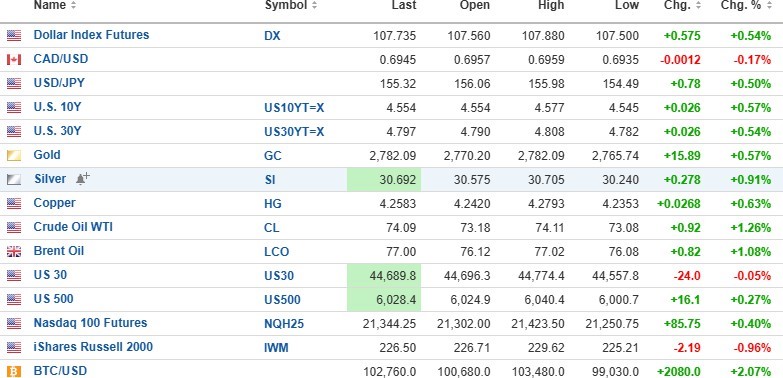

USD dollar index is up 0.575% to 107.735 this morning, with the 10-year yield up 0.57% to 4.518% and the 30-year yield up 0.54% to 4.797%.

Gold (+0.57%), silver (+0.91%), oil (+1.26%), and copper (+0.63%) are all higher. Stock index futures are mixed, with the DJIA (-0.05%) down 24 points, but the S&P 500 (+0.27%) is up 16.1 points, and the NASDAQ (+0.40%) is up 85.75 points.

Risk barometer Bitcoin (+2.07%) is up $2,080 to $100,680.

US stocks: DJIA vs. DJT

The market action yesterday underscores the divergences that are present in the major averages, and as the chart on page 2 illustrates, the Dow Jones Industrial Average ("DJIA") is now charging ahead to record highs while the Dow Jones Transportation Average ("DJT") is lagging behind.

In classic Dow Theory, this is seen as a "non-confirmation" as the goods being produced by industry are greater than the amount being transported which means sales are lagging and if sales are lagging, then earnings are lagging and since earnings are the "mother's milk" of economic expansions (and bull markets), non-confirmations are therefore bearish for stocks.

Of course, the perma-bulls like Tom Lee (and Donald Trump) will point to conditions being "different this time" because of the transformation from an industrial economy to a services economy, but traditionalists like me view Dow Theory as a stalwart of the bull market's strength or fragility. Now, the Trannies can play catch-up over the next few weeks, but if stocks roll over and start a more serious correction, DJT weakness will be an important harbinger of doom as the year progresses.

Volatility

Yesterday, the portfolio managers were long volatility going into the Monday opening crash in the technology stocks brought about by the revelation that China had developed an AI solution at a fraction of the cost and reliance on microchips like the ones being provided by NVidia Corp. In order to capture the capital gains afforded by the volatility positions, they sold the VIX:US and the UVIX:US shortly after 9:30, with the lows of the decline pretty much contained by the prices seen by 10:00 am.

As I indicated in yesterday's alert, I needed to avoid the decay that occurred, and luckily for me, the VIX February $15 calls opened at $3.55 but then leaked all day long, going out at $2.81. I was able to bag the opening trade and now sit on the cash ($31,950), looking for an entry point on the VIX March $15 calls that closed at $3.30 bid, so by waiting, I am now able to capture and extra 30 days time for the volatility trade to really gather team which is precisely what I expect.

As for today, I expect that the losses incurred by the "AI" space yesterday are not going to be contained in a one-day blow-off because of the leverage that has been built up over the past 2- 3 years in NVDA:US and its AI-related brethren like AAPL:US and MSFT:US, where 2x and 3x and even 10x single-stock ETF's have proliferated within the retail crowd, filled with Millennials and Gen-Xers that have never experienced a bear market, especially a prolonged one like 1981- 1982 or 1973-1974.

In the GGMA Trading Account

- Add to VIX March $15 calls at $2.75

I own 40 at $3.35 and elected to hang on rather than taking yesterday's high print at $4.24. VIX:US is off $0.17 in the pre-market trade.

GTCH/GGLDF

I added 50,000 Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) at CA$0.18 in my wife's account yesterday and am looking to add more to the grandkid's trust accounts today.

I recognize that there are more than a few cheap warrants out there, but with a 3-year term on the debenture warrants, I expect the company will be bought prior to the expiry date so I can put fresh cash to work now while holding onto those 10-cent warrants as a leverage play.

Getchell is an absolute no-brainer at current prices.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp..

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Getchell Gold Corp. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.