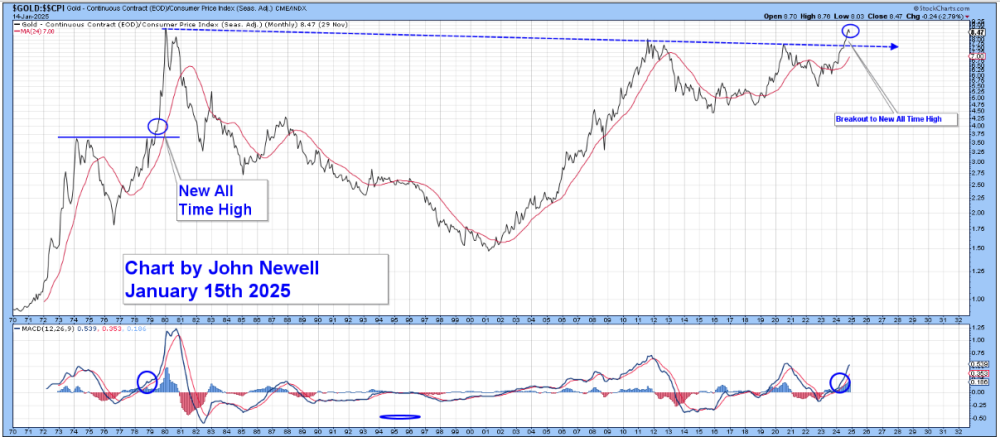

The Gold-to-CPI ratio, a key indicator of gold's purchasing power relative to inflation, has recently reached a new all-time high.

This milestone reflects gold's enduring role as a hedge against inflation, but it also serves as a reminder of the complex forces driving rising costs in today's economy.

What Is the Gold-to-CPI Ratio?

The Gold-to-CPI ratio measures the price of gold divided by the Consumer Price Index (CPI), a common metric for tracking the cost of goods and services.

A rising ratio indicates that gold's purchasing power is increasing faster than inflation, making it a strong hedge against rising costs.

Historically, this ratio has spiked during periods of economic turmoil, such as the late 1970s when inflation ran rampant, reaching levels that rival today's economic challenges.

Understanding Inflation: Why Prices Rise

Inflation occurs when the purchasing power of money decreases, causing the price of goods and services to rise. One key driver is the overprinting of currency by governments. When too much money enters circulation, the supply of money outpaces economic productivity, eroding its value. This scenario often leads to higher prices for everyday necessities, from food to housing.

For example, during the COVID-19 pandemic, massive stimulus programs flooded economies with liquidity to prevent economic collapse. While these measures helped stave off immediate crises, they also contributed to inflationary pressures as demand surged while supply chains struggled to keep up.

Natural Disasters and Inflation: The Hidden Costs

Inflation isn't just driven by monetary policy; natural disasters can also play a significant role in pushing up the cost of living. Take the recent fires in California as an example. Such disasters disrupt supply chains, destroy housing stock, and reduce agricultural output, driving up prices for basic necessities like food, housing, and energy.

In California, the destruction of homes and infrastructure has increased demand for materials and labor, pushing construction costs higher. Agricultural losses from fires have also reduced the availability of crops, causing food prices to spike. These localized inflationary pressures can ripple through the broader economy, compounding the challenges faced by households.

Gold as a Safe Haven

As inflation erodes the value of fiat currencies, gold's appeal grows. Its status as a store of value is particularly evident during times of uncertainty when economic instability or geopolitical turmoil drives investors to seek safety.

The current high in the gold-to-CPI ratio underscores this trend, reflecting gold's ability to outpace inflation and preserve wealth.

Looking Ahead

The Gold-to-CPI ratio reaching a new peak signals more than just the strength of gold; it highlights the broader economic forces shaping our lives.

From government policy to natural disasters, a range of factors are driving inflation and reshaping the global economy. For investors, this underscores the importance of diversifying portfolios and considering assets like gold to protect against the ongoing erosion of purchasing power.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.