CPI/Stocks

The U.S. Bureau of Labour Statistics reported that consumer prices rose by 0.4%, up from 0.3% in November, with "core" CPI rising an unexpectedly low, 0.2% down from four months of 0.3% increases.

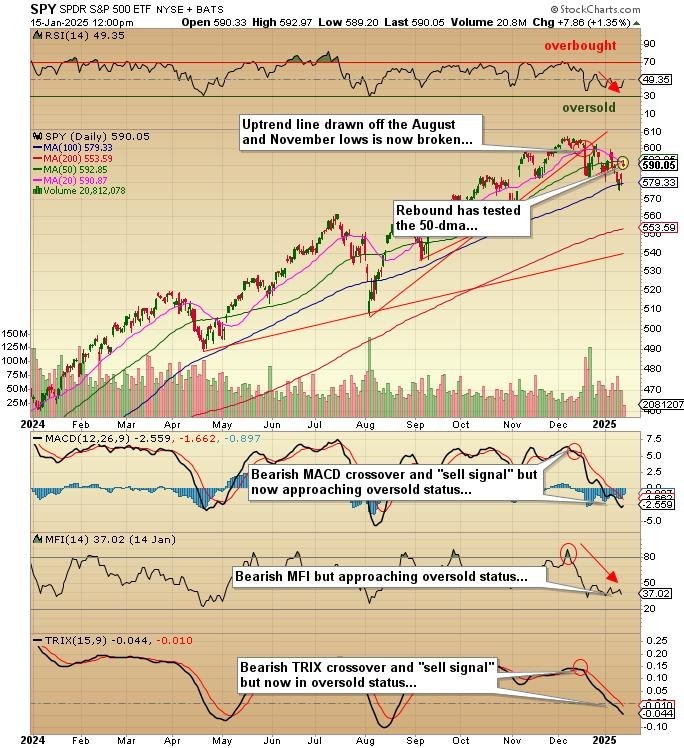

Stocks bolted out of the gate with the S&P 500 up 148 points before profit-taking knocked it back to a gain of "only" 78 points by 11:50 am. I expected an oversold bounce this week in advance of the Trump inauguration ceremony next Monday and we are certainly getting one today.

Breadth is good, and the Mag Seven are all green, so while a mid-session fade is probable, this rally took the SPY:US up to the 50-dma at $592.85 before the pullback. If it can close above the 50-dma, it sets up a test of the highs at $609.07. If it reverses and closes weak, then the 100-dma at $579.33 becomes the target.

Certainly, from where I sit, the CPI number was not a solid excuse for new highs but with the MAGA nation on Wall St. wanting to jam it to the Democrats, it would not surprise me to see them take stocks higher into the pre-MLK-Day holiday and inauguration on Monday.

GTCH/GGLDF

I have learned that Getchell Gold Corp.'s (GTCH:CSE; GGLDF:OTCQB) PEA is now completed and is being compiled for final release early next week. I fully expect that the PEA will be robust and that it will provide IR led by Karen Mate to attract "new eyes" (and buyers) into the market.

I was chatting with Getchell shareholder Lawrence Lepard this morning and he was lamenting the state of the juniors right now in their inability to respond in any way, shape, or form to the gold price performance, which was better than the S&P 500 last year. W

e both agree that 2025 is going to see the "turn" in which the speculative flow of capital turns to resources. It is long overdue.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.