The Trump Administration is certainly operating at express train speeds in reconfiguring the U.S. and, indeed, the world economy. This is all very positive.

Keep in mind that gold is the Metal of Prosperity, and it is rising after decades of suppression. The cleanout of the SEC and the CFTC will allow commodity prices to reflect their true supply/demand without criminal market interference.

The changes underway in the U.S. have been in planning for many years and are enormous in magnitude and scope. For most people, this is beyond comprehension because it operates on so many different levels. We need to keep watching the U.S. bond market because a rally there is a sign of great confidence in the future of the U.S.

Forget the Fed; its job is finished.

Its role is now over, and the markets will soon reflect the real world and not the fantasy of just printing money. Why should the world be dictated to by a small group of bankers?

A gold standard is coming back.

Gold is the protector and the punisher. Gold is now moving higher, and silver is following.

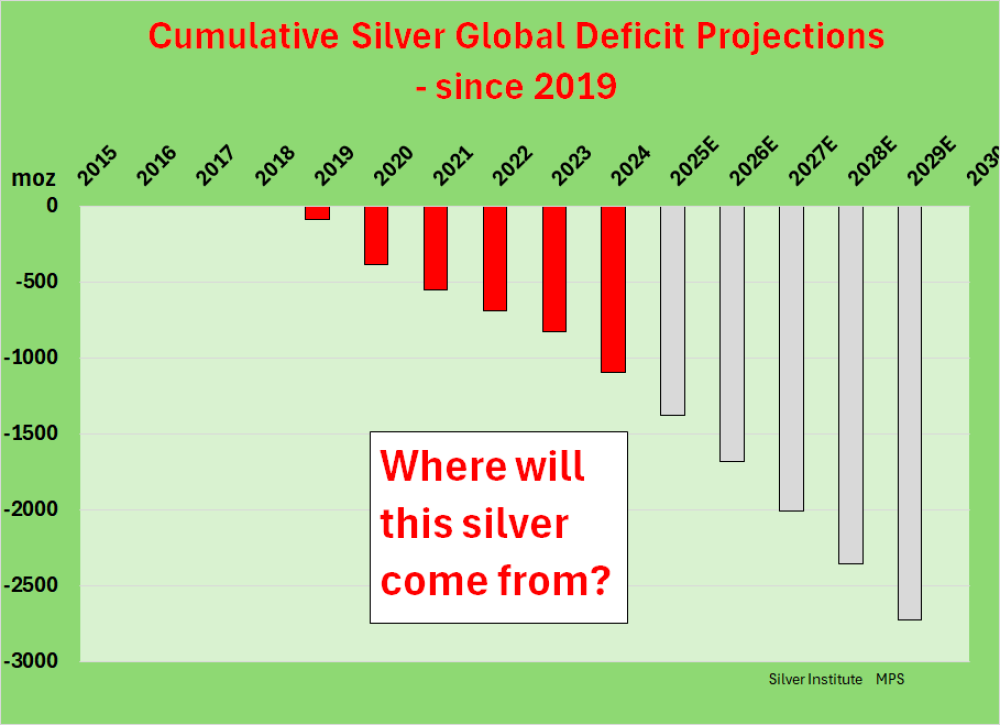

As noted here over the last couple of months, the supply/demand positions on so many of these commodities make current prices illogical.

Silver is repeated here. Silver mine production is lower than a decade ago, so do not expect any dramatic increase in supply. Demand has been growing in new uses and even if the rate of change slows there will still be further rundowns in silver inventory.

Silver to gold ratio has been frustratingly low for years now, but it is time for a change.

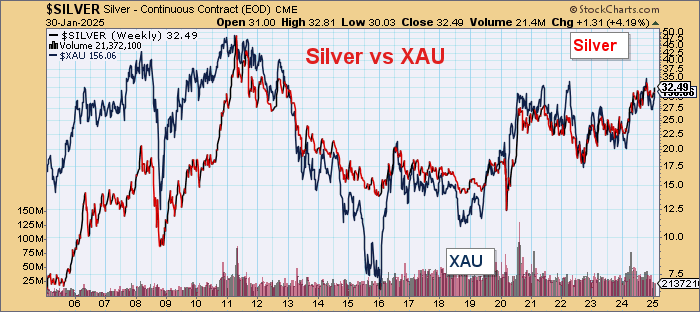

Gold stocks have quite a strong correlation with the silver price, and it does seem that the performances of gold stocks are more related to the animal spirits associated with market interest in silver.

Where goes silver, goes gold stocks.

And the AU$.

The ASX Gold Index is moving up again to test 10,000 driven by a AU$4,500/oz gold price.

A break above 10,000 should see a 20% move to 12,000 and then a major move toward 20,000 over the next year or so.

It should be a swift move.

Gold has made a new all-time high in the cash market. This parabola should steepen from here.

A new all-time high.

Gold futures (premium included) have made a new high.

Silver is also now ready to make a big move.

First, keep in mind that demand is far greater than supply, mine supply in 2025 is lower than in 2015, and identifiable stocks are declining rapidly.

And then the cupboard was bare.

Big move coming here.

Silver is moving higher

This is a very big parabola for silver.

This long-term parabola saying silver >US$100/oz.

Gold Stocks

The XAU looks brilliant. The big stocks like NEM and Barrick have been laggards but others are doing well.

The indices are saying a big catch-up to gold is coming.

Big break out here.

Lots of eye candy technicals here.

Look at that back test on the 2011 DT. Look at the underlying parabola.

Beautiful backtest on the 2011 DT.

The rise in silver should push this Gold stock index much higher.

Silver is looking to break out against gold.

It has been a long, frustrating journey.

Head the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp.

- Barry Dawes: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.