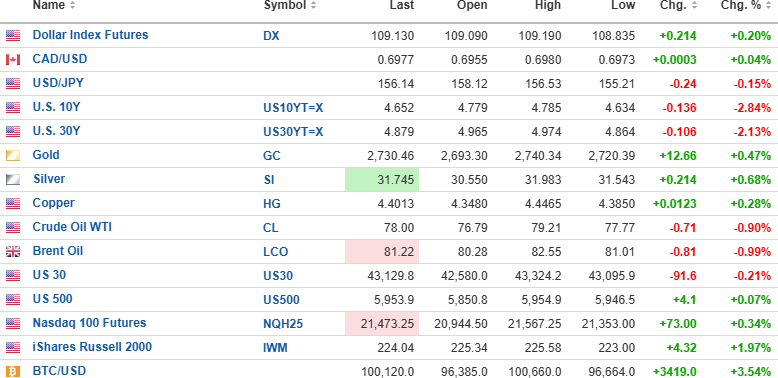

USD dollar index is up 0.20% to 109.130 this morning, with the 10-year yield down 2.84% to 4.652% and the 30-year yield down 2.13% to 4.879%.

Gold (+0.47%), silver (+0.68%), and copper (+0.28%) are all higher, while oil (-0.90%) is down $0.71 to $78.00/bbl. Stock index futures are mixed, with the DJIA (-0.21%) down 91.6, but the S&P 500 (+0.34%) up 4.1 points, and the NASDAQ (+0.34%) up 73 points. Risk barometer Bitcoin (+3.54%) is up $3,419 to $100.120.

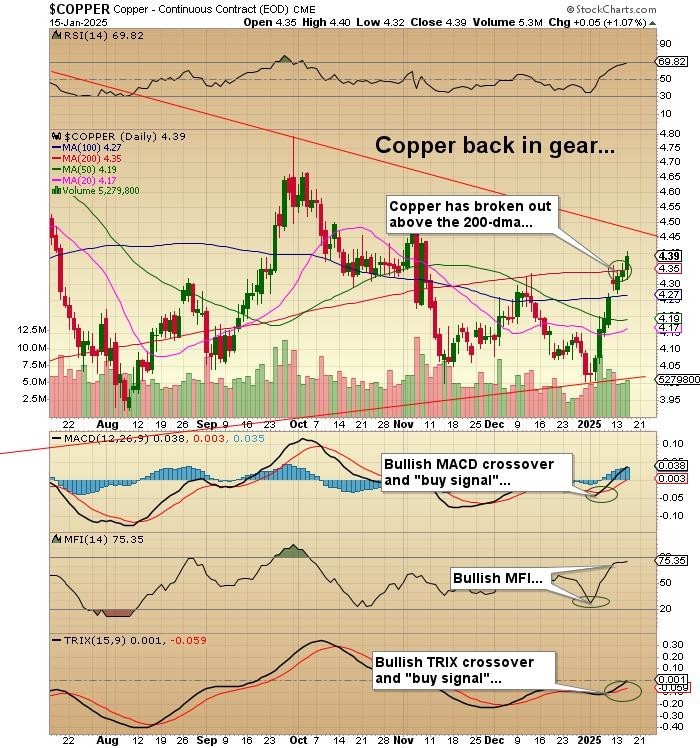

Copper

Going into year-end, I was concerned that fears over the Trump tariffs would drive investors away from the bullish copper narrative and have a dampening effect on the junior copper developers and explorers and the mighty Freeport-McMoran (FCX:US), which I own as a long- term core position but which only just breached $40 yesterday and is still a good $15.00 off the 53-week high.

Last week, copper prices did a complete bullish reversal just as I was fully expecting a drop to the August lows under $3.90/lb. Instead, it turned just above $4.00 and screamed higher and, as of this morning, has breached the 200-dma by $4.35/lb. trading briskly up to $4.44. If it holds the 200-dma for another day or two, I see the May highs as the next resistance level at $5.19/lb.

I am finally prepared to re-enter the FCX:US trade.

In the GGMA Trading Account:

- BUY 1,000 FCX:US at $40.00

For option traders:

- BUY half-position FCX March $40 calls at $2.75

Gold / GDX:US

The superstar of 2024 is continuing its upward trajectory here in 2025 as gold is once again taking the lead in the commodities space. It doesn't hurt that oil is rebounding off the 60-handle of late 2024, but as I wrote in the GGMA 2025 Forecast Issue, "While a global recession would take its toll on global copper demand, I have not veered for one iota of my bullish theme for gold bullion." That opinion is bearing out as the knee-jerk reaction to the Trump election victory has now been fully shrugged off, with new highs on the immediate horizon. Prices turned higher just

before Christmas but did not receive the MACD "buy signal" until after New Year's Da,y followed by bullish turns in the MFI and TRIX indicator,s which are now both on full "buy signals". With an RSI at 59, the market has more room to advance before approaching overbought status,s so I am going to take a leap of faith and buy the March calls on GLD:US.

- BUY GLD:US at $250.00 limit

For option traders:

- BUY GLD March $250 calls at $7.00 limit Target: $15.00 by expiry

| Want to be the first to know about interesting Base Metals, Critical Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michale Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.