Thursday, gold broke out to new highs against the dollar after a period of consolidation lasting several months to commence another upleg that promises to be big. While this breakout was greeted with jubilation by gold bugs, we had expected it all along. This is because the fiat money system is now meeting its nemesis and is flying apart with exponential money creation going vertical.

There are two only ways this can end: two scenarios — one is a global credit lockup that causes an instant Mad Max scenario with Banks slamming their doors, bank cards and card machines not functioning, deliveries not being made to stores and gas stations, and a terrified public going on the rampage in blind panic. The other scenario, considered much more likely, is that money creation continues to expand at an ever more rapid rate, using excuses such as wars, Stargate, and DeepSeek, etc, until we have hyperinflation virtually everywhere. The reason that this scenario is considered more likely is that it enables continued wealth transfer up to the top of the pyramid until the bitter end. Both scenarios end in ruin for the majority.

If the latter scenario prevails, then gold, which always holds its value, will do a moonshot, which means that the orderly uptrend will accelerate into a massive spike.

Now to review the charts. On the 6-year gold chart we can see that yesterday the strong uptrend started to reassert itself following several months of consolidation which did not see the uptrend breached. Gold has just started another significant run that will result in sizable gains if it makes it up to the top of the channel, as expected. . .

On its 6-month chart we can see that gold's breakout to new highs yesterday followed a breakout earlier this month from the Symmetrical Triangle shown.

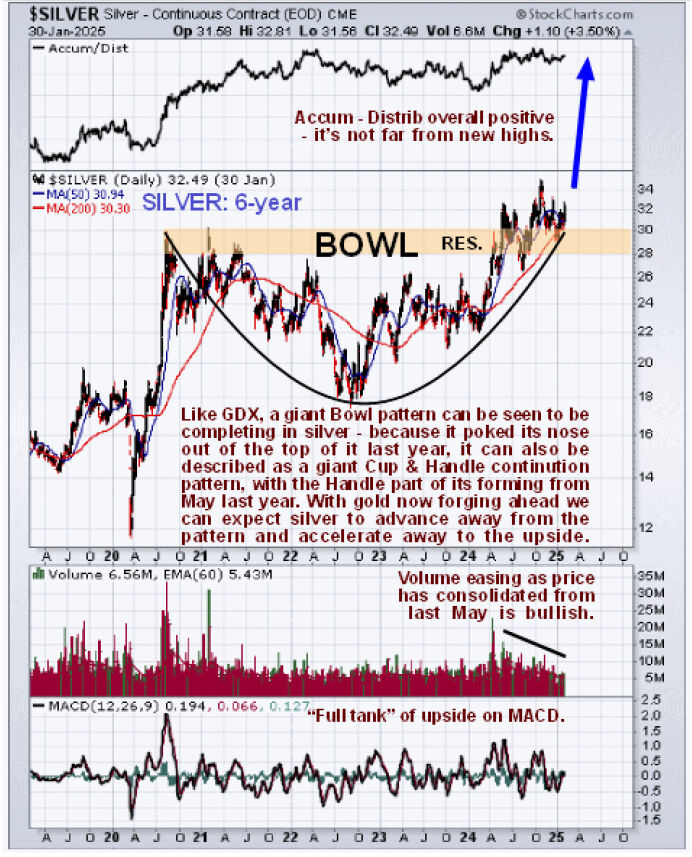

Meanwhile, on silver's 6-year chart, we can see that it is now in position to ascend away from the huge Bowl pattern that formed from mid-2020.

This pattern could also be described as a Cup & Handle consolidation, with the Handle part of the pattern having formed from early last year. This pattern promises a major advance from here that is likely to start immediately- it is believed that yesterday's rally marked the start of it.

On the 6-month chart we can see that silver's sharp rally yesterday broke it out of the corrective downtrend in force from mid-late October and it is now in position to advance to challenge the October highs before breaking above them and forging ahead in a powerful uptrend.

Precious Metals stocks have been "dragging their feet" relative to gold for a long time, and our 6-year chart for GDX shows clearly when this underperformance can be expected to end — it will end when GDX breaks above the key resistance marking the upper boundary of the giant Bowl base pattern that has been building out since early-mid-2020.

Once it does so, we can expect to see it accelerate to the upside, although we should keep in mind that it will have to break above the 2011 highs at about $58 before it makes it to clear new all-time highs so that there is no more overhanging supply.

GDX actually broke out of its corrective downtrend about two weeks ago, and Thursday it rose strongly on gold's breakout and is on course to challenge its October highs as an initial objective as we can see on its 6-month chart. . .

Clearly, with gains of this magnitude in prospect the sector is a strong buy across the board, although at first the gains will be most reliably made in the large and mid-cap stocks. We will therefore be reviewing a range of PM stocks going forward.

The end of December sector bottom call proved to be exactly right.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.