A stock that I went for early this month, Eastside Distilling Inc. (BLNE:NASDAQ), which is getting into the AI-driven mortgage business, announced on Monday that it will be trading under the new name Beeline Holdings and under the new ticker symbol BLNE on the NASDAQ.

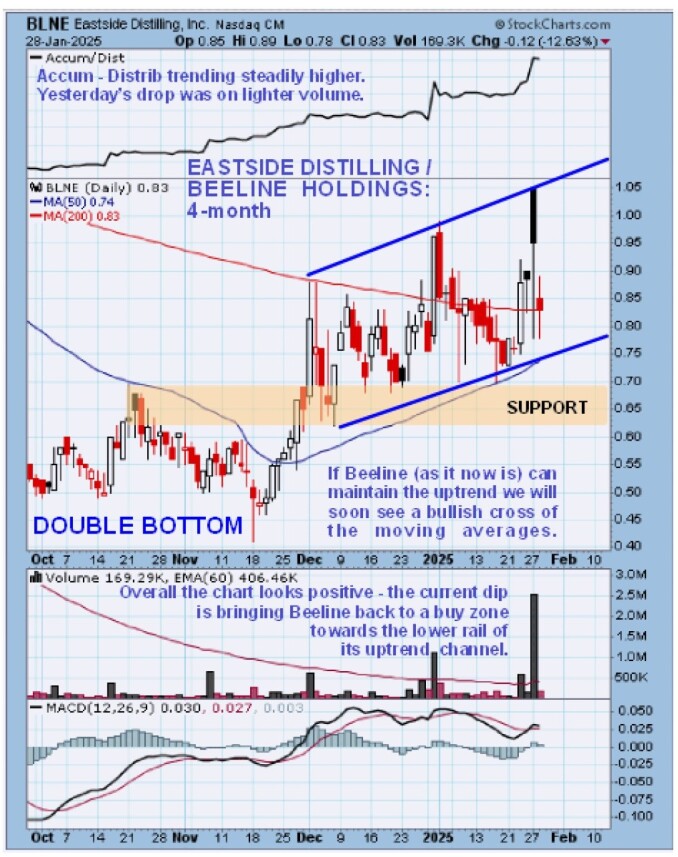

Although this development is believed to be a major step in the right direction for the company, the stock dropped yesterday partly due to collateral damage to AI stocks inflicted by the Nvidia rout as a result of the DeepSeek news and partly due to the fact that the news from the company itself had driven the stock up to the upper boundary of the uptrend channel shown on the 4-month chart below.

However the uptrend remains in force with volume and volume indicators positive — the drop yesterday was on much lighter volume — and so the current dip back towards the lower rail of the uptrend channel is regarded as presenting an opportunity to buy.

It is not entirely clear whether the company will also be known as Beeline Holdings on the stock market — the new name may only apply (perhaps for the time being) in relation to its customers — it still has the name Eastside Distilling on chart service websites.

Beeline Holdings' website.

Eastside Distilling Inc. (BLNE:NASDAQ) / Beeline Holdings (formerly EAST on NASDAQ) closed at US$0.83 on January 28, 2025.

| Want to be the first to know about interesting Special Situations and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Beeline Holdings and Eastside Distilling have a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Beeline Holdings and Eastside Distilling.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.