thieves and charlatans), which is certainly on the high end of levels normally associated with short-term raids. The relative strength index for the April gold futures contract could not exceed 70 on this run so any pullback from here will probably be contained by the previous high just above $2,801. However, caution is warranted because if the NASDAQ begins to take air with a continued rotation out of the Mag Seven group, I can see gold being sold as traders capitalize on their portfolio insurance, typically taking the form of the GLD:US.

The big news on Friday was the decision by the U.S. to impose 25% tariffs upon those two mortal enemies of the United States — Canada and Mexico — plus a 10% tariff on their much-less-hostile ally — the People's Republic of China. You see, there are no iPhones manufactured in either Canada or Mexico, so given the ample campaign contributions made by Tim Cook and Apple fresh in the mind and heart of the newly-installed American Chief Executive, the U.S. President views China far more favorably than its two lethal North American neighbors.

After all, to "Make America Great Again," the optimum time-tested strategy described in detail by the brilliant Chinese military strategist Sun Tzu in his book written in 1060 A.D. called "The Art of War" must be employed. The tactic known as "divide and conquer" is being demonstrated masterfully by the author of "The Art of the Deal" in granting Canada's oil-rich province of Alberta an exemption from tariffs. This is a genius move in that it will force the limp-wristed Liberal government to prohibit the Albertans from doing a cushy side deal with "the Donald," splintering the country into "west-versus-east" factions and driving the "51st State" narrative to the front pages.

That decision derailed what looked like a CNBC-pleasing month-end romp into new high ground and sent the Dow down over 300 points, with the S&P down 0.5% and the NASDAQ down .28%. However, choosing to ignore defeat, those ClownTV anchors were waving frantically at the 2.7% increase in the S&P 500 for January thus ensuring with an 84% accuracy rating that the calendar year 2025 will be an "UP" year.

From the Stock Trader's Almanac: "Focusing on just the positive JB alone has a solid track record. Up Januarys are followed by up years, 88.9% of the time (40/45 years), with an average S&P 500 gain of 17.0%. 14 of 18 of the last post-election years followed January's direction. When January is positive in post-election years, eight of nine full years were up with an average gain of 17.8%. 2001 was the exception. January was up 3.5%, but the full year was down 13.0%."

With great deference and respect for Jeffrey Hirsch (son of founder Yale Hirsch with whom I enjoyed a wonderful dinner back in 1997), I believe that 2025 will be a mirror image of the first year of the Reagan Presidency, where a 6% gain to April 1981 devolved into a 9% drop by year-end. Covered in last week's missive, I need not go into detail any more than to cite the abrupt turnaround in stock prices on Friday once the Trump tariffs were officially unleashed.

The major question everyone is asking is whether the Trump 2.0 presidency will exert pressure on the Fed's Powell and Treasury's Scott Bessent to protect Wall Street from a Reagan-style bloodletting and recession. If Trump really wants to reward those "deplorables" (thank you to Crooked Hillary for that term) that elected him, then protecting stock portfolios will take second place to ample supplies of Bud Light, Remington buckshot, and John Deere tractor hats. Since there is no "third term" for which DJT must strategize, I am speculating that he will mold his legacy as "Champion of the Working Class" rather than "Wall Street Deity" at least for the first two years while he is still able to shift the blame to "Sleepy Joe" and those DEI-obsessed Democrats who still post videos of themselves wailing uncontrollably into their cellphone cameras because their lives are finished forever.

I promise you all that in 2025, the main focus of the nightly news broadcasts the world over will be outrageous quotes from Donald J. Trump. If I were a betting man (tongue firmly implanted in cheek), I would place a large wager that it is Trump's mission to enrage and alienate literally everyone he comes across, with focused crosshairs containing the liberal media that bludgeoned him ruthlessly for the past four years. That kind of chaos is generally frowned upon by the investor class, as we witnessed Friday afternoon, an observation of which all dip-buyers should take emphatic heed.

Silver

I used to have an uncle who was a decorated hero in the Second World War and was a Golden Gloves regional champion in Toronto in the 1930s, just before enlisting. His unit paratrooped on D-Day into rural France and cut their way through the German ranks so far that their British commander was forced to call them back in a few short days. Comprised of Canadians and a smattering of Scots, the unit was the subject of a Toronto Star feature in the 1980s that actually mentioned "Uncle Don" and many of the brave souls who sacrificed life and limb for Queen and Country during a period that saw over 45,000 Canadian soldiers perish thousands of miles from their homeland.

After moving up the ranks to become a sniper in the Black Forest of SW Germany, he returned to Canada in 1945, where life took on a dark turn. My father would tell me that the war changed my uncle from a gifted, fun-loving athlete who took great pride in his appearance and level of fitness into a degenerate drunk who would spend days on end in the rooming houses of Hamilton on benders too depraved to even think about.

However, when he came to visit, he was the most delightful of all our uncles. He was a gifted prankster and storyteller (never about the war) and loved to laugh with his toddling nieces and nephews. As we got older, he would watch us sparring in the backyard with CCM boxing gloves, stopping the matches to instruct us on the proper way to "stick and move" or how to target the kidneys with a left hook. We learned later that "Unc" was once a one-man wrecking ball whenever the taverns of Ancaster erupted into bottle-throwing brawls, but one would never have known that watching him with his nieces and nephews. He was, without question, our favorite uncle despite the lingering body odor of cigars, whiskey-tinged perspiration, and beer. We could all look well beyond his warts and scars and human foibles, all carefully crafted tools demanded by his battered psyche to forget the horrors of 1941-1944.

Every time I look at the silver market, it is almost the same feeling of watching my decorated uncle walk up the driveway some 60 years ago. Silver has had its own share of warts and scars over the years, but it has always carried a morbid curiosity for me ever since watching the absolute mastery with which the Hunt Brothers cornered the silver market in the late 1970s. As I have written before, anyone who mentions the Hunts' "failed attempt" to own every available ounce of silver on the planet and laughs at how stupid they were in even trying, let it be known that if the U.S. government had not stepped in to rescue the bullion banks, the dealers, the brokers, the millionaire-billionaire groups that were all collectively short silver and absolutely bleeding buckets from the eye sockets with terminal velocity, the Hunts would have been successful.

The ruling elite pulled every marker and every string to change rules that had been followed religiously for decades without incident in order to derail the Hunts' mission, but not before allowing us to watch in wonderment the meteoric rise from under $2 per ounce to over $50 taking the silver "penny dreadfuls" like United Keno Hill from $.69 to $69 in a matter of weeks. I was a fuzzy-cheeked novice to the world of investing, having just quit my quest for the NHL with a career that resembled a WWII fighter coming out of the sky when a floor trader buddy rang me on one of those new-fangled push-button phones and told me to "load up" on an obscure little company called Dolly Varden Minerals (not the one you see quoted in 2025) that was trading at $0.28 per share with a high-cost silver asset way up in the Canadian Yukon. It had a production cost that was around $18 per ounce so with silver at $8 per ounce, this little compliance nightmare certainly deserved to trade in the very low pennies.

Knowing nothing about silver or the junior mining market and only very slightly more about how to offer investment advice to people, I took the plunge, and within weeks, the silver price has vaulted into the $ 20s, "little Dolly" went from the low pennies to the mid-teens where the big bad floor traders not only dumped all of their stock but with thoroughly-annoying condescension and arrogance, shorted the entire issued capital of the company thinking of course that it would gravitate back to earth and totally enrich them for their bravado versing on skullduggery. However, that was just as the Hunt short squeeze was reaching the "critical line" on the change-your-underwear-meter, and within days, silver was in the $30s and then $40s, with the "Dolly Girl" hitting over $30 per share.

By this

time, I was convinced that I was the next coming of Gerald M. Loeb and was just about to hit my granny for some of her savings when my floor trader buddy called up and told me that the "big boys" were about to "lower the boom" on the Hunts and that I should "lighten up" on my precious little "Dolly Jewel." Well, as the story should have gone, as a 20-something kid with a negative net worth coming taking the bus to work every day to offer investment advice to senior business owners worth millions of dollars and decades of experience and driving their Mercedes to work, I took the floor trader's advice and dumped the enormous board lot representing my entire liquid asset base. However, as you all can imagine, the move in "the Dolly" has made me not only brilliant, it made me irresistibly handsome, bullet-proof, and invisible (you know, somewhat like the "Four Stages of Tequila"). I held on to the shares for another five days and decided in a rare fit of humility and remorse to let the lot fly at $17 per share, a tad over half the peak of a week earlier but still well above what I paid.

That three-month joyride was like a scene out of that old B-rated movie from 1936 called "Reefer Madness," which, in my youth, we would watch over and over in the wee hours of the morning while partaking of some powerful Columbian Sinsemilla. The stories that accompanied the famous Hunt Bros.' Silver Squeeze were repeated in bars and living rooms for decades after the late 1970s, but for septuagenarians injected with precious metals fever over 40 years ago, that narcotic has never left my bloodstream and affects my decision-making every minute of every hour of the trading day.

As stated here before, you cannot place a 2025 target price for one's beloved gold position of $3,650 per ounce and still turn your nose up and head away from silver. As treacherous as it is to trade, it is far less treacherous to simply own it. It is a "pinch-your-nose-and-buy-it" type of investment vehicle. It is like giving one's beloved "smelly Uncle Don" a great big hug and a kiss whenever he pays a visit. There are always good visits mixed with bad visits but the good visits are always so much fun that you wonder why you ever doubted them. That, in a solitary nutshell, is silver. I have been a cautious observer since 2021 but let the world now know once and for all that I am taking a position in what I believe will be my 2025, grey-hairs-in-my-beard version of that "darlin' little Dolly" of four-and-a-half decades ago. I will provide you with the name of the little jewel once I have completed the perfunctory period of "due diligence," a phrase that is arguably the most abused and misused in the entire world of investing. (First, however, my paid subscribers will be notified, after which they will buy ALL the cheap stock, leaving the expensive paper over which everyone else may pick.)

Last point: From my vantage point, there is no shortage of silver in the world, so I would ask that the IR departments of all those penny dreadful Pan American wannabe's refrain from bombarding my inbox with stories about "imminent shortages" of a metal that is found in copious amounts in all world-class copper-zinc-lead deposits since the Dawn of Creation. It is good ol' monetary demand that will fuel silver and those same addictive behaviors that drove Fartcoin and Butt Hole Coin to ridiculously elevated market caps on zero fundamentals and even-less investment merit.

COT Report

I enter the first weekend of the month of February with guarded apprehension over the state of the broad markets and with an equal dosage of apprehension over the current Commitment of Traders set-up for gold.

At 330,000 contracts in the net short category, the Commercials are now locked and loaded for a serious rug-pull.

I will not attempt to establish any new trading positions in physical gold or silver options or futures positions while the COT is this hostile, but it will give me time to complete the DD on the new silver stock, which is exploring 100%-owned ground that lies directly in the shadow of the headframe of one of the world's largest silver mines.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Agnico Eagle Mines Ltd.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Agnico Eagle Mines and GLD. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.