This article was paid for and disseminated on behalf of Tier One Silver.

Tier One Silver Inc. (TSLV:TSXV; TSLVF:OTCQB) was spun out from Auryn Resources in October 2020 and has 100% ownership of the Curibaya Project in southern Peru.

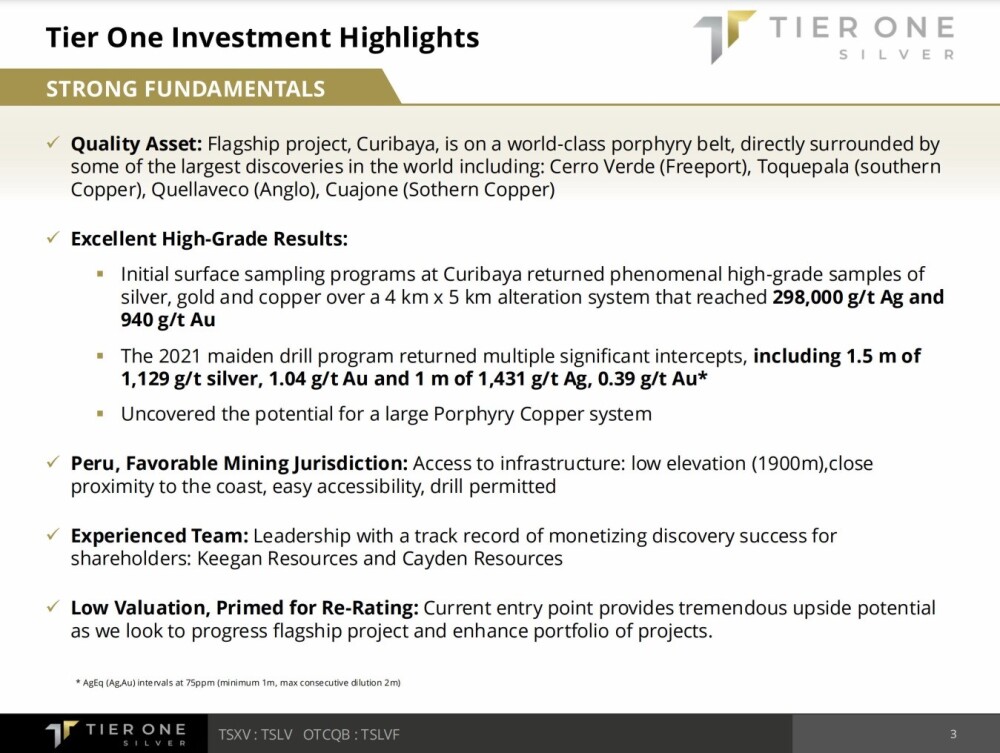

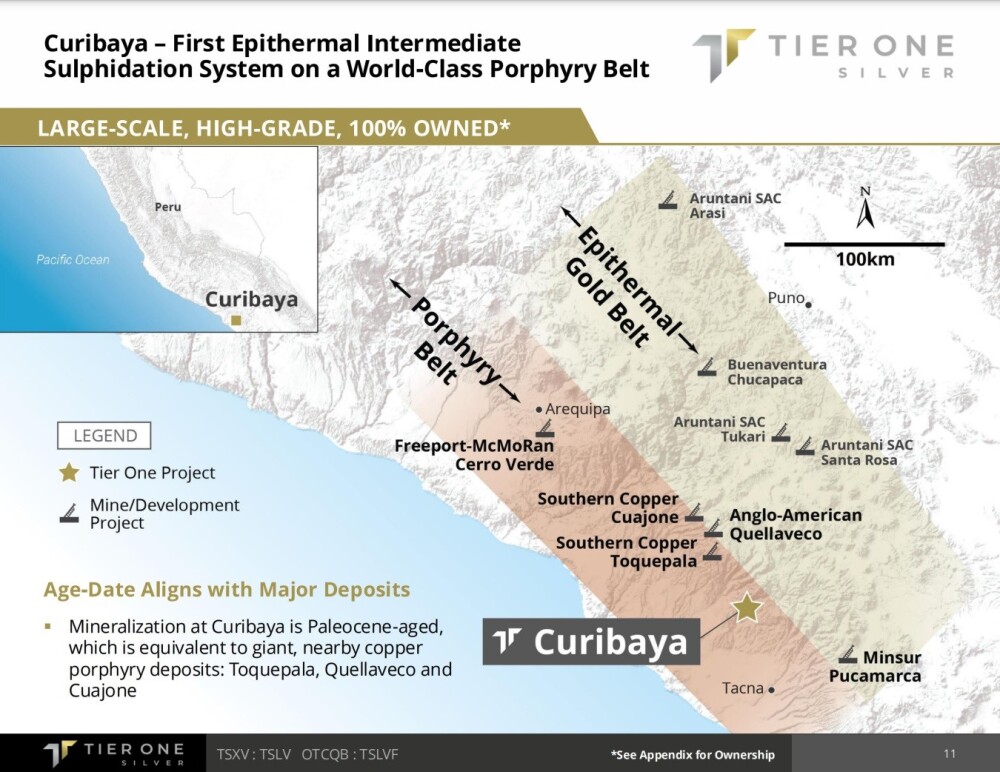

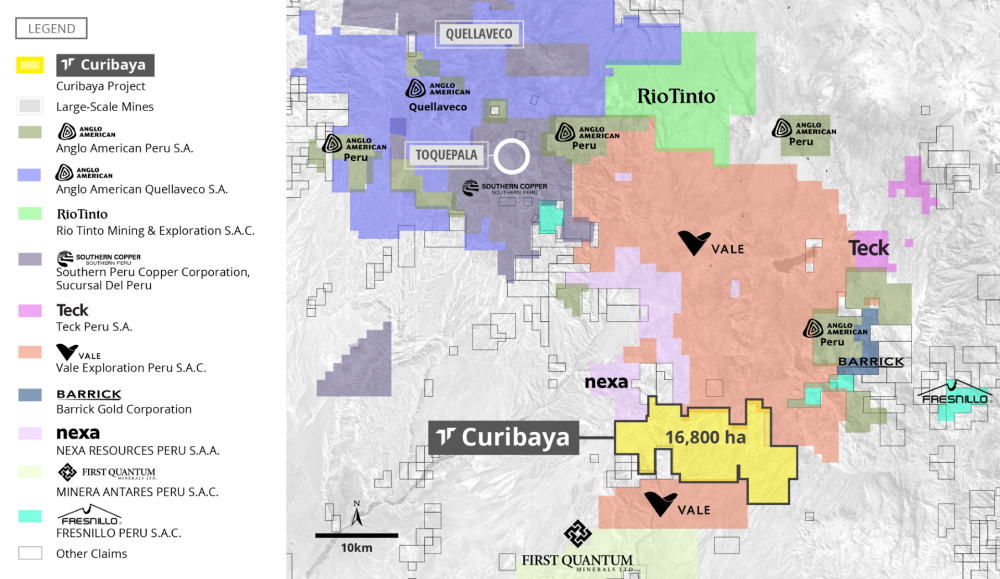

The Curibaya Project is a District Scale 16,800 hectares property situated in a copper porphyry belt that hosts some of Peru's largest porphyry deposits, including Freeport McMoran's Cerro Verde deposit, Southern Copper's Cuajone and Toquepala deposits, and Anglo American's Quallaveco deposit.

This alone makes it highly likely that Curibaya hosts a major deposit or deposits of copper / gold / silver, and the chances that it does are increased substantially by the initial surface sampling programs, which turned up some phenomenal grades of copper, gold, and silver and the positive results from the Maiden drilling program undertaken in 2021.

The chief focus of this article is to bring to investors' attention the outstanding opportunity being presented by Tier One Silver at this time, to which end we will be focusing on its latest stock charts. Before we look at the charts, we will overview the fundamentals of the company using selected slides from its latest investor deck and any relevant news releases.

To begin, here are the Investment Highlights of the company:

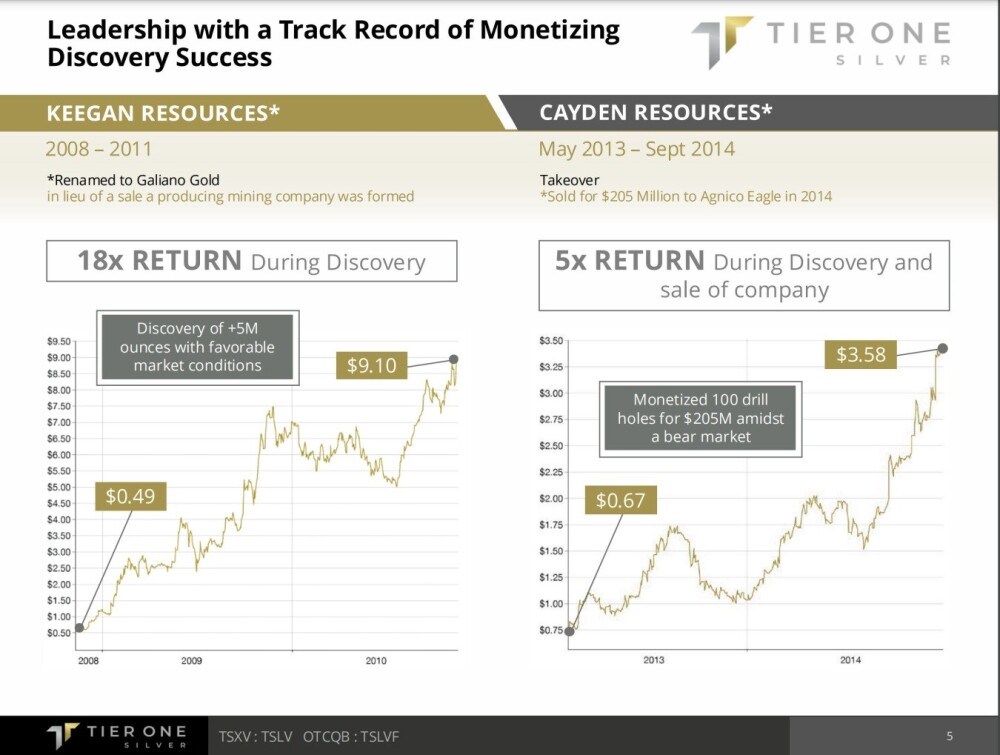

Management of the company has an impressive track record of discoveries, including the following:

The company's flagship Curibaya Project is located northwest of Tacna in southern Peru, and this slide also makes it clear that Peru is a big player in the metals world.

Tier One is in good company with big producers such as Anglo American, Freeport McMoran and Southern Copper being active in the same porphyry belt.

This is not said to "name drop," but rather the presence of these other big mining companies nearby on the same trend clearly greatly increases the chances that the company is sat on a big resource.

Vale has properties adjacent to the north and south of Curibaya, with Barrick, Rio Tint,o and Teck nearby too.

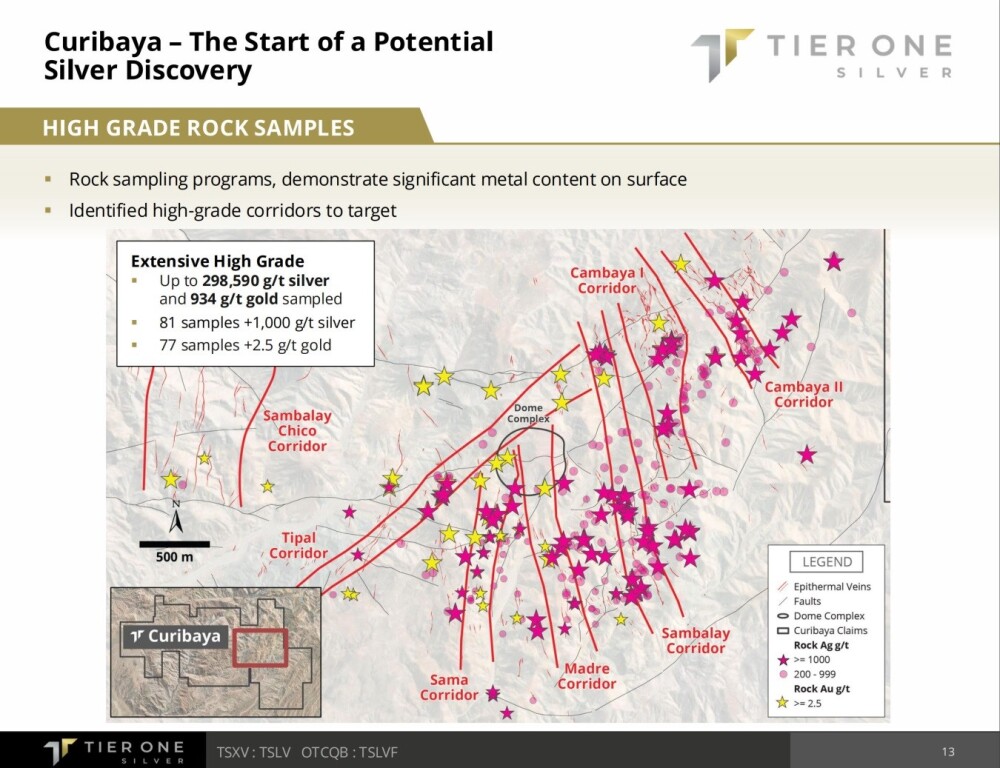

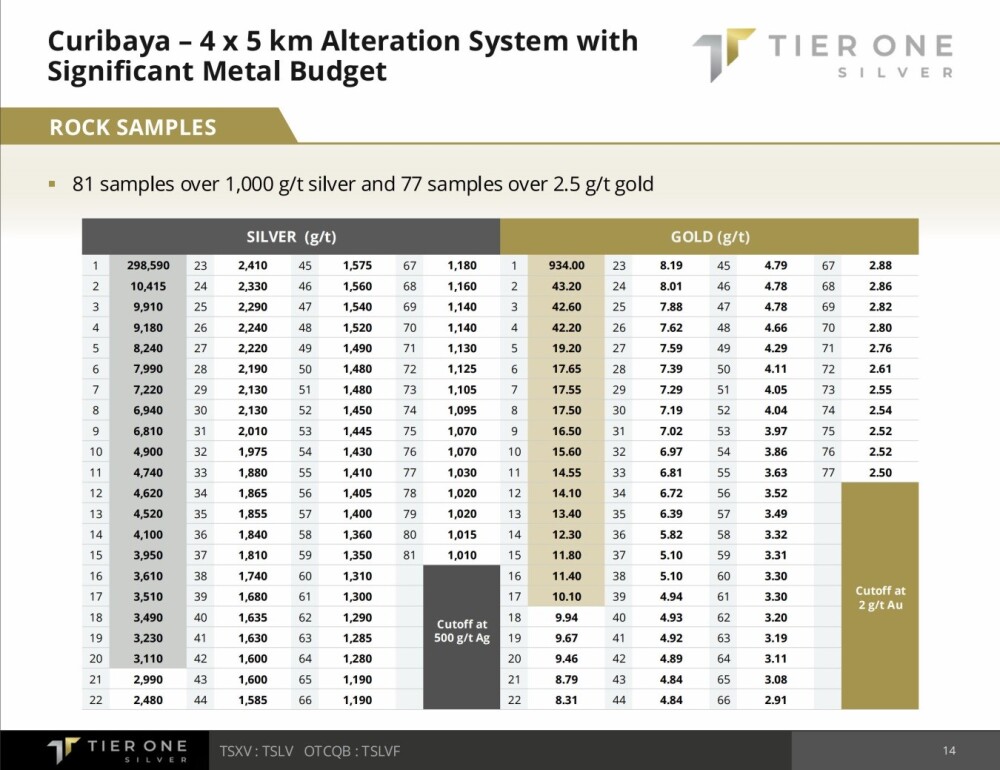

Some of the rock samples returned delivered truly astounding grades, as shown on this next slide. These have been used to identify high-grade corridors to target with drill campaigns.

I AM NOT MESSING AROUND — rock samples have returned impressive grades.

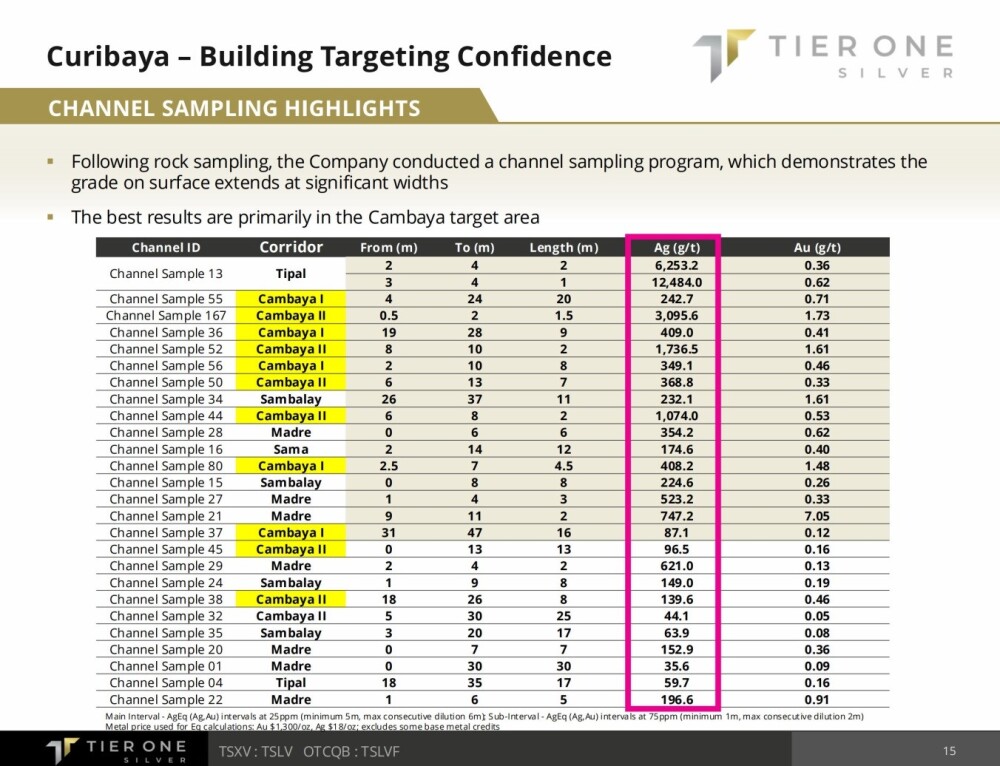

A follow-up channel sampling program also demonstrated that the grade on surface extends at significant widths.

The local infrastructure is good, with nearby ports, power supply, and adequate roads, and the city of Tacna is nearby with its international airport.

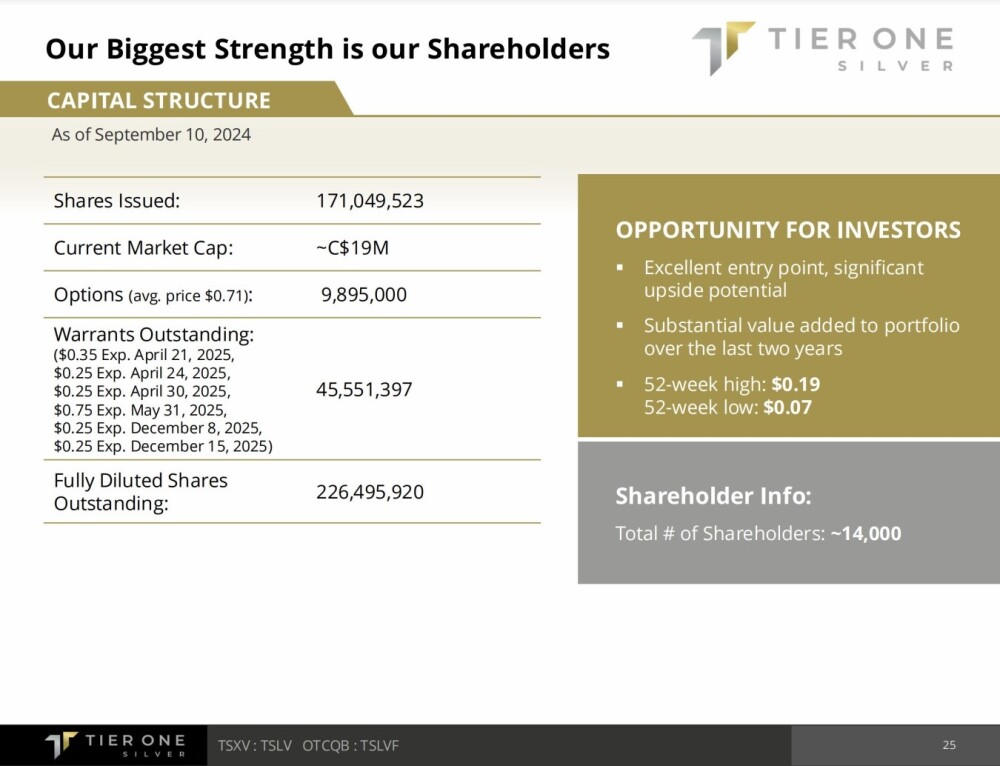

There are approximately 171 million shares in issue with 226.5 million fully diluted.

Now, we proceed to review the latest stock charts for the company, on which it quickly becomes clear that this is a favorable time to buy.

Shortly after it came to market in early/mid-2021, Tier One Silver peaked at CA$1.90 before tipping into a severe bear market that, by the time it had about run its course late in 2023, had erased most of the stock's value as we can see on its latest 54-month (4-year, 6-month) chart below but it is clear on this chart that a basing process that began in late 2023 has continued through all of 2024 and as it is difficult to see what is going on within this base pattern on an arithmetic chart we will proceed to look at another chart for the same timeframe using a log chart, which has the effect of "opening out" the base.

The 54-month log chart enables us to see that the bear market is defined by the down trend channel shown and although it is still not over we can readily see what is believed to be basing action since late last year — it looks like a Double Bottom has formed and the probability that a genuine Double Bottom is completing is increased by the steady uptrend in the Accumulation line all through 2024 which bodes well for a reversal to the upside.

Zooming in on the base pattern via the 18-month chart enables us to examine it in more detail. The steadily uptrending Accumulation line indicates a high probability that the stock is reversing to the upside as mentioned above, and this being the case, we are thought to be at an excellent entry point now with the price having, in recent weeks, dropped down close to the lows of last February, with which it is believed to be about to complete a Double Bottom and start advancing again.

A positive point to note is the marked volume buildup since September, which is considered to be bullish as it shows a considerable degree of stock rotation from weaker to stronger hands, with the buyers being less inclined to sell until they have a profit.

Looking at recent action in more detail on the 6-month, there are some additional favorable factors to note. The stock has this month broken out of the intermediate downtrend in force from the peak last October, which took the form of a bullish Falling Wedge, and is now trending higher again.

The announcement of the closing of the first tranche of the private placement announced on November 20, which was later amended</A> from 15 million units to 20 million units with the offer price adjusted down from 10 cents to 7.5 cents, doubtless helped the stock to break out of its intermediate downtrend and rally this month, and it is expected that the second and final tranche will be announced closed early next month which could give the stock another boost.

Therefore, my conclusion is that Tier One could be considered a great investment opportunity.

Tier One Silver's website.

Tier One Silver Inc. (TSLV:TSXV; TSLVF:OTCQB) closed for trading at CA$0.09 US$0.06628 on January 22, 2025.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tier One Silver Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Tier One Disclosures:

Christian Rios (SVP of Exploration), P.Geo, is the Qualified Person who has reviewed and assumes responsibility for the technical contents of this press release.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.