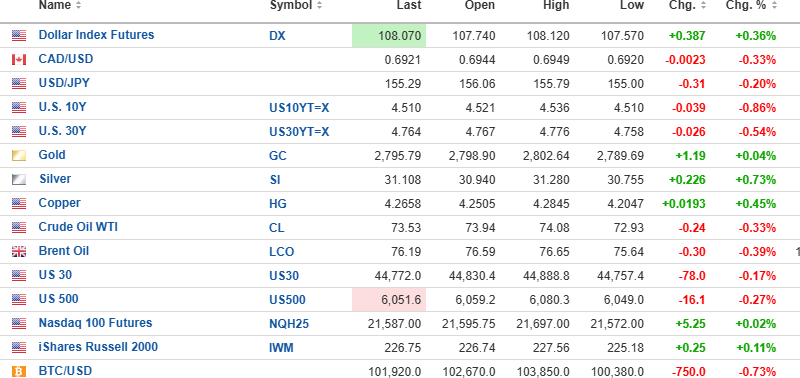

USD dollar index is up 0.387% to 108.070 this morning with the 10-year yield down 0.86% to 4.51% and the 30-year yield down 0.54% to 4.764%.

Gold (+0.04%), silver (+0.35%), and copper (+0.02%) are higher, while oil (-0.33%) is down. Stock index futures are mixed with the DJIA (-0.17%) down 78 points; the S&P 500 (-0.27%) is down 16.1 points, but the NASDAQ (+0.02%) is up 5.25 points.

Risk barometer Bitcoin (-0.55%) is down $750 to $101,920.

US stocks: "DeepSeek" explained

Rather than me trying to plagiarize the good work of Adam Taggert and Charles Hugh Smith in explaining the bearish implications of "DeepSeek" and how the Chinese software-generated "AI" program threatens to derail the egregiously expensive monopoly created by the Mag Seven group of companies, you can watch it with this link.

Once you have watched the podcast and grasped the importance of the "open source" status of the project, you will come to recognize that despite the across-the-board denials from Wall Street yesterday amplified by the CNBC spin machine, the "AI" pump machine has just entered that seminal moment as in 2000 when the internet bubble popped.

Now, I will not run out and buy a bunch of put options this morning on NVDA:US, but I have it on my radar screen along with the QQQ:US as candidates for downside speculations.

Volatility

The markets enjoyed a brisk rebound yesterday, with NVDA:US gaining 8.93% ($10.57) to $128.99, down 15.56% from its 52-week and all-time high at $153.13. The VIX:US is now down 25% from Monday's opening high, once again demonstrating why one must reduce position sizes when there is a "black swan" or "tail event" that roils markets.

Having blown out the VIX Feb $15 calls on Monday, I now await the pullback in the March calls in order to re-establish my volatility position. This "DeepSeek" event is not over, and while the MSM went into full-on damage control since Monday's opening, I refuse to listen to those gurus long up to the eyeballs in AI deals that were spewing out, "The Chinese are lying!!!" baloney for the retail crowd to gobble up.

In the GGMA Trading Account

- Add to VIX March $15 calls at $3.00

I own 40 at $3.35 and elected to hang on rather than take Monday's high print at $4.24. VIX:US is up $.39 in the pre-market trade.

Silver

Let it be known that I have found a junior silver explorer who is currently drilling in North America and may be in need of money and trades at around CA$0.10 per share. I have not made the final decision because I am not sure that silver is yet ready to take off above $35/ounce.

However, this is the first time since 2019 that I have been on the hunt for a cheap silver deal, as was Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA) back then when I took down the unit financing at CA$0.085. Once silver finally took off in mid-2020, AAG:TSXV went on a run that ended at $1.70 in January 2021. I hope to have the DD completed by the weekend.

| Want to be the first to know about interesting Special Situations, Silver and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: VIX and Aftermath Silver. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.